The Nasdaq Golden Dragon is scorching November; China-themed ETFs are doing even better

Via Getty

The Nasdaq Golden Dragon China Index, which tracks about 65 of the biggest and brightest US-listed Chinese stocks, has climbed 24% in four sessions.

The Golden Dragon rose 8% alone last Tuesday. Even at this early stage November is looking like the Dragon’s most golden yet.

China’s once darling internet giant Alibaba Group jumped 11%, while its techno-peers like Pinduoduo Inc. and JD.com found at least 7%. Tencent Music surged 31% after delivering a beat on earnings.

Looking at the gains in the past 10 days, dozens of US-listed Chinese stocks have all risen by more than 20%.

US-listed Chinese stocks Vs. November 2022

Like the (other) Christians say: After the crucifixion, comes the ressurrection

Chinese stocks and their markets have largely taken a beating in 2022.

That pattern got particularly unpleasant in October. Sometime around the 20th Chinese National Party Congress (NPC) which rubber-stamped President Xi Jinping’s absolute control over every single one of the levers of Chinese power.

China’s most outward-facing market, the once ‘Special Administrative Region’ (now just ‘region’) of Hong Kong, saw its benchmark Hang Seng Index endure its biggest one-day sell-off since the global financial crisis (GFC). Tech stocks in particular crashed and burned as investors decided to jump ship rather than take a moment to digest the potentialities of the impact of the 20th NPC and how things might play out with a confident, secure Chairman Xi taking to his unprecedented third term like a shark to water.

On the 25th of that month, the Hang Seng – bleeding like a stuck pig for most of the month – gave away another 7%, ending at its lowest ebb since April 2019 and pulling stumps on its biggest one-day loss since November 2008.

The big name tech companies, Alibaba and Tencent, closed down more than 11% in Honkers, while the mainland’s messed up version of Google – Baidu – and the food delivery co Meituan both gave up around 13%

Over the same weekend in October, while you were out clubbing, the Golden Dragon China Index shed 14% – or more than US$72bn – which helps explain why Goldman Sachs now expects both the MSCI China benchmark and the CSI 300 Index to rise by 16% in the next 12 months.

Volatility at these peaks was a little too much for many foreign investors who cashed their chips and Chinese holdings.

American depository receipts (ADRs), a very handy thing that simplifies the process which allows US investors to get hold of foreign stocks (China’s five largest stocks in particular) gave up by more than $50 billion.

Most impacted again were the once fortified, now brittle Chinese technology firms, such as Alibaba, Baidu, Pinduoduo, and JD.com.

Red sails in the sunset

Now even Franklin Templeton are among the growing list of money managers snapping up Chinese stocks, largely based on increasingly sound bets the assured third term President will be able to reign in everything from shonky property markets to shonky US trade negotiations and very shonky Covid Zero policies.

Global X Head of Investment Strategy Blair Hannon told Stockhead, while Global X has no targeted China ETFs listed on the ASX, the company has them elsewhere, including Hong Kong and the US.

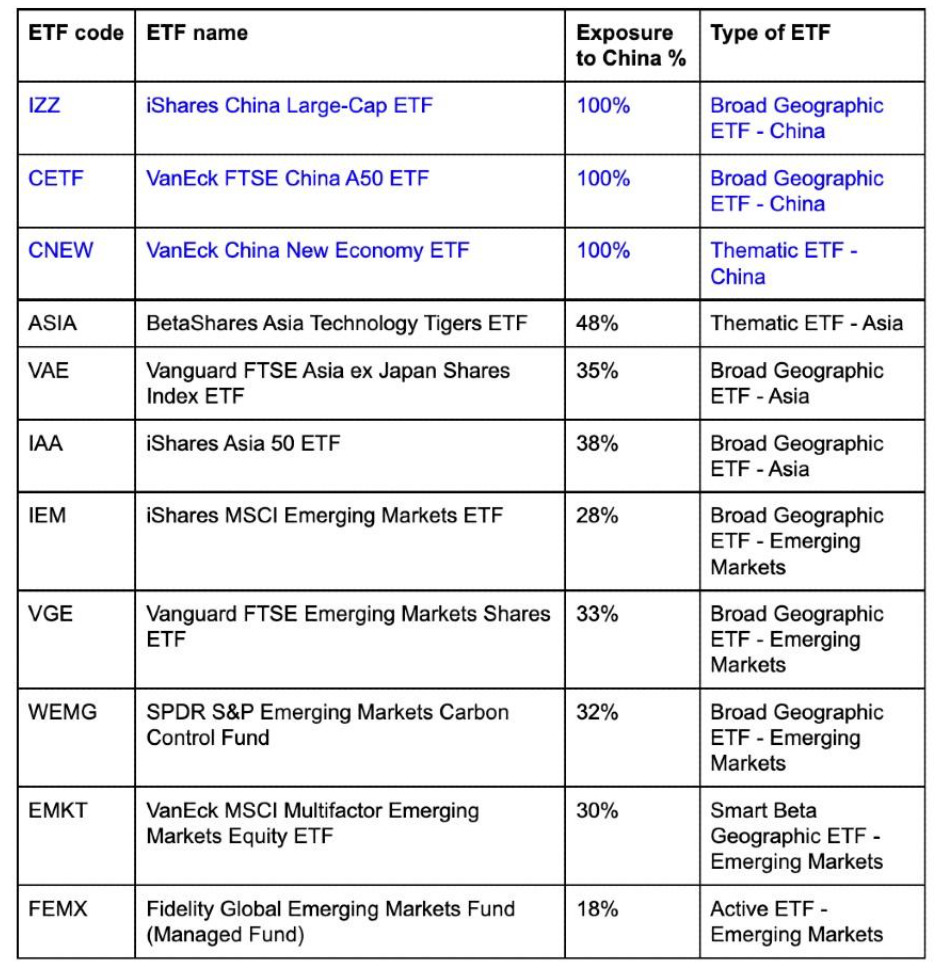

Hannon said investors can capture China broadly through an emerging markets ETF, narrow down to a pure-play Chinese-focused ETF or even specialise further down to sectors in the country.

“We are starting to see more sophisticated investors play that card of targeting sectors in China like energy or technology,” he said.

He said in the past week there has been massive back moves in general towards China including of American depository receipts (ADRs) of stocks traded on US exchanges that access China.

“There’s been a massive buy up in the past week around the Covid reopening, property finance rescue plus positive discussions between President Xi Jinping and US President Joe Biden and Australian Prime Minister Anthony Albanese,” he said.

But before we take off all our clothes and bathe in the glory of the dragon resurrected, Stockspot senior manager – investments and operations initiatives – Marc Jocum told Stockhead investing in China comes with its own unique set ever-changing risks, (dominated of late by punitive Chinese regulators and an upsurge in geopolitical tension).

“This increased risk is one reason why Chinese stocks are more volatile and can sometimes trade at lower multiples than other investment regions,” he said.

Jocum said if Australian investors want to gain exposure to China sans taking too much geographic risk, they can look at a broader Asian ETF, such as IAA or an emerging market ETF, such as IEM, which have exposure to China among other countries.

China is the world’s second largest economy, produces nearly nearly one-fifth of the total flow of global goods and services, but according to Stockspot, accounts for less than 1% of the total share market.

“Therefore, we believe that China can play a part in a portfolio to provide extra diversification. ETFs provide the perfect building blocks for investors to gain exposure but can do so as a small overall position,” Jocum says.

With the Golden Dragon Index now ahead by circa 23% thus far in November, unsurprisingly interest in global China-facing ETFs has exploded.

And traders don’t have to look too far for ETFs outperforming the Hang Seng of late.

Get a pen

According to Zacks as of last week, these were the top 5 performing global China-facing ETFs:

- Loncar China BioPharma ETF CHNA – up 27.3% Past Month

- Global X MSCI China Health Care ETF CHIH – up 22.0%

- Global X MSCI China Information Technology ETF CHIK – up 19.2%

- KraneShares MSCI All China Health Care Index ETF KURE – up 17.1%

- KraneShares SSE Star Market 50 Index ETF KSTR – up 16.6%

Among the more popular internationally and in no particular order:

- iShares China Large-Cap ETF FXI

- iShares MSCI China ETF

- iShares MSCI Taiwan ETF

- Xtrackers Harvest CSI 300 China A ETF

- WisdomTree China ex-State-Owd Entpr ETF

- Invesco Golden Dragon China ETF PGJ

- KraneShares CSI China Internet ETF KWEB

- KraneShares Hang Seng TECH Index ETF KTEC,

- MSCI China Communication Services ETF CHIC

- WisdomTree China ex-State-Owd Entpr ETF

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.