Explainer: Why OTC is key for making bitcoin mainstream

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Special Report: Over-the-counter (OTC) trading of Bitcoin and other digital currencies at high volume represents a critical pillar for the industry’s move to mass adoption. Stockhead dives deeper into how this is playing out in the Australian market.

OTC trading of digital currencies has become increasingly popular among qualified investors and traders around the world. For Australian investors seeking higher liquidity, it provides an elegant solution with a significant level of anonymity in trading larger volumes of digital assets. Typically the domain of brokers who specialise in large transactions, OTC has evolved to be the channel of choice by many large-scale traders, including hedge funds, private wealth managers or high-net-worth individuals.

The key difference with OTC desks is that they service a much more diverse set of clients, usually crypto savvy investors who prefer convenience and professionalism of execution services – particularly those seeking the best execution price, or who want to complete an order with minimal information leakage.

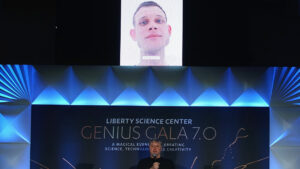

Nelson Minier heads up OTC Sales and Trading at San Francisco-based Kraken, a global exchange that trades digital currencies like Bitcoin and Ethereum.

Kraken, which is the world’s largest global digital asset exchange in euro volume and liquidity, saw an opportunity to launch its global OTC desk back in 2014, with Australia’s OTC desk following suit in January of this year. It was ushered in by Minier – who came across after stints in JP Morgan and Credit Suisse – and it counts a number of high net worth individuals and asset managers among its clients.

“We launched the OTC desk to fulfill a market need: we saw an increase in sophisticated groups of clients who needed deeper markets for larger trades,” Minier told Stockhead.

“We had tremendous growth from the end of 2017 to the end of 2019 and since then, flows have stabilised but they are steadily increasing over time. Number of assets, clients and regions continue to expand and grow. We’ve seen a lot of success in Australia, Europe, Latin America and are now looking at the Middle East.”

Top cryptocurrencies traded by volume on OTC

| # | Name |

| 1 | BTC |

| 2 | ETH |

| 3 | USDT |

| 4 | USDC |

| 5 | XRP |

| 6 | LINK |

Source: Kraken OTC (August 2020)

Another reason why some traders may seek to explore OTC trading is that it better matches their preferences for high volume trading without excessive regulation.

Investors who turn to OTC desks may look to minimise the overall impact on the market as a consequence of a large deal. This advantage is key for those who are looking to buy or sell thousands of a popularly held digital currency like bitcoin. Minier told Stockhead that growth in the OTC market in Australia has been strong over the past few years, driven largely by traders seeking to exploit arbitrage opportunities between markets.

“This has been due in part to the adoption of stablecoins by traders in the region taking advantage of the ability to move value around easily while opportunistically arbitraging price and liquidity differentials,” Minier said.

“Everyday, we have conversations with money managers figuring out a way to satiate the demand of crypto their clients crave. We’ve seen a tremendous amount of interest on the OTC desk fuelled by global 0% interest rate policy. The 0% and negative rate policy adopted globally has created an entire new wave of interest as people search for new avenues to store value.”

$15 billion in daily trades and growing

The market size and potential for OTC remains considerable. Digital Assets Research and TABB Group found that the OTC market facilitated USD $250 million to USD $30 billion in trades per day in April 2018, while digital currency exchanges globally handled approximately USD $15 billion in daily trades during the same period.

Kraken does not impose minimum order sizes for its users on the OTC desk, with all clients being pro-verified in accordance with AML/KYC compliance regulations, ensuring security with each trade. While OTC pricing is determined based on market conditions, no fees are charged for trades above $100,000.

Rapid evolution on the cards

The growing frequency and interest in high volume trades on OTC desks is recognised as being instrumental towards helping drive cryptocurrencies like bitcoin towards mainstream adoption. As the OTC market evolves, companies like Kraken are either working on building trusted custodial solutions and risk management systems or seeking to partner with those who can provide users with the safety and security of those custodial solutions.

“We continue to work on efficiencies across the board to enhance trading for our clients. This includes partnerships with foreign exchange (FX) brokers so we can offer more currencies and continue to expand our liquidity provider pool,” Minier told Stockhead.

The OTC market is expected to continue steadily growing, with a key focus remaining on ensuring security remains paramount in the face of any emerging cyber threats, to provide large-scale traders with the comfort they need to become more involved in crypto.

To remain ahead of the curve, Minier recognises the need for Kraken to expand its burgeoning pipeline of partnerships and provide traders with the best experience when it comes to OTC trading.

“Typically institutional investors want a custody solution so we’re exploring partnerships, especially as banks are getting into the asset custody business. Ultimately, our clients come to us for white glove service,deep liquidity, and the comfort that comes from trading with Kraken.”

This article was developed in collaboration with Kraken, a Stockhead advertiser at the time of publishing. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.