A significant shift is under way across iron ore markets

Lower grade iron ore prices continued to surge on Thursday, closing the session at fresh multi-month highs.

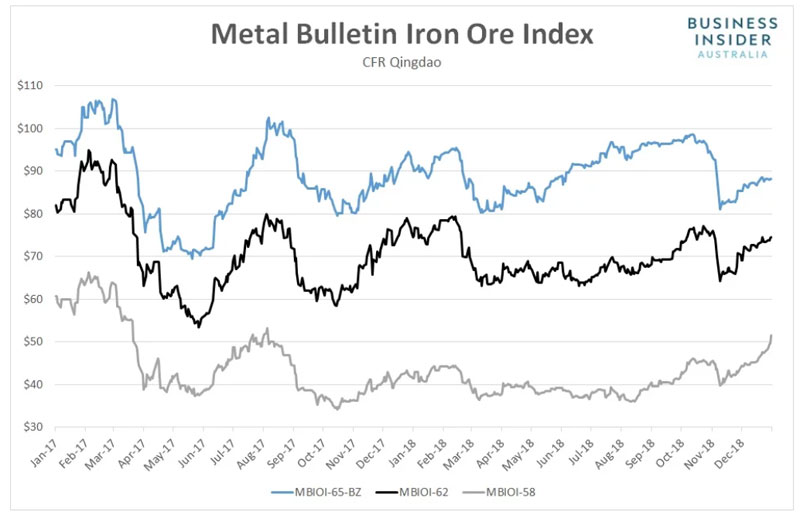

According to Metal Bulletin, the price for 58% fines jumped by a further 3.6% to $51.51 a tonne, leaving it at the highest level since late August 2017.

The daily percentage gain was the largest in seven weeks, extending its rally from late November to nearly 30%.

The price surge in cheaper, less efficient ore was in stark contrast to the performance of mid and higher grades on Thursday.

Benchmark 62% fines added 0.3% to settle at $74.55 a tonne, the highest level since November 11 last year. The price for 65% Brazilian fines was steady at $88.10 a tonne, continuing to lag the uptrend seen in lower grades.

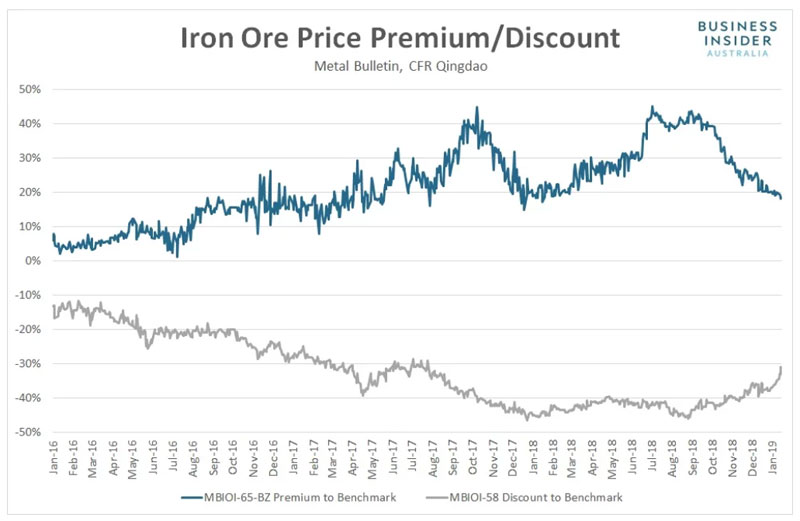

With the price for 58% fines far exceeding that for 62% fines, the price discount between the two narrowed to the smallest level since late July 2017. The price premium for demanded for 65% fines over the benchmark also declined to the lowest level since January 19 last year.

“China’s preference for higher grade iron ore has declined notably from recent peaks as mills look to cheaper lower grade alternatives like the 58% Fe grade following the fall in steel margins,” Vivek Dhar, Mining and Energy Commodities Analyst at the Commonwealth Bank, wrote earlier in the week.

“The fall in high grade iron ore prices doesn’t mean that China’s preference for high grade ore is set to diminish structurally, but the economics of higher grade ore over mid and low grade ore remains an important consideration.

“Steel margins remain the critical driver of iron ore prices and China’s preference for higher grade ore.”

The gains in spot markets came despite another quiet session in Chinese steel and bulk commodity futures with minimal movement recorded from Wednesday evening.

Rebar and hot-rolled coil futures in Shanghai finished at 3,551 and 3,458 yuan respectively, while iron ore, coking coal and coke contracts in Dalian edged higher to last trade at 513.5, 1,231.5 and 2,034.5 yuan respectively.

However, after lagging the move in physical markets earlier in the day, iron ore futures, along with all other steel and bulk commodity contracts, pushed higher during Thursday’s night session.

SHFE Hot Rolled Coil ¥3,493 , 1.13%

SHFE Rebar ¥3,590 , 1.10%

DCE Iron Ore ¥519.50 , 1.56%

DCE Coking Coal ¥1,236.00 , 0.65%

DCE Coke ¥2,053.50 , 1.03%

The gains point to continued buoyancy in spot markets on Friday.

Trade in Chinese commodity futures will resume at midday AEDT.

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.