After a game of two halves in 2022, experts predict a big gold breakout in 2023

Pic: Chris Collins/The Image Bank via Getty Images

- Experts see gold approaching US$2000/oz in 2023 after holding up remarkably well against the rate hikes of 2022

- Martin Place Securities says currency weakness will prompt buyers to turn to gold as a safe haven

- Argonaut’s Eddie Rigg gives his pick of the top plays in the gold space

On the international market, gold prices have surged again – up around 3.5% in the last week by and are sitting at $US1865.79 (+1.78%) per ounce levels.

After two years besotted with crypto and battery metals, investors could circle back to gold miners in 2023 as the rate rises and cost pressures which have hammered the sector ease experts believe.

In search of a better phrase, gold equities have been honking for much of 2022.

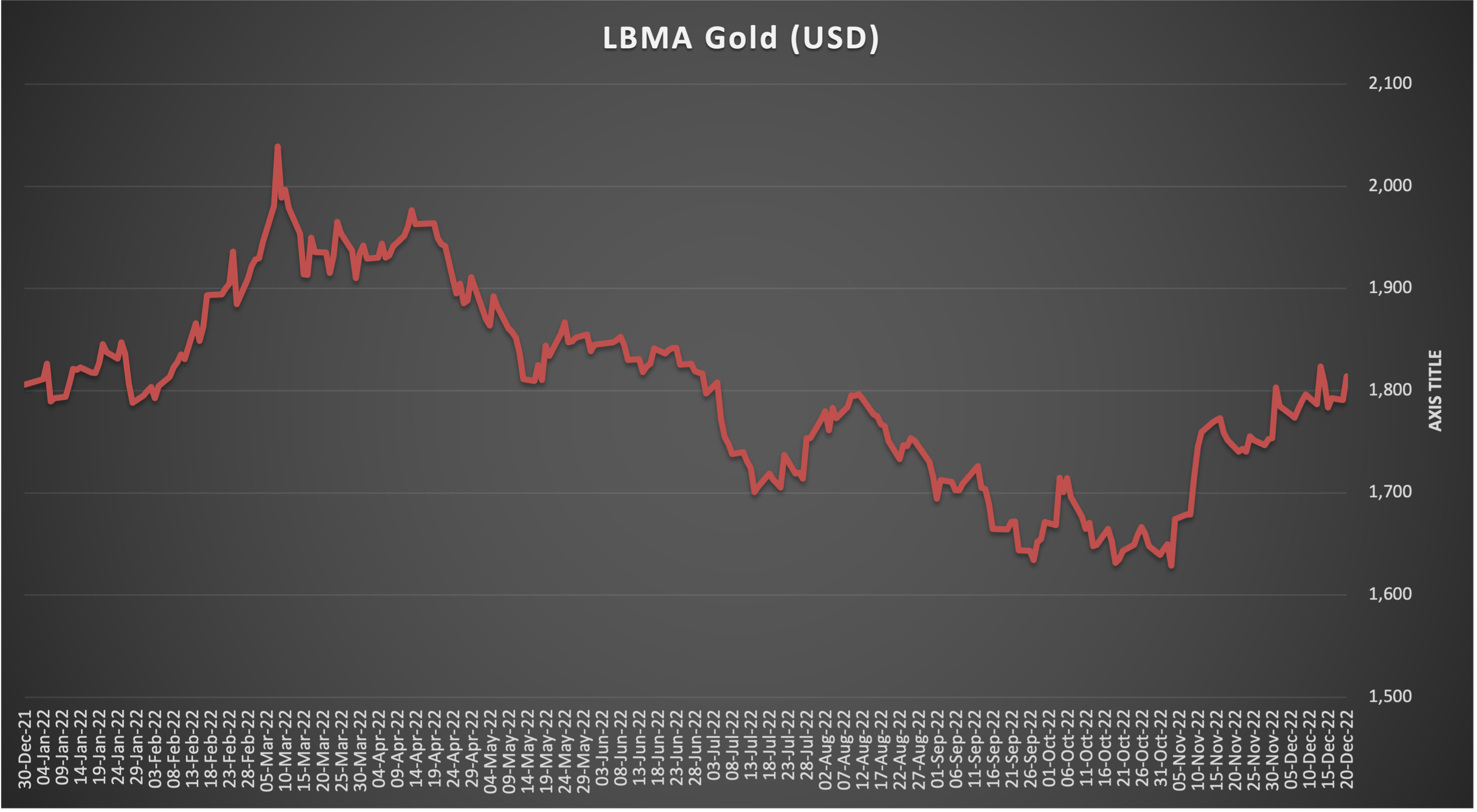

Having tested the all time record of ~US$2070/oz early in the year on a rush of safe haven buying in the days following Russia’s invasion of Ukraine, prices threatened to fall below US$1600/oz as a cycle of rate rises central banks thought would not be needed for two years sent investor confidence in bullion spiralling.

The US Fed hiked rates for the first time since 2018 with a 25 point lift in March before throwing the kitchen sink at the problem of 40 year inflation records by issuing another six, far more severe, hikes to end 2022 at a range of 4.25% to 4.50%.

Australia followed suit, Reserve Bank Governor Philip Lowe forced to issue a mea culpa to mortgage-holders after cheap loans came to an end with eight straight rises.

But with physical and central bank demand booming late in the year and hopes those rate rises will see an end in 2023 as inflation in the US begins to fall, the yellow metal has caught some late tailwinds to pull it over the line.

Having fallen to a loss of around a quarter at one point this year, the All Ordinaries Gold Sub-Index could turn actually turn positive in a late 2022 charge, down just 6.56% YTD on December 21 (aka Gravy Day) when gold was fetching US$1813.90/oz according to the LBMA.

Interest in gold has diverged in different quarters. While ETF investment has plummeted, jewellery consumption is above pre-pandemic levels and central banks bought 400t of gold in the September quarter, a record according to the World Gold Council.

So what will that mean for 2023?

The metal of prosperity

Veteran mining and gold analyst Barry Dawes of Martin Place Securities told Stockhead calls gold “the metal of prosperity” and thinks demand is going to rise from Asia and the US in 2023.

“The key thing to this prosperity is Asian demand and so looking into 2023, I see China, India, ASEAN and also the US believe it or not as being good strong markets. And the Middle East, I think will also be important there in terms of demand,” Dawes said.

“Then we’ve got the central banks being buyers. They’ve only come in the last couple of years as major buyers, but there’s a lot of strategic buying and the reason for that is concern over all currencies.

“So if you’re a central bank in Europe, the Euro has gone down the toilet and I’m very, very pessimistic on the Euro. People always talk about the US dollar being weak, I can’t see weakness in the US dollar that is a major bull market.

“And also central banks hold bonds and bonds took such a bath this part of this year. And I think longer term bonds look just absolutely horrible because they’re mispriced. So the central banks are going to continue to be buyers.”

Dawes thinks underlying demand for gold, based on physical premiums which peaked in October, is strong.

“When we look at the physical market to try and buy gold coin, you’re having to pay a premium and it can be 8-10% or more above the spot price,” Dawes said.

“And so that’s showing market tightness as well. And then you’ve got silver, try to buy silver you’re paying maybe a 60-70% premium for silver.”

2023 outlook

“The way the technicals run for me is that we should we should test US$1850-1870 possibly before the end of the year through to US$1900. If we go there, we almost certainly go very quickly to the previous high of sort of US$2080-90,” Dawes adds.

“In a bear market you’re always forecasting lower, in bull markets you’re always forecasting higher, but what we need to understand is that once we do get a bull market starting in something like gold, it runs for years and once it gets that momentum it just runs.”

He likes the look of a number of stocks on the ASX.

The big boys Newcrest (ASX:NCM) and Northern Star (ASX:NST) are “very cheap, excellent companies”, Dawes says, while a higher gold price “solves many of the issues” for producers in the next bracket down like Evolution (ASX:EVN).

He likes Westgold (ASX:WGX) as a producer as well, with Bellevue Gold (ASX:BGL) and De Grey Mining (ASX:DEG) the standout developers.

On the exploration side Dawes is keeping a close watch on Siren Gold (ASX:SNG), currently prospecting the Reefton Goldfield in New Zealand.

“It’s got assets in the Reefton Goldfields in New Zealand where the geology there is essentially identical, absolutely identical to what we’re seeing in the Victorian Goldfields and there are real potential replicas of Fosterville,” he said.

In Victoria and Tasmania Dawes says Southern Cross Gold (ASX:SXG) and Flynn Gold (ASX:FG1) have interesting discoveries on their hands, while he views Nova Minerals (ASX:NVA) with a 9.6Moz resource in Alaska’s Tintina belt as “absurdly cheap” and likes TSX-listed PNG explorer K92.

On the other hand, Dawes says the “political risk in Africa is still too high”.

SNG, FG1, SXG, BGL and DEG share prices today:

Also positive on gold

Also in the gold bull category is Argonaut executive chairman Eddie Rigg, whose iconic Perth stockbroking firm launched a $50 million gold fund in October this year.

“We formed a very strong view that we saw good upside on gold and we’ve experienced poor performance, particularly in Aussie gold equities,” he said.

“Over the last year the US (dollar) gold price stayed quite resilient, which is really unusual given we had so many interest rate rises during the year.

“If you go back over hundreds of years, literally, if you have interest rate rises, we normally see gold come off but gold stayed reasonably strong, reflecting the global uncertainties, reflecting quite strong central bank buying.”

If interest rate rises are close to their top, Rigg says it could create an environment where gold could really pop.

One concern is cost management among gold miners. While a weaker Aussie dollar against the US dollar has meant Australian companies have received more for their bullion, average costs in Australasia rose above US$2000/t for the first time in the September quarter.

Those inflationary pressures have seen the collapse of Wiluna Mining in WA and the closure of Gascoyne Resources’ (ASX:GCY) Dalgaranga mine.

Aurelia Metals (ASX:AMI) in New South Wales also felt the pinch, prompting the departure of its boss Dan Clifford and prompting plans to close the loss making Hera mine early in March 2023.

Rigg thinks inflationary pressures will ease, but noted one of the big handbrakes on gold miners, accessing top level and skilled young talent, would remain an issue.

“We think once again cost inputs, obviously diesel and energy inputs are one of the biggest inputs, it’s definitely coming off and hopefully continues to come off further.

We’ve also seen just a little bit of loosening on the employment market,” he said.

“One thing I do say about that (is) it worries me getting talented people to work in the gold industry that’s actually a concern.”

Where is the commodity headed?

One thing some gold miners have held up as a bastion for gold heading into 2023 is the collapse of confidence in crypto as an asset class following the FTX debacle.

Rigg doubts that will have a big impact, noting investors in gold and crypto tend to come from different demographics.

But he sees gold staying strong nonetheless.

“I think underlying equity prices is a pretty good signal for where commodity prices are going. We’ve seen lithium equities come right off over the last month and a half.

But you’ve also seen gold stocks start to move up,” Rigg said.

“So I think the market’s telling us the gold price is going up Argonaut’s sort of view we would not be surprised to see US$2,000.

“Plus, it’s getting expensive to mine, there has to be a certain margin and it’s hard to find.”

Any stock picks?

Rigg says standouts in the gold space include companies who have been beaten from pillar to post in 2022 despite strong underlying operations.

He ranks Ramelius Resources (ASX:RMS) and Silver Lake in this group.

~280,000ozpa Ramelius, he said, is priced for “asset destruction”.

The addition of the ultra-high grade Penny mine should have a positive impact on Ramelius’ margins, containing 230,000oz at a ridiculous 15g/t.

“Penny is really high grade and we saw historically when Ramelius was mining at Vivian that high grade material acts as a real sugar coating and can cause quite strong profit,” Rigg said “So we like Ramelius and we’re strong on Ramelius, and we continue to be strong on Silver Lake.

“We think Luke Tonkin runs a really find company once again, it’s not really priced to reflect how good that management team is.”

270,000ozpa Westgold, which is down over 50% YTD, is another Rigg says is undervalued.

“Westgold has been trading at an EV per production ounce of around 1000 bucks an ounce. That’s not even taking into account they’ve got $150-200 million worth of plant and equipment,” he noted.

“So if you actually took off their market cap the cash, the value of the plant and plant equipment, it’s most probably trading at well less than $1000 per production ounce and Australian companies trade typically in that sort of $4000-6,000 range.”

If they can take cost out Rigg thinks WGX could surprise to the upside, especially if they can source a new asset and drop some older lower quality ones.

WGX, RMS and SLR share price today:

Unlike Dawes, Rigg is positive on African-based Perseus (ASX:PRU) and West African Resources (ASX:WAF), two of the lowest cost gold miners on the ASX.

“If both companies had Aussie assets … we would think they’d be both worth double what they’re trading at now,” Rigg says.

“We’ve been really impressed by how well they’ve run their operations and we continue to believe they’re reasonable value.

“Our analysis shows that you’ve got to produce twice the amount of gold at the same margin in Africa to be rated the same as an Aussie producer.”

PRU and WAF share price today:

The developers

Rigg says “no one will convince us otherwise that De Grey (ASX:DEG) isn’t a standout”.

De Grey owns the 500,000ozpa plus Hemi discovery in WA’s Pilbara region near Port Hedland, the first tier-1 find in Australia since the Tropicana gold mine.

That makes it a potential target for some of the world’s biggest miners like Barrick, Newmont and Agnico Eagle.

“Even including the producers, we don’t think any of them are particularly attractive because they have some sub-standard assets, right?” Rigg said.

“The last thing a Barrick wants to buy or a Newmont wants to buy is a company where they have to sell-off the assets. So this is a company which has an asset which would be perfect in those companies.”

From an African perspective, Rigg thinks Predictive Discovery (ASX:PDI) and its 4.2Moz Bankan find in Guinea is another standout.

Like De Grey’s Hemi, he says the consistency of the orebody and predictability of drill hits makes it standout geologically.

“It hasn’t been as well recognised in the marketplace because you’ve got some permitting issues,” he said.

“But those pemitting issues they’re moving through those and they’ll get those those dealt with and to us once I get that permitting resolved and get they’re updated. I think it’s a scoping study in the first half of next year, and it’s another absolute takeover target.”

Another potential takeover target, according to Rigg is Musgrave Minerals (ASX:MGV), owner of the 927,000oz Cue gold project and 10.4g/t Break of Day deposit.

MGV has Evolution on its register and is in the same neighbourhood as Ramelius and Westgold Resources, both likely hunting for bolt on assets.

MGV, DEG and PDI share price today:

Any disappointments?

Rigg says new mines have done substantially better than restarts in recent times, with Capricorn Metals’ (ASX:CMM) Karlawinda the standout development in recent years.

He views the capital raising to support the continuation of recent ASX laggard Resolute Mining’s (ASX:RSG) Syama project as ‘disappointing’ as well.

Rigg also cautioned that Australian gold miners’ foray into North America and particularly Canada has yet to bear fruit, with St Barbara’s (ASX:SBM) purchase of the Atlantic Gold Operations in Newfoundland particularly disappointing.

They will be spun out along with the Simberi mine in PNG into a new company called Phoenician Gold as part as Raleigh Finlayson’s management team at Genesis Minerals (ASX:GMD) take the reins at SBM’s flagship Gwalia mine in Leonora as part of the Hoover House merger.

RSG, GMD, SBM and CMM share prices today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.