ASX Cannabis Stocks Guide 2022/23: Here’s everything you need to know

Pic: Getty Images

- More Aussies are using medicinal cannabis than ever and the Greens says legalise it already

- The global medicinal cannabis market could be worth US$52.1 billion by 2027

- Cann Group COO says over-the-counter products could be available next year

The stigma around cannabis-based medicine and health products is well and truly disappearing, with more Aussies than ever using medicinal cannabis and countries around the world loosening up regulations around the drug.

Just last week US President Joe Biden announced plans to pardon all federal offenses of cannabis possession in the USA – highlighting the first significant step towards decriminalisation in the country and the potential to reclassify cannabis on a federal level.

Could Australia follow suit? It certainly looks like demand is growing.

FreshLeaf Analytics estimate there’s about 100-120,000 people accessing medicinal cannabis products via the Special Access Scheme (SAS) which means getting a prescription from a doctor.

The TGA limits Schedule 3 (Pharmacist Only Medicine, or over-the-counter – OTC) supply to only those products that are approved by themselves and which are included on the Australian Register of Therapeutic Goods (ARTG).

While there are currently no TGA approved products on the ARTG that meet the Schedule 3 criteria, an OTC Schedule 3 medicinal cannabis product in Australia could be a reality as soon as next year.

That would mean access to a global medical cannabis market that research firm IMARC Group says could be worth as much as US$52.1 billion by 2027.

But before we look further into the whole ‘where do we stand’ thing, let’s dive a bit deeper into cannabis land.

The difference between cannabis and hemp

Marijuana is the colloquial name for the cannabis variety that’ll get you high and has been used for millennia as both a medicine and a recreational drug.

Cannabis is the formal name, and there are two main cannabis species: cannabis sativa and cannabis indica.

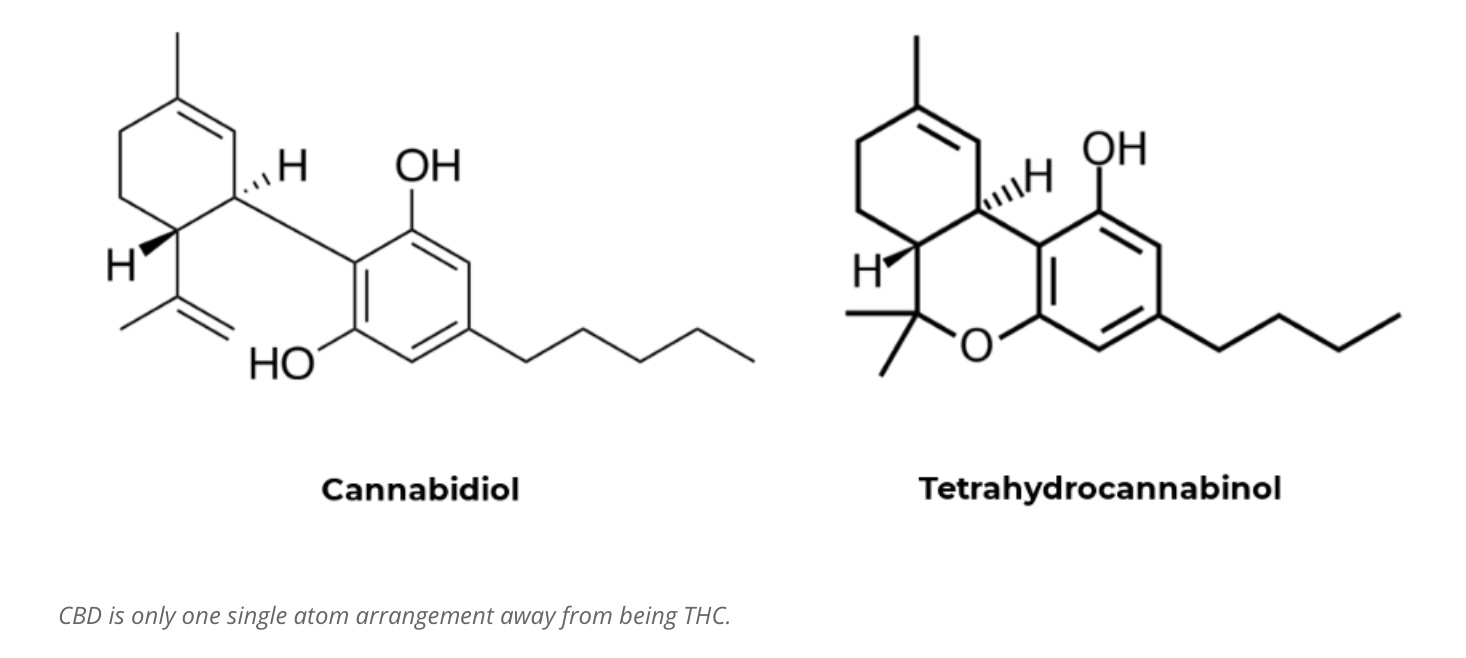

Both produce delta-9 tetrahydrocannabinol (THC) — the part that gets you stoned — and cannabidiol (CBD).

Hemp is a variety of cannabis sativa grown specially for its fibre which contains low levels of THC and slightly higher levels of CBD.

Legally speaking, hemp has less than 0.3% THC (0.35% in Australia), while marijuana contains more than 0.3%.

THC is the psychoactive stuff that gets people high and addicted but medical science is now pushing for CBD oil because it offers similar therapeutic benefits to THC without the negative side effects.

Cannabis is commonly smoked in a rolled cigarette (joint) or water pipe (bong), often in combination with tobacco, but it may also be added to food and eaten.

Cannabis oil is generally applied to cannabis herb or tobacco and smoked, or heated and the vapours inhaled.

Other key compounds in cannabis are terpenes, the fragrant oils that carry flavour and aroma but no THC or CBD – but different cannabinoids and terpenes do influence whether it makes you sleepy, hungry, creative, or acts as a pain reductor.

What you need to know about licensing

Equally important from a regulatory perspective are the licences and permits needed to grow, manufacture and research cannabis in Australia well before products can be prescribed.

A licence enables a company to start preparing a growing, research or manufacturing site.

A permit, which stipulates constraints such as strains and the number and weight of its plants, allows them to start work.

The federal government’s Office of Drug Control (ODC) has issued an ever-increasing number of licences that allow companies to grow cannabis for commercial purposes, grow cannabis for research, manufacture cannabis-based products, and import and export marijuana.

It takes between 18 months and two years to go from submitting an application to receiving a permit for a cultivation site, and the ODC lists 49 licence holders on its website as of Nov 2021 – and those are just the ones who’ve consented to sharing their information.

The list also includes a handful of ASX stocks such as Althea (ASX:AGH), Little Green Pharma (ASX:LGP), Cronos (ASX:CAU) and AusCann (ASX:AC8).

It’s worth noting however that other ASX companies are able to piggyback off other companies’ import and supply licences.

The biotech route to market

While everyone knows weed can make you drowsy or hungry, there are not many completed clinical trials that can back that information up and give doctors a basis on which to prescribe.

In Australia, a handful of cannabis companies are taking treatments through clinical trials or have plans to do so in the near-term.

As Stockhead’s Nadine McGrath explains, clinical trials are generally divided into three phases.

Phase 1 focuses on safety, Phase 2 tests for effectiveness and Phase 3 examines whether the new drug is an improvement on existing treatment. Sometimes trials are further divided into parts A and B, where a B stage is generally more rigorous.

Some examples in the cannabis space include Zelira Therapeutics (ASX:ZLD), which is trialling its medical cannabis formulations for insomnia, chronic pain and opioid use reduction, Medlab Clinical (ASX:MDC) which is looking at cancer-induced bone pain and chemotherapy-caused nausea and vomiting and Incannex (ASX:IHL) which is looking at the effect of its anti-inflammatory drug for arthritis.

ASX listed cannabis stocks

Scroll or swipe to reveal table. Click headings to sort.

Code Company Price (Oct 12) % Year % Six Months % Month Market Cap Sector What they do AC8 Auscann Grp Hlgs Ltd 0.04 -56% -43% 0% $17,621,884 Pharma Develops & produces medical cannabis products & drugs AGH Althea Group 0.093 -65% -50% 13% $29,876,051 Distributor Patient access portal & importer ALA Arovella Therapeutic 0.032 -30% -26% 39% $21,467,226 Pharma Developing oral cannabis spray AVE Avecho Biotech Ltd 0.01 -47% -47% -17% $18,378,693 Biotech Developing oral cannabis products BOD BOD Australia 0.091 -66% -46% 6% $13,365,306 Biotech & Lifestyle Developing cannabis products BOT Botanix Pharma Ltd 0.059 -12% -27% -15% $64,032,346 Biotech Developing cannabis -based skin medication CAN Cann Group Ltd 0.27 -7% -33% -2% $92,597,677 Grower Grows cannabis in Victoria CAU Cronos Australia 0.72 380% 148% 20% $390,831,346 Distributor Medicial cannabis product distribution CGB Cann Global Limited 0.021 -79% -48% -13% $5,436,345 Hemp & Grower Hemp grower, product distributor & medical cannabis products CPH Creso Pharma Ltd 0.034 -69% -49% -6% $60,714,043 Lifestyle Developing portfolio of products covering animals DTZ Dotz Nano Ltd 0.26 -35% -22% -4% $117,107,727 Tracing Tracing technology for plants including cannabis ECS ECS Botanics Holding 0.022 -42% -24% -15% $25,454,805 Hemp & Grower Agribusiness, hemp food & medicinal cannabis EMD Emyria Limited 0.215 0% -28% -7% $59,125,531 Lifestyle & Biotech Runs clinics, offers data analysis and is trialling drugs EOF Ecofibre Limited 0.215 -75% -52% -16% $82,065,419 Biotech Produces and sells hemp-derived products EPN Epsilon Healthcare 0.025 -77% -46% 9% $7,121,224 Grower & Manufacturer Grower & product manufacturer EVE EVE Health Group Ltd 0.001 -70% -20% 0% $5,274,483 Invsestor Investor in hemp honey and farm leases for cannabis growth EXL Elixinol Wellness 0.035 -62% -41% -5% $11,069,295 Hemp & Grower Hemp grower & product distributor HGV Hygrovest Limited 0.071 -3% 15% 8% $16,326,733 Investor Investor in Australian and offshore cannabis-related businesses IDT IDT Australia Ltd 0.1 -84% -39% -17% $24,102,180 Pharma Contracted as product manufacturer IHL Incannex Healthcare 0.2625 -25% -42% -8% $403,752,329 Ancilliary Licenses medical cannabis products IRX Inhalerx Limited 0.061 -42% -51% 9% $11,423,284 Ancilliary Owns cannabis vaporiser technology LGP Little Green Pharma 0.24 -65% -48% -16% $56,616,381 Grower Grows & manufacturers cannabis products LV1 Live Verdure Ltd 0.21 -44% -18% -22% $12,158,508 Lifestyle Sells hemp-based products in the US MDC Medlab Clinical Ltd 11.11 -52% -15% -15% $25,369,707 Biotech Developing drug delivery platform and medications MRG Murray River Grp 0.245 0% 0% 0% $10,808,210 Agribusiness Owns & operates organic farms, has license to grow hemp MXC Mgc Pharmaceuticals 0.015 -73% -35% -6% $42,759,710 Biotech & Lifestyle Developing medical cannabis products and medications NTI Neurotech Intl 0.11 116% 83% 11% $75,148,408 Biotech Runs medicinal cannabis studies RGI Roto-Gro Intl Ltd 0.011 -63% 0% 0% $3,768,521 Ancilliary Growing system for cannabis plants RNO Rhinomed Ltd 0.135 -56% -45% -25% $38,572,159 Ancilliary Sold nasal stents nto US cannabis drug delivery market ROO Roots Sustainable 0.005 -44% -29% 25% $3,748,163 Ancilliary Growing system for cannabis plants SCU Stemcell United Ltd 0.013167 0% 0% 0% $14,915,372 Biotech Commercialising cannabis stem cell extraction technology TSN The Sust Nutri Grp 0.14 -50% -14% 0% $16,884,894 Hemp & Grower Grows & processes hemp for its health products WFL Wellfully Limited 0.022 -85% -52% -27% $6,131,339 Grower Runs regenerative food operation incuding with hemp WOA Wide Open Agricultur 0.46 -39% -31% -16% $59,124,616 Biotech Makes patch technology for drug treatments ZLD Zelira Therapeutics 1.24 -82% -61% -17% $11,875,624 Biotech Developing cannabis medications

Each cannabis stock on the ASX typically fits into one (or more) of the following categories:

- Biotechs and pharmaceutical – These are companies that are focused on creating drugs and taking them through clinical trials. A risky business with a 13.8% success rate. Two of the more prominent stocks in this space are Incannex (ASX:IHL) and Zelira (ASX:ZLD).

- Growers – These companies grow cannabis plants and ship their produce to cannabis companies in other categories. Examples include Little Green Pharma (ASX:LGP) and Cann Group (ASX:CAN).

- Hemp – Hemp is a specific variety of cannabis sativa grown specially for its fibre as well as for its low levels of THC. This category contains some of the most successful ASX pot stocks including ECS Botanics (ASX:ECS) and Elixinol Wellness (ASX:EXL).

- Lifestyle – These companies create cannabis-based lifestyle products and sell these to the public. One example is Live Verdure (ASX:LV1).

- Ancilliary – Cannabis is not their primary trade but are involved with the sector – perhaps having cannabis clients. An example is Roto-Gro (ASX:RGI) which makes vertical farming systems including for cannabis companies.

Over-the-counter products in 2023?

Technically, over-the-counter cannabidiol (CBD) products are legal in Australia without a prescription since the Therapeutics Goods Administration (TGA) down-scheduled low dose CBD (150mg or less) from a schedule 4 to schedule 3 drug in February.

But, there are currently no CBD products approved for sale. And with the rigorous testing, clinical trials, and regulatory hurdles involved in registering any drug, it could be a while before we see products on pharmacy shelves.

A few months ago, Cann Group (ASX:CAN) COO Shane Duncan told Stockhead he didn’t expect to see the first products available over the counter at pharmacies until mid-to-late 2023.

“I think it’s probably more like the middle to the second half of 2023,” he said.

Not to mention the Schedule 3 process is also quite lengthy – even once a company has submitted their drug registration dossier to the TGA, often taking a year for approvals.

Side note: the TGA has one of the highest and strictest pharmaceutical standards in the world, and is considered as a global gold standard.

Wellnex Life (ASX:WNX) CEO George Karafotias told Stockhead this week that the TGA doesn’t just hand out approvals.

“It is a 12-18 month process,” he said. “And it does require about $3.5 million every time.”

What about recreational cannabis?

The Greens are pushing for the cannabis to be legalised as soon as next year, after Senator David Shoebridge obtained “compelling constitutional law advice that provides a path forward for Federal Parliament to legalise cannabis for adult use across the country.”

Dr Vendula Belackova from the Drug Policy Modelling Program (DPMP) at the University of New South Wales’ Social Policy Research Centre says we can learn from various non-prohibition policy models for recreational cannabis which are already in use in countries around the world.

“Should Australia loosen recreational cannabis laws, we have a growing body of data and knowledge to lean on from overseas studies in the United States, Canada, Uruguay, the Netherlands or Spain, just to name a few,” she said.

While medicinal cannabis is legal in all Australian states and territories, patients must have a genuine medical condition assessed by a practitioner to be in possession of cannabis.

Yet, non-medicinal cannabis use and possession remains a crime in several Australian states, despite diversion schemes in place where people who are deemed eligible (e.g., first or second-time offenders, caught with a small amount of drug only) can avoid criminal proceedings.

“Besides medicinal production, the circulation of recreational cannabis comes from the black market,” Dr Belackova says.

“There are harmful consequences when the black market controls cannabis production, such as increased criminal activity, increased likelihood of young people accessing cannabis and no quality control, meaning no opportunity to manage impacts on physical and mental health.”

On the other end of the spectrum, there is a full-legalisation commercial model, which sees commercial, profit-driven production of cannabis in a private market setting – like what has been implemented in over 20 US states to date.

“Commercial legalisation can look appealing to both business and consumers and offers taxation revenue possibilities,” Dr Belackova added.

At Stockhead we tell it like it is. While Incannex and Wellnex Life are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.