Market Highlights: Instacart jumps on Nasdaq IPO debut, and 5 ASX small caps to watch today

Instacart jumped by 12pc on Nasdaq IPO debut. Picture Getty

- ASX to track Wall Street and open lower

- Instacart jumped by 12pc on Nasdaq IPO debut

- A look at how the world’s biggest companies have changed from 1980 to today

Australian shares are poised to track Wall Street and open lower on Wednesday. At 8am AEST, the ASX 200 index futures was pointing down by -0.2%.

In New York, the S&P 500 fell by -0.22%, blue chips Dow Jones up by -0.31%, and tech heavy Nasdaq by -0.23%.

Debutant IPO stock Instacart stole the limelight as it rose over 40% at one point before pulling back to just 12% higher at the close.

The online grocery delivery company closed at US$34.23, valuing the company at about US$11bn which is still a steep plunge from the US$39 billion valuation it received in a 2021 funding round.

Automakers GM and Ford gained despite threats from the United Auto Workers union of more strikes if no deal is struck by Friday.

Starbucks lost -1.5% after broker TD Cowen downgraded the coffee chain to “underperform”.

Walt Disney lost -3.6% after doubling its capital expenditure for its parks business to about US$60 billion over the next 10 years.

European shares were mixed ahead of key central bank meetings, with Bank of England and the US Fed Reserve set to hand down rates decisions later this week.

In economics data, housing starts in the US fell 11.3% on August, a three-year low as increases in mortgage rates weighed on demand for housing.

Closer to home, the Westpac Leading Index – an indicator of the direction of the economy – will be released later today along with People’s Bank of China’s loan prime rates.

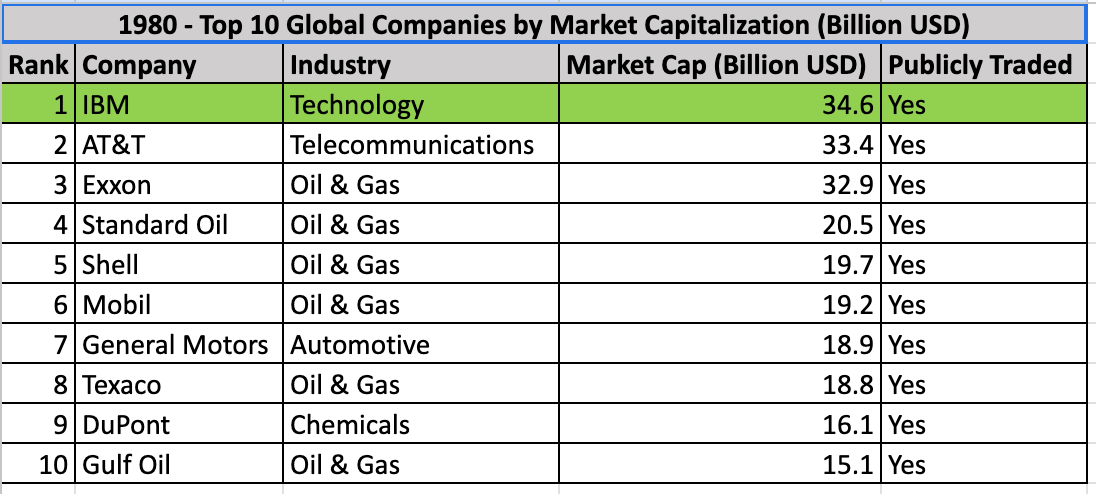

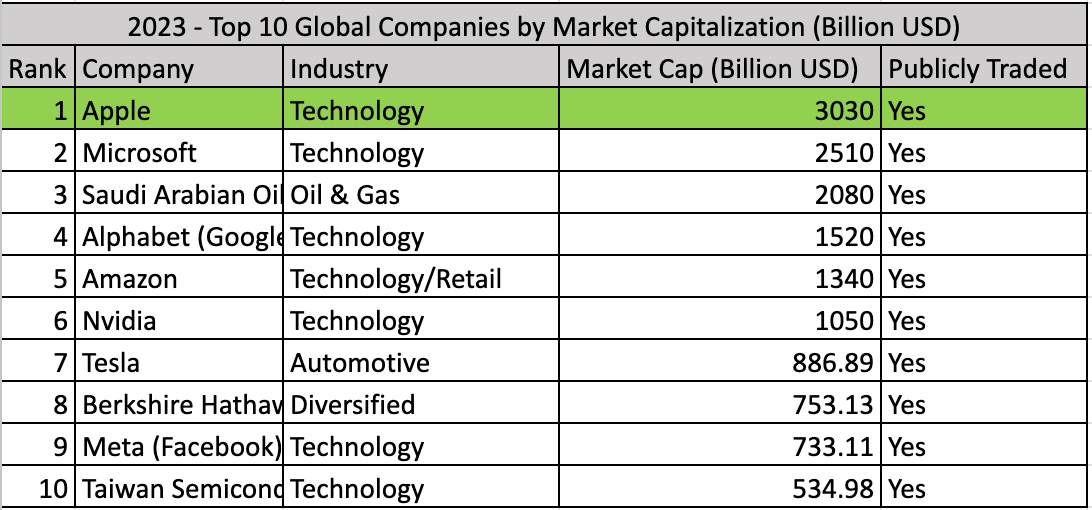

The biggest stocks in 1980 vs 2023

Apple recently made history as the world’s first US$3 trillion company, making it the biggest company in the world by market cap, thanks to expansion into new markets.

City Index has revealed the biggest companies in 1980, 2000 and today by market cap, to establish how stock markets have changed in the last 40 years.

These are some highlights from the research :

Apple is the world’s biggest company in 2023 – worth $3.03 trillion, followed by Microsoft ($2.51 trillion)

Microsoft was the world’s biggest company in 2000, worth $586 billion (equating to $1.03 trillion in 2023)

IBM was the biggest company in 1980, with a market cap of $34.6 billion (equating to $128.12 billion in 2023)

The Oil and Gas sector dominated the market throughout the 1980s, however from 2000 onwards, the Technology industry produced the most valuable companies.

In other markets …

US bond yields hit the highest levels since 2007, with the 10-year rising by 5bp and 2-year lifting by 3bp.

Gold price traded flat US$1,931.67 an ounce.

Crude prices climbed another +0.2%, with Brent closing at US$94.65 a barrel. Fears of a recession have resurfaced as oil heads toward US$100/barrel.

Base metals prices were mixed, with nickel futures gaining +0.6%, and copper futures down -0.6%.

Iron ore futures fell -0.1% to US$122.16 a tonne, still at a five-month high.

The Aussie dollar was up around +0.3% to US64.58c.

Bitcoin meanwhile rallied +1.15% in the last 24 hours to jump back over US$27k at US$27,129.

Federal Judge Zia Faruqui rejected the SEC’s request to inspect Binance US’ software, and has instead asked the regulator to narrow its request for information.

5 ASX small caps to watch today

Micro-X (ASX:MX1)

Micro-X announced it has received a purchase order from the Australian Government for $1.5m of Micro-X Rover systems. These Micro-X Rover units are currently in inventory and will undergo final modifications in Adelaide before they are due to be delivered in early October. The purchase brings Micro-X’s total sales and orders for this quarter to $2.8m.

Allup Silica (ASX:APS)

Allup has confirmed that rare earths have been discovered below the silica at 100% owned Pink Bark Project in WA. Clay-hosted rare earth oxides (REOs) were confirmed with grades up to 1985 ppm Total Rare Earth Oxides (TREO). Further drilling is now being planned for November to explore for silica sand and higher grade REO potential.

Hazer Group (ASX:HZR)

Hazer’s Commercial Demonstration Plant (CDP) remains on schedule to commence Phase 2 of its operation (hot operations), to produce hydrogen and graphitic carbon, in 2023. The hot reactor has passed a major heat treatment milestone, and the final machining and assembly are underway prior to delivery to site.

Burley Minerals (ASX:BUR)

Recently completed mapping coupled with pXRF mineral vectors at Chubb North in Quebec indicates additional pegmatites prospective for lithium minerals. Additional permits to drill new Chubb North targets have been received, and drilling will commence shortly to test the pegmatites for spodumene mineralisation.

Sezzle (ASX:SZL)

Sezzle reported that Total Income increased to US$14.0 million in August, representing a 44.3% growth on pcp. During the month, Sezzle also recorded GAAP Net Income and Adjusted EBITDA of $0.6 million and $2.4 million, respectively.

At Stockhead we tell it like it is. While Burley Minerals is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.