Africa has some of the world’s highest concentrates of uranium, who’s going to make the next big discovery?

Pic via Getty Images

We take a deep dive into the African nations with significant uranium mining potential and the intrepid ASX explorers looking to strike while the iron’s hot.

Namibia might be the driest country in sub-Saharan Africa, but its unexploited uranium-rich deposits are continuing to attract foreign investor interest as the world shifts away from fossil fuels.

The semi-arid southwest African nation is Africa’s biggest producer of the ore and the world’s third-largest, accounting for 11% of global production in 2022.

Its 48-year history with the energy metal dates back to 1928 when uranium was first discovered in the Namib Desert and eventually produced by Rio Tinto in 1976 following the opening of the Rossing Mine – the largest, longest running open pit uranium mine in the world.

That’s two generations of Namibians familiar with uranium.

While nuclear power continues to be outlawed in many places around the world, including Australia, Elevate Uranium (ASX:EL8) managing director Murray Hill says it is growing in acceptance amongst Namibians who aren’t scared of it.

“There’s been three uranium mines developed in Namibia in the last 16 years and there’s been two mining licences granted to our peers – Bannerman and Deep Yellow – in December last year,” he says.

“It is a great country to do business, it is the only country with a dedicated uranium association, the conduit between exploration, operating resource companies, the public and other stake holders.”

EL8’s growing uranium portfolio in Namibia

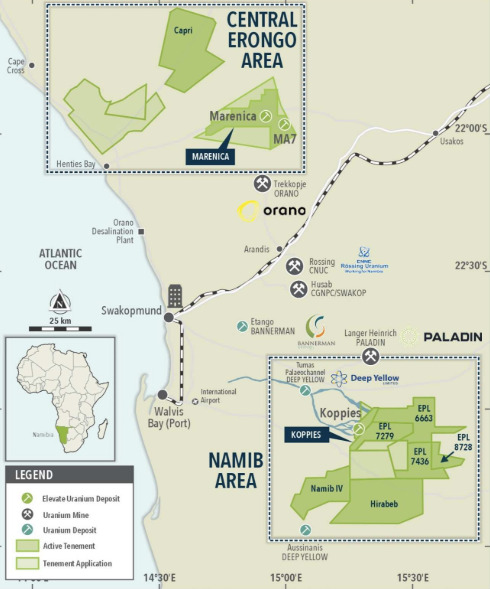

EL8 owns the largest tenement area for uranium in Namibia with its shallow Koppies and Merenica uranium deposits in the Central Erongo area.

The company is sitting on 57.8Mlb U3O8 at Koppies after upgrading its resource by 20% in early April with three rigs still on the go.

An infill drilling program is underway to upgrade the inferred resource to the higher confidence indicated category which has sufficient certainty for mine planning.

The explorer has also demonstrated exploration success having made four discoveries over the past four years (Koppies, Hirabeb, Capri, and Namib IV) thanks in large part to historical information from the previous owners, General Mining.

“They explored the Erongo region back in 1970s and ’80s which provided a guide to where they thought there may have been uranium,” Murray says.

“Our initial focus was upstream of known deposits where we thought there could have been extensions to known mineralisation.

“We also used a combination of airborne radiometrics and EM, as well as walking the ground to confirm the target areas selected from the airborne surveys.

“But when it comes to considering where the next major uranium discovery might be made in Africa, I would lean towards a country with low geopolitical risk,” he says.

“It would be a country where exploration is possible without fear of coups or the like, and the country would be Namibia.”

Spotlight on Senegal

Next on our grand tour is Senegal, which according to the World Bank, has cemented a reputation as a stable African nation following its independence from France in 1960.

The country’s growing mining sector produces phosphates, gold, mineral sands, manganese, and industrial clays which accounted for 40% of the country’s export revenue, 2.2% of GDP, and 5.3% of government revenues in 2019.

Recent mining exploration activities have been driven by major gold discoveries such as TSX-V listed Endeavour’s Sabodala-Massawa expansion project, Resolute Mining’s (ASX:RSG) Mako gold mine and Chesser Resources’ (ASX:CHZ) Diamba Sud gold project.

But foreign interest in Senegal’s mineral wealth diversity is also growing with multiple operations exploring for deposits such as iron ore, zircon, titanium, and uranium.

Looking to repeat the success of Namibia’s robust uranium production industry, ASX juniors like Haranga Resources (ASX:HAR) are branching out to countries such as Senegal in the hope of making new uranium discoveries.

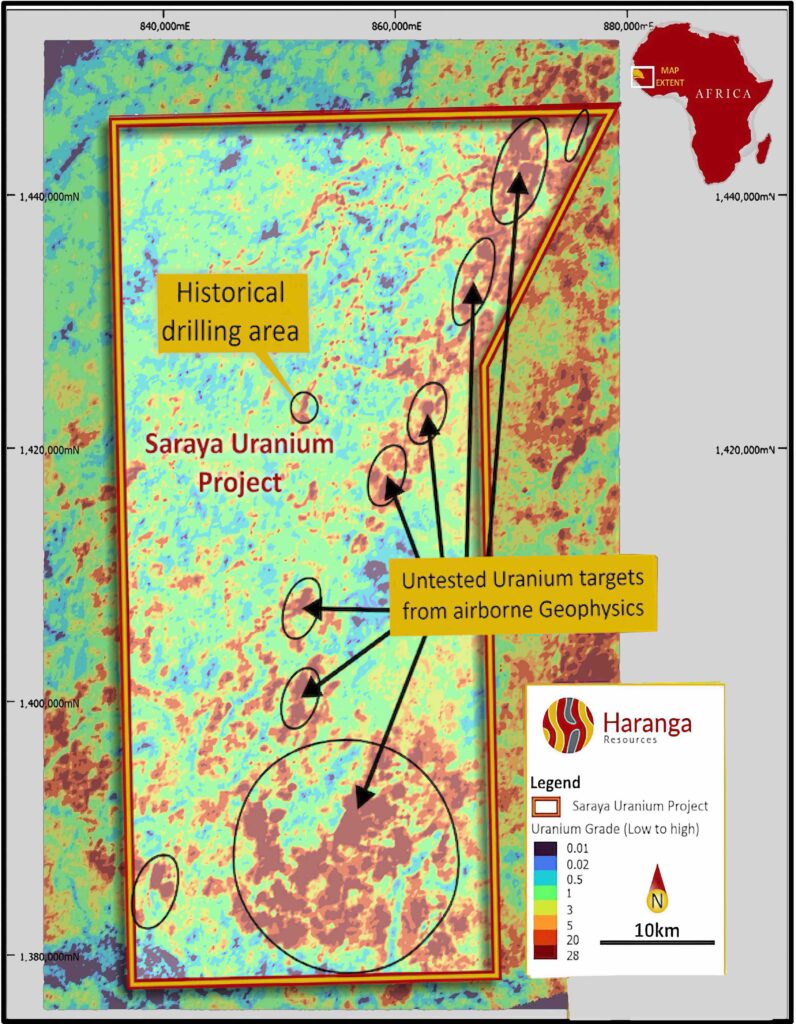

HAR identified a ‘significant exploration target’ for uranium mining at the Saraya project in 2022 after conducting a review on historical drilling results.

A drilling program of 541 historical holes and 22 holes led to the release of an inferred resource of 12.45Mt grading 587 parts per million eU3O8 for 16.1Mlbs of contained U3O8 in October last year.

But there could more where that came from with several anomalies even larger than the resource yet to be tested.

As part of HAR’s exploration strategy, 91 new auger holes have been drilled and assayed at the Sanela prospect with 29 recording significant pXRF readings in saprolite samples.

These results returned concentrations ranging from 14ppm to 81ppm.

The project received an additional shot in the arm after test work confirmed that uranium could be leached at rates consistent with other projects.

A resource upgrade is expected by the end of June.

Tapping into Tanzanian resources

Tanzania is another African country that is emerging as an important hub for the mining of green energy transition minerals.

The East African nation boasts 13% of the world’s graphite deposits, hosts enormous natural gas reserves, produced roughly 3,000 metric tons of copper in 2022 and held roughly 58,200t of uranium resources in 2021.

Despite past challenges and government interference, the country’s abundant mineral resources could position the country as a key player in the global critical minerals supply chain.

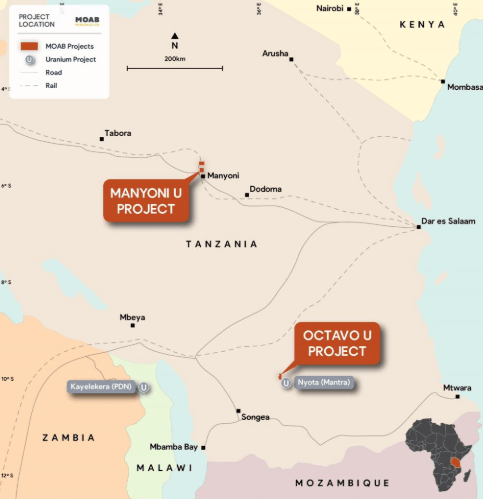

One company looking to capture a slice of Tanzania’s mineral wealth is Moab Minerals (ASX:MOM) following its agreement to acquire 81.85% of Linx Resources, the owners of the Manyoni and Octavo uranium projects.

Manyoni is 100km northwest of Tanzania’s capital Dodoma and was previously explored by ASX-listed company Uranex – now Magnis Energy Technologies (ASX:MNS).

Uranex’s work identified six separate resource areas and led to the definition of a 20.5Mlb of U3O8 at a grade of 147ppm U3O8 resource in 2010 under the older JORC Code 2004.

MOM managing director Malcolm Day says the project acquisitions are a potential company maker.

“The immediate task at hand is to upgrade the historic resource at Manyoni to JORC 2012 and at the same time increase resources by additional drilling in prospective areas,” he says.

Meanwhile the company’s Octavo tenement, which is more grassroots, is in a highly prospective area adjacent to and abuts Rosatom’s world-class uranium deposit at Nyota, formerly owned by ASX lister Mantra Resources before its $1.02bn takeover in 2011.

Nyota has a measured and indicated mineral resource estimation of 187 million tonnes at 306ppm, containing 124.6 million pounds of uranium, representing one of the largest uranium reserves in the world.

Work at Octavo is focused on the acquisition of airborne radiometric and magnetic survey data which is expected to deliver uranium targets for ground follow-up.

Movers and shakers in Mauritania

Mauritania, bordered by the Atlantic Ocean to the west, Western Sahara to the north, Algeria to the northeast, and Senegal in the southwest is a sovereign country in Northwestern Africa, known predominantly for its iron ore production.

The country produced 13Mt of the material in 2022 but mining projects in rare earths, vanadium, phosphates, and uranium are also under development.

Aura Energy (ASX:AEE) believes its Tiris project can grow to represent a globally significant uranium province as drilling continues to define new areas of extensive, shallow, high-grade uranium mineralisation.

Tiris, already a well-established asset with 113Mt at 236ppm U3O8, for a contained resource of 58.9Mlb U3O8, represents a calcrete-type uranium deposit – the largest of the surficial deposits – which had not been reported in Mauritania prior to Aura’s discoveries.

AEE’s find spurred the Mauritian government to grant the company a 30-year tenure security for exploration and development in February 2023, allowing mining activities to occur over a 30-year period.

The company raised more than $18m in March to fast-track predevelopment activities after a front-end engineering design (FEED) study estimated Capex at a relatively low US$230m with payback in 2.5 years and a 17-year mine life.

With a development decision expected later this year, the soon to be producer is focused on proving up its resource base through drilling for future expansion opportunities beyond the currently proposed 2Mlbs per annum production rate.

Uranium stocks share prices today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.