2023 was a record breaker for maiden resources in Oz and these ones caught our eye

The 2023 calendar year topped the greatest exploration spend since the 2012 mining boom. Pic: Getty Images

- A record 77 maiden resource estimates were announced in Australia in 2023

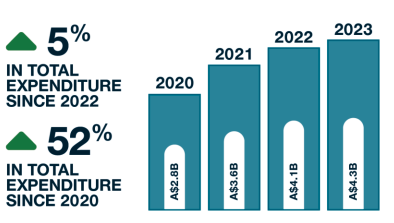

- Exploration budgets also topped the charts at $4.26m, a 5% jump on spending in 2022

- Here’s a closer look at some of the resources that piqued our interest

Once a discovery has been made, resources estimates are the next step in the mining process to determine both the quantity and quality of an ore deposit.

Information on the size of the ore body will tell the company (and investors) how much of the commodity is present, while higher grades prove that more of the commodity can be recovered for the same effort and cost, which is never a bad thing.

A small resource that sits at the surface, for instance, could be more valuable than a large one at depth given it’s less expensive to mine, safer, and comes with fewer complications in terms of electricity and water.

According to Geoscience Australia, a record 77 maiden resource estimates were announced across the country in 2023 while exploration budgets topped $4.26m, the highest ever nominal expenditure Australia has seen thanks to high gold prices and increased demand for key critical minerals that support clean energy tech.

That number represented a 5% jump on spending in 2022 and a 52% increase in total expenditure since 2020.

In a new report titled ‘Australian Mineral Exploration Review 2023’, Geoscience Australia says the trend in the number of maiden resources appears to broadly correlate with mineral exploration expenditure, showing that direct investment in exploration leads to the discovery and delineation of more resources.

Of those maiden resources, 36 included a critical mineral – minerals that are essential for modern technologies but the supply chain may be at risk – and 21 contained a strategic material, minerals that are essential for the socio-economic development of a country.

According to Geoscience Australia, gold was found in 36 maiden resources, followed by copper in 15. Rare earth elements were the most reported critical mineral with 12 maiden resource announcements, followed by lithium and nickel with six each.

We take a closer look at the companies that rank in GeoScience Australia’s list.

Some maiden resources in 2023

Raiden Resources (ASX:RDN)

RDN fast became a lithium market darling after acquiring ground directly to the north and south of Mark-Creasy backed stock, Azure Minerals, now owned by Gina Rinehart and SQM, the world’s second biggest lithium producer.

Slated as one of Stockhead’s Top 100 resources companies that made gains for FY24, the company rose to the top of an average lithium market as it uncovered the highest grade lithium (2.73% Li2O) and rubidium (0.55% Rb) results within tenements of the Andover South projects.

RDN also continued to carry out exploration work at its Mt Sholl nickel project – the only open pittable nickel-copper-PGE deposit in WA’s Pilbara region – which resulted in the unveiling of a 23.4Mt maiden indicated and inferred resource at 0.36% nickel, 0.40% copper and 0.31 g/t PGM 3E.

While indicated resources aren’t quite the highest level of geologic knowledge and confidence, they do support grade continuity and overall mine planning.

The lure of nickel-copper-PGEs at Mt Sholl proved irresistible to C$6.7bn market cap First Quantum Minerals, whose Australian arm First Quantum Minerals Australia (FQMA) signed a MOU with RDN in relation to a strategic partnership back in December 2023.

Rumble Resources (ASX:RTR)

A stock favourite of Wilsons Advisory, RTR declared a maiden 94Mt resource at 3.31% zinc-palladium as well as 4.1g/t silver on its Earaheedy zinc project near the town of Wiluna in WA in April last year.

That resource estimate placed the stock well in the realm of the largest zinc sulphide discoveries globally in the past decade, only two years after the initial find.

The strength of the resource is supported by 41Mt of higher-grade resources that could be part of a possible early development scenario, and a much larger 462Mt resource that could potentially be upgraded via beneficiation, providing the project with significant future flexibility.

Metallurgical test work is ongoing with initial results due to be reported in the September quarter and internal development studies will kick off once the metallurgical work has been carried out. Rumble has recently been focused on gold exploration, but expect this one to come back around when zinc prices kick off again.

Lithium Energy (ASX:LEL)

Lithium Energy delivered a maiden inferred resource at its Corella graphite deposit in Queensland of 13.5 Mt at 9.5% TGC, a satellite of the super-high grade Burke deposit in the State’s north.

Having raked in $97 million through the sale of its Solaroz brine lithium project in Argentina, LEL has set its sights on reinventing as a high grade graphite play focused on building into the supply chain for the electric vehicle batter input out of Australia.

It is looking to combine Burke, which contains 9.1Mt at 14.4% TGC, with US focused synthetic graphite producer Novonix’s (ASX:NVX) nearby Mt Dromedary deposit and Corella to feed a battery anode material plant to be based near Townsville.

Impact Minerals (ASX:IPT)

The high-purity alumina market might be small, but IPT is angling to become a disruptive player with the belief that it can produce the critical material cheaper than any other producer or developer in the supply chain.

The company is currently undertaking a pre-feasibility at its Lake Hope project in WA, which is underpinned by 3.5Mt resource of mud-like ore just 2m deep, enough to be mined for 80 years on IPT’s early assessments.

At a grade of 25.1%, that’s 880,000t of alumina, or Al2O3.

If a PFS and 10t pilot plant this year is successful and mining approvals are straight-forward, IPT could be producing demonstration plant rates of 1000-2000tpa in a couple of years.

IPT is now looking to extend that resource it released in June 2023 and is undergoing the necessary approvals process to advance the project towards production.

Dreadnought Resources (ASX:DRE)

DRE slapped a gold resource on its Metzke’s Find prospect in WA’s Central Yilgarn region in April last year, the first ever resource declared over any part of the project which covers four greenstone belts.

A shallow, high-grade 14,900oz at 6.8 g/t gold resources forms a starting point for additional discoveries and growth, potentially providing a high-grade source for nearby processing facilities.

The company views the asset as having significant potential for both gold and nickel and plans to progress it in the background while it retains its focus on rare earths at Mangaroon.

Great Boulder Resources (ASX:GBR) and BMG Resources (ASX:BMG)

Great Boulder and BMG hold the distinction of announcing the largest maiden gold resources by ounce profile in 2023, coming in at 518,000oz respectively.

BMG’s Abercromby is located in the Wiluna-Agnew gold belt in the northern Goldfields of WA and is likely to be revisited by the company, which also explores for lithium and niobium given gold prices are near record highs.

Great Boulder’s Side Well meanwhile is higher in grade at 2.6g/t and has been regularly rumoured as a potential bolt-on acquisition for Meekatharra explorer Westgold Resources (ASX:WGX) at its current scale.

At Stockhead we tell it like it is. While Raiden Resources, Lithium Energy and Impact Minerals were Stockhead advertisers at the time of writing, they did not sponsor this article.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.