‘A vast, swarming gold system’: Successful mine builder Adonis Pouroulis on why he joined the Golden Rim board

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Special Report: In January, experienced explorer and mine builder Adonis Pouroulis joined the board of explorer Golden Rim. What does Pouroulis – who most notably guided Toro Gold from microcap explorer to $407m takeover target — see in this West African gold play?

London-based Pouroulis cut his teeth on the gold mines of South Africa. Since then, he has established no less than eight mining companies, most notably Petra Diamonds — which he grew into Africa’s largest diamond producer and a FTSE250 company — and Toro Gold.

Founded in 2009, Toro went from making a greenfields discovery at the Mako project in late 2011 to first gold production in just six years.

Toro was recently bought out by major miner Resolute (ASX:RSG) for $407m.

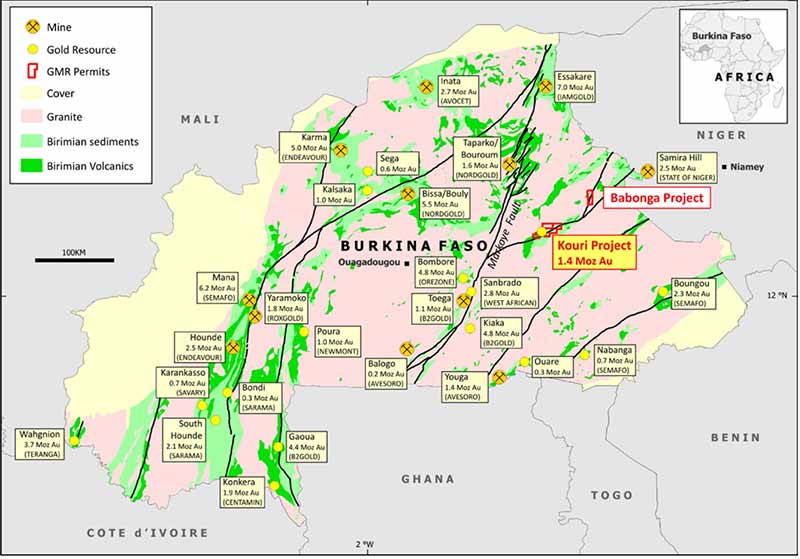

Last year, Golden Rim (ASX:GMR) acquired the Margou and Goueli permits, which literally ran to the edge of its existing 1.4moz Kouri project resource in Burkina Faso.

The seller was a consortium that included Westward Investments, a company associated with Pouroulis.

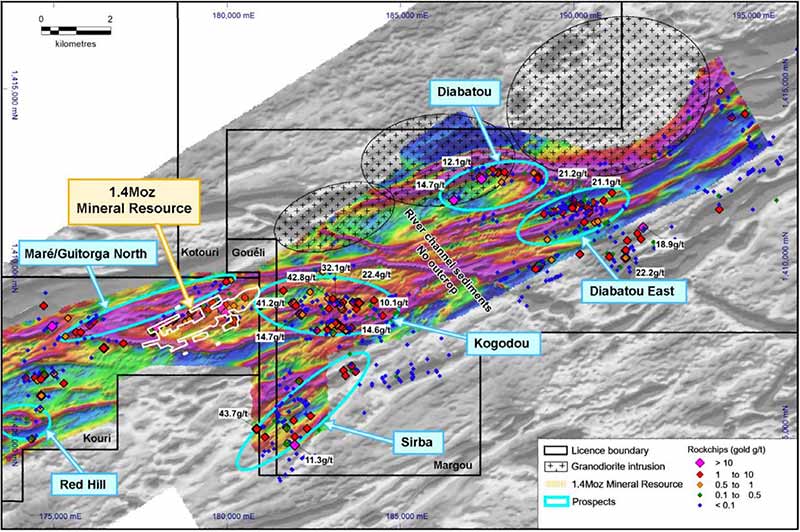

The initial plan was to drill extensions to the existing deposit, before Golden Rim stumbled upon some artisanal mining areas in the new licences, about 10km away.

These high-grade workings were granite hosted — quite different from the existing Kouri resource — so the explorer drilled a hole underneath an ~8-gram-per-tonne (g/t) surface rock chip.

Lo and behold in early August, Golden Rim announced near-surface intersections like 1m at 783.8g/t gold from 44m, inside a larger 7m intercept grading 121.2g/t at this new Diabatou target.

Those are phenomenal grades from an incredible land package, Pouroulis says.

10 big mines have come online in the last decade or so, he says, like Kiaka (5.9moz), Bomboré (5.2moz), Essakane (7moz) and Sanbrado (2.8moz).

These are all controlled by a major fault system which runs directly through Golden Rim’s ground.

“Put the original Kouri property together with the two new properties, Goueli and Margou, and you have 40km of strike. There’s gold mineralisation along that entire strike length,” he told Stockhead.

“This is a vast, swarming gold system. I’m just excited by the possible scale of it.

“Gone are the days of looking for 1 million ounces, or even 2 million ounces.

“The idea for any junior in today’s world is to have upside beyond 3 million ounces – and I think we have the land package to get there.”

Unlike the Mako orebody — which Pouroulis calls ‘contained’– the upside at Golden Rim’s acreage remains open-ended.

“Toro Gold was a fantastic success for us,” he says.

“Mako was a beautiful ~1moz orebody — easy mining, great metallurgy — but we couldn’t extend it, despite everything we tried.

“[The orebody] was contained in a ‘bowl’ shape. We didn’t have room for expansion, whereas Golden Rim has plenty.”

You only have to look at the underlying geology, he says.

“You can see these beautiful folds on the geophysical data, [some of which line up with] zones where Golden Rim has drilled already.

“You can see where the gold is. That whole system runs north right through Goueli and Margou and beyond.”

The road to 3moz and beyond

By the end of 2019 the explorer had touched just 10km of the entire 40km-long mineralised shear zone at Kouri. A massive drilling barrage in 2020 is set to change that.

The next step for Golden Rim is to prove up the magnitude and size of this resource, which is going well. The explorer is currently making high-grade gold discoveries all over the place.

“The next 12 to 18 months will see us focusing on growing that resource, adding ounces to the balance sheet,” Pouroulis says.

“I think we should be focusing on getting that 1.4moz Kouri resource to about 3moz, but we would love to go for a long-term target of 5moz.

“I’m not saying we have that yet, but we have space to grow – it’s a beautiful thing.”

This story was developed in collaboration with Golden Rim, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.