10-year high price alert: LME warehouses are down to a single day’s supply of tin

Pic: Schroptschop / E+ via Getty Images

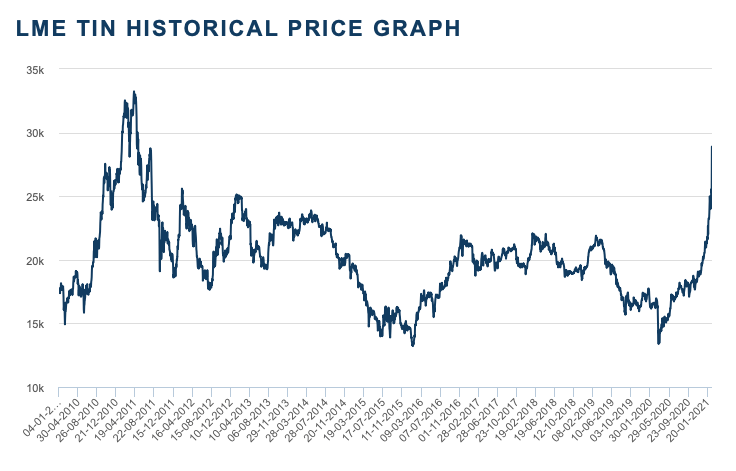

- Tin metal prices soar to their highest since 2011 on supply crunch

- ‘Prices increased this year on the back of declining stockpiles and strong industrial demand particularly for semi-conductors and electronics’ – CBA

- Myanmar military intervention is adding to supply tightness for China and market nervousness

International prices for tin have soared 14 per cent over the past week and consumers are scrambling for physical stocks as supply of the base metal dwindles at London Metal Exchange warehouses.

Tin was trading at $US28,900 per tonne ($37,350/tonne) Tuesday on a cash price basis, up from around $US25,300 per tonne on Friday.

This week’s spot price means tin has climbed 116 per cent since hitting a multi-year low in March 2020 at $US13,375 per tonne.

In order to secure delivery of the metal from LME warehouses European consumers are having to pay hefty premiums of up to $US500 per tonne and even higher prices in the US.

“The metal [tin] usually attracts less attention than its base metal peers because of its low liquidity, however, investor interest is growing particular on China’s Shanghai Futures Exchange (SFE),” said Commonwealth Bank of Australia analysts in a report.

The Shanghai Futures Exchange’s tin contract for March settlement was trading at ¥163,460 per tonne ($32,690/tonne) Wednesday, according to exchange data.

There were open interest trading positions for 5,690 tonnes for the SFE’s March futures contract, rising to 30,994 tonnes for the April contract, said the exchange.

Available tin metal for delivery under SFE futures contracts was around 7,500 tonnes last week, which covers only one-fifth of spot demand for March and April on the exchange.

This is assuming that all of the holders of March and April tin futures contracts decide to take delivery of physical metal instead of settling their trading positions in cash.

LME tin supply down to one day’s demand, price soars

Stocks of tin metal in LME warehouses, a key indicator of demand, were roughly 1,140 tonnes on Wednesday after 220 tonnes of tin were earmarked for delivery to buyers that day.

Global tin consumption is around 1,000 tonnes per day and current available stocks represent about one day’s consumption for the world market.

“Supply is simply struggling to keep up with demand,” said analysts at Commonwealth Bank of Australia in a report.

“Prices increased this year on the back of declining stockpiles and strong industrial demand particularly for semi-conductors and electronics,” they added.

As Stockhead has documented, there is a worldwide shortage of semiconductor components that has curtailed the production of electronic goods, EVs, smartphones and computers.

Tin is used as a replacement for lead in solder for connecting electronic circuits, an application that accounts for 50 per cent of the metal’s demand.

Projects for a total of 50,000 tonnes of tin-in-concentrate production are set to come online by 2025, said industry body the International Tin Association (ITA).

However, many of these projects are currently at early stages of development and others had been shelved because of low tin prices in 2020.

“As a result, we expect the refined tin market to enter a significant deficit after 2023,” said the ITA in a report.

Myanmar coup may affect tin shipments to China

The recent military intervention in the government of Myanmar formerly Burma may be adding to the feverish sentiment that has driven international tin prices to a 10-year high.

Consumers in China seeing the military action in Myanmar may be contemplating alternative sources of supply to the country’s tin mines.

The International Tin Association sought to play down the impact of political unrest in Myanmar on the country’s tin shipments, saying it expects business to continue as usual.

“We feel that February imports into China will remain relatively steady. Following December shipments of 3,400 tonnes of tin ore and concentrates, we forecast that around 3,200 tonnes of material will be shipped to China,” the tin industry body said on its website.

Myanmar which borders southern China is the third largest producer of tin in the world and supplies much of China’s appetite for the base metal, said the ITA.

In 2020, Myanmar’s tin exports to China fell 17 per cent year on year to 36,400 tonnes, a five-year low, said the ITA.

Border closures cloud Myanmar tin production

Tin mines in southern Myanmar may reduce their production or halt operations on a temporary basis because of their low stockpile situation said the industry body.

“According to miners in the country, the Heinda and Dawei mines in the south of the country are likely to reduce production in the short term in an attempt to prolong their stockpiles,” said the ITA in a statement on its website.

“However, if the situation continues it may force the mines to close,” it said.

Southern Myanmar tin mines account for 20 per cent of the country’s tin production, about 500 to 600 tonnes per month, (6,000 to 7,200 tonnes per year), said the ITA.

Some tin mines in eastern Myanmar centred on the border town of Ruili are affected by some border closures that may delay the delivery of mining equipment and fuel, said the ITA.

But the tin industry body suggested any border closures would have a limited impact, as the majority of eastern Myanmar’s tin supply comes from the autonomous Shan state.

“Because the region acts separately to the central government, it has not been affected by the coup d’etat. Here, the port town of Mengalian remains open, with tin shipments still possible,” said the ITA.

Australian tin projects well positioned for China’s demand

China has become a voracious consumer of tin on the international market, its net imports were 17,700 tonnes of the metal in 2020, up 520 per cent on year.

The Asian nation has increased its imports from a range of countries including Russia, Laos, Vietnam and the Democratic Republic of Congo, as well as Australia.

Tasmania’s Renison Bell mine ships a large proportion of its production to China and new tin projects in Australia may capitalise on this trade flow.

Renison Bell mine’s operator and 50 per cent owner Metals X (ASX:MLX) said the mine produced 2,000 tonnes of tin-in-concentrate in the December-ended quarter, down 14 per cent on the September-ended quarter.

All-in sustaining cash costs for the Renison mine were $US20,978 per tonne in the December quarter, and the mine has a production target of 8,200 to 8,500 tonnes for the 2021FY.

Several ASX companies have tin mining projects under development including, Australian Tin Mining (ASX:ANW), Stellar Resources (ASX:SRZ), and Venture Minerals (ASX:VMS).

ASX share prices of Australian Tin Mining (ASX:ANW), MetalsX (ASX:MLX), Stellar Resources (ASX:SRZ), Venture Minerals (ASX:VMS)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.