How the ASX’s Pre-open market works, and the risk of placing an order during this window

ASX traders can place orders when the market is closed. Picture Getty

- ASX traders can place orders when the market is closed

- We explain how the Pre-open market mechanism works on the ASX

- And what are the risks of placing orders during this window?

Unsurprisingly, it’s common for investors to get confused about trading periods beyond the official opening and closing times of the ASX.

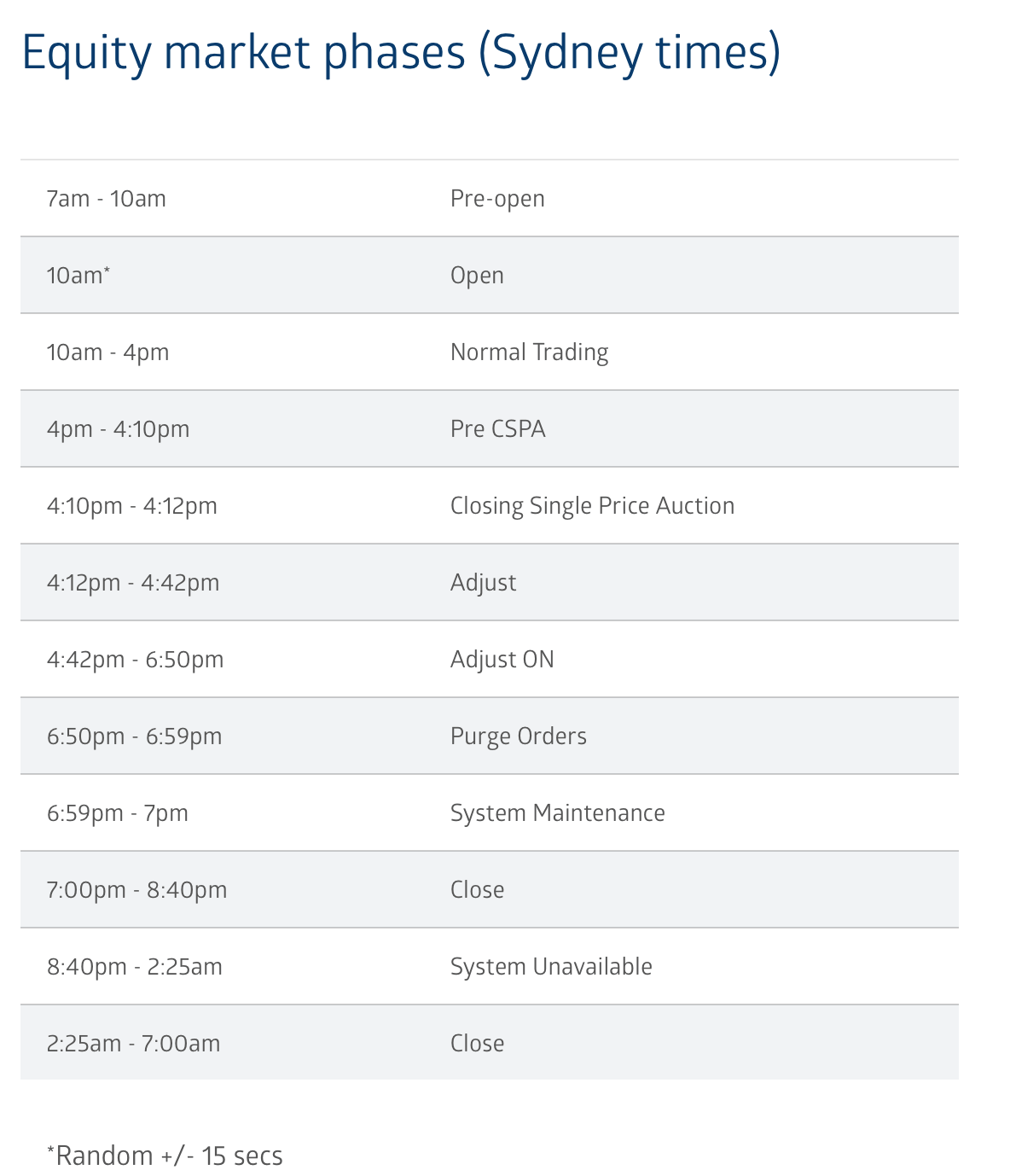

While many know that official trading starts at 10am and ends at 4pm AEST, there’s often some confusion about the brief windows before and after these times when buy or sell orders can be placed.

So here’s the lowdown:

From 7am to 10am, we enter what’s called the ‘Pre-open’ market window.

This period allows for trade orders to be submitted into the market, although trading hasn’t commenced yet.

Essentially during this three-hour window, buyers and sellers can enter buy and sell orders, with the actual execution taking place around 10am.

Between 4pm – 4:10pm, the market enters what is known as ‘Pre-CSPA’ (Closing Single Price Auction).

During this window of just 10 minutes, brokers can place new trades, as well as change and cancel orders in preparation for the market closing. You can’t place any more orders after 4.10pm.

Between 4:10pm and 4:11pm, the market enters into what is known as the Closing Single Price Auction, which is where the ASX calculates closing prices for each stock.

Then from 4.12pm to 5pm, the Adjust phase takes place where brokers may ‘tidy up’ their orders by cancelling unwanted orders, amending orders, etc.

Orders that are expired or too far from market will be centrally inactivated or purged during this window.

Then at 7pm until 7am the following morning, the ASX system is effectively on maintenance and shutdown mode. No trades may be amended, and no matching or auctions take place during this period.

How ASX calculates a stock’s opening price

At or near 10am, the ASX will gather all the information and trades from the Pre-open market window, ie: trade orders that were placed between 7am and 10am.

The ASX then uses an algorithm to ascertain the volume of buy orders versus sell orders, and the corresponding prices they’re set at. This algorithm results in an official ‘auction price’, which is the price at which the stock opens.

As an example, suppose BHP closed at $43.00 on 13 May.

If a trader enters an order to buy 100 BHP shares at $43.10 between 7am and 10am on May 14, and the auction price ends up being $43.05, that trader will have purchased the stock at $43.05 on the opening auction.

However, if the trader had entered their order to buy 100 BHP shares at $43.02, their order will be sitting in the screen unfulfilled as it is 3 cents below the prevailing market price.

The order will stay unfulfilled until the BHP price goes back down to $43.02 (if it actually does).

ASX’s staggered open times

At 10:00am, the ASX opens for ‘Normal Trading’, but on a staggered basis.

What this means is that ASX stocks will open alphabetically at set times. Here are the staggered ASX opening times:

Group 1 10:00:00 am +/- 15 secs – Stock tickers starting with 0-9 and A-B

Group 2 10:02:15 am +/- 15 secs C-F

Group 3 10:04:30 am +/- 15 secs G-M

Group 4 10:06:45 am +/- 15 secs N-R

Group 5 10:09:00 am +/- 15 secs S-Z

Why place orders outside trading hours?

ASX traders may want to place buy or sell orders before the market opens for several reasons.

The most common is that they’re reacting to overnight developments on Wall Street.

News, events, or economic data released outside of trading hours, especially in the US, may impact market sentiment on the ASX – often leading to price gaps when trading resumes on the ASX the next morning.

Placing orders before the market opens therefore allows traders to potentially take advantage of price movements that occur as soon as trading begins.

This can be profitable as it allows you to get on the bandwagon early before other investors jump on.

The risk of placing orders before market opens?

Submitting orders before the market opens also carries several risks.

For one, you simply just don’t know what the market will do when it opens; and the buy price you submit could be significantly higher from the actual price action in the opening few minutes.

Price movements can be particularly volatile at the market open. The potential to misjudge market sentiment could be a pretty serious one, given the lack of liquidity in the pre-open market.

For instance, you might aim to exit or enter a position following a significant news event overnight ahead of the broader market response.

However, the limited liquidity in the pre-market could mislead you into expecting a stock to decline during regular trading, when it’s actually poised to rise.

Similarly, you could end up purchasing a stock based on what seems like positive news, only to witness a market downturn.

Also, if you insist on trading at any price (called a Market Order), you may end up with a much different execution price than you had originally intended.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.