DeFi guide: Everything you need to know about decentralised finance

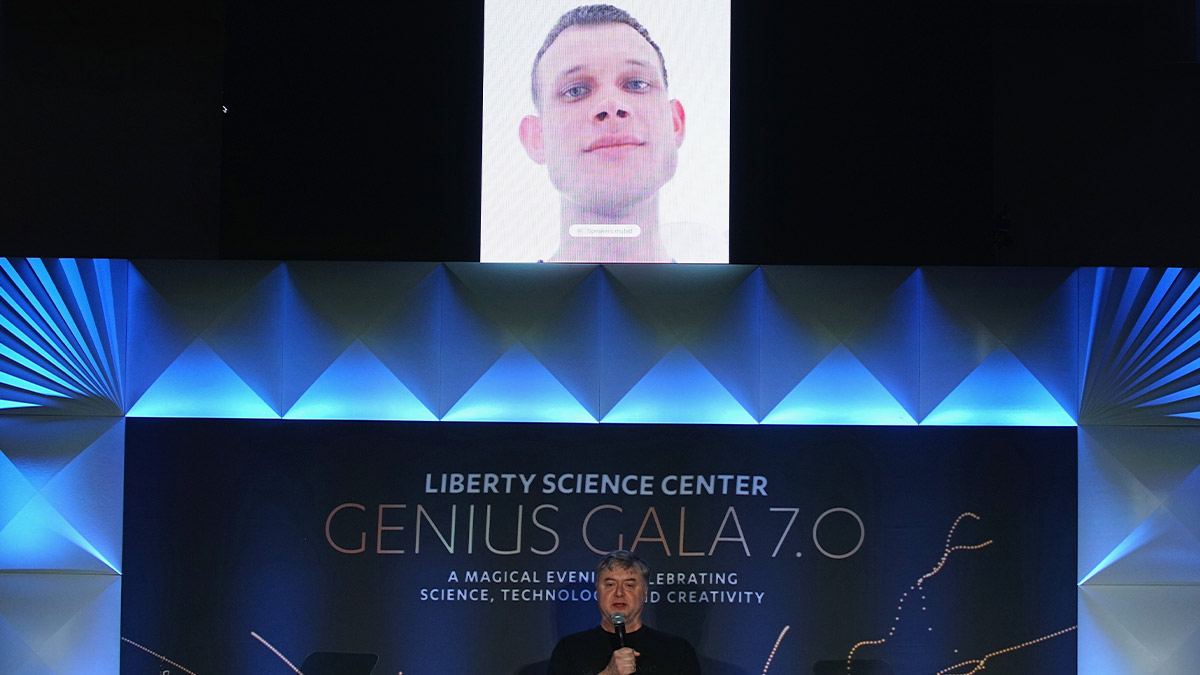

Co-founder of Ethereum Vitalik Buterin (top) dials into a conference at the Liberty Science Center. (Pic: Getty)

Now that crypto is booming again for the first time since 2017, a DeFi guide is in order.

Bitcoin is back near all-time highs and Ethereum up 5x in 2020 after a smart contract on the network accrued 524,288 ETH tokens — the amount required to trigger a proposed upgrade to Ethereum 2.0.

Like the 2017 ICO (initial coin offering) boom, Ethereum has also acted as the base network for the rise of Decentralised Finance technology, known as DeFi.

Since June, the amount of capital locked in DeFi contracts has risen from around $US1bn to around $US15bn, according to DeFi Pulse.

There’s plenty of activity in the space but it remains a speculative and highly complex sector.

To get a handle on it, Stockhead caught up with two sector experts — Anthony Sassano from DeFi platform Set Protocol, and Dan Fries, CEO of The Tokenist — for an explainer.

DeFi guide

In many ways 2020 has been the year of DeFi, but Sassano said the surge in activity is the result off a three-year development process since the first DeFi platform was launched in December 2017.

“Those in the ‘ETH weeds’ so to speak were the ones building the network and laying the infrastructure,” said.

“But what had to happen was you needed to put the building blocks in place for a financial system like this to develop.”

Building block 1 — Stablecoins

A feature of all cryptocurrencies is volatility, which limits their use case as a transaction mechanism.

Sassano says that in constructing a sustainable digital ecosystem, the first step was to create “a stable asset you could trade”.

Stablecoins are typically pegged to another asset or trade within a range, giving them more utility as a means of exchange.

But in late 2017 at the height of the first crypto bull market, crypto organisation MakerDAO launched the first decentralised stablecoin on the Ethereum network.

Sassano contrasted it against a centralised stablecoin to explain how they work:

“A good example of a centralised stablecoin is the USD Coin issued by American crypto exchange Coinbase. For every USDC issued, Coinbase holds $US1 in a bank account that’s fully audited and regulated.”

“What MakerDAO did was create a decentralised one which isn’t backed by dollars in a bank account, it’s backed by ETH in their system.”

By posting their ETH as collateral via a smart contract, anyone can mint DAI (stablecoins).

If the price of a user’s collateralised ETH falls below a certain point, their underlying asset can be liquidated – one of a number of checks and balances the network uses to operate a functioning decentralised stablecoin platform.

“MakerDAO was a product that took years to explain for the narrative to set in. It’s a very complex system, but it works for now,” Sassano said.

Building block 2 — Decentralised exchanges

To date, most crypto investments take place on centralised exchanges.

Binance and Coinbase (global) or Independent Reserve, CoinJar and BTC Markets (Australia) facilitate crypto transactions and take a fee for doing so.

But after the launch of decentralised stablecoins, decentralised exchanges were the next to launch and one of most popular was Uniswap.

“Uniswap was very popular because it allows everyone to provide liquidity and earn a return,” Sassano said.

“Say you have ETH and you want to provide liquidity, you can go to Uniswap and they act as an automated market maker for you.”

“So all a user has to do is input their liquidity into the system, and they’ll be able to capture fees from that.”

Building block 3 — money markets

The development of stablecoins and decentralised exchanges provided the platform for the next wave of DeFi in the form of expanded money markets.

“Money markets were a natural evolution because you have people who want to earn yield by lending out assets, or posting collateral and taking leveraged bets,” Sassano says.

“So in the last year or so we’ve seen a lot more exotic products come online – sophisticated options products and synthetic assets.”

“But these products can only exist because we had other blocks to build on, they can’t exist in a vacuum.”

Yield farming

A DeFi guide wouldn’t be complete with commentary on yield farming, one of the key developments in crypto this year.

With a decentralised framework in place for more complex financial products, the “final catalyst that made 2020 the year of DeFi was the explosion in yield farming”, Sassano says.

For decentralised asset markets (like traditional asset markets), liquidity is key.

And with infrastructure set up around stablecoins, exchanges and money markets, participants can generate returns by using their crypto assets to provide liquidity in various decentralised markets.

It’s a complex process, but two yield farming projects that saw rapid growth in 2020 were Yearn.Finance and Compound.

“Compound allows users to put up their ETH for collateral and draw or borrow stablecoins against it,” Sassano explained.

A key aspect of the platform is the COMP token, which users can earn by lending or borrowing from the Compound system.

“People flooded in with capital; they were able to mine these tokens then sell them, and they appreciated rapidly because a bit of mania had taken hold,” Sassano said.

“So I think Compound kicked off the ‘DeFi summer’, because you had all these other projects popping up with their own yield farming programs essentially.”

‘DeFi summer’

Compound and other DeFi platforms boomed over the northern summer through June, July and August.

Along with excitement about the technology, Fries added that US regulators also played a key role.

“Part of what triggered the DeFi bull run was a court ruling in June which deemed that COMP tokens weren’t a security,” Fries said.

Assets deemed a security are subject to stricter financial oversight from corporate regulators, in both the US and Australia.

“A lot of ICO (initial coin offerings) in the 2017 bull market were offering investors dividends, and the SEC said ‘no that’s clearly a security’,” Fries said.

“In this model, platforms were saying ‘if you stake a token on our network with your own ETH assets, we’ll reward you for that work. And that ruling by the US opened the gates for all these projects to come out with different structures.”

“What DeFi projects effectively do now is raise capital by buying liquidity. And that’s why people pile into those projects because if you’re the first to provide liquidity, you get a disproportionate share of the reward.”

DeFi guide to investing

With the broader crypto bull market in full swing, Sassano says DeFi is heading into “another mania phase”.

But after three years of development work on the decentralised ecosystem, he says this time will be different to the 2017 ICO boom.

“People can come into ecosystem and do useful stuff — lend assets, borrow assets, provide liquidity or trade.”

“So we’ll have the mania, prices will run ahead of themselves but this time around there’s a system in place. People will be using this space for more than just pumping and dumping.”

So, how does one actually get involved in the space? Sassano breaks it down:

“The easiest way into DeFi is to buy ETH on a traditional exchange, and withdraw it to your own ETH wallet.”

“What most people use is a wallet called Metamask in their browser, which is just an extension on Chrome or Firefox.”

“From there you go to platforms like Uniswap, and select the token you want to buy. For broad exposure, you can choose the DeFi Pulse Index which includes a basket of tokens.”

“Select and transfer ETH for however many tokens you want, click swap, and your Metamask wallet will pop up with a prompt to confirm the transaction. The Metamask will give you a notification it’s confirmed, and you’ll have DeFi Plus tokens in your wallet.”

“Those might be foreign concepts — installing a new wallet, getting an ETH address, paying transaction fees (which in Ethereum are called GAS) — these are all things investors will have to get familiar with.”

“Centralised exchanges still play a big part in crypto because they make it easy to buy. But if you want to generate alpha you won’t find it there because DeFi tokens aren’t listed there,” Sassano said.

“Investors will need to go ‘into the weeds’ and learn this stuff.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.