473,000oz A YEAR: Hemi emerges as one of the world’s largest potential new gold mines in landmark scoping study

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

De Grey Mining is on track to deliver potentially Australia’s largest new gold mine since AngloGold’s Tropicana almost a decade ago at its world class Hemi discovery in WA’s North West.

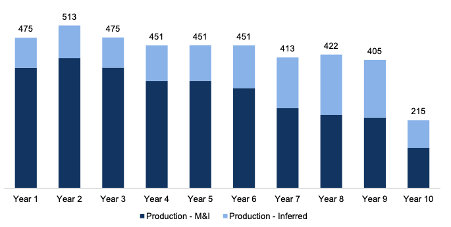

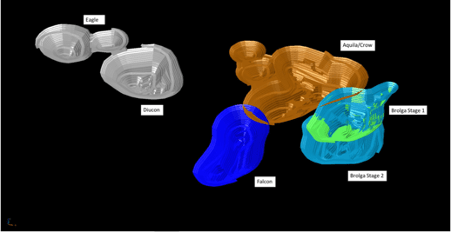

A scoping study on De Grey Mining’s (ASX:DEG) 9Moz Mallina gold project, which contains the intrusive Hemi gold deposit and its 6.8Moz resource, shows it would produce an incredible 473,000oz of gold a year for the first five years of operation and 427,000ozpa over its initial 10 year mine life for almost 4.3Moz.

The exciting thing is that this Study presents an initial evaluation of the Mallina Gold Project, with the Company having identified clear opportunities for improvement. The Production rate and mine life are expected to grow with continued resource definition and extensional exploration programs, with the Company pointing to recent announcements at Diucon and Eagle and ongoing exploration activities in Greater Hemi and Regionally.

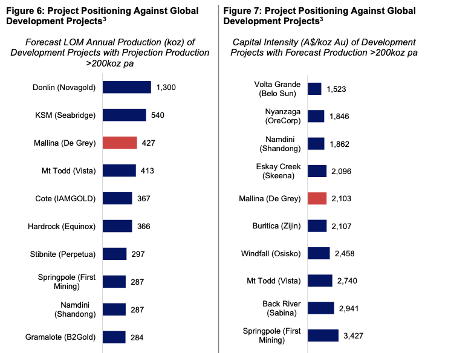

In terms of scale that would place Mallina among the five largest gold mines in Australia, and make it one of the most impressive new gold operations anywhere in the world.

Mallina would be the third largest gold mine under development anywhere by production, and one of the least capital intensive over 200,000ozpa.

It would significantly outstrip the ~300,000ozpa run rate of its closest comparison in recent times, Gold Road Resources’ Gruyere discovery, which like Hemi opened up a new gold province in regional WA.

With those sorts of numbers in the foreground, De Grey has understandably pressed the button immediately on a pre-feasibility study to be delivered in the second half of 2022.

The study estimates that the mine and ~10Mtpa processing plant would cost around $893 million to develop, with De Grey potentially becoming one of Australia’s lowest cost gold miners, producing at all in sustaining costs of $1,111/oz over its first five years to approximately $1,224/oz over the life of the project.

The fact Hemi has been built from discovery into one of the world’s most promising new gold mines in such a short time is remarkable.

It has been a little over 18 months since De Grey, then a junior explorer, announced Hemi was emerging as a ‘major gold discovery’ in February last year.

It has since become a $1 billion company as it outlined a 192Mt @ 1.1g/t Au for 6.8Moz at Hemi amid a broader regional resource of 9Moz.

But feed grades would be higher, with the scoping study modelling the mine delivering 1.6g/t to a ~10Mtpa processing plant over its first five years and 1.4g/t over a 10-year period.

Financial metrics attractive to say the least

To illustrate the scale of opportunity sitting in De Grey’s hands, the initial project study estimates it to generate some $3.9 billion in pre-tax undiscounted free cashflow, or $2.9b when taxes are taken into account.

It has a modelled NPV before tax of $2.8b and post-tax of $2b, with an internal rate of return of 60% and 49%, respectively, underlining its Tier-1 status.

The initial outlay on developing the mine at Mallina would be paid back in just 1.8 years post tax, or 1.5 years pre-tax.

De Grey says these already impressive production rates and financial metrics will continue to be optimised with further resource growth and studies ahead of the mine’s development.

“The scoping study provides an initial evaluation of the project’s physical and financial metrics, following the discovery of Hemi in February 2020 and the definition of Hemi’s maiden Mineral Resource Estimate of 6.8 million ounces in June 2021,” De Grey managing director and CEO Glenn Jardine said.

“The results of the initial evaluation of the project are compelling and confirm its status as a Tier 1 gold asset.

“The company sees further improvements and optimisation of the project with ongoing resource extension and definition drilling and exploration success.

“This could increase production rates and/or the mine life of the project. For example, the production metrics for Diucon and Eagle incorporated into the study do not include the recently announced mineralised extensions along strike, in width and at depth.”

More upside to come

And there remains even more upside for De Grey at Hemi.

Around 78.1% of the resources used over the first five years in the scoping study are JORC indicated, with around 70.2% of the resources incorporated into its 10-year evaluation period are indicated.

Testwork shows around 93% recoveries based on conventional processing methods like comminution, flotation, oxidation via either pressure of oxidation, Albion or biological oxidation and carbon in leach.

That will be optimised in further studies – 800,000oz in the study pit shell also remains outside the scoping study’s 10-year evaluation period.

Around 90% of that resource remains inferred so more drilling will be completed to upgrade it ahead of the PFS, while resource extension drilling is ongoing at the growing Diucon and Eagle deposits as well as targets across the Greater Hemi package.

Jardine said the study outcomes justify the Mallina Gold project as commercially viable, committing to the PFS.

“The six existing zones at Hemi provide the company with the flexibility to sequence production according to gold grade, gold endowment per vertical metre, mining advance rate and the strip ratio of each zone,” he said.

“The Hemi deposits comprise approximately 80% of the production over the 10-year study evaluation period.

“Metallurgical testwork has demonstrated that consistently high gold recoveries can be achieved across the different zones at Hemi using the robust flowsheet developed during the study.

“Each of the three potential sulphide oxidation processes (pressure oxidation, biological oxidation and Albion) have delivered excellent gold recoveries and will be carried forward into future studies. Further testwork and trade-off studies will optimise capital cost, operating costs, recoveries and operability to enable the company to select the preferred sulphide oxidation route for the future operation.

“The study provides justification that the Mallina Gold Project is commercially viable and accordingly the board has approved progression of the project to a PFS.

“The PFS will immediately commence in parallel with ongoing resource extension and definition drilling, exploration activities and further metallurgical testwork. The results of the PFS are expected to be provided in the second half of calendar year 2022.”

This article was developed in collaboration with De Grey Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.