When Lambo? BetaShares crypto ETF smashes the rest to climb 200pc in 2023

BetaShares CRYP ETF stages a comeback in 2023 after the crypto winter of 2022. Pic: Getty Images

- BetaShares Crypto Innovators ETF (ASX:CRYP) surges 200% YTD, to be top 2023 performer

- Best performing ETFs in 2023 didn’t correlate with popular ETFs purchased by investors

- Resurgence of interest rates globally in 2023 saw fixed income ETFs make a comeback

While final figures for 2023 are yet to come in it seems BetaShares Crypto Innovators ETF (ASX:CRYP) has been a star performer of the Australian ETF industry this year.

According to the latest November 2023 ASX Investment Products Report, exchange trade products listed only on the ASX have grown more than 24% over 12 months to 323 reaching $165 billion. When combined with data from CBOE, there are now more than 350 exchange traded products.

ETF industry expert Kanish Chugh told Stockhead says assessing the Australian investment landscape through the lens of the ETF market provides intriguing insights.

“While expectations might dictate that the best-performing ETFs correlate with those witnessing increased investor interest, the reality presents a different picture,” he says.

Chugh says crypto has notably staged a remarkable comeback, with Bitcoin surging by a staggering 157% YTD as of December 20, 2023.

He says the CRYP ETF focused on digital currency and blockchain-associated companies, emerged as a top performer, despite not aligning with the ETFs drawing the most investor inflows.

CRYP, which broke an ETF record when it listed on the ASX on November 4 2021, by attracting more than $8 million within 45 minutes, has risen more than 200% YTD.

However, for investors who’ve been in CRYP since the start it has been a bumpy ride. CRYP was biggest ETF loser in Australia 2022, with its performance falling ~82% in CY2022 with many of the companies in the CRYP leveraged to tanking crypto prices.

“From a performance side it was crypto ETFs that really bounced back and that was driven by the uplift in crypto prices in 2023,” Chugh says.

The CRYP performance YTD

Crypto shakes winter blues

Crypto certainly appears to have shaken off the 2022 winter blues to emerge into the blooms of spring this year, despite challenges along the way.

The sector has had to deal with fallout from the collapse of FTX along with Silvergate and Signature Banks, leading liquidity crunch, regulatory scrutiny, and enforcement actions against major industry players.

However, crypto has shown resilience and as a result seen strong growth in recent months and attracting the attention of big fund managers .

Hype around the launch of spot bitcoin ETFs in the US next year continues to grow, which Chugh says would further legitimise the sector.

“For a long time, the SEC has said no but has started to warm up to asset managers like BlackRock looking at a crypto ETF and that will be an interesting story for 2024,” Chugh says.

He says up until now, mainstream investors, whether individual or institutional, lacked a robust avenue to invest in Bitcoin, with a spot ETF changing the play game.

Bitget’s MD Gracy Chen told Stockhead recently “the concentrated application for a Bitcoin ETF led by BlackRock is the most significant narrative of 2023”.

“Spot Bitcoin ETFs can reduce investment costs, increase liquidity, improve price tracking efficiency, and meet stricter regulatory requirements, expanding the accessibility and acceptance of Bitcoin,” Chen says.

“Especially for retail and institutional investors, spot Bitcoin ETFs provide a more convenient and direct investment channel.”

If ETFs are approved crypto watchers say it will significantly increase the demand for Bitcoin, leading to a potential demand surge, followed by an imminent supply shock during the next halving event, expected in April which will reduce production.

Bitcoin undergoes a halving once every four years with the baked-in process effectively increasing the scarcity of BTC by cutting in half the rate at which new coins are released into circulation.

“If I look at all the predictions made about 2023 such as volatility, interest rates rise as central banks fight off inflation many got that right,” Chugh says.

“With crypto people were saying it’s going to be a dud investment and 2023 could even be the year of the death of crypto and Bitcoin but no that’s not the case and it’s up nearly 154% YTD.

“It’s not dead and potentially is here to stay but crypto as an investment should be viewed cautiously, as its history as an asset class is very young.”

Big Tech and AI-focused ETFs also top performers

Chugh says the top 10 best performing ETFs were rounded out by other big tech related exposures which were driven by an uplift from the Magnificent 7 and themes like AI. Chip maker Nvidia has returned 247% YTD as at December 19.

“ChatGPT and the AI thematic was the saviour of the US equity market for 2023, and saw companies like Nvidia bounce back from dismal 2022 where its stock price was down over 50% to a Steven Bradbury like moment in 2023,” Chugh says.

“When we look at the bottom of the ETF performance league tables, a common trend was clean technology ETFs as underperformers.

“There wasn’t one clean technology or theme that stood out with hydrogen, solar, green metals and even carbon credit ETFs featuring in the bottom 10.

“Investors however need to be aware that underperformance in greenfield themes can be expected and investing in thematic ETFs need to be seen with a long term multi-year lens.”

Popular ETFs not always best performing

Chugh says the best performing ETFs in 2023 didn’t correlate with the popular ETFs which were purchased more by investors.

“Part of that reason is the Australian ETF market is still very much invested and widely used by professional investors so financial advisors, stockbrokers and private wealth managers,” he says.

Chugh says the most heavily bought ETFs of 2023 predominantly comprised broad Australian equity ETFs from major managers like Vanguard, BetaShares, and iShares.

Fixed income also stages comeback

Chugh says fixed income and cash in 2022 were seen as a dead investment, but the resurgence of interest rates globally in 2023 saw fixed income ETFs making a significant comeback.

“Despite their reputation for being less thrilling, fixed income ETFs gained traction, especially with innovative products catering to different facets of the fixed income market such as duration, yield, and geography,” he says.

“Although fixed income ETFs might not appeal to everyday Australian investors, the sustained high rates have piqued the interest of financial advisors and professional wealth managers.

“This trend underscores the increasing innovation in this sector, highlighting the need for diversified investment solutions in a changing market landscape.”

He says in 2023 when long term yields were rising over the year professional investors were drawn to allocating to fixed income.

Furthermore, with their rising popularity asset managers launched products aimed at the professional investor market.

“That may not continue to be the case in 2024 but there was the flight to safety and a lot of those bigger inflows into fixed income were driven by professional investors,” Chugh says.

Prominent players enter ETF sector

2023 marked the entry of prominent global active fund managers into the Australian ETF market.

“JP Morgan, Dimensional, and Macquarie made significant strides in this arena, reshaping the competitive landscape, and offering investors an expanded array of options,” Chugh says.

“Dimensional are this massive US fund manager, offering a systematic investment approach very widely used by financial planners across the globe and so their products were traditionally hard to access.

“They’ve launched a wide range of funds here in Australia with an initial focus on hedged and unhedged core Australian and global equity solutions.”

He says JP Morgan did so well with some of their strategies in the US they launched those over here in Australia, entering with their equity premium income products in late 2022.

He says JP Morgan expanded in 2023 with 10 ETFs across emerging market equity, fixed income and more equity premium income solutions.

He says with more competition another trend of 2023 emerged, which was lower fees across products.

“There’s going to continue to be more competition for Australian investors and their advisors, which is a real plus as they’ll have access to solutions which they previously wouldn’t have been able to access,” he says.

Optimism heading into 2024

Chugh says themes dominating 2023—namely, inflation, interest rates, volatility, and global conflicts—will likely continue their influence in 2024.

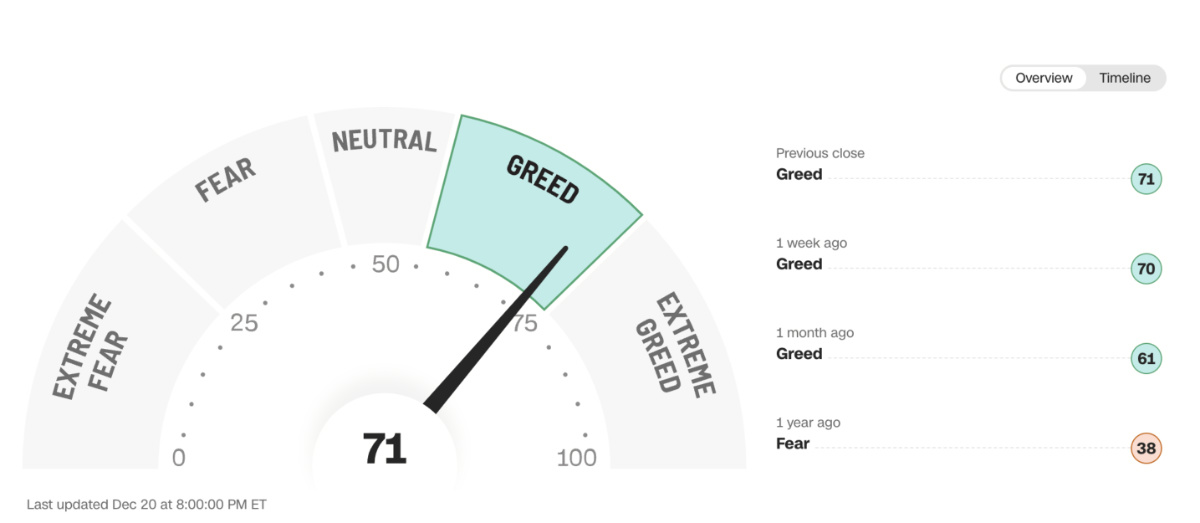

However, he says buoyed by positive equity market returns, investors appear more optimistic, as indicated by CNN Business’s Fear and Greed Index.

“This time 12 months ago, the index was at extreme fear but now it’s into greed and last week was extreme greed with the expectation for a recession not there,” he says.

“People are now just wanting to invest and it’s hard to know if that’s driven by necessity with cost of living so expensive, they need to find somewhere to get more money or is it more confidence around where markets are going.”

Chugh says heading into 2024 investors should note the essence of successful investing remains unchanged.

“Diversification, long-term investment strategies, and a focus on time in the market over timing the market will continue to be fundamental principles for investors navigating the evolving financial terrain,” he says. Be aware of the risk of potentially going in to 2024 overconfident that markets cant fail.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead. Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.