We’ll still be spending heaps on gas, so hey, why not put a little energy into finding who’s set to profit?

Via Getty

The big news of east coast gas price caps – a governmental response to skyrocketing prices and predicted shortfalls – have shone a bright light into the significant challenges facing domestic supply now and over the years to come.

The federal government last week announced a proposed energy relief plan which would cap coal and gas prices for 12 months – a response to ongoing turmoil in domestic supply to the east coast.

The energy relief package passed a slightly crabby parliament this week despite some vocal crossbench whingeing in an extraordinary and curtailed sitting enough allowing the bill to smash its way through the upper house with the Indy Senator David Pocock rolling back the months to his former life as an utter rugby beefcake, legend, Aussie captain and enforcer. (Someone needs to say it.)

It’s also drawn much-publicised ire from some of the nation’s biggest gas producers.

Gas rich, gas poor

But to be even be close to a gas shortage is a remarkable position for Australia, given its natural resources endowment and the headline figures around its place in the world of gas.

Geoscience Australia reckons the land down under was the number one source of liquified natural gas (LNG) exports globally in 2020, concurrently ranking 7th for production and 15th for resources.

On face value those numbers would suggest energy security, but they don’t quite paint a full picture of the intricacies of the domestic and international gas markets. They also offer some clues as to the challenges faced by domestic energy producers in sourcing local supply.

It’s on this basis that the Australian Competition and Consumer Commission’s (ACCC) July 2022 interim report, released as part of its 2017-2025 Gas Inquiry, painted such a bleak picture for the gas market in the eastern states – home to around 19.5 million, or 81% of the nation’s overall population.

A table of contents never tells a full story. But how’s this for a table of contents…

The report predicted a 56 petajoule (PJ) supply shortfall into the east coast’s gas market in 2023 – massively higher than the 2 PJ shortfall predicted for 2022 in July of 2021.

“Supply conditions in the east coast market are expected to deteriorate significantly in 2023, with a shortfall of 56 PJ now expected,” the report says.

“This is equivalent to around 10% of domestic demand and is the largest projected supply shortfall we have forecast since the inquiry commenced in 2017.”

As would be expected from a competition and consumer commission watchdog, the ACCC’s report is highly focused on producers sending domestic production abroad instead of locally.

It, along with rising energy prices and unreliable energy output, contributed to the government’s latest move – the proposed cap, which producers have warned will inhibit incentive for investment from the majors in more supply coming onto the market.

Speaking with Stockhead prior to the announcement of the cap proposal, Australian Petroleum Production and Exploration Association (APPEA) Chief Executive Samantha McCulloch said any changes made to the system would need to encourage new investment in gas.

“Energy system pressures present Australia with an important opportunity to make policy decisions that can provide the foundations for economic growth and energy security in a cleaner energy future,” he said.

“Encouraging new investment in gas supply is the most enduring and sustainable way to ensure competitive gas prices, deliver larger emissions reductions and provide bigger economic benefits for Australians.

“This can only happen if the policy settings are right. The industry and has announced over $20 billion of new supply in recent years and is keen to invest.

“But the playing field has to be competitive internationally, policy levers need to encourage investment rather than discourage it through regulatory or other interventions, and there needs to be regulatory certainty and stability from governments.”

Why not the west?

The state of play between the east and west coast gas markets couldn’t be more different. In one country, how can that be so?

The answer is largely down to state-based energy policy. WA produces 50% of the nation’s gas output, and the state has long enforced measures to ensure it receives an adequate domestic share of the gas captured by producers operating in the region.

This goes all the way back to 1979, when the government helped to underwrite the North West Shelf gas project, was formalised in 2006 by the Carpenter government and revised as recently as 2020.

Today the state requires producers to make the equivalent of 15% of LNG exports available locally – providing around half of the WA market at current demand levels and somewhat insulating it against supply shock.

By contrast, the eastern gas region comprises an interconnected grid which joins all Australia’s eastern and southern states and territories, supplying them with gas from basins which contain about a third of the nation’s overall reserves.

Having historically met domestic needs, the introduction of the LNG export industry in Queensland in 2015 gave east coast gas producers accessing the network the choice of exporting.

At the same time, some state-based moratoriums were being enforced on gas project development which limited new projects being brought online. After almost a decade MIA, Victoria only lifted its moratorium on onshore gas exploration and production last year.

New South Wales introduced its Future of Gas Statement in 2020, which reduced the amount of land made available for gas exploration by 77%, to a limited number of licences in the Narrabri region. The state’s Department of Planning and Environment also boasts that it has “some of the toughest coal seam gas regulations” in the country.

It leaves the heavy lifting to projects largely located in Queensland, South Australia and offshore.

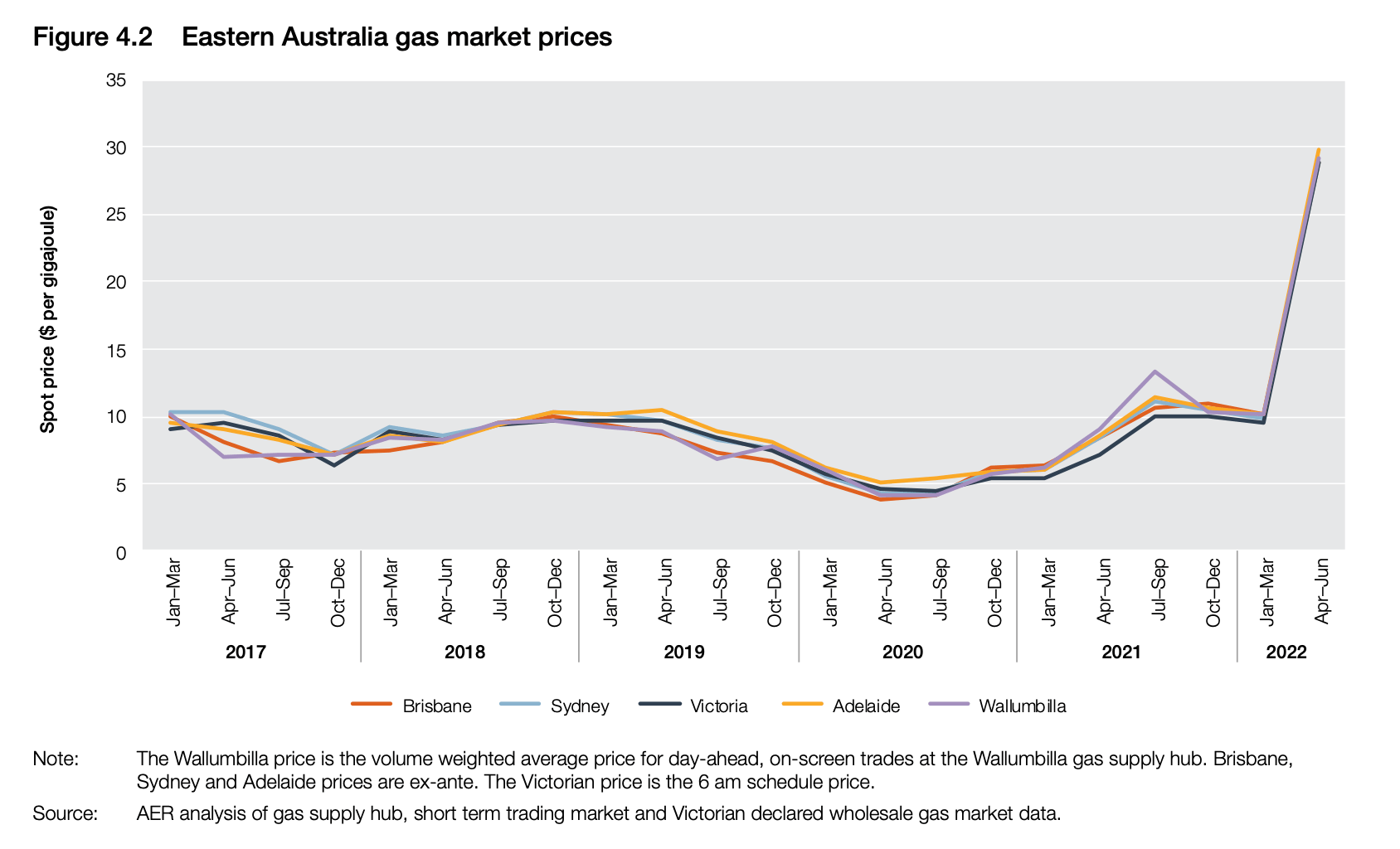

Meanwhile, Australian Energy Regulator (AER) analysis suggests global price rises this year on the back of geopolitical uncertainty created by the Russia-Ukraine conflict have incentivised east coast gas producers to put more of their output into LNG exports.

This came alongside increased domestic demand from gas-powered generators due to other supply constraints in the national energy market, and further demand pressures from residential heating in the southern states.

Here’s what that all looks like in price terms.

Calls from New South Wales for a national gas policy which would override WA’s arrangement and see some of its supply sent east were shot down by the Federal Government in November.

Federal Resources Minister Madeleine King instead urged NSW to free up its gas reserves for exploration and potential production.

That’s a lot of information. Let’s break it up a bit. Here’s Classical Gas.

So. Damn. Smooth. I feel better already.

Help on the way?

Anyway. Don’t be too blue.

Politics abound, but blue sky opportunity awaits those players who can deliver diversity of supply to a market literally screaming blue murder for it.

Omega Oil and Gas has made it’s objectives pretty clear and the timing will be welcomed by the Albanese government – drive Australia’s future energy demands by realising value across some of these immense, untapped gas assets.

Permian Deep Gas

Omega Oil and Gas has two exploration permits in the Surat Basin in South East Queensland, ATP 2037 and ATP 2038. The two permits represent an area of over 250,000 acres and are located approximately 50 km away from critical gas transmission infrastructure.

The significance of Omega’s Permian Deeps gas play has already been given special dispensation by the Queensland government.

Omega has been offered a special amendment to defer the completion of its initial work program.

The move to defer initial work programs within Authority to Prospect permits 2037 and 2038 allowed the company to align its regulatory obligations with commercial strategy at the Surat Basin project, which it says could be integral to the state’s future energy landscape.

Omega is now placed to begin drilling by the end of February – a significant milestone in the life of any gas explorer.

“The Permian Deep gas play is of significant scale and represents significant value for both Omega’s investors as well as the state of Queensland,” Lauren Bennett, OMA managing director, said.

“The granting of the special amendment is recognition that the scope of the work program has significantly increased, and Omega’s Permian Deep Gas exploration program is the first step in unlocking this potentially resource.”

Since listing, OMA has also completed successful testing of its Bennet-1 and Bennett-4 oil wells.

It’s hard to believe Omega only joined the ASX on October 25, this year.

Major backer and noted investor Quentin Flannery joined the Omega Board, after serving across multiple early-stage start-ups and listed entities. Lauren Bennett leads the Omega executive.

“The country needs gas, the world needs gas,” Flannery Forbes earlier this year. “It is the transition fuel that needs to be there currently, that is just the reality. Nuclear takes years to become operational and coal is getting harder.”

“If the world does want to move towards a lower carbons emissions footprint, gas is that fuel to get us to the next step.”

If the Surat Basin pays off, Omega will be first in line to benefit.

Galilee is striving to commercialise the wholly-owned Glenaras coal seam gas project in Queensland’s Galilee Basin on the back of a busy year, with a maiden reserve scheduled for early 2023.

The project has one of the certified, uncontracted 3C contingent resources on the east coast of about 5 trillion cubic feet (TCF) of gas.

A memorandum of understanding was signed in September with APA Group, which outlined a potential pipeline to connect Glenaras with the pipeline network linking to the east coast gas markets.

The project also produces high quality water suitable for irrigation purposes, which is used as part of a resource monitoring and management plan.

GLL also signed a non-binding MoU with state-owned Oil India at the start of December, agreeing to explore the possibility of coal seam gas project collaboration in Australia, India and elsewhere.

3D Oil is focused on finding and developing a major gas resource in the offshore Otway Basin, with energy giant ConocoPhilips farming into the project by funding two wells.

ConocoPhilips paid US$3 million in cash and committed to a spend of US$35 million for an exploration well in return for an 80% interest of the VIC/P79 permit off Victoria.

This deal followed a farm-out of 80% of the T/49P permit, also in the Otway Basin and off the coast of Tasmania to ConocoPhilips for $5 million cash, the acquisition of at least 1580sqkm of 3D seismic, and the option to pay for up to US$30 million of costs towards an exploration well.

The company also holds 100% stakes in the VIC/P74 and WA-527-P exploration permits in WA and Victoria respectively.

Metgasco and its joint venture partners are in the process of commissioning facilities which will lead to production from their Vali gas field (MEL 25%) in Queensland as early as January 2023.

That’s about as near-term as you can get. The project has a proved plus probable (2P) reserve of gross 101 PJ of gas, and while retailer AGL is committed to take 9-16% of that over a period of around 4.5 years, the remaining 84% is uncontracted.

Just over the border in South Australia is the Odin JV, in which Metgasco also holds a 25% stake, which has gross uncontracted 2C contingent resources of 36.4 billion cubic feet of gas and is being fast-tracked to market via connection to the Vali pipeline.

Under JV arrangements both projects are operated by Vintage Energy (ASX:VEN). A number of exploration targets are also in MEL’s sights in the area, with the potential for a hub and spoke model to be used should more discoveries be made.

It doesn’t get much bigger than a joint venture agreement with energy behemoth Santos, which is exactly what Red Sky has secured over the Innamincka project in Queensland’s Cooper Basin.

Red Sky has a 20% working interest at Innamincka and being free carried by Santos which has earned up to an 80% stake in the project, where it recently completed memory production logging tool work the Yarrow 3 well to assess completion as a potential future producer.

Yarrow has an estimated 2C contingent resource of 18 billion cubic feet (BCF) and is just 8km away from Flax – a shut-in oil well with a further 20 BCF estimate.

The company believes Yarrow and Flax offer strong development opportunities in the next 18 months, with a pipeline route already approved to tie into the Napowie grid.

Innamincka isn’t even Red Sky’s flagship. That honour goes to Killanoona – a 100% owned oil project primed for long-term production which had an eye-popping 1228% upward revision to its potential petroleum initially in place (PIIP) in May.

Vintage is the project operator and holds a 50% stake in the Vali and Odin gas fields being connected to market from Queensland and South Australia.

That stake gives it a share of an impressive 42.55 PJ of uncontracted 2P gas reserves – of a total 85 PJ – from the Vali field, which is expected to be in production in January.

Vintage also has a ~19 PJ share of the ~40 PG gross 2C gas resource over the uncontracted Odin gas field, which is being accelerated to connect with the Vali pipeline ahead of drilling the Odin-2 exploration well.

Marketing of Odin’s contingent resource will begin once regulatory approvals are in place.

As demonstrated by shortages the world over, gas looms as a critical component of a global net zero transition. For more insight and analysis check out Stockhead’s FY2023 Energy Investor here.

At Stockhead we tell it like it is. While Omega Energy and Galilee Energy are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.