An M&A alarm is ready to sound in the WA gold sector, could Gold Fields push the button?

The clock's ticking for explorers to put themselves in the shop window. Pic: Getty Images

- Record gold prices have led to a plethora of M&A in the sector across multiple districts in WA

- The Goldfields recently saw a $2.2bn merger between Red 5 and Silver Lake Resources to become Vault Minerals

- Is South Africa’s Gold Fields and its underutilised St Ives operation primed to snap up nearby deposits?

Newmont’s (ASX:NEM) record breaking US$15 billion acquisition opened the floodgates for gold mergers in Australia and especially the bountiful gold fields of WA.

Its sale of the Telfer gold mine and majority Havieron JV stake to London-listed Greatland Gold for US$475 million in cash and shares was among the largest dominos to fall in a waterfall of M&A, with cash cascading down the sectors of the market.

As gold spot prices punch through all-time highs above US$2650/oz, explorers through to global mining majors are shaking hands faster than a rat up a drain pipe.

The Havieron/Telfer sale seems to have implications in the surrounding Paterson Province, where Rio Tinto (ASX:RIO) has since bought out Antipa Minerals’ (ASX:AZY) 32% interest in the 2.8Moz Citadel gold project and reputedly has its 8Moz Winu discovery on the market.

READ MORE: MoneyTalks: Antipa prime gold M&A target, says Euroz analyst Michael Scantlebury

But attention is also turning south to Kambalda, where gold miners have displaced the region’s struggling nickel sector as the lifeblood of the WA Goldfields community.

Westgold Resources (ASX:WGX) made the big acquisition, beating out Gold Fields, the owner of the region’s dominant St Ives operation, to a merger with TSX-listed Karora Resources, nabbing the high grade Beta Hunt mine.

With Gold Fields boasting excess processing capacity at St Ives, it begs the question, when will it make a move on the region’s legion of junior deposit owners?

Fields of Goldfields gold

In and around Kalgoorlie the consolidation of gold assets in the Goldfields has been pretty spectacular so far this year, notably with Red 5’s $2.2bn merger with Silver Lake Resources back in February, consolidating the King of the Hills, Deflector and Mount Monger gold operations.

The pair of mid-tiers recently morphed into Vault Minerals (ASX:VAU) after a 97% yes vote from Red 5 shareholders to swallow 100% of Silver Lake shares and combine into a 12.4Moz global gold miner – the mothballed Sugar Zone mine in Canada makes up 12% of that inventory – with production guidance of ~390-430,000oz gold for FY25.

As the deal kicked off, Red 5’s Russell Clark said on a webcast the larger company would boast greater power in future M&A initiatives.

“I think it moves the combined company into a different space from a gold production perspective and puts us in a great position to be acquisitive in the future and that’s something we’ll look at once we’ve bedded the company down.”

Since those comments, the gold price has risen about 25% and is creating buzz around the sector.

Waiting in the wings

South Africa’s global bullion producer Gold Fields has been in Australia for quite some time and is not new to WA M&A. St Ives was part of its initial entry to the Australian market in a joint acquisition with WMC’s Agnew mine near Leinster in 2001.

It later bought Barrick’s Granny Smith and Wallaby mines before nabbing half of junior explorer Gold Road Resources’ (ASX:GOR) Gruyere gold discovery via a 50% buy-in.

But its fortunes have been waning. Profits were down 33% for the most recent half-year, with the new Salares Norte mine in Chile facing ramp-up issues and production down in both Australia and South Africa.

Revitalising and solidifying the long-term future of its WA mines – the most substantial and profitable part of the Joburg-based miner’s +2Mozpa portfolio – will be critical.

Its commitment to the St Ives operation, now based around the enormous Invincible discovery, has also been reaffirmed after inking a landmark Native Title deal over a 102,000km2 of landholding across its Goldfields tenure. That gives it the certainty to expand its portfolio as bullion keeps punching through all-time highs.

Yet the company hasn’t really made a significant move in the M&A space in Australia of late, opting rather to secure not just land agreements, but other facets of the business such as processing optimisation in the region with low cost renewable investment – a mammoth $300 million solar and wind renewable project expected to power 73% of the ~350,000ozpa St Ives from 2025 is an example of its enormous buy-in.

Could it just be lining up its ducks ready to have a crack at juniors around St Ives?

Drilling for gold around St Ives

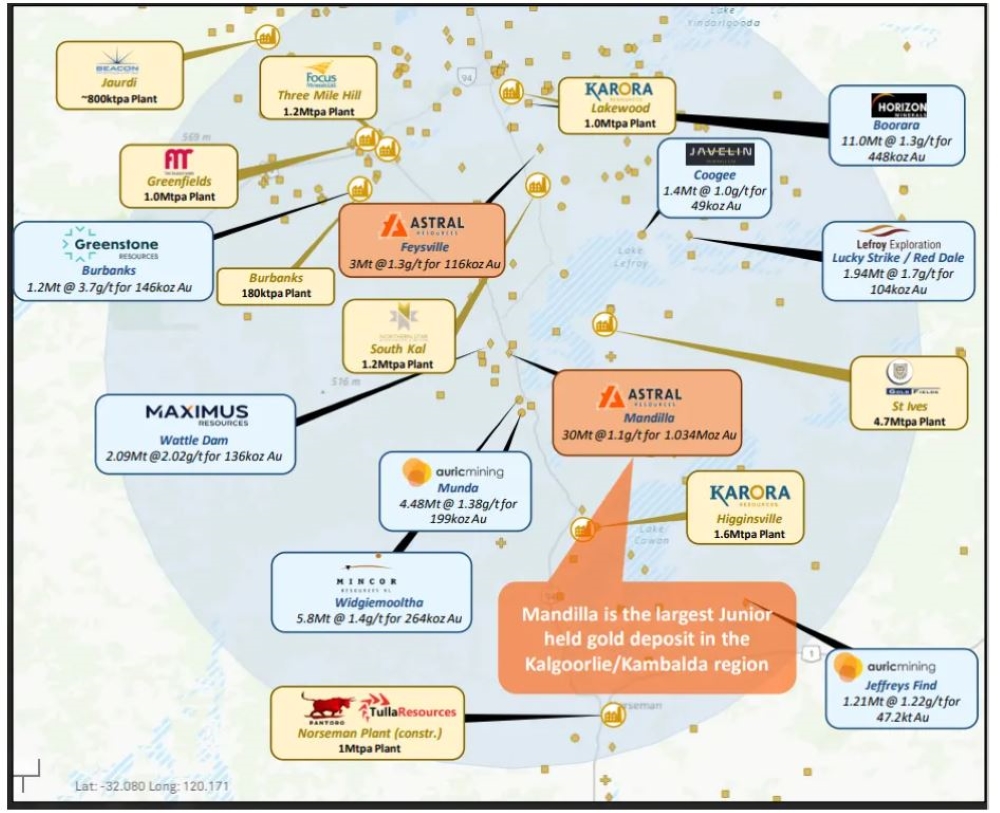

If so, there’s plenty of advanced projects in the vicinity.

The entry of Westgold, which emerged from the $2bn Karora merger with the Higginsville and Lakewood mills, adds a layer of competitive tension.

Insert Astral Resources (ASX:AAR) and its Mandilla gold project, a $132m market-capped explorer heading into a pivotal development stretch as it accelerates extensional and infill drilling of its deposits, nailed on to culminate in a pre-feasibility study.

It’s holding onto the only +1Moz gold project in the vicinity and is putting itself, more than enough bulk to go it alone and build the thing itself. But Astral is undoubtedly also in the shop window for potential suitors that want to add ounces to their mills.

The company hopes recent legwork will advance it towards becoming a minted >100,000ozpa Goldfields producer from Mandilla’s growing endowment and an imminent upgrade to the 116,000oz Feysville project to the south of Kalgoorlie’s famous Super Pit.

The junior’s more than doubled in share price since March, completing RC drilling and hitting grades of up to 21.3g/t at the tenure’s Theia deposit; and with a scoping study that outlines a thick, shallow, open pit mining operation, ounces are likely to be added to the pipeline.

“This is an exciting time for the company following the strongly supported institutional capital raise completed in late September,” AAR MD Marc Ducler said.

“Astral now has the balance sheet strength to accelerate our exploration efforts at both Mandilla and Feysville and complete the necessary project studies as we advance towards becoming a plus 100,000ozpa gold producer in the heart of the Kalgoorlie Goldfields.”

Also on St Ives’ doorstep is Javelin Minerals (ASX:JAV) which is full of confidence after proving up a 158% increase to the resource of its Coogee gold-copper project, which now sits at 3.65Mt at 1.08g/t for 126,685oz of contained gold.

Javelin’s continuing to build confidence in Coogee as it seeks to extend the mineralisation along strike and below the existing pit. The project was mined profitably by Ramelius Resources in 2013 when Aussie dollar gold prices were close to three times lower than they are today, and almost certainly would have been drilled out further at the time if the gold market wasn’t in a downturn.

“Recent work in the project area has delineated significant walk-up drill targets yet to be systematically drill tested,” JAV exec chair Brett Mitchell said.

“We will be testing the recently identified gold-copper zones within the granted mining lease hosting the Coogee gold-copper deposit along strike and depth.”

Torque Metals’ (ASX:TOR) 700km2 Paris gold project is down the road from the St Ives and Higginsville mills too, plonked across the Boulder-LeFroy Fault where >70Moz of gold has been turned up over time.

The explorer last month revealed a maiden resource of 250,000oz gold across the projects’ Paris, Observation and HHH deposits with 190,000oz of the endowment shallow and open-pittable at 2.9g/t, while the remaining 60,000oz has underground mining potential at 3.8g/t.

TOR MD Cristian Moreno says there’s still a lot of work to be done to unearth the full potential of Paris.

“Considering the project’s large 57km strike length, within a generous 350km2 greenstone belt, the Paris MRE – currently focused on an area spanning only 2.5km2 – has significant expansion opportunities, with gold already identified both outside and next to the MRE area,” Moreno said last month.

The ASX junior has identified four additional prospects outside the current resource zone and has hit up to 16.96g/t in soil anomalies.

Further north, Great Southern Mining (ASX:GSN) is proving up its Duketon gold project, where assays from ~2km worth of RC drilling have showed up to 12.5g/t at the Golden Boulder prospect.

Golden Boulder sits on a prominent north-south structural trend that is host to multiple gold deposits, including Rosemont (>2Moz), Baneygo (~380,000oz) and Ben Hur (~390,000oz).

10Moz of gold have been identified in the historical Duketon region to date and GSN reckons exploration in the region is increasingly showing mineralisation extending at depth.

The region’s dominant player Regis Resources (ASX:RRL), which operates a network of mines across its Duketon North and South hubs, is confident more gold will be found in the underexplored district.

“The Duketon Belt is a really interesting one. It really hasn’t had a real focus until probably the past 10 years or so. So we see that while the size of it may not look much, it’s actually got a huge amount of potential sitting in front of it for the exploration team,” RRL chief Jim Beyer said at a WA Mining Club function last month.

Tick… tock…

At Stockhead we tell it like it is. While Javelin Minerals, Antipa Minerals, Great Southern Mining and Astral Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.