Hot Money Monday: How to read market mood and find the ASX stocks investors are bullish about

The Put/Call Ratio is used to gauge sentiment by comparing trading volume of put and call options. Pic via Getty Images

- Market sentiment reflects investor feelings about a stock

- The Put/Call Ratio is used to gauge sentiment by comparing trading volume of put and call options

- Which ASX stocks are investors most optimistic about right now?

Market sentiment, also known as investor sentiment, refers to how investors feel about a particular stock or the market as a whole.

It represents the overall mood or attitude that investors have, whether they are feeling optimistic (bullish) or pessimistic (bearish) about future price movements.

A widely favoured method for assessing market sentiment is by examining the VIX Index.

The VIX, also known as the Volatility Index or the “Fear Gauge,” measures the market’s expectation of volatility over the next 30 days.

When the VIX is high, it suggests that investors expect significant market volatility, and vice versa.

But while the VIX gives an idea of the overall market mood, it does not tell you how investors feel about specific stocks.

To understand how investors feel about an individual stock, one effective approach is to examine the options market.

Introducing the Put/Call Ratio

Even if you’re not actively trading derivatives, you can use freely available options data to understand market sentiment toward a particular stock.

One of the most commonly used metrics for this purpose is the Put/Call Ratio.

The Put/Call Ratio essentially compares the trading volume of a stock’s put options to its call options.

PUT/CALL RATIO =

TOTAL PUT OPTION INTEREST / TOTAL CALL OPEN INTEREST

where:

* Total Put Open Interest is the total number of outstanding puts; and

* Total Call Open Interest is the total number of outstanding calls.

How to read the data

In order to understand why the Put/Call ratio is relevant, it’s useful to understand the basics of put and call options.

Investors buy put options when they anticipate the price of the underlying stock to fall.

Conversely, investors buy call options when they expect the price of the underlying stock to rise.

Therefore, when the Put Call Ratio (PCR) is below 1, it means investors are buying more call options than put options. This indicates positive sentiment, as it reflects their optimism and expectation that the stock’s price will increase.

Conversely, when the PCR is above 1, it means investors are buying more put options than call options. This indicates negative sentiment, as it reflects their pessimism and expectation that the stock’s price will decline.

A PCR at 1, meanwhile, means an equal number of put and call options are being bought, indicating a neutral sentiment where investors are not strongly leaning towards either bullish or bearish expectations.

While there’s no perfect PCR, a number below 0.7 is often seen as a strong signal of bullish sentiment. Conversely, a PCR above 1 is generally interpreted as a strong indication of bearish sentiment.

ASX stocks with the best Put/Call Ratio

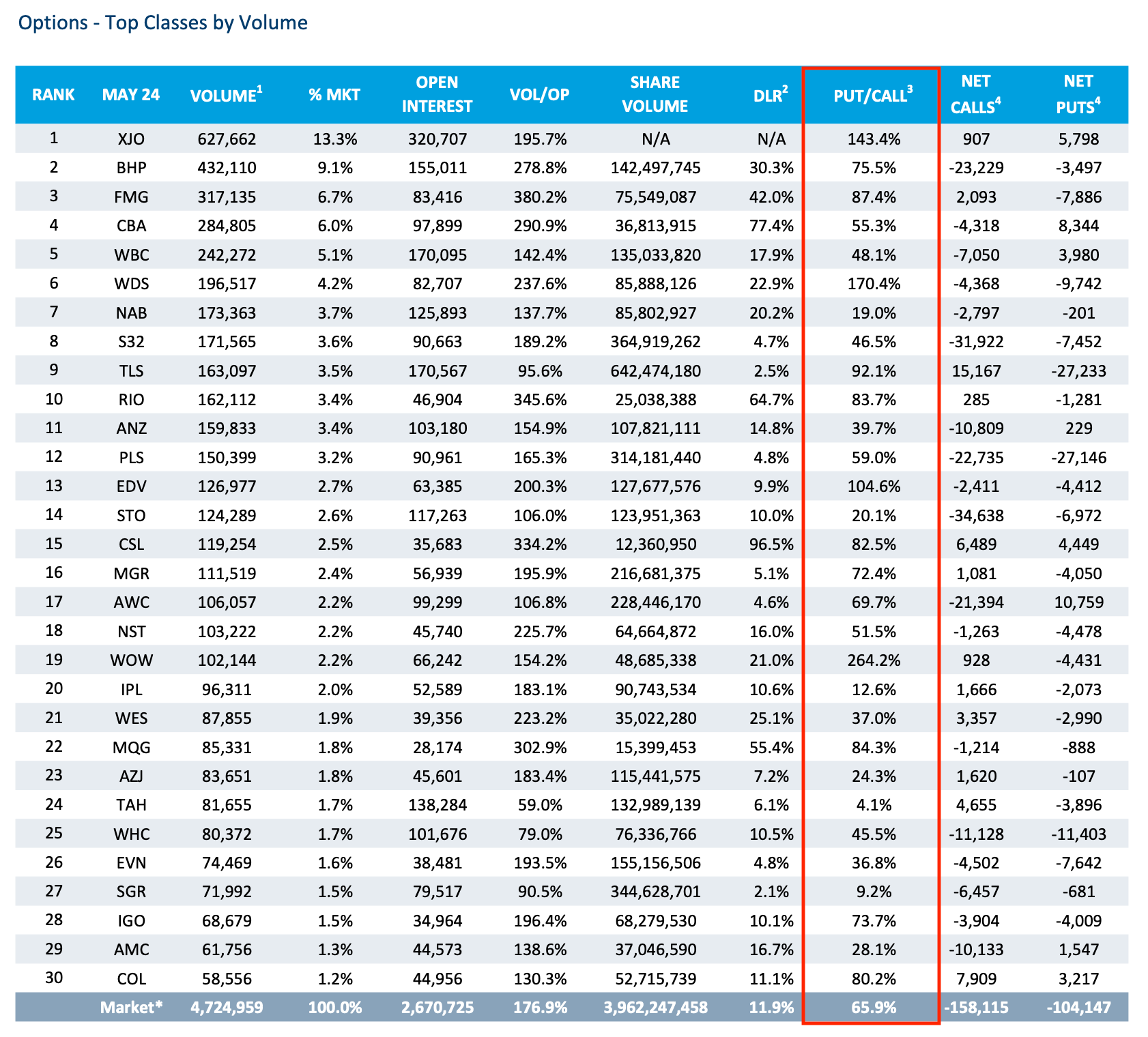

The ASX publishes monthly options data, highlighting the most traded options on the exchange, including the Put/Call Ratio.

However, it’s important to note that only the largest stocks have options available, so small-cap stocks won’t have corresponding options data.

Keep in mind, the lower the Put/Call Ratio is, the more optimistic about the stock traders are.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.