Weekly Small Cap and IPO Wrap: Small caps jumped 3% this week, but there’s fewer of us to enjoy it

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

The ASX Emerging Companies (XEC) index has come out the other end of an explosive week of trade almost 3% higher. T’is a grand performance driven by resources outfits which made up nine of the top 10 performers. The ASX200 looks like ending 2.9% for the better.

In a busy, busy five days of macro-economic carnage, including The Fed’s historic rate hike and China’s historic fiddling with the free market, I thought it might be worth looking at some other numbers which matter.

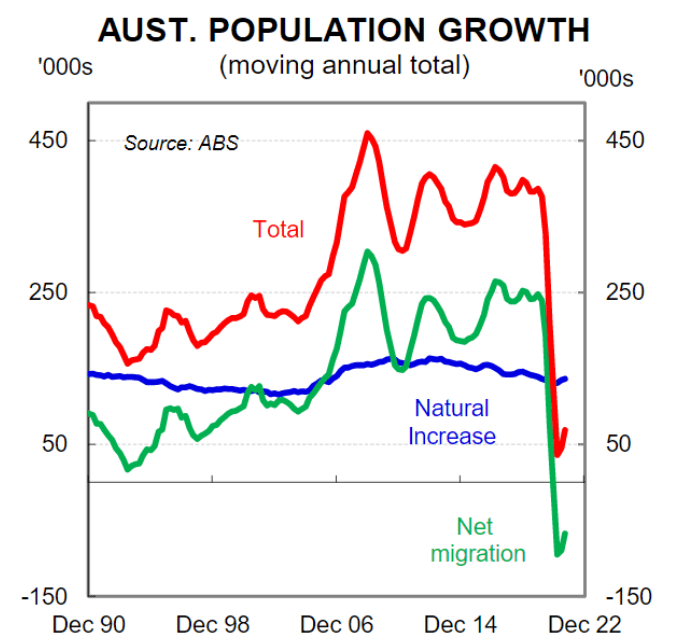

The ABS says Australia’s population rose by a pathetic 0.05% during Q3 21, barely enough for us to straggle our way to 25.75 million bogan-legend-punters (BLD) net.

Even worse, we only added an unAustralian 0.3% BLD over the past year.

The take away here is not just 2021’s alarming deficit in net regular Australian sex – which the numbers certainly imply – but the outflow of some 67k overseas migrants.

That’s having a big impact on our jobs market – as we saw this week – the vacancies at record levels and the skills shortages galore.

It’s going to hurt Treasurer Josh Frydenberg’s Federal Budget – set to be handed down on 29th March, minus some tax dollars – a small bonus for the small-minded among us.

CBA’s senior economist Belinda Allen says the new numbers also back up her POV that the next few months will feature but a meandering-trickle return of Australia’s migration-as-usual.

Residents coming home over Chrissy accounted for almost half (44%) of all bloody arrivals, while full-on settlers and longer-term visitors rose only very, very marginally.

Hardly 28k foreign students made the effort to get here in January, that’s a wee 70% drop on the level of normality which we’ll call January 2019.

Tourism: still crap.

“Australia’s two largest sources of tourists, New Zealand and China, have not fully reopened their borders. This will limit the uptick in tourist arrivals. The UK, India and the US were the largest source of arrivals in January,” Allen said.

It’s not great, but we do think it’s worthwhile comparing us with what’s happening over in Hong Kong, which, as touched on in my recent devastating exposé on the Hang Seng, recorded almost 50k departures in just he first half of March as the exodus from the city-state shows no sign of slowing.

The latest HK Immigration Department numbers show that for two weeks, the net outflow of Hong Kongers (between March 1 and 15) was 43,200.

On 6 March alone 5,082 people left the city, from a population of circa 7m.

Let’s get up in some IPOs:

On its first day of trade earlier this week, Many Peaks Gold (ASX:MPG) shares closed up 22.5% at 24 cents after an IPO targeting $5.5m at $0.20 a pop. The money raised aims to back an upcoming drilling program at Mt Weary.

The company has also secured options to acquire, in two tranches, a 100% interest in two exploration permits over a total area beyond460km2.

Stelar Metals (ASX:SLB), listed earlier today, dropping 5% to 19 cents before the close.

This copper and zinc explorer raised some $7m at $0.20 cents and will dig big in South Australia; across the Gawler Craton, Stuart Shelf and Adelaide Fold Belt.

The company’s Linda Zinc Project in the Flinders Ranges is considered prospective for MVT and Beltana-Kipushi type zinc-lead mineralisation as well as Zambian style copper mineralisation.

Here’s a few which almost listed, but did not:

The explorer, Pure Resources (ASX:PR1), was a cert to list this week, but looks like there’s been a wee delay. The plan was to raise $4.65m at $0.20, allowing the company to focus ion its five projects in the Kimberley and Eastern Goldfields regions of WA.

We contacted them via email for an explanation but didn’t get a response.

The projects are highly-prospective for all kinds of gold, nickel and copper – among the primary commodities. The initial exploration will cost circa $2,5m for the first two financial years. Heaps to play with.

And then there’s Equity Story Group Limited (ASX:EQS), which offers stock market trading advice, research, investor education and fund management. Due to list today, did not. The IPO set for: $5.5m at $0.20.

ASX SMALL CAP WINNERS:

Here are the best performing ASX small cap stocks for March 14 – March 18 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| CODE | COMPANY | PRICE | % WEEK | MARKET CAP |

|---|---|---|---|---|

| BKY | Berkeley Energia Ltd | 0.425 | 66.7% | $178,318,686 |

| KNI | Kunikolimited | 1.08 | 62.4% | $39,398,461 |

| RMI | Resource Mining Corp | 0.025 | 56.3% | $9,841,827 |

| MAY | Melbana Energy Ltd | 0.1925 | 54.0% | $508,846,650 |

| OXX | Octanex Ltd | 0.027 | 50.0% | $6,992,398 |

| PBX | Pacific Bauxite Ltd | 0.15 | 50.0% | $1,189,876 |

| PHO | Phosco Ltd | 0.135 | 50.0% | $28,961,574 |

| AJL | AJ Lucas Group | 0.0665 | 47.8% | $71,777,198 |

| KNM | Kneomedia Limited | 0.023 | 43.8% | $26,309,906 |

| 4DX | 4Dmedical Limited | 0.865 | 41.8% | $176,567,620 |

| AVL | Aust Vanadium Ltd | 0.051 | 41.7% | $161,710,286 |

| LRS | Latin Resources Ltd | 0.056 | 40.0% | $76,907,465 |

| VMG | VDM Group Limited | 0.002 | 33.3% | $13,855,322 |

| KPO | Kalina Power Limited | 0.025 | 31.6% | $37,794,450 |

| EOS | Electro Optic Sys. | 2.585 | 31.2% | $378,794,715 |

| AON | Apollo Minerals Ltd | 0.085 | 30.8% | $40,483,150 |

| ARL | Ardea Resources Ltd | 1.03 | 30.4% | $164,451,639 |

| MTC | Metalstech Ltd | 0.26 | 30.0% | $42,499,470 |

| EZZ | EZZ Life Science | 0.4 | 29.0% | $4,976,400 |

| QHL | Quickstep Holdings | 0.58 | 28.9% | $40,469,822 |

| NVA | Nova Minerals Ltd | 0.695 | 28.7% | $109,923,394 |

| IHL | Incannex Healthcare | 0.675 | 28.6% | $804,901,372 |

| ABX | ABX Group Limited | 0.16 | 28.0% | $30,184,760 |

| GTR | Gti Resources | 0.028 | 27.3% | $24,833,187 |

| MOH | Moho Resources | 0.057 | 26.7% | $7,417,336 |

| HPC | Thehydration | 0.285 | 26.7% | $37,667,032 |

| MCM | Mc Mining Ltd | 0.105 | 26.5% | $13,434,501 |

| WR1 | Winsome Resources | 0.43 | 26.5% | $53,111,698 |

| MHI | Merchant House | 0.091 | 26.4% | $8,578,251 |

| 3DA | Amaero International | 0.265 | 26.2% | $50,729,700 |

Melbana Energy (ASX:MAY) says this week that results from an independent resources assessor of three oil reservoirs the explorer has locked away in the upper thrust of its Alameda-1 exploration well located in onshore Cuba, is big. It’s been in a halt, but the shares have not – it’s about 50% higher this week.

A weird one, but Josh Chiat’s all over that – the uranium play Berkeley Energia (ASX:BKY) has seen its shares mysteriously power on over 60% the last few sessions, this despite having plans for a plant in Spain knocked back last year.

Shares in Australian Vanadium (ASX:AVL) got abso-pumped this week following thanks to the $49m government grant which will be used in the development of the Australian Vanadium Project, near Meekatharra and Geraldton to create an Australian green-fuelled vanadium industry.

AVL is a bit of an emerging producer of Vanadium (V) – a super critical mineral in Australia and the US – primarily used to strengthen steel while energy storage is a growing market.

The Australian Vanadium Project consists of a high-grade V-Ti-Fe deposit located in the Murchison Province, approximately 43kms south of the mining town of Meekatharra in Western Australia and 740km north-east of Perth. In September 2019, The Australian Vanadium Project was awarded Major Project Status in recognition of its national strategic significance.

And on the same theme, Neometals (ASX:NMT) did pretty bloody well this week too , this time over a partnership with Mercedes-Benz for the design and construction of a battery recycling plant in southern Germany. The stage is set to build a two-stage 2,500 tonne a year lithium-ion battery recycling and waste disposal plant with first stage commencing production in 2023.

ASX SMALL CAP LOSERS:

Here are the worst performing ASX small cap stocks for March 14 – March 18 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| CODE | COMPANY | PRICE | % WEEK | MARKET CAP |

|---|---|---|---|---|

| IS3 | I Synergy Group Ltd | 0.094 | -57.3% | $52,349,978 |

| RDN | Raiden Resources Ltd | 0.01 | -44.4% | $13,753,273 |

| CCE | Carnegie Cln Energy | 0.002 | -33.3% | $30,205,147 |

| TMS | Tennant Minerals Ltd | 0.053 | -31.2% | $22,078,542 |

| IPT | Impact Minerals | 0.012 | -25.0% | $24,095,077 |

| YPB | YPB Group Ltd | 0.0015 | -25.0% | $12,235,667 |

| AUH | Austchina Holdings | 0.013 | -23.5% | $23,626,165 |

| YOJ | Yojee Limited | 0.11 | -21.4% | $129,820,227 |

| WGX | Westgold Resources. | 1.92 | -21.3% | $819,080,120 |

| AIR | Astivita Ltd | 0.57 | -20.8% | $17,886,221 |

| PXX | Polarx Limited | 0.027 | -20.6% | $19,311,206 |

| UUL | Ultima Utd Ltd | 0.27 | -20.6% | $24,924,558 |

| AHN | Athena Resources | 0.008 | -20.0% | $5,690,773 |

| CLE | Cyclone Metals | 0.004 | -20.0% | $20,416,948 |

| RBR | RBR Group Ltd | 0.004 | -20.0% | $5,794,292 |

| VRC | Volt Resources Ltd | 0.012 | -20.0% | $34,363,842 |

| AUK | Aumake Limited | 0.0105 | -19.2% | $7,984,693 |

| TOY | Toys R Us | 0.1175 | -19.0% | $101,268,689 |

| A3D | Aurora Labs Limited | 0.073 | -18.9% | $14,364,329 |

| LVT | Livetiles Limited | 0.11 | -18.5% | $105,618,395 |

| KFE | Kogi Iron Ltd | 0.009 | -18.2% | $11,858,200 |

| GCR | Golden Cross | 0.185 | -17.8% | $20,847,866 |

| HTA | Hutchison | 0.08 | -17.5% | $1,085,800,686 |

| MOQ | MOQ Limited | 0.066 | -17.5% | $12,576,723 |

| CPM | Coopermetalslimited | 0.38 | -17.4% | $11,078,200 |

| AEE | Aura Energy | 0.2775 | -17.2% | $112,476,846 |

| HCD | Hydrocarbon Dynamic | 0.01 | -16.7% | $5,283,481 |

| INP | Incentiapay Ltd | 0.015 | -16.7% | $18,975,954 |

| SBR | Sabre Resources | 0.005 | -16.7% | $10,174,068 |

| SIT | Site Group Int Ltd | 0.005 | -16.7% | $4,206,226 |

| PCL | Pancontinental Energ | 0.005 | -16.7% | $35,771,114 |

| ARC | ARC Funds Limited | 0.51 | -16.4% | $14,286,267 |

| WSR | Westar Resources | 0.092 | -16.4% | $3,770,396 |

| OAK | Oakridge | 0.155 | -16.2% | $3,009,244 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.