Weekly Small Cap and IPO Wrap: Sezzle up 263% this week; Emerging Co’s up 11% this month; IMF useless all year

Via Getty

- ASX Emerging Companies (XEC) index up 4.5% this week, over 11% for July

- US, EU markets lift, Chinese and Japanese fell

- IMF reminds everyone of it’s purposeless with further downgrades

US stock futures are ahead on Friday arvo in Sydney as a weirdly positive mood continues to infect investors following a few strong quarterly reports from the mega (not Meta) tech companies, like Amazon and Apple.

The sunny dispositions stateside are in defiance of the near 1% slip up in second quarter US GDP in the second quarter, confirmed by the US of A Bureau of Economic Analysis overnight.

Technically, two straight quarterly negative GDP reads are confirmation of a recession, so it’s possible US traders now no longer have to wrestle with the “deepening fears of a possible recession” which have been nagging at them for many moons.

This week The US Fed put many more out of their misery by giving rates another upward nudge by 75 basis points.

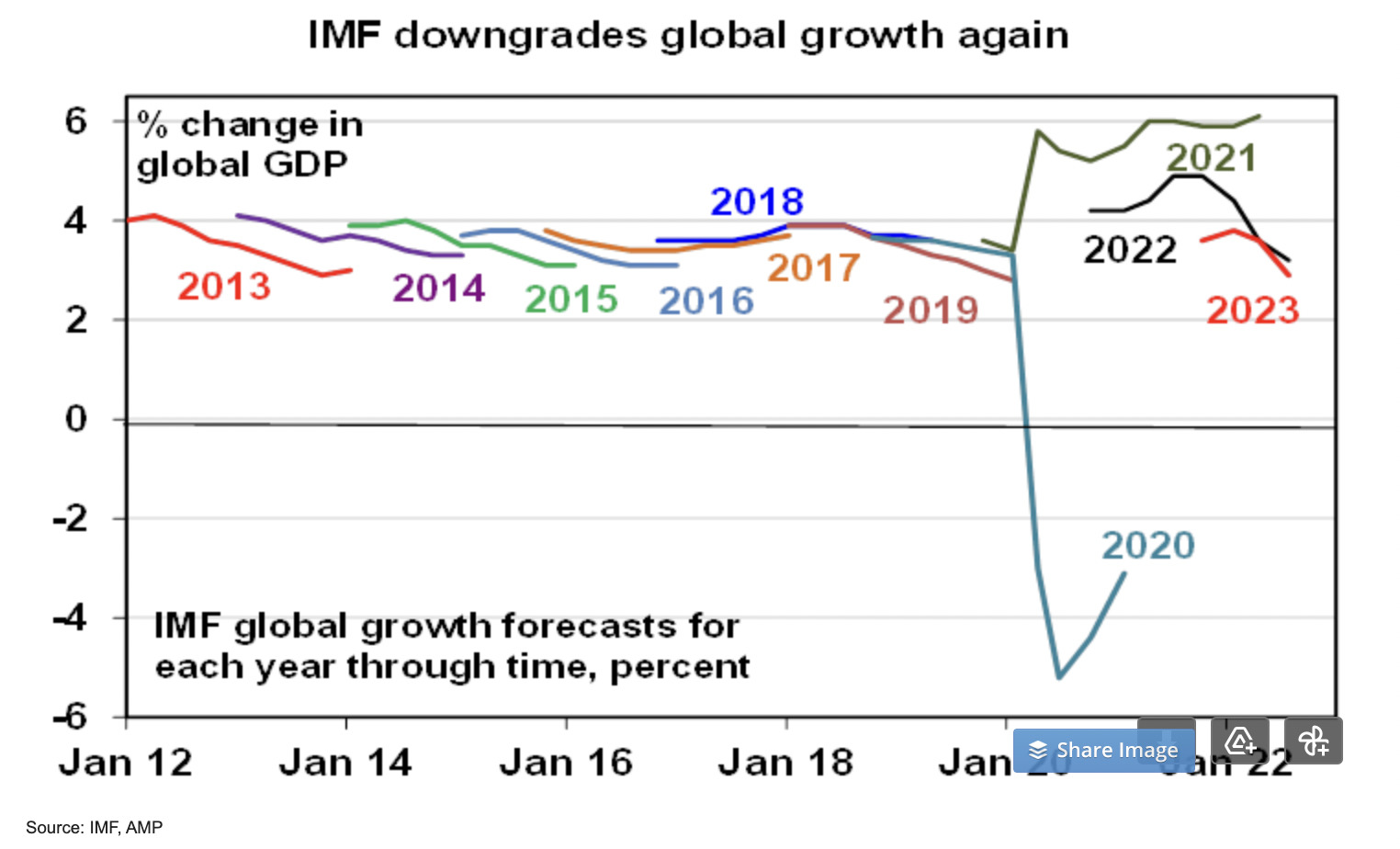

And as it often does, the International Monetary Fund popped up out of nowhere to downgrade the hell out of the global growth outlook and raise its interest rate forecasts.

None were surprised nor helped by this, compelling some observers to remark how annoying the rich, organised and over-educated can often be.

It’s been a Commonwealth Games silver medal effort from the ASX Emerging Companies (XEC) index – up 4.5% this week, and over 11% for July.

The rebounding confidence among market participants has really leant into the hopes slowing growth will ease central banks’ pace of monetary tightening.

Results like the strong shows among some of the big American tech names helped put a golden glow over the lingering storm clouds. (Damn. That’s market poetry, right there.)

While the US and European shares lifted this week, our colleagues in the Asia-Pacific have had a mixed run. In Korea and Taiwan the markets edged higher, as Japanese and Chinese shares fell.

Dr Shane Oliver the chief economist at AMP – who I saw this morning on TV sporting a cheerfully a technicolor tie so trademark in its garishness I all but dropped my morning chocolate cake – says falling bond yields are another sign of the expectations for slower growth.

“The positive global lead along with a less bad than feared CPI result reducing the risk of a further step up in RBA rate hikes pushed the Australian share market higher, with gains led by resources stocks despite a dividend cut from RIO, property stocks and financials.”

Oil, metal and iron ore prices rose.

ASX IPOs This Week

Devastated fans of Australia Sunny Glass (ASX:AG1) which was set down to list on Wednesday, will have to hold their building facades a little longer.

This Australian-based holding company is targeting a $7.5m initial public offering at $0.35 a share and operates a glass production and supply business for structural building facades.

The group has a fully automated processing plant which it says is highly-efficient, accurate and scalable with an extra R&D focus to boot, on the “development of cyclone resistant glass using new laminating and bonding techniques.”

ASX SMALL CAP WINNERS:

Here are the best performing ASX small cap stocks for July 25 – July 29:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| SZL | Sezzle Inc. | 0.955 | 282% | $204,852,301.80 |

| LBY | Laybuy Group Holding | 0.115 | 161% | $38,222,880.15 |

| PSC | Prospect Res Ltd | 0.1225 | 147% | $55,471,135.44 |

| INP | Incentiapay Ltd | 0.017 | 143% | $15,180,763.50 |

| CBE | Cobre | 0.086 | 139% | $14,225,002.86 |

| SMX | Security Matters | 0.26 | 117% | $46,455,229.52 |

| WBE | Whitebark Energy | 0.002 | 100% | $11,296,438.39 |

| NGY | Nuenergy Gas Ltd | 0.03 | 88% | $42,947,709.41 |

| MCM | Mc Mining Ltd | 0.235 | 81% | $48,425,443.15 |

| OPY | Openpay Group | 0.375 | 74% | $79,139,669.50 |

| POL | Polymetals Resources | 0.15 | 67% | $6,008,484.90 |

| ABE | Ausbondexchange | 0.415 | 66% | $12,032,282.79 |

| GNX | Genex Power Ltd | 0.215 | 65% | $297,813,085.10 |

| ZIP | ZIP Co Ltd.. | 1.21 | 56% | $1,045,734,979.28 |

| MRR | Minrex Resources Ltd | 0.052 | 53% | $43,466,025.40 |

| ANL | Amani Gold Ltd | 0.0015 | 50% | $35,540,161.69 |

| GNM | Great Northern | 0.006 | 50% | $10,254,305.86 |

| TYX | Tyranna Res Ltd | 0.027 | 50% | $33,711,934.67 |

| VMG | VDM Group Limited | 0.0015 | 50% | $10,391,491.43 |

| KGN | Kogan.Com Ltd | 4.66 | 49% | $502,559,734.10 |

| SDV | Scidev Ltd | 0.32 | 49% | $57,822,411.79 |

| B4P | Beforepay Group | 0.55 | 47% | $22,347,262.74 |

| PYR | Payright Limited | 0.13 | 44% | $10,167,848.21 |

| NWM | Norwest Minerals | 0.046 | 44% | $7,766,117.64 |

| ARN | Aldoro Resources | 0.2075 | 43% | $20,913,336.57 |

| APS | Allup Silica Ltd | 0.11 | 43% | $4,075,731.11 |

| TGM | Theta Gold Mines Ltd | 0.084 | 42% | $52,271,597.02 |

| SPN | Sparc Tech Ltd | 0.93 | 41% | $58,031,852.28 |

| GLV | Global Oil & Gas | 0.0035 | 40% | $5,620,064.12 |

| KNO | Knosys Limited | 0.105 | 40% | $18,804,066.73 |

| CAU | Cronos Australia | 0.285 | 39% | $160,178,500.82 |

| BIR | BIR Financial Ltd | 0.033 | 38% | $5,743,085.01 |

| IR1 | Irismetals | 0.375 | 36% | $21,465,000.00 |

| NXS | Next Science Limited | 1.035 | 36% | $205,124,577.97 |

| IND | Industrialminerals | 0.34 | 36% | $9,408,000.00 |

| IS3 | I Synergy Group Ltd | 0.054 | 35% | $13,959,994.15 |

| TTB | Total Brain Ltd | 0.058 | 35% | $7,755,825.60 |

| SOP | Synertec Corporation | 0.12 | 35% | $41,096,464.40 |

| INV | Investsmart Group | 0.31 | 35% | $41,743,260.30 |

| 4DX | 4Dmedical Limited | 0.7 | 35% | $127,463,015.43 |

| GL1 | Globallith | 1.465 | 34% | $229,318,979.92 |

| CY5 | Cygnus Gold Limited | 0.2 | 33% | $18,877,650.40 |

| RR1 | Reach Resources Ltd | 0.004 | 33% | $5,730,151.92 |

| VPR | Volt Power Group | 0.002 | 33% | $18,689,067.12 |

| GTN | GTN Limited | 0.5 | 33% | $107,639,520.50 |

| HE8 | Helios Energy Ltd | 0.091 | 32% | $221,344,202.66 |

| E79 | E79Goldmineslimited | 0.13 | 31% | $7,222,263.10 |

| ZEO | Zeotech Limited | 0.065 | 31% | $97,594,590.08 |

| XPN | Xpon Technologies | 0.19 | 31% | $26,497,014.64 |

| SPX | Spenda Limited | 0.017 | 31% | $54,088,249.56 |

Sezzle reported a 6.8% bump in total quarterly income today. After gaining some 263% this week, t’is but the cherry.

So, now ladies and gentlemen, a the end of that absurd week and for your fascinated satisfaction, I give you Sezzle (ASX:SZL) chairman Charlie Youakim:

“In the last few months we have launched $US400m ($565m) worth of revenue and cost savings initiatives, as we move towards profitability and positive free cash flow generation.

“And we believe the results of those actions are starting to show.

“We expect to see the full benefit of these initiatives on a run rate basis by year end.

“Coupled with additional actions we are taking, we anticipate (by year end) achieving positive monthly net operating income.”

ASX SMALL CAP LOSERS:

Here are the worst performing ASX small cap stocks for July 25 – July 29:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| SRX | Sierra Rutile | 0.3075 | -99% | $156,967,485.39 |

| CPT | Cipherpoint Limited | 0.009 | -49% | $4,252,870.36 |

| PVS | Pivotal Systems | 0.13 | -35% | $30,298,587.50 |

| MEB | Medibio Limited | 0.001 | -33% | $2,756,490.12 |

| HXG | Hexagon Energy | 0.017 | -32% | $8,206,654.42 |

| NTO | Nitro Software Ltd | 1.1225 | -32% | $269,923,733.56 |

| WYX | Western Yilgarn NL | 0.11 | -29% | $4,530,075.44 |

| TD1 | Tali Digital Limited | 0.005 | -29% | $7,395,783.14 |

| HIO | Hawsons Iron Ltd | 0.32 | -27% | $251,958,003.00 |

| LVT | Livetiles Limited | 0.059 | -27% | $54,458,257.05 |

| NVU | Nanoveu Limited | 0.011 | -27% | $2,565,973.03 |

| SPA | Spacetalk Ltd | 0.056 | -26% | $11,315,498.95 |

| ICG | Inca Minerals Ltd | 0.053 | -25% | $26,504,210.65 |

| AL8 | Alderan Resource Ltd | 0.009 | -25% | $5,049,877.76 |

| PPG | Pro-Pac Packaging | 0.3 | -25% | $28,388,643.50 |

| T3D | 333D Limited | 0.0015 | -25% | $4,551,445.00 |

| JRV | Jervois Global Ltd | 0.405 | -24% | $607,900,384.40 |

| AQC | Auspaccoal Ltd | 0.095 | -24% | $4,796,056.95 |

| CMO | Cosmometalslimited | 0.13 | -24% | $3,316,300.00 |

| AR9 | Archtis Limited | 0.15 | -23% | $40,889,497.09 |

| DUB | Dubber Corp Ltd | 0.68 | -22% | $283,724,057.76 |

| ALY | Alchemy Resource Ltd | 0.014 | -22% | $16,202,258.97 |

| RLC | Reedy Lagoon Corp. | 0.014 | -22% | $8,918,830.59 |

| NUH | Nuheara Limited | 0.23 | -22% | $28,811,018.46 |

| RLG | Roolife Group Ltd | 0.011 | -21% | $7,724,539.49 |

| TGH | Terragen | 0.13 | -21% | $25,144,500.55 |

| FGL | Frugl Group Limited | 0.015 | -21% | $3,039,782.93 |

| SEG | Sports Ent Grp Ltd | 0.23 | -21% | $60,055,766.44 |

| APC | Aust Potash Ltd | 0.04 | -20% | $33,952,077.94 |

| AHI | Adv Human Imag Ltd | 0.12 | -20% | $20,009,925.84 |

| CFO | Cfoam Limited | 0.004 | -20% | $2,201,521.90 |

| EXL | Elixinol Wellness | 0.04 | -20% | $12,650,622.84 |

| R3D | R3D Resources Ltd | 0.1 | -20% | $12,003,761.77 |

| SHP | South Harz Potash | 0.1 | -20% | $52,671,339.96 |

| PTG | Proptech Group | 0.25 | -19% | $40,210,239.60 |

| GCX | GCX Metals Limited | 0.046 | -19% | $9,288,934.70 |

| MMI | Metro Mining Ltd | 0.021 | -19% | $58,281,008.97 |

| EMH | European Metals Hldg | 0.645 | -18% | $79,109,491.56 |

| NCR | Nucoal Resources Ltd | 0.009 | -18% | $6,917,511.19 |

| CE1 | Calima Energy | 0.135 | -18% | $88,855,429.86 |

| SGA | Sarytogan | 0.32 | -18% | $20,593,678.62 |

| WCN | White Cliff Min Ltd | 0.0115 | -18% | $8,496,843.71 |

| AHN | Athena Resources | 0.014 | -18% | $10,568,578.25 |

| MRL | Mayur Resources Ltd | 0.07 | -18% | $16,908,056.41 |

| OSX | Osteopore Limited | 0.14 | -18% | $17,003,894.51 |

| ASR | Asra Minerals Ltd | 0.019 | -17% | $29,275,230.68 |

| CAY | Canyon Resources Ltd | 0.049 | -17% | $40,321,103.20 |

| X2M | X2M Connect Limited | 0.09 | -17% | $9,888,172.88 |

| VIP | VIP Gloves | 0.01 | -17% | $9,441,377.22 |

| IBX | Imagion Biosys Ltd | 0.035 | -17% | $42,606,304.29 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.