ASX BNPL stocks guide 2021: Here’s everything you need to know

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Here’s the ASX investor’s guide to ASX ‘buy now, pay later’ (BNPL) stocks in 2021.

The BNPL sector is one that has seen exponential growth in recent years in the number of companies in the space, their customers and market capitalisations (although the largest companies have by far the largest share of the pie).

In 2021 has had new wave of excitement breathed into it since Afterpay (ASX:APT) announced it was being bought by Square.

This updated edition of Stockhead’s ASX BNPL stocks guide includes a new section on what the deal means for Afterpay and as well as an overview of the new companies that have entered the space in the last 12 months.

BNPL Sector Overview

The market value of the ASX BNPL sector as represented by 15 ASX companies is currently $48.3 billion as share price valuations of industry leaders have soared over recent years and new companies have entered the space.

Sector leader Afterpay (ASX:APT) now has a market value of $38.2bn, up from $19.8bn in August 2020, a figure that has fluctuated in 2021 but has never looked back since Square (NYSE:SQ) made its bid for the company.

The BNPL sector’s second largest ASX company Zip (ASX:Z1P) has grown to $4.4bn from $2.4bn over the same period, and has nearly 6 million customers worldwide.

The stock market values of the next three largest BNPL companies in Australia — Humm Group (ASX:HUM), Splitit (ASX:SPT) and Sezzle (ASX:SZL) range between $265m to $1.6bn.

The massive popularity of BNPL among consumers of all ages is a testament to the inventiveness of Australia’s retail and finance sectors in developing a flexible payments product.

The innovation has even spread abroad to countries including the US and UK, where some Australian BNPL companies now have operations.

ASX Buy Now Pay Later companies

| Code | Company | Price (16-August 2021) | % Return 1 Year | Market Cap |

|---|---|---|---|---|

| APT | Afterpay Limited | 130.67 | 83 | $38.2B |

| Z1P | Zip Co Ltd. | 7.53 | 23 | $4.4B |

| SZL | Sezzle Inc. | 8.21 | 16 | $1.6B |

| SPT | Splitit | 0.555 | -60 | $265.7M |

| OPY | Openpay Group | 1.295 | -64 | $137.7M |

| HUM | Humm Group Limited | 0.945 | -19 | $473.0M |

| LBY | Laybuy Group Holding | 0.565 | -60 | $145.0M |

| ZBT | Zebit Inc. | 0.92 | -42 | $88.0M |

| PYR | Payright Limited | 0.425 | -65 | $28.6M |

| DOU | Douugh Limited | 0.095 | 207 | $34.5M |

| IOU | Ioupay Limited | 0.265 | 703 | $146.1M |

| FFG | Fatfish Group | 0.062 | 464 | $63.2M |

| NOV | Novatti Group Ltd | 0.54 | 163 | $163.0M |

| CI1 | Credit Intelligence | 0.013 | -48 | $20.8M |

| LFS | Latitude Financial | 2.42 | -7 | $2.4B |

How BNPL works

The BNPL business model is straightforward. BNPL companies act as middle-men between customers and retailers, providing credit to consumers to facilitate purchases from retailers.

Retailers benefit by receiving cashflow from sales that may not have occurred because the consumer was cash-strapped, or unable to afford an item in a single payment.

Shoppers can purchase goods at their convenience and repay the credit in instalments, sometimes interest free.

When a sale happens using BNPL, the credit risk transfers from the retailer to the BNPL provider, and it is up to the BNPL provider to ensure they are paid by the consumer.

BNPL providers carry out credit and identity checks on customers in real-time to curtail potential attempts at fraud and to ensure customers have the capacity to repay any credit.

Retailers pay the BNPL provider a commission or a flat fee for managing the system.

Afterpay charges retailers a fee of 30c per transaction and a commission of 4 to 6 per cent depending on transaction volumes.

Debit card companies typically charge retailers 0.5 to 1 per cent of a transaction’s value, and credit card providers charge a little more at 1 to 2 per cent per sale.

Consumer protections are built into the system in the case shoppers default on bills.

Customers that decline to settle bills are no longer allowed to use a BNPL provider’s system.

The BNPL operator will still pay the retailer for any goods purchased but not paid for. The customer in default is not referred to credit status agencies, unlike say credit cards.

BNPL Sector has seen rapid growth

BNPL companies first appeared in Australia around five years ago and customer numbers started to increase from 2018 as more retailers and merchants participated in the business concept.

There were 3.7 million active account users for BNPL in Australia in the 2019 financial year, up 38 per cent form the preceding 2018 financial year.

The value of BNPL transactions in the 2019 financial year was $5.6bn, a rise of 79 per cent on $3.1bn in the 2018 financial year.

However the sector really took off in 2020, when share price valuations escalated and investors piled into the BNPL sector as it attracted increasing numbers of customers.

This is the so-called network effect in action, when the value of a company increases rapidly as more and more customers use its services, thereby attracting more users to its ranks.

By March 2021, the 2 largest players, Afterpay (ASX:APT) and Zip (ASX:Z1P) had 6 million accounts between them.

Afterpay and Zip grew their individual customer numbers further as they expanded into Northern Hemisphere markets.

While Sezzle (ASX:SZL), the third largest, already had a foot in the door in the USA being founded in Minneapolis, it expanded its presence.

The sector’s explosive growth also happened during an exceptional time and set of social circumstances with the COVID-19 pandemic as a backdrop.

COVID-19 effectively prevented people from visiting shops and retail centres, as they stayed at home for work, rest and play and shopped and worked over the internet.

At the same time, large numbers of Australian consumers were laid off from regular employment or were forced to work from home, leading to reduced income for many.

Practical solution to a changing economy

Practical-minded consumers hooked into BNPL as a way of buying goods online while deferring payment and its popularity began to climb steadily.

BNPL means consumers can purchase an item from a participating retailer with a small upfront payment and then settle the outstanding amount in three or four installments.

As of June 30, 2021 Afterpay had a customer base of 3.6 million people in Australia and New Zealand for sales of $9.4bn in the 2021 financial year.

Zip meanwhile had 2.8 million customers in Australia and New Zealand and recoded $893.5 million in transaction volume.

But for both companies, even as its customer numbers are growing in Australasia, they are shrinking as a portion of its worldwide customers.

Afterpay has 16.2 million customers worldwide, up from 9.9 million a year ago and 10.5 million of these are in the US and another 2.1 million are in Europe where it operates as Clearpay.

While Afterpay’s Australia and New Zealand customers only grew 8% in FY21, they grew 88% in North America and 104% in Europe.

Zip meanwhile has 4.4 million of its 73 million customers in the USA and its customers in America have grown 144% year on year while they have only grown 33% in Australia and New Zealand.

What Square’s acquisition of Afterpay means for the BNPL sector

The biggest development in the ASX BNPL sector in 2021 was Square’s bid for Afterpay.

Afterpay’s growing number of American customers and its publicly announcing of intention to list on the NASDAQ showed it had higher ambitions in the USA but the deal came out of the blue for many of its shareholders.

Afterpay will still be listed on the ASX as a part of Square which will see the new entity rival the Commonwealth Bank (ASX:CBA) as the biggest ASX stock.

It is a consensus among Afterpay’s backers Stockhead has spoken to since the deal that Afterpay will be able to grow its customers through this tie up as will Square.

“In a way it was a surprise to us but in another way it makes a lot of sense and we think there are synergies as a result, it’s a perfect merger and one plus one equals three type situation,” Hyperion Asset Management’s Chief Investment Officer Mark Arnold told Stockhead.

“They’ll be able to get access to the millions of merchants Square has in their ecosystem so that’ll be very good for all concerned – we’re very excited about that.

“Afterpay’s shareholders will benefit in terms of the robustness of the business they end up with once the merger goes through – [a] stronger competitive advantage, stronger value proposition, higher levels of sustained growth over long periods of time and less risk as well.”

Could we see more BNPL takeovers?

On the day the Afterpay news broke, the share prices of other ASX BNPL stocks rose off the back of the news – most particularly Zip.

While it is arguably investors are anticipating further takeovers in the BNPL space, they are warned not to get their hopes up.

“It would be unusual for someone to take a plus bet [but] not impossible because that’s what Square has done and they’re excited about what they’re bringing into the business,” Hyperion’s deputy CIO Jason Orthman told Stockhead.

“Jack Dorsey is a special CEO and he saw something your average board and advisors couldn’t see.

“Even if Square didn’t come in, we were excited about what they could do over the next 10 years.”

Also weighing in was early Afterpay backer Dean Fergie from Cyan Asset Management.

“I don’t necessarily think it will act as a catalyst for further optimism towards Australian tech among global investors,” he told Stockhead’s Sam Jacobs.

“I think APT’s built something pretty unique that’s also gained traction globally, and that’s what’s been attractive to an international player like Square.

“The best player has been picked now, and it’s becoming part of an even bigger organisation. Which means the smaller players become more marginalised, and the competitive landscape becomes tougher.

“So I look at it as something that has the potential to have a short-term positive impact, but long term those competitive headwinds are still there.”

BNPL regulation

And the competition between the companies is not just the only thing with potential to cause headaches for BNPL investors.

One of the reasons why BNPL has taken off is because BNPL products have been easier to access than many conventional financial products particularly credit cards and personal loans.

The Australian government and regulators have to date taken a light-touch approach to overseeing BNPL, but in recent months there have been moves to formalise the way the sector operates.

A new BNPL industry Code of Practice began operating from March 1, and was formed with inputs from the BNPL companies and the Australian Finance Industry Association.

The AFIA has among its members a number of BNPL companies including, Afterpay, Brighte, flexigroup, Klarna, OpenPay and Zip.

“This is a world-first BNPL Code of Practice and it is crucial to customers and to the future of the industry that we get it right,” AFIA chief executive, Diane Tate, said.

The Code goes above and beyond the law Tate said, “because we all understand the need to protect vulnerable consumers while supporting innovation that allows people to make purchases and payments in ways that suit them”.

The code is in response to recommendations from the Australian Securities and Investment Commission’s (ASIC) report into the sector of November 2020.

ASIC noted the development of the BNPL Code of Practice and said in its report that it retains the power to intervene in the sector to address “any significant consumer detriment”.

The regulator can order a person or company to not engage in specified conduct related to BNPL products, to enable it to respond to potential consumer harm in a timely way.

From October this year, new design and distribution product obligations will apply to the BNPL sector in Australia.

“These obligations will require the industry to design fit-for-purpose products that meet consumer needs,” said ASIC.

Of course as BNPL firms expand overseas, they will face regulation overseas. In Britain, regulators threw a cat amongst the pigeons back in February in recommending BNPL firms be required to conduct affordability before lending to customers.

While it was reported the government would respond to the report, nothing has eventuated as of August 2021.

Market leaders dominate the BNPL landscape

Afterpay, the market leader and the sector’s early mover, is one of five BNPL companies that dominate the sector in Australia.

The company was founded by Anthony Eisen and Nicholas Molnar in October 2014 and it listed on the ASX in May 2016 at $1 per share.

As at June 30 2021, Afterpay has 16.2 million customers worldwide and its BNPL system is available in approximately 98,200 retailers in Australia, New Zealand, the United Kingdom and the United States.

The company has experienced rapid growth over the 2021 financial year, including a 77% rise in its merchant base, and 63% per cent increase in customer numbers.

Customers can now pay for retail items using Afterpay’s app on their mobile phone including Apple iphones and on android phones using Google Pay.

The company’s service was first adopted by retailers in 2016, starting in Australia and New Zealand, which has historically been its core market.

Thanks to rapid expansion into the US and Europe, Afterpay’s sales reached $21.1bn in the 2021 financial year, up 90% from FY20.

Prior to the Square acquisition, the most prominent investors in the company included Hong Kong-listed Tencent, a provider of internet and cloud-based services in China, which bought 5% of the company back in May 2020.

Tencent operates a mobile phone payments platform in China, Weixin Pay, that facilitates an average of 1 billion transactions each day.

“Afterpay’s approach stands out to us not just for its attractive business model characteristics, but also because its service aligns so well with consumer trends we see developing globally in terms of Afterpay’s customer centric, interest free approach as well as its integrated retail presence and ability to add significant value for its merchant base,” Tencent’s chief strategy officer James Mitchell said.

Zip Co and Sezzle

Next in market size in the BNPL sector on the ASX is Zip with a market cap of around $4.2bn.

Like Afterpay it has seen exponential growth since listing, hitting the bourse in September 2015 at 20 cents per share.

While Zip has not yet released its full financials for FY21, its customer numbers are at 7.3 million, up 87% year on year and its merchants grew to 51,300, up 84% year on year.

Zip has undertaken several acquisitions in recent months, the most prominent of which was US BNPL company QuadPay for $403m to accelerate its growth strategy in America.

At the time of acquisition, QuadPay has 1.8 million US customers and annualised revenue of $66m.

Zip has also snapped up European based Twisto Payments and Middle Eastern based Spotii Holdings.

Third in line in the BNPL sector by customer base is Sezzle, which had 2.9 million active customers and 40,200 merchant members at the June quarter 2021.

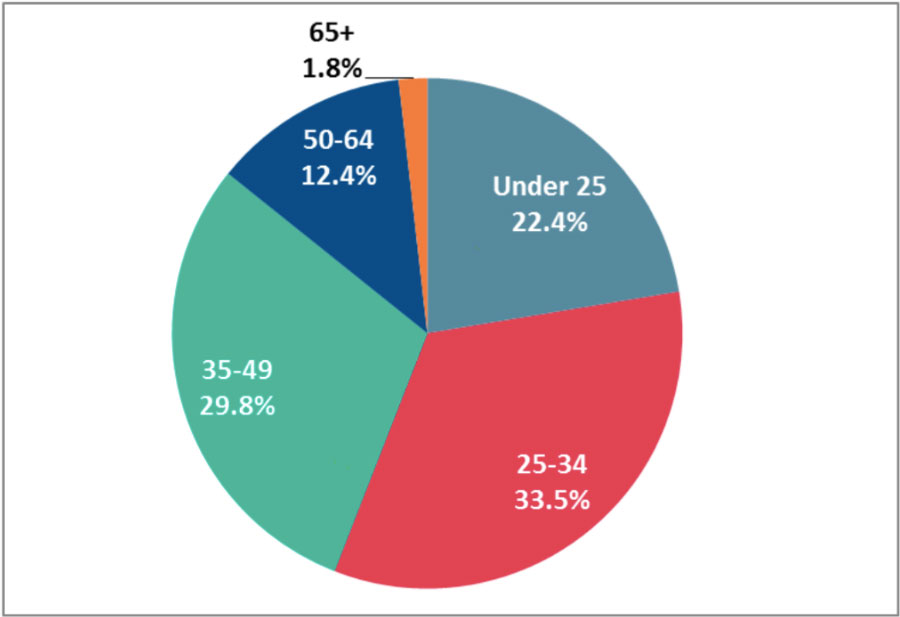

Around half of Sezzle’s customer base are Millennials — born in the 1980s to early 1990s, and 20 per cent are Generation Z (late 1990s to 2010s).

The company says it was well positioned to benefit from future growth in spending power for the Millennial and Generation Z age groups.

This is because 25 per cent of society’s disposable income will belong to the Generation Z age group of which there are 84 million in the US.

Sezzle listed on the ASX in July 2019 at $1.22 per share and is now over $8.

It opted to list in Australia in light of the greater understanding among investors about the BNPL sector but in recent months has dropped hints of a US listing.

The mid cap BNPL stocks

One of the more recent entrants is Latitude Financial (ASX:LFS) which only listed in April 2021.

Latitude is better known for its personal loans and credit cards but it is often put into the BNPL space because of its LatitudePay product which offers interest free repayment plans – making revenue off late fees and merchant service fees.

Nevertheless, it has attempted to distance itself from its peers by claiming to conduct more credit checks and service higher quality customers.

Then there’s Splitit which was arguably the firm that sent ASX investors into a frenzy over the BNPL space.

Splitit says its delayed payment system solves the problem for retailers of online consumers abandoning purchases at the checkout stage.

“The single biggest challenge for e-commerce retailers is overcoming around 70 per cent cart abandonment by shoppers. This translates into $4.6 trillion in lost e-commerce sales each year,” the company said.

Price is the main reason consumers abandon online purchases, said the company, which has formed partnerships with credit card companies Mastercard and Visa.

As a payment option Splitit allows customers to pay for goods in three to 24 monthly instalments using their existing credit card, thereby splitting the cost into manageable payments.

At the June quarter, Splitit had 1,000 merchants including home, sports and luxury brands, and 309,000 customers.

“Accelerating merchant demand, strong foundations and a great shopper experience have set Splitit on a rapid growth trajectory, with record merchant sales volume and revenue during the quarter,” chief executive Brian Paterson said.

Humm (ASX:HUM), until recently known as FlexiGroup, has a range of credit products including BNPL for consumers as well as BNPL for business and revolving credit.

Humm has a market capitalisation of $465 million, 2.7 million customers and operates in Australia, New Zealand, Ireland and Britain.

Rounding out the list is the Commonwealth Bank (ASX:CBA) which launched its BNPL product in March.

Recent IPOs

Despite the success of Afterpay and Zebit since their IPOs, more recent listees have not been as successful.

After Sezzle listed in July 2019, the next listing was Openpay (ASX:OPY) which entered the bourse just prior to Christmas. It has attempted to differentiate itself by targeting customers making larger purchases and utilising Openpay as a budgeting tool.

It too is targeting the USA as well as Australia.

Openpay debuted at $1.60 and rose as high as $4.70 last year amidst the post-COVID resurgance the BNPL sector went through but is now below its IPO price.

As at June 30, 2021 Openpay had 541,000 active customers although only 3,800 active merchants.

Next was New Zealand founded Laybuy (ASX:LBY) in August 2020. It has lagged since listing despite a solid FY21 and a gradual expansion in the UK.

The company’s Gross Merchandise Volume (GMV) was NZ$589 million as at March 31 2021 and it had 746,000 active customers and 9,000 merchants.

Following in October 2020 was Zebit (ASX:ZBT), a US-based ecommerce outlet that has an inhouse BNPL solution for its customers.

And the company targets the pool of over 100 million people in the US that have lower credit scores and are unlikely to pass a credit check.

The most recent listee was Payright (ASX:PYR) which has shed nearly two thirds of its value since listing in December 2020.

In the June quarter it achieved a GMV of $26.1 million and has 53,400 customers.

South East Asia focused BNPL stocks

The remaining ASX BNPL stocks available to investors have pivoted from other financial offerings and are targeting South East Asia.

Two are digital banking companies IOUpay (ASX:IOU) and Novatti (ASX:NOV).

The latter of these runs B2B and B2C payments ecosystems in South East Asia which process over $2 billion of transactions per year and was also selected by Afterpay to deliver its payment card program in New Zealand.

Another is Tech venture firm FatFish Group (ASX:FFG), which owns Singaporean BNPL entity Smartfunding.

Conglomerate fintech financial group Credit Intelligence (ASX:CI1) rounds out the list.

The Hong Kong based company’s bread and butter has historically been in insolvency services but it owns SME-focused BNPL platform Yozo Finance and is targeting Australia as well as Singapore and Hong Kong.

Non-ASX BNPL players and future entrants

Of course, not all BNPL players are ASX listed.

Several overseas BNPL companies have a presence in Australia, such as Sweden’s Klarna and US-based Affirm.

And several others could be joining in the months to come – and not just startups.

Citi, Australia’s 5th largest provider of credit cards after the Big 4 banks, it launching a BNPL later this year.

And just two weeks before Afterpay’s takeover was announced, BNPL investors were spooked with news that Apple was developing its own BNPL platform, and Paypal was launching a “Pay in 4″ BNPL offering in Australia.

At Stockhead, we tell it like it is. While IOU, Credit Intelligence, Fatfish and Novatti are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.