Resources Top 5: We’re still doing that antimony thing, hey?

This unassuming rock has doubled in value in 2024. Pic: Getty Images

- Canadian insto builds stake in Aussie antimony explorer Larvotto

- Osmond gets new family member as Tolga Kumova builds big stake

- Sleepy silver play Alicanto runs hot on nada

Here are the biggest small cap resources winners in morning trade, Monday, September 9.

LARVOTTO RESOURCES (ASX:LRV)

The run in antimony stocks feels like it reaches fever pitch each day before somehow lifting higher like Beyoncé scaling the keys at the end of Love on Top.

Soundalike Larvotto is front and centre, up more than 15% today after revealing a major buying spree from Canadian into 1832 asset management, which has picked up close to 16.5m shares on market since August 19.

Part of the Bank of Nova Scotia, the Canucks now control 5.31% of the stock, which is up a trippy 443% YTD. At a market cap of $118 million, the vast bulk of those gains have come since mid-August when the company was trading at just 15c.

It now sits at 38c. 1832 has dropped around $6 million on market since August 19, with its latest buy a lot of 1.08m shares at 36.76c on September 5 and the average sale price clocking in at around 36.5c.

Going the other way, market filings disclosed that Trafigura’s Urion Holdings has used the rise in the company’s share price to cash in, last month cutting its stake from 15.01% to 5.46%.

Larvotto recently commissioned a drill rig to start a second exploration program at its Hillgrove project in New South Wales, regarded as Australia’s largest accumulation of antimony.

5250m of drilling at the Clarks Gully deposit (measured and indicated resource of 266,000t at 3.8% antimony and 2g/t gold for 10.6g/t AuEq) will infill drilling to 20m to increase confidence and test a large geochemical anomaly to the south.

A recent PFS, dropped early last month, put a $73m price tag on restarting production at Hillgrove, where LRV is aiming to produce upwards of 80,000ozpa on a gold equivalent basis.

That included a 606,000oz AuEq reserve at 6g/t, though prices of both gold and antimony are now far higher on spot markets, thanks in no small part to export restrictions announced by dominant supplier of the tech and defence metal by China last month.

According to LRV, the project had a post tax NPV8 of $157m at US$2000/oz gold and US$15,000/t antimony prices, with a DFS now underway to target first product in early 2026.

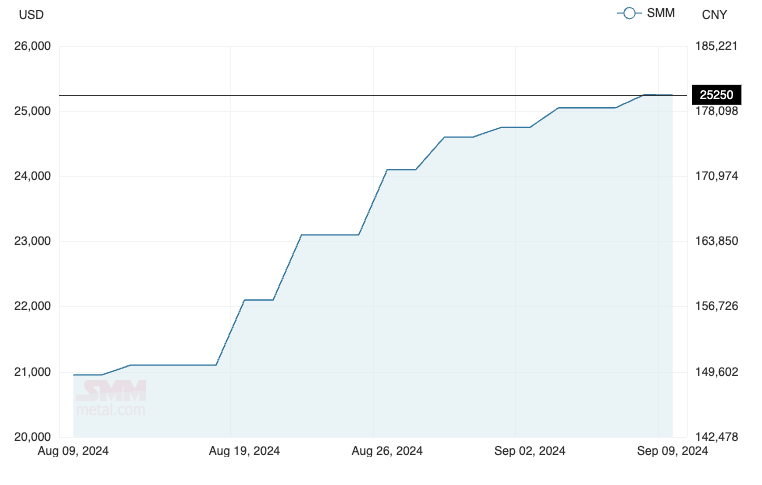

Gold is now trading around US$2500/oz on spot with antimony up around US$24,000/t on the Chinese trade war jitters. At spot prices seen in early August, Hillgrove could deliver a post tax NPV8 of $383m and IRR of 114%.

OSMOND RESOURCES (ASX:OSM)

Larvotto isn’t the only explorer riding high on past glories, with last week’s leading stonker Osmond continuing its upward momentum after rising 160% in morning trade on Friday.

The background there was the acquisition of an 80% stake in Iberian Critical Minerals, holding of the Orion EU project in Spain, which contains high grade samples of rutile, zircon and rare earths.

Those all screen as critical minerals, the sort of thing the EU needs to develop onshore thanks to its extreme reliance on imports, largely from China.

The EU wants to extract 10% of its critical minerals and process 40% of its consumption onshore, with permitting timeframes set at a maximum of 27 months for extraction projects under the European Critical Raw Materials Act, which came into force on May 23 this year.

But it currently produces none of its own titanium, light or heavy rare earths and less than 20% of its zircon.

Located halfway between Seville and Madrid, the award of the ‘Province Bulletin’ permit is due in Q4 this year.

It already announced some major changes with the deal, which will be voted on at an AGM in late October or early November.

Anthony Hall, former MD of Spanish focused potash stock Highfield Resources (ASX:HFR), will replace exec director Andrew Shearer as MD.

Meanwhile, Tolga Kumova was pulled in as a strategic advisor.

Disclosures today have shown the ‘small cap whisperer’, known for his early backing of Bellevue Gold (ASX:BGL) and stint as MD at graphite miner Syrah Resources (ASX:SYR), has taken a significant 8.18% stake in Osmond on Friday through his investment vehicle Kitara Investments.

Not all of his picks have been winners, but a gentle hiss of the word ‘Tolga’ does tend to bring the bees to pollinate the flower, at least on the first instance.

OSM shares are up 9% this morn to 18c, up over double from when it entered a trading halt ahead of the Spanish acquisition last Monday.

ALICANTO MINERALS (ASX:AQI)

(Up on no news)

All quiet on the Swedish front today and, in fact, for a long while, despite the silver and copper explorer charging more than 30% higher this morning.

The company has been in the midst of a long process to identify new opportunities since engineering a board restructure in June.

MD Rob Sennitt departed on the solstice, replaced by former Bellevue man Ray Shorrocks as interim exec chair.

The explorer, which owns the Falun copper and Sala silver projects in Sweden, also said it would tap on the experience of ex-BGL and now FireFly Metals (ASX:FFM) MD Steve Parsons and departed CFO Michael Naylor to engage in the review.

Last we heard in the company’s quarterly was the process was still ongoing. Maybe a hint of the firm’s new direction is close at hand.

BALLYMORE RESOURCES (ASX:BMR)

(Up on no news)

A close-run thing with Enova Mining (ASX:ENV) for our last no news entrant.

Enova had some results out last week from drilling at its CODA North rare earths project in Minas Gerais, Brazil.

Meanwhile, the last peep out of Queensland gold explorer Ballymore was the news it had begun drilling at its Day Dawn vein system within the Ravenswood project near Charters Towers.

The explorer is chasing up some rock chip samples which delivered results like:

- 127.5g/t Au, 708g/t Ag & 2.83% Pb

- 50.3g/t Au, 7100g/t Ag & 9.40% Pb

- 71.8g/t Au, 1460g/t Ag & 2.76% Pb; and

- 52.4g/t Au, 1515g/t Ag & 5.97% Pb.

Regal Funds-backed Ballymore should have some some assay results this month also from drilling at its Dittmer prospect.

MACRO METALS (ASX:M4M)

Macro Metals shares lifted close to 16% after announcing it had received the exploration licence for its Goldsworthy East project in the Pilbara.

A programme of works application is in with WA’s Mines Department, with M4M aiming to complete a minimum of 30 holes in its maiden campaign at 50m spacing to an average depth of 200m.

All up between 6000m and 8000m will be punched into the red dirt, proximal to recently discovered hematite outcrops of a width of 220m and strike of 450 which remains open to the west.

Rock chips delivering significant results have graded between 58% and 65% Fe, with drilling to begin on September 25 subject to the POW’s approval timeline.

“The Cook government recently reiterated its commitment to supporting Western Australia’s mining industry by expediting approvals, streamlining the approval process and providing incentives to exploration companies and the department’s handling of our Goldsworthy East project has certainly reflected that commitment,” MD Simon Rushton said.

“I am particularly grateful to the office of the Minister for Mines as well as the heritage and tenure teams at DEMIRS for accepting the two State Deeds that were executed on behalf of the Ngarla and Nyamal people and thereafter granting our exploration licence in a quick order of time.”

The site is just 1800m along strike from the historic Mt Goldsworthy project, which exported 55Mt of iron ore at 63.5% Fe between 1965 and 1982 by BHP.

M4M’s rise came despite bearish news for iron ore, with 62% Fe prices down almost 1% in Singapore this morning to US$90.90.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.