The ‘Fear Index’ ain’t as bad as it sounds. Here’s a way to trade and profit from volatility

How to trade market volatity through options. Picture Getty

- The VIX, sometimes called the ‘fear index’ has risen significantly

- Options offer a way to profit from this volatility

- Here’s a primer on how you can trade options on the ASX

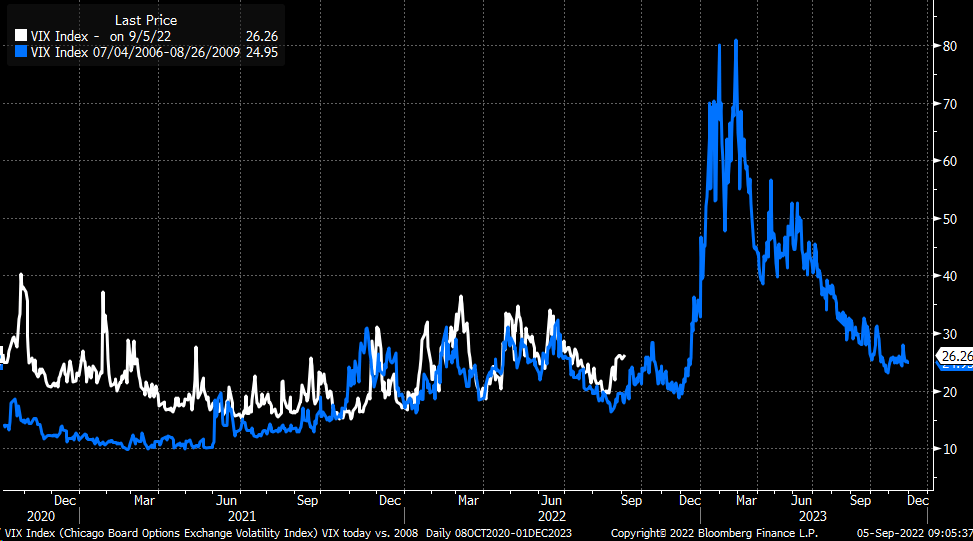

Market turmoil this year has pushed the US CBOE VIX Index higher by well over 80%, and the chart is is beginning to look frighteningly similar to the one we saw in 2008.

Often called Wall Street’s “fear gauge”, the CBOE VIX Index indirectly predicts how volatile S&P 500 stock prices could be in the next 30 days through observing listed options prices.

Read more about how the CBOE VIX index is calculated here.

In Australia, there is an equivalent index called the S&P/ASX 200 VIX, which similarly measures the near-term volatility of ASX 200 stocks.

The S&P/ASX 200 VIX index has also surged this year, rising by almost 60% in 2022.

So why does it all matter, and does this spell doom and gloom for investors?

Fortunately no, because there is actually way to exploit and profit from volatility in the market by trading in Options.

First, a quick primer on Options

Options offer a way for Aussies to trade volatility either on an index or single stocks. It’s a huge subject which we’ll try to condense into a few paragraphs here.

In short, an Option contract provides the buyer with the right but not the obligation to buy a stock (or index) at a certain price (called the Exercise Price).

Listed options can be bought and sold on the ASX just like any stock.

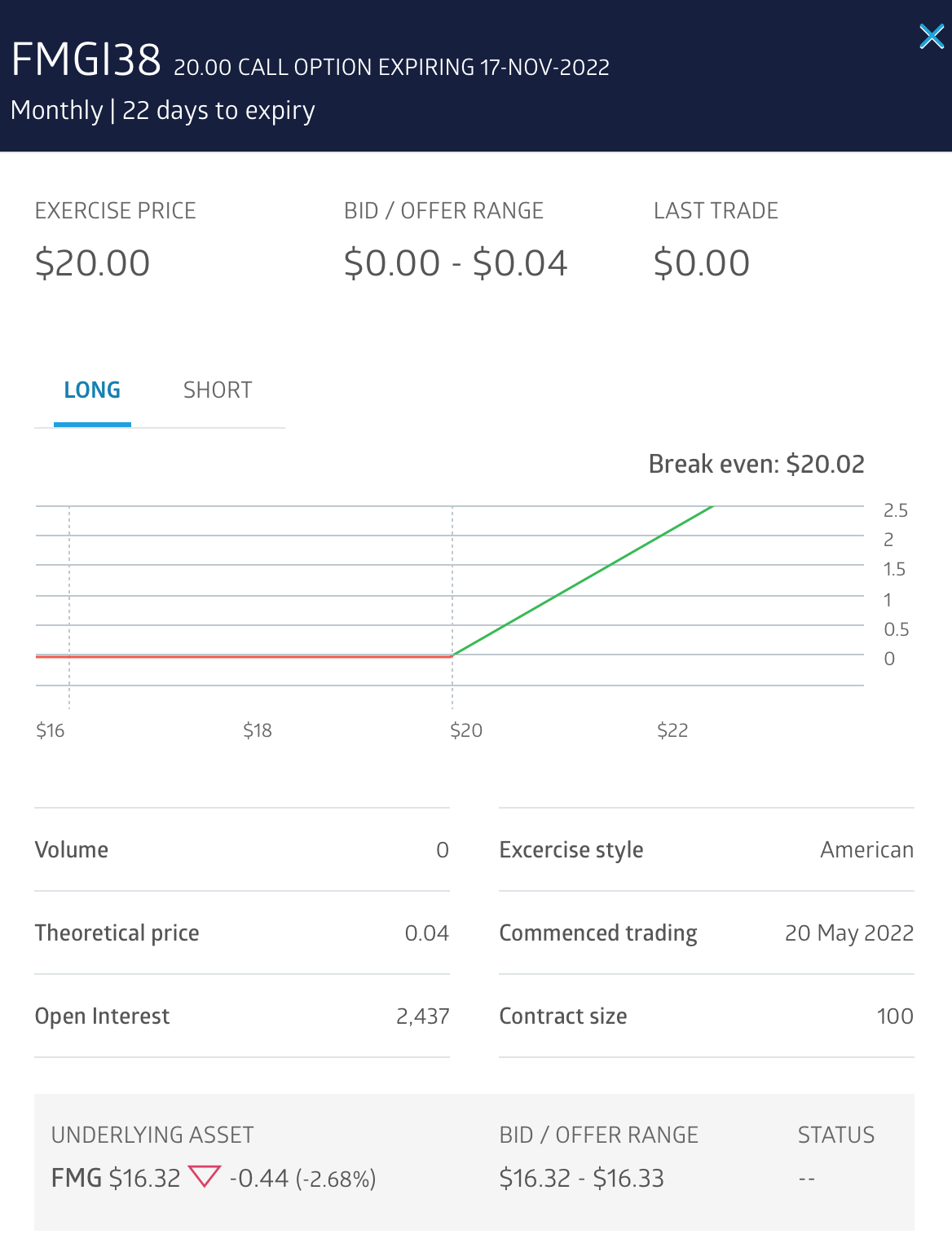

To illustrate, here is a Call Option on Fortescue Metals (ASX:FMG) listed on the ASX:

This Option expires on 17 Nov, and has an Exercise Price of $16.00, while the underlying FMG share price trades at $16.77.

This means that traders who bought the Option will have the right to buy FMG stock at $16 (at or before expiry date) when the current price is 77c higher.

It sounds like a bargain but it’s going to cost you $1.26 (current price) to buy that Call Option.

But intuition tells you the Option should only be worth 77c ie; the difference between current share price and the Option’s Exercise Price (this difference is called Intrinsic Value).

The reason why the Option is trading at a much higher price ($1.26 instead of $0.77) is due to Time Value.

Option Price = Intrinsic Value + Time Value

In other words, traders are placing a value on the time left before expiration (17 Nov), because from now until then, there is a probability the underlying FMG share price could rise.

And this is where volatility comes in, because Time Value is correlated to volatility and time left to expiry.

The higher the volatility of the underlying stock, the higher the Time Value is, and in turn, the higher the Option price will be.

To illustrate the concept of Time Value and volatility further, here’s another Fortescue option – this time with an Exercise Price of $20 with the same expiry date of 17 Nov.

This Option is way out-of-the-money, because why would you want to have the right to buy FMG at $20 when the current share price is only $16.77 ?

But yet, the market has placed a price of Option of 4c. A small value but still significant considering the Instrinsic Value is zero.

Again, the reason for this is Time Value as traders place a probability that FMG could reach $20 by 17 Nov on the basis of its forward volatility.

How do we make money on volatility then?

As we explained, the price of an Option reflects the market’s expectation of future volatility of the underlying stock.

The future volatility of the underlying is also called the Implied Vol.

It’s called “implied”, because it can only be implied or worked backwards from the Option price itself.

Traders can profit from fluctuations in Implied Vol by buying and selling Option contracts.

As stated before, the higher than Implied Vol, the higher the value of an option and vice versa.

Traders can therefore profit by selling their Option position before it expires, capturing the rise and fall of the Option price

By doing this, traders are essentially capturing and monetising volatility in the market.

Important stuff to remember

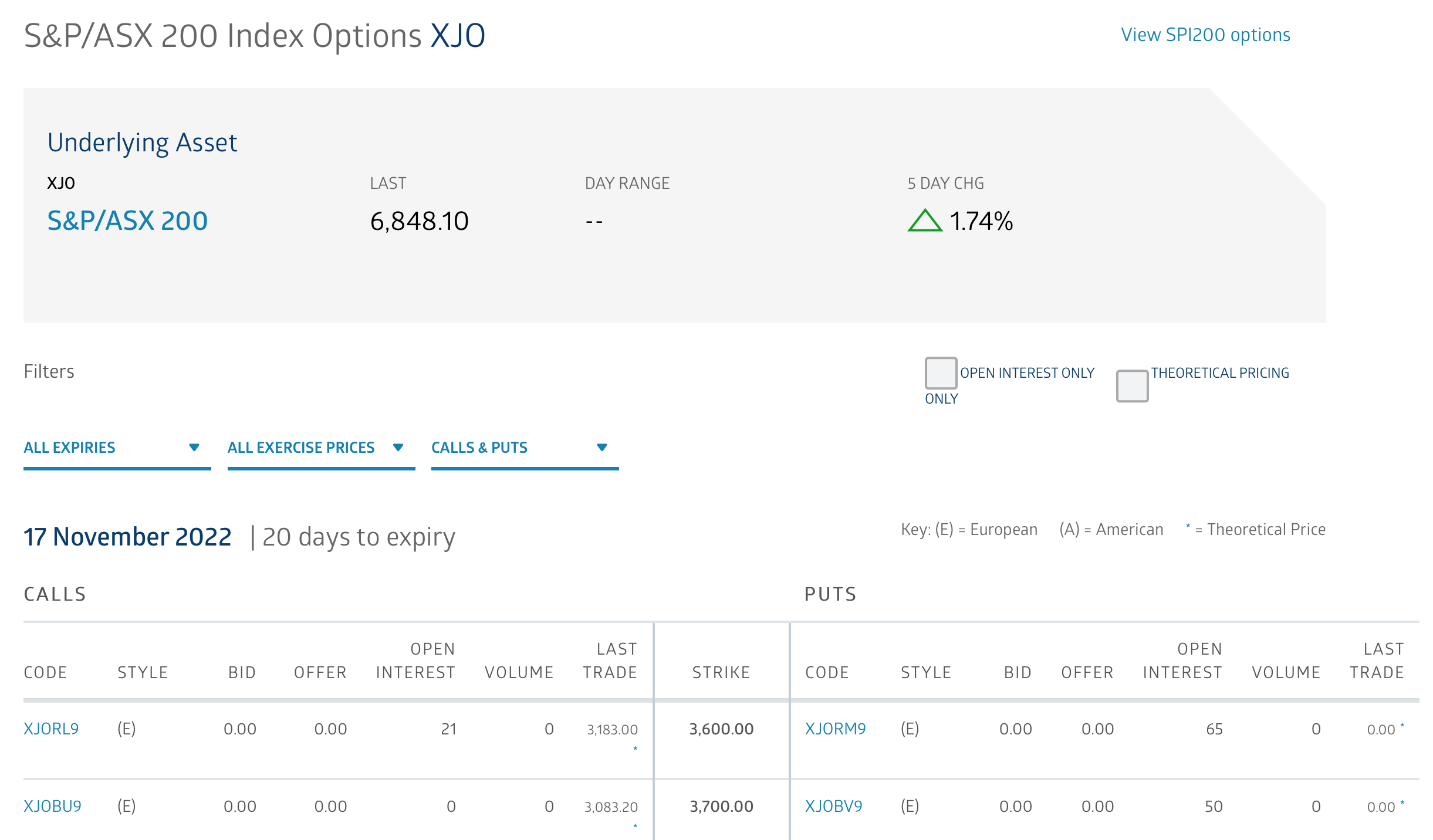

There are two types of option styles available on the ASX – American and European.

An American style Option (denoted A by the ASX), allows holders to exercise their Option at any time before and including the expiration date.

A European option (denoted E) on the other hand allows holders to exercise their rights only on expiry date.

Note that we’ve used the word Trader instead of Investor throughout the article because with Options, you can’t invest for the long term.

Unlike stocks, you won’t be able to keep a losing Option trade on your books beyond expiry date.

On the bright side, you can just about trade Option contracts on most of the the larger-capped ASX stocks.

You can also trade Options based on the ASX 200 index.

It’s important to note that Options, like all derivative securities, enable profits as well as losses to be amplified. As such, it’s best to reach out to your advisor before dabbling in them.

Unfortunately, Option is a big topic that can’t be explained thoroughly in one single article.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.