Adelong kicks off gold and antimony drilling at Lauriston project in Victoria

Adelong has kicked off an antimony and gold-targeted drilling program at the Comet and Yankee/Trojan prospects. Pic: Getty Images

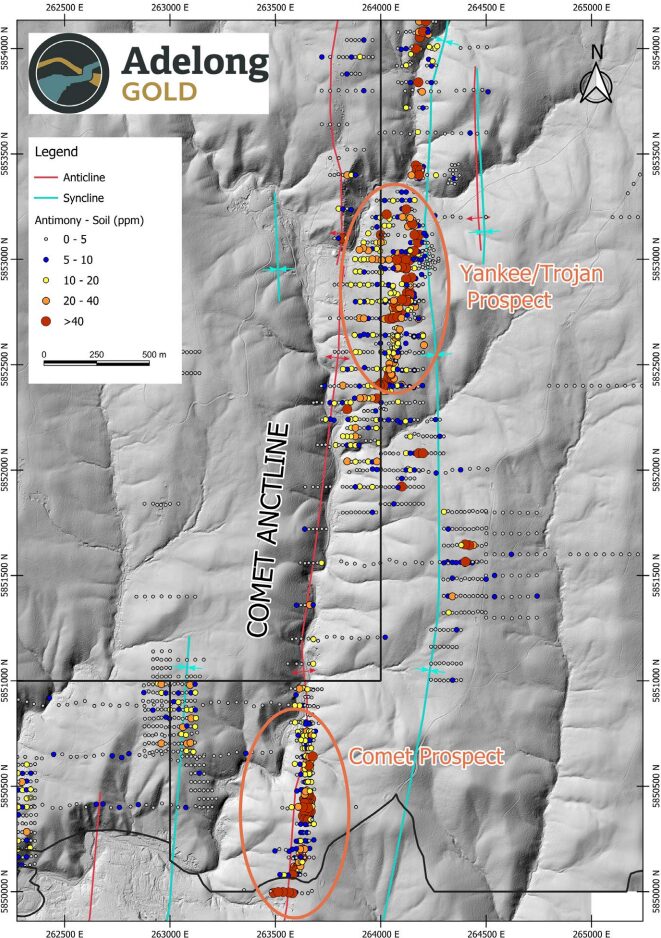

- ADG is targeting antimony and gold mineralisation with drilling at the Comet and Yankee/Trojan prospects

- Maiden drilling program to cover 3000 metres centred on historical high-grade drilling intercepts

- Funding available to rapidly expand program with first assays expected in December quarter

Special Report: As gold prices keep pushing for new highs and demand for antimony rapidly expands, Adelong Gold is zeroing in on both minerals with a diamond drilling program at the Lauriston project in Victoria.

The company intends to drill 3000 metres at the Comet and Yankee/Trojan prospects at Lauriston, following up on historical drilling results that produced up to 8m at 104g/t gold and 2m at 413g/t gold.

There is also historical evidence of antimony in diamond core from Lauriston, grading up to 0.89m at 2.24% stibium (antimony) and 0.1 metres at 10.3% stibium.

Adelong Gold (ASX:ADG) managing director Ian Holland said Lauriston had seen very limited modern exploration despite sitting in a highly prospective part of Victoria.

“Drilling at Comet and Yankee/Trojan will test more than 3km of strike, following up exceptional historic grades at Comet and advancing targets with the same structural setting seen at Fosterville,” he said.

“It is a significant step in building value across our Victorian portfolio.”

Adelong expects the program to take two to three months to complete, anticipating first results sometime in the December quarter.

Should ADG’s program be successful, the company is well funded to extend the program along strike and at depth, as well as following up with ground mapping and geochemical sampling.

Promising structural indications

Adelong’s drilling program at the Lauriston project is targeting an area of high-grade mineralisation associated with west-dipping faults thought to be related to the Comet Anticline.

ADG believes Lauriston displays similar characteristics to the Costerfield project – structurally controlled, high-grade gold-antimony mineralisation hosted in Paleozoic sediments.

Operated by Alkane Resources (ASX:ALK), Costerfield produced 43,346 ounces of gold in 2024 and 1282 tonnes of antimony.

The company says the project’s mineralisation is epizonal in nature, a style associated with some of Victoria’s most lucrative gold systems.

One such example is the Fosterville gold mine, which produced 4.2 million ounces of gold between 2005 and 2023.

ADG is exploring Lauriston with a staged approach, with the goal of ensuring a systematic evaluation of its prospects.

This article was developed in collaboration with Adelong Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.