Chinese stocks are bouncing back, and here’s how you can buy them

How to buy Chinese stocks in Australia. Picture: Getty

- Investors have recently flocked back to Chinese stocks

- What are ADR, ADS, and China A-shares, and how to buy Chinese stocks on the ASX

- Risks of investing in Chinese stocks

Once highly sought after, Chinese technology stocks have become somewhat of a pariah since President Xi tightened the screws on the sector last year.

Former tech darlings Alibaba and JD.com are down 20% this year, while TikTok creator Tencent has fallen 30%.

The NASDAQ Golden Dragon China Index, which tracks Chinese stocks listed in the US, has also slumped by 25%.

But over the past month, there has been a big rebound despite little evidence that President Xi will reverse his campaign to rein in the country’s tech giants.

Things are also looking up for Chinese property stocks after the government unveiled a string of financial measures to prop up the industry.

Goldman Sachs expects China’s GDP to bounce back to 5.3% by 2024, and bargain hunters have already returned in droves to size up dip-buying opportunities.

How do I buy Chinese stocks?

In short, it’s not as simple as buying American or European stocks.

Only a few brokers in Australia offer access to the stock markets of Hong Kong, Shanghai and Shenzen.

Stocks traded in the the mainland cities of Shanghai and Shenzen are denominated in renminbi, and are called Chinese A-shares.

Interactive Brokers give investors direct access to Chinese A-shares through the Shanghai-Hong Kong Stock Connect, which allows investors to trade in both markets.

Tiger Brokers also provide a similar service, providing investors access to the Shanghai-Shenzhen-Hong Kong Stock Exchange Trading Interconnection Mechanism.

Meanwhile, bigger security brokers like Commsec, NABTrade, ANZ, and Westpac don’t currently offer those services.

Buying Chinese stocks through US exchanges

Despite the ability to trade Chinese A-shares directly, the most popular way of investing in Chinese stocks is still through the US stockmarket.

This is usually done through trading in American Depository Receipts (ADR) and American Depository Shares (ADS).

Alibaba is a good example. The company has its primary listing in Hong Kong, but also has its ADR listed on NYSE.

An ADR is basically a security that represents a foreign company listed in the US, similar to what a CHESS Depositary Interest (CDI) is to the ASX.

In theory, you don’t get voting rights with most ADRs, as is the case with Alibaba ADRs on NYSE.

Other popular Chinese stocks with an ADR listing in the US include Tencent and Pinduoduo.

Baidu meanwhile has an ADS (American Depository Share) listing on Nasdaq, which is the US dollar equivalent stock of its shares in Hong Kong.

Investors could easily buy these securities by opening a US brokerage account with your local broker.

Now read: The pros and cons of owning US stocks, and how to go about buying them

Buying Chinese shares on the ASX

The only way to get exposure to Chinese stocks on the ASX is through buying one of the China-themed ETFs.

iShares MSCI China ETF (ASX:MCHI) is a China-focused fund run by Blackrock.

The fund has been running for more than 10 years, and buys large and mid-sized stocks in China.

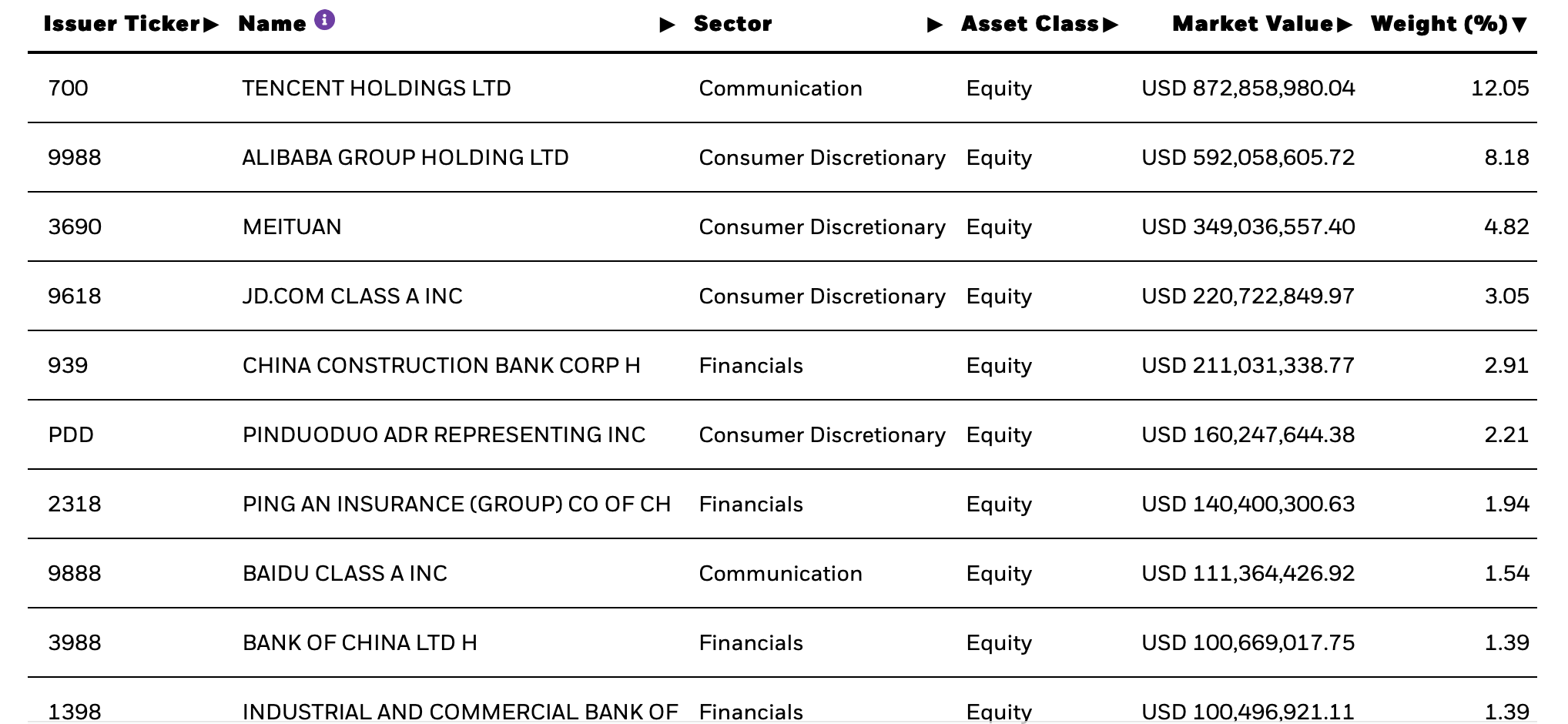

As of December 2, the top 10 holdings of the MCHI are shown below:

Another Blackrock Chinese themed fund is the Ishares’ China ETF (ASX:IZZ) .

The IZZ fund has a long exposure to 50 of the largest and most liquid Chinese companies listed on the Hong Kong Stock Exchange.

Van Eck’s China A50 ETF (AS:CETF) meanwhile is the only China A-shares ETF on the ASX.

The fund replicates the FTSE China A50 Index, which was designed to represent the performance of the 50 largest companies in the mainland Chinese market.

Its top 10 holdings include lesser known Chinese companies such as BYD, China Merchants Bank, and Ping An Insurance.

Risks of investing in Chinese stocks

Being the second biggest economy and consumer market, there are obvious benefits in buying shares in Chinese companies.

But there’s also a unique set of risks investors should be aware of.

First, political tensions between the US and China could spill over to the stockmarket.

In 2020 for example, former President Trump signed a legislation that could kick Chinese companies off US exchanges unless American regulators can review their financial audits.

This has led to the voluntary delistings of five Chinese state-owned companies from US exhanges in August, including oil giant Sinopec, PetroChina, and China Telecom.

Another risk in investing in Chinese stocks, especially in China A-shares, is investor-unfriendly regulations.

The CCP has especially been cracking down on big tech as part of Xi’s ‘Common Prosperity’ agenda.

Last year, the government labelled video games as ‘mental opium’ and ‘electronic narcotics’, while reclassifying gig workers as employees – a move that cost food delivery companies like Meituan billions of dollars.

In general, the risk of the CCP meddling into a company’s operations is very high, as we’ve seen with privately held global giant Huawei.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.