A-Cap Energy ready to restart Letlhakane uranium project in Q1 2022

Pic: Tyler Stableford / Stone via Getty Images

A-Cap Energy has dusted off its Letlhakane in Botswana – one of the world’s largest undeveloped uranium deposits – off the back of improving prices and market sentiment.

The company plans to kick off a work program in Q1 2022, to re-work the previous studies, bring them up to date and gear up to get the project up and running.

“We’ve been working on this for 10 years, and we’ve had it on care and maintenance for the last five years, waiting for the uranium price to turn,” A-Cap Energy (ASX:ACB) deputy chairman Paul Ingram said.

“We’ve taken it to prefeasibility, we’ve got a mining lease already granted and we own 100% of the project.

“We have spent over A$50m on the project to date and have done all the hard yards. We now plan to refine and update some of our previous work plus do additional drilling and metallurgy.”

“And we’ve maintained most of our technical team and we have good local relationships in Botswana, so we’ll be cranking up a pretty big program there next year.”

Ingram and his team are not newcomers to the uranium scene, having been involved for many years in his career with the Ranger uranium project in the Northern territory, and also with Cogema, the former French Atomic Energy Commission. Later, he had close ties with Cameco, the worlds second largest uranium producer.

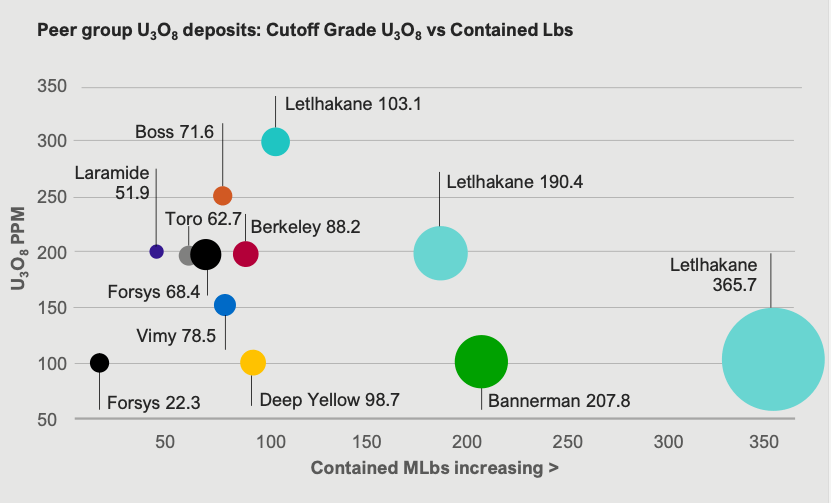

Undervalued compared to peers

Ingram said there’s a bit of a comparison battle between A-Cap and its peers Bannerman (ASX:BMN), Deep Yellow (ASX:DYL) and Vimy Resources (ASX:VMY).

“Our project is bigger, similar grade to Bannerman, and depending on cut off – a lot more tonnes,” he said.

“Both projects are in the same sort of jurisdiction and there’s not much difference overall.

“But the big difference is Bannerman’s market cap is about $360 million and ours is about $150 million.

“At the moment we’re undervalued by a factor of two.”

Ready to pounce when the price is right

Plus, all the uranium would-be-developers are in the same boat, with production years away.

“You have got a three-year lead time – minimum, before you’re doing one pound of production,” Ingram said.

“And all these groups, including us, need a stable uranium price close to $60 a pound.

“Currently, it’s about $46-48 and there’s rumours around it’s supposed to go up towards $100.

“But when it gets up around $60, you’ll see a lot of action in the uranium space – and we’re just sitting back there with a big low-grade deposit, ready to go.”

This article was developed in collaboration with A-Cap Energy Limited, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.