A behind-the-scenes look at the progress PNX is making to become a near-term gold producer

Pic: Getty

Not every junior explorer has a daily or even weekly news update to present to the market but that doesn’t mean they aren’t working hard behind the scenes to bring a project to fruition.

PNX Metals (ASX:PNX) is a prime example of a small explorer making big inroads into becoming a near-term gold producer but hasn’t had a lot of newsflow.

So just what exactly has PNX been up to?

Managing director James Fox says a considerable amount of work has been completed at its Fountain Head gold project in the Northern Territory since the positive pre-feasibility study (PFS) results were announced in June this year.

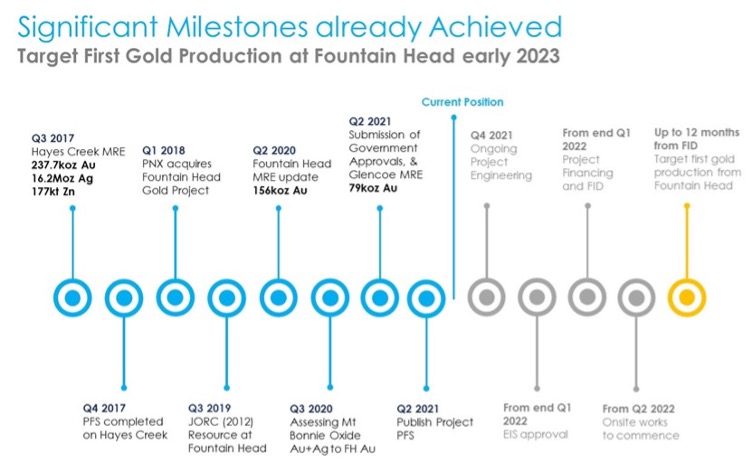

“PNX is progressively ticking the boxes and is on track to make a final investment decision once government and environmental approvals have been granted, which we anticipate will be from the end of the first quarter of 2022,” he said.

According to PNX’s timeline, this aspiring gold producer is aiming for construction of the Fountain Head project to begin in the second quarter of next year, followed by first production in early 2023.

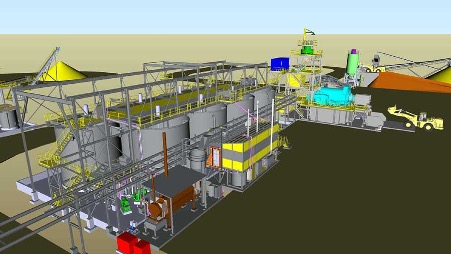

There’s even a mock-up of what the gold plant will look like.

PNX has checked off several milestones since it acquired Fountain Head in early 2018, including the definition and update of JORC-compliant resources, identifying opportunities to bring forward projected cashflow, submission for government approvals, and completion of a pre-feasibility study.

Extensive exploration

Since the release of the PFS, PNX has completed around 4,000m of drilling at the Glencoe deposit to test for near-surface extensions to gold mineralisation and increase the confidence of the resource.

Glencoe currently hosts an inferred resource of 2.1 million tonnes at 1.2 grams per tonne (g/t) for 79,000 ounces of contained gold.

Drilling, however, has identified immediate extensions to near-surface gold mineralisation.

These new hits have extended the strike by more than 280m to the southeast of the existing resource, and 450m from the historic North-Central pit.

Importantly, several thicker near-surface zones of gold mineralisation were intersected.

This all bodes extremely well for increasing the Glencoe resources.

Making strides in ESG

PNX has partnered up with Sunrise Energy Group to complete a front-end engineering design (FEED) study in Q1 2022 for a standalone hybrid power station located at Fountain Head.

PNX envisages the power station will use an initial 41% renewable power, delivering an overall reduction in the project’s carbon footprint as well as operating costs.

The power station will comprise a 4.6-megawatt-peak (MWp) solar farm, 2.3MW (2.2MWh usable) Batter Energy Storage System (BESS), 3 x 2,000 kilovolt-ampere diesel generators and a hybrid energy controller.

PNX says the design of the architecture is important as it will allow the solar PV, BESS and generators to be interconnected in a complementary manner to ensure smooth power transmission to the project.

The mining operation will be built in stages, with the Fountain Head project to be brought into production first. The near-surface oxide and free-milling gold and silver from the Mt Bonnie, Glencoe and Fountain Head open pits will be processed through a 750,000-tonne-per-annum plant over the first five years.

The Hayes Creek gold-silver-zinc project would then be brought into production in year four. The processing plant has capacity potential of up to 900,000 tonnes per annum.

The combined operation would have an initial mine life of 10 years and is estimated to have a pre-tax net present value (NPV) of $171m and a pre-tax internal rate of return (IRR) of 63 per cent.

Both NPV and IRR are metrics used to assess the profitability of a project – the higher the number is above 0, the more profitable it will be.

PNX has engaged Argonaut PCF to handle the project financing process, which is expected to be finalised in Q1 2022.

Mitigating cost increases

While third party contractor costs have increased by around 20% over the costs used in the PFS, PNX says it has found ways to mitigate those, such as by using second-hand equipment, moving crushing off the balance sheet, and using a modular design to reduce site-based construction costs.

The company has an in-principle agreement to acquire suitable tailings filtration equipment which is being surveyed and assessed by Como Engineers and will allow for relocation and rebuild costs to be included in the project budget.

PNX is opting for a mobile crushing plant as opposed to a fixed unit to reduce capital costs and time to production. The company is working with several contract groups to finalise this component.

“By applying these measures, the project capital cost inclusive of contingency and margins, first fill and critical spares will be close to the PFS estimate of $46m, and in such a challenging environment is testament to the hard work of the engineering team.”

This article was developed in collaboration with PNX Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.