Alicanto confirms acquisition of legendary Scandinavian polymetallic mine

Alicanto is now at the helm of the historic Falun mine in Sweden, which has a history spanning more than 1,000 years. Pic via Getty Images.

Alicanto Minerals will take control of one of Sweden’s largest historic mines, after announcing its plans to proceed with the acquisition of the Falun project.

The mine was operated for an incredible 1000 years until low commodity prices forced its closure in 1992.

Alicanto Minerals (ASX:AQI) has today confirmed it will proceed with the acquisition after a three month period of due diligence, with data supporting its concept that a 10km long mineralised belt runs from Falun through its adjacent Greater Falun project.

The mine produced 28Mt of ore at 4% copper, 4g/t gold, 5% zinc, 2% lead and 35g/t silver until it was placed on ice in the early 1990s.

The deal will give Alicanto control of more than 60km of its target limestone horizon within a landholding of 312km2, considered highly prospective for analogues of the Falun mine.

It is also designing and submitting work plans to continue exploration at its own Greater Falun project, including the first modern use of surface electromagnetic techniques.

An exceptional acquisition

“Our due diligence has confirmed that this is an exceptional acquisition opportunity for the Company. The data suggests there is significant geological potential remaining at Falun,” Alicanto MD Rob Sennitt said.

“This data also supports the concept being developed by Alicanto that there is a major mineralised belt stretching over 10km from the historic Falun mine through Alicanto’s current holdings at the Greater Falun Project.

“There are numerous high quality targets already identified and this will only increase and be further refined by an extensive Ground EM program expected to be initiated in the first quarter.

AQI established a maiden inferred resource at its Sala deposit in July last year of 9.7Mt at a 4.5% zinc equivalent, containing 311,000t of contained zinc, 15Moz of silver and 44,000t of lead.

“Combined with our Sala Project, where we have defined our maiden Resource, Alicanto now has two outstanding assets in a Tier 1 location,” Sennitt said.

Data lives up to world class status

Historic drill data has identified significant gold and base metal mineralisation outside previous mining voids at Falun.

AQI says mineralisation at Falun is open in several historic, unmined drill intersections modelled in its 3D dataset.

They include:

- 50.8m at 3.4g/t gold, 0.5% copper (Eastern Cu-Au Zone)

- 37.4m at 23.6g/t gold, 0.5% copper (Eastern Cu-Au Zone)

- 21.1m at 6.9g/t gold, 0.9% copper and 0.07% bismuth (Eastern Cu-Au Zone)

- 11.6m at 61.2g/t Au, 1.2% Cu (Eastern Cu-Au zone)

- 6.3m at 4.3% copper, 1.2 g/t gold (Albenius Cu-Au Zone)

- 8.8m at 7.9% zinc, 0.2% lead, 0.8% copper, 8 g/t silver (SE Extension)

- 11.9m at 2.5% copper, 2.6g/t gold, 78g/t silver, 1.0% lead, 5.2% zinc (Western Cu-Au Zone) ; and,

- 7.2m at 7.2% copper, 1.1g/t gold, 75g/t silver (Western Cu-Au Zone).

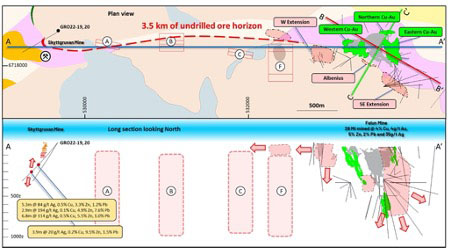

According to data from a high resolution gravity survey, completed after the mine stopped operating, several high priority targets were also identified between Falun and Skyttgruvan-Naverberg, presenting potential walk-up drill targets that have never before been tested.

If they are similar in nature to Skyttgruvan, Sennitt and co. will be very happy indeed.

Recently reported results from the first drill hole there, just 3.5km from the Falun mine, intersected:

- 5.3m at 6.8% Zn eq (84g/t Ag, 0.5% Cu, 3.3% Zn, 1.2% Pb)

- 2.9m at 14.7% Zn eq (194g/t Ag, 0.1% Cu, 4.9% Zn, 7.6% Pb)

- 6.8m at 9.7% Zn eq (114g/t Ag, 0.5% Cu, 5.5% Zn, 1.0% Pb, 0.13g/t Au); and,

- 3.9m at 11.3% Zn eq (20g/t Ag, 0.2% Cu, 9.5% Zn, 1.5% Pb).

Could Falun be a bargain?

If Alicanto is successful in showing Falun’s future is as bright as its illustrious past, the deal could be an absolute steal.

It has entered into a binding agreement with Explora Mineral for the acquisition for just $200,000, with a first condition of due diligence now satisfied.

The explorer is now just waiting on the approval of the transfer of tenements by Sweden’s Mining Inspector.

The project has seen little exploration since its closure, with no drilling or modern electromag surveys since 2011.

That is despite drilling hitting zinc and copper mineralisation in the South-East Extension of the Falun Mine down to the 750m level, and other hints of open mineralisation in the copper rich Albenius zone and West extension.

Some of the most extensive unmined mineralisation has been found in the Eastern copper-gold zone, where a drill program from 2009 to 2011 consisting of 33 holes and 5138m of core hit high grade gold and copper sulphides.

They include hits of 32m at 3.42g/t gold, 0.7% copper and 0.04% bismuth and 11.6m at 61.2g/t gold, 1.2% copper and 0.09% bismuth.

It is worth noting prices for gold, zinc and copper were miles back of where they are today when the mine was closed 31 years ago.

Gold was trading at under US$400/oz, compared to over US$1800/oz today, with copper (~US1/lb in 1992 and ~US$4/lb in 2023) and zinc (~US$1000/t in 1992 and ~US$3000/t in 2023) both at significant discounts to modern prices.

This article was developed in collaboration with Alicanto Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.