New results confirm ‘stunning’ virgin gold discovery at Hemi

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Special Report: Fresh drilling results confirm there’s plenty to get excited about at De Grey’s high-grade Hemi discovery, part of the 1.7moz Mallina project in the Pilbara.

Thick, shallow and high grade – De Grey’s (ASX:DEG) new greenfields discovery at Hemi already ticks some very important boxes.

New drill results released today correlate strongly with previously announced results on February 6, which has sparked a ~270 per cent surge in the explorer’s share price.

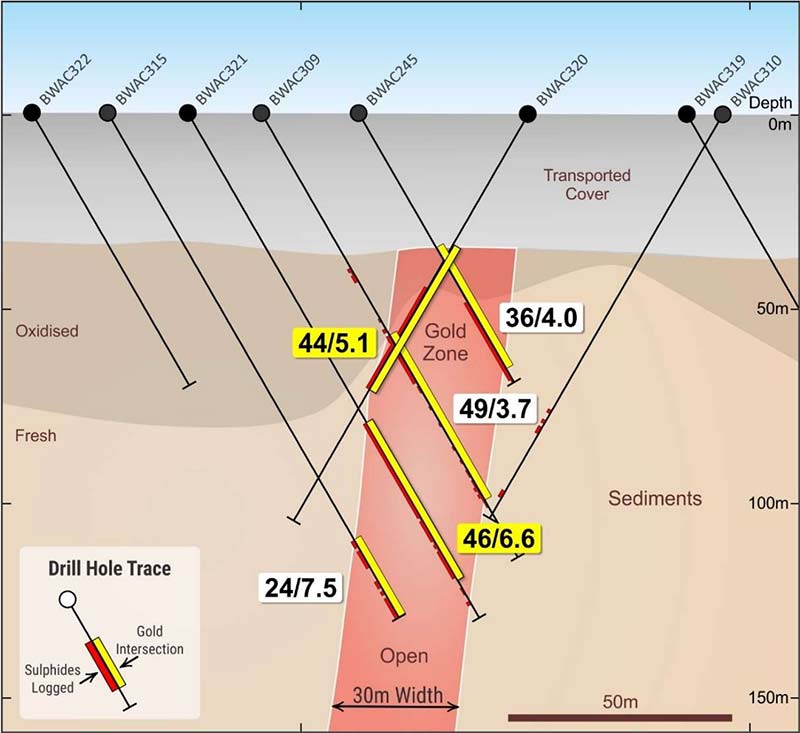

They confirm a substantial, steeply dipping zone of high-grade gold at Section A, which is currently 30m wide extending to 130m below surface.

It remains ‘open’ in all directions, De Grey says.

READ: De Grey needs a bigger drill rig after confirming major Pilbara gold discovery

Today’s results include 13m grading 8.8 grams per tonne (g/t), inside a larger 40m intersection grading 5.1g/t. Anything above 5g/t is generally considered high grade.

Technical Director Andy Beckwith calls them “stunning results – high grade, thick and consistent”.

“Clearly, drilling below this zone and the mineralisation on Section B are two key high-priority RC targets,” he says.

“We are looking forward to receiving the remaining aircore drilling results and re-commencing drilling activities now the cyclone has dissipated.”

“Further wide zoned mineralisation has been found in Section C, a zone 320 m between Section A and B. The fact that mineralisation is occurring is seen by the company as extremely positive.”

Another 39 aircore holes have been completed with those results pending.

Detailed resource definition RC and diamond drilling — in combination with further infill aircore drilling — is expected to kick off soon.

NOW WATCH: 90 Seconds With… Andy Beckwith, De Grey Mining

This story was developed in collaboration with De Grey, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.