Weekly Small Cap and IPO Wrap: Aussie markets lose Queen; a whack of market cap; merit only bullet point summary

Via Getty

- The ASX 200 has ended the week 4% lower

- The small cap index ends 6.6% down

- Kuga Gold up 45% in four sessions

Wow. Another exciting week. I’m going to dot point it:

☫ The small caps (XEC) index copped it bad this week. Down 2.5% today and 6.6% since Monday.

☫ The benchmark is down circa 4% this week. The rate sensitive local sectors Messrs Property, Tech, Utilities and Consumer Discretionary (retail ) shares all hurting.

☕️ As Kermit the Frog so presciently said:

☕️ No. Green is not easy.

☼ Global markets found the same as the hawk-shaped shadow of rising rates pushed bond yields to get higher and even more inverted.

☁ A real recession is looking realer now.

☢ The mobilisation of the Russian war machine with its nuclear arsenal was both scary and unhelpful.

☝Oil, metal and iron ore prices were down – war, supply, China also unhelpful. The Aussie Peso fell as the USD continues its meteoric ascent.

☕️ Not much insight from the week’s Reserve Bank meeting minutes, but my word, central banks are right hawkish: confidence (forget ANZ-Roy Morgan) is shot and technical analysts have tried to explain to Stockhead that any slide back to Wall St’s June lows could trigger the next stage (circa 10%) collapse in US shares, then the rest of us.

☕️ While inflation data might look like it’s peaking-stateside: the American central bank, which hiked by another 0.75% and remains more velociraptor than common hawk, is unlikely to be fooled twice.

✌ The Bank of England got hawkish to the tune of 50 bps.

✌ The Swedes went for the Full Volcker at 100 bps. The Swiss central bank did 0.75%.

✌ The central bankers of Norway, the Philippines, Indonesia, South Africa and Taiwan all put on crampons and went hiking.

✌ The so-called dot plot of Fed officials’ interest rate expectations was revised up by 1% for this year to 4.25-4.5%, its inflation forecasts were revised up, its growth forecasts were revised down and its unemployment forecasts were revised up to 4.4% next year.

㊋ Morgan Stanley’s chief fixed income strategist Jim Caron says the Fed’s latest will weigh on asset valuations and tighten financial conditions.

㊋ Recorded overnight, here’s a few cherries from Morgan Stanley’s latest poddy:

- The 75 basis point (bps) rate hike came as expected, but one surprise was the 100 bps markup in end-of-year policy rates to 4.4% from 3.4%.

- The next surprise was the increase in the Fed’s forecast of their terminal policy rate to 4.5% – 4.75% from 3.8%.

- The path of rate hikes corresponds to a 75 bps hike at the November 2022 meeting, a 50 bps hike in December 2022, and a 25 bps hike in January 2023.

- Despite this aggressive pace of tightening, the Fed expects the labor market to remain strong with an unemployment rate rising only to 4.4%, while inflation simultaneously falls toward target levels of 2%-2.5%.

- While the front-loading of rate hikes may address inflation risks in the near term, it also increases the risks of recession in the longer term. This will weigh on asset valuations and tighten financial conditions.

☠ JPM chief economist Michael Feroli in the note Bring the pain reckons the Fed will hike 50 bps in November, but has raised JPM’s December view to another 50 bps, lifting its terminal forecast up 25 bps to 4.5%.

“The response of the real economy to higher rates has been muted thus far, leading the Fed to pencil in a higher peak rate and longer hiking cycle. We think inflation persistence will keep the Fed at peak for most of next year, challenging the market’s assumption of an earlier start to cuts.

“The new forecasts are not only more hawkish but somewhat more realistic, as they now recognise at least some labor market weakness will be needed to get inflation down. Even so, it’s still close to an immaculate disinflation, as only a whiff of labor market weakness generates a very sizable (sic) decline in inflation.”

♬ But the last word (bullet point) as always goes to Dr Shane Oliver who says Fed Chair Powell was channelling Paul Volcker, when he promises we will keep at it until the job is done.

♬ And then reconsidered, perhaps knowing I have the library:

♬ “Or maybe Tom Petty and The Heartbreakers (along with half the Beatles and Jeff Lynne in the video) with “I Won’t Back Down.”

☮ “To slow the pace of tightening Powell wants to see a slowing labour market and more evidence inflation is slowing,” he added. “Another 0.75% hike looks likely November. ”

ASX IPOs for September

Still waiting on Australia Sunny Glass Group (ASX:AG1)

Listing: 21 September

IPO: $7.5m at $0.35

This Australian-based holding company, through its subsidiaries, operates a glass production and supply business for structural building facades.

The group has a fully automated processing plant which it says is highly-efficient, accurate and scalable and an R&D focus on the development of cyclone resistant glass using new laminating and bonding techniques.

Listing: 26 September

IPO: $13.25m at $0.58

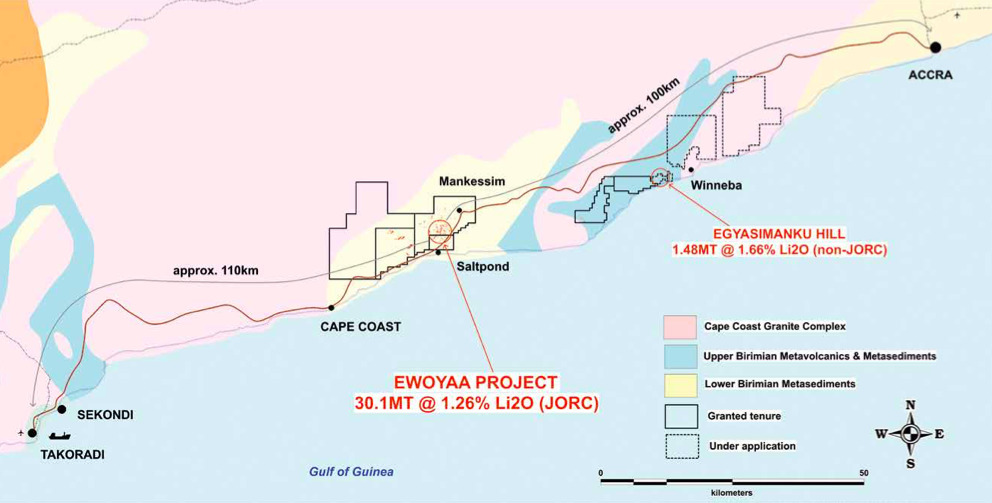

Atlantic’s main game is the 30Mt Ewoyaa lithium project in Ghana, where it is funded through to production via a co-production agreement with fellow mine developer Piedmont Lithium (ASX:PLL).

Piedmont has the right to earn up to 50% at the project level for 50% SC6 spodumene concentrate offtake at market rates by solely funding US$17m towards studies and exploration and US$70m towards mine capex.

Atlantic completed a scoping study for Ewoyaa in December 2021 and in March, updated the mineral resource estimate by a massive 42% to 30.1 million metric tonnes at 1.26% lithium, including indicated resources of 20.5 million tonnes at 1.29%.

A project pre-feasibility study is due in the third quarter of CY2022 which will incorporate the expanded resource.

Atlantic also has two applications pending covering a combined 774km2 area for lithium in the Ivory Coast; Agboville and Rubino.

Critical Minerals Group (ASX:CMG)

Listing: 27 September

IPO: $5m at $0.20

The company holds the Lindfield vanadium project in Queensland, where it plans to complete bulk ore sample collection through its large diameter core drilling campaign, add to the existing JORC resource, and complete metallurgy and pilot plant test work and a scoping study.

CMG also holds the Figtree Creek and Lorena Surrounds, both greenfield copper-gold projects in the Cloncurry region.

Basin Energy (ASX:BSN)

Listing: 29 September

IPO: $9m at $0.20

This explorer is looking for uranium in the Athabasca Basin in Canada, with the exclusive right to earn controlling interests in three highly prospective projects strategically located in near high grade operating mines and milling operations.

The company intends to begin systematic exploration on its projects immediately post-listing, with initial drill testing planned for the upcoming winter field season.

Adrad Holdings (ASX:AHL)

Listing: 30 September

IPO: $22m at $1.50

The company designs and manufactures heat transfer solutions for OE customers globally.

They also manufacture, import and distribute automotive parts for the aftermarket in Australia and New Zealand.

Bridge SaaS (ASX:BGE)

Listing: 30 September

IPO: $4.5m at $0.20

This company provides Software-as-a-Service (SaaS) based Customer Relationship Management (CRM) and workflow solutions to employment, care and support industries. The software is a single platform that simplifies the unique data, compliance and documentary evidence requirements of major government-funded programs through a unified user interface, BGE says.

Nightingale Intelligent Systems (ASX:NGL)

Listing: 30 September

IPO: $10m at $0.35

This company develops and sells Unmanned Aerial Vehicles (UAVs) or drones for commercial applications – and there’s a bunch of them.

NGL says its tech has applications across solar farms, ports, O&G facilities, critical infrastructure like dams and power stations, in construction, border patrol, securing pipelines, fire and oil spills along with search and rescue, crowd control and for prisons.

Basically, the drones can respond to a threat; when a security alarm is triggered the system automatically dispatches a drone to the alarm location and streams live video to the security team.

They can also be scheduled for autonomous patrol missions based on day, time, path, altitude, hover duration, camera direction, and other mission details.

During a major event like an oil spill, chemical leak, or fire, you can manually dispatch a drone to monitor events as they unfold on the ground.

Plus, they can autonomously patrol areas of interest around the facility and send out alerts only when human and vehicle intruders are detected.

ASX SMALL CAP LEADERS:

Here are the best performing ASX small cap stocks for September 19 to September 23:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| ACP | Audalia Res Ltd | 0.012 | 71% | $8,305,634 |

| AEV | Avenira Limited | 0.015 | 50% | $15,825,357 |

| RAS | Ragusa Minerals Ltd | 0.395 | 49% | $41,166,102 |

| DRM | Demetallical | 0.295 | 48% | $25,620,343 |

| CGA | Contango Asset | 0.44 | 47% | $21,210,591 |

| KGD | Kula Gold Limited | 0.029 | 45% | $8,338,056 |

| ENT | Enterprise Metals | 0.014 | 40% | $9,141,730 |

| NAE | New Age Exploration | 0.009 | 38% | $12,923,090 |

| AUR | Auris Minerals Ltd | 0.022 | 38% | $9,532,519 |

| VOL | Victory Offices Ltd | 0.041 | 37% | $6,313,921 |

| GMN | Gold Mountain Ltd | 0.008 | 33% | $9,785,193 |

| GO2 | Thego2People | 0.016 | 33% | $5,286,297 |

| TSL | Titanium Sands Ltd | 0.016 | 33% | $22,502,366 |

| OLY | Olympio Metals Ltd | 0.2 | 29% | $7,233,589 |

| ARV | Artemis Resources | 0.049 | 29% | $66,639,887 |

| SKN | Skin Elements Ltd | 0.032 | 28% | $11,697,136 |

| FIN | FIN Resources Ltd | 0.023 | 28% | $13,427,515 |

| CXU | Cauldron Energy Ltd | 0.014 | 27% | $8,031,169 |

| TMK | TMK Energy Limited | 0.014 | 27% | $49,290,938 |

| GNM | Great Northern | 0.005 | 25% | $8,545,255 |

| SYN | Synergia Energy Ltd | 0.0025 | 25% | $21,044,477 |

| TSC | Twenty Seven Co. Ltd | 0.0025 | 25% | $5,321,628 |

| ABV | Adv Braking Tech Ltd | 0.031 | 24% | $11,753,612 |

| FG1 | Flynngold | 0.13 | 24% | $7,687,326 |

| MTC | Metalstech Ltd | 0.405 | 23% | $66,665,836 |

| TML | Timah Resources Ltd | 0.073 | 22% | $6,601,988 |

| MX1 | Micro-X Limited | 0.17 | 21% | $78,455,848 |

| RSH | Respiri Limited | 0.047 | 21% | $36,568,625 |

| ATU | Atrum Coal Ltd | 0.009 | 20% | $4,839,578 |

| AMD | Arrow Minerals | 0.006 | 20% | $12,202,591 |

| AQX | Alice Queen Ltd | 0.003 | 20% | $6,461,083 |

| OAR | OAR Resources Ltd | 0.006 | 20% | $13,026,227 |

| FEG | Far East Gold | 0.73 | 20% | $87,866,791 |

| SLM | Solismineralsltd | 0.08 | 19% | $3,712,186 |

| XTE | Xtek Limited | 0.47 | 19% | $46,285,312 |

| SKS | SKS Tech Group Ltd | 0.22 | 19% | $24,610,984 |

| PTR | Petratherm Ltd | 0.082 | 19% | $19,328,598 |

| WEC | White Energy Company | 0.355 | 18% | $14,199,252 |

| HPC | Thehydration | 0.13 | 18% | $18,701,262 |

| MLM | Metallica Minerals | 0.047 | 18% | $33,199,635 |

| VAN | Vango Mining Ltd | 0.041 | 17% | $47,877,630 |

| LVT | Livetiles Limited | 0.055 | 17% | $47,997,108 |

| DM1 | Desert Metals | 0.485 | 17% | $23,276,032 |

| AVM | Advance Metals Ltd | 0.014 | 17% | $5,734,529 |

| BXN | Bioxyne Ltd | 0.021 | 17% | $11,522,617 |

| CVR | Cavalierresources | 0.175 | 17% | $5,318,084 |

| RIE | Riedel Resources Ltd | 0.007 | 17% | $7,501,949 |

| LNY | Laneway Res Ltd | 0.007 | 17% | $45,766,115 |

| ILA | Island Pharma | 0.18 | 16% | $8,000,571 |

| M24 | Mamba Exploration | 0.145 | 16% | $6,115,375 |

Kula Gold (ASX:KGD), has made this week, their week. Up about 45%, lots happening and a dimming economic outlook never hurts the precious metal.

On Monday, KGD revealed plans to raise $1.8m to fast-track its WA lithium exploration and “assess new opportunities in the sector”.

Funds raised from the placement will focus on accelerating lithium exploration work at the company’s 100% owned Brunswick project in WA — ~45km from the Greenbushes lithium mine — as well as follow up recently identified Westonia Ni/PGE/Gold prospects adjacent to the Edna May gold mine, also in WA.

“Kula is also assessing new opportunities in the lithium sector that would complement the existing Brunswick lithium project,” it says.

Demetallica (ASX:DRM) enjoyed the fruits of an off-market takeover offer from copper miner AIC Mines Limited (ASX: A1M) earlier this week.

In an exciting development indeed for Demetallica shareholders there’s one A1M share on the hook for every one and a half Demetallica shares.

That makes Demetallica worth about $38 million or 34 cents per share. I’m fumbling at the wee buttons but the offer represents a near 69% upside on DRM’s last closing price of 20 cents a pop.

DRM’s 9.1Mt Jericho copper deposit is only 4km from A1M’s 12,500tpa copper, 6000ozpa gold Eloise copper mine and processing facility, which it acquired in November last year.

In the first eight months of ownership, Eloise generated $104.4 million in revenue and $16.9 million in net mine cashflow at an AISC of A$4.33/lb Cu and AIC of A$4.82/lb Cu.

The $130m miner says this offer for Jericho – part of the Chimera polymetal project — is the start of a regional consolidation drive, as it aims to become a new mid-tier Aussie copper and gold miner.

“Combining these assets will provide the quickest and most efficient means of developing and mining the Jericho deposit – to the shared benefit of both AIC Mines and Demetallica shareholders,” it says.

A mineral resource update at Jericho is due October. Reubs says the company had $10.5m in the bank at the end of June.

ASX SMALL CAP LAGGARDS:

Here are the best performing ASX small cap stocks for September 19 to September 23:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| PET | Phoslock Env Tec Ltd | 0.062 | -75% | $36,214,650 |

| GGE | Grand Gulf Energy | 0.016 | -53% | $29,385,603 |

| CBE | Cobre | 0.165 | -44% | $37,686,245 |

| MOM | Moab Minerals Ltd | 0.016 | -42% | $11,593,379 |

| IEC | Intra Energy Corp | 0.008 | -33% | $4,240,471 |

| TNG | TNG Limited | 0.088 | -32% | $124,957,640 |

| HYD | Hydrix Limited | 0.056 | -31% | $13,835,030 |

| RR1 | Reach Resources Ltd | 0.007 | -30% | $15,280,405 |

| UVA | Uvrelimited | 0.175 | -30% | $5,827,498 |

| LEL | Lithenergy | 0.9 | -30% | $44,698,500 |

| GW1 | Greenwing Resources | 0.245 | -29% | $35,125,494 |

| MMM | Marley Spoon | 0.165 | -28% | $51,092,650 |

| PNN | Power Minerals Ltd | 0.525 | -28% | $33,253,259 |

| AGN | Argenica | 0.475 | -27% | $35,041,591 |

| GRV | Greenvale Mining Ltd | 0.068 | -27% | $27,014,915 |

| FRS | Forrestaniaresources | 0.2 | -26% | $7,005,874 |

| LNR | Lanthanein Resources | 0.043 | -26% | $47,178,453 |

| DUB | Dubber Corp Ltd | 0.52 | -26% | $167,924,869 |

| DYL | Deep Yellow Limited | 0.895 | -25% | $691,312,142 |

| ADR | Adherium Ltd | 0.006 | -25% | $15,593,869 |

| CFO | Cfoam Limited | 0.003 | -25% | $2,201,522 |

| ECG | Ecargo Hldg | 0.018 | -25% | $11,074,500 |

| FAU | First Au Ltd | 0.006 | -25% | $6,519,877 |

| GES | Genesis Resources | 0.009 | -25% | $7,045,572 |

| LNU | Linius Tech Limited | 0.003 | -25% | $6,941,599 |

| MEM | Memphasys Ltd | 0.018 | -25% | $19,203,983 |

| BTE | Botalaenergyltd | 0.145 | -24% | $8,867,200 |

| NOX | Noxopharm Limited | 0.21 | -24% | $62,831,159 |

| AHN | Athena Resources | 0.01 | -23% | $8,129,676 |

| ACB | A-Cap Energy Ltd | 0.077 | -23% | $103,524,547 |

| NME | Nex Metals Explorat | 0.027 | -23% | $9,345,827 |

| IR1 | Irismetals | 1.685 | -22% | $113,218,200 |

| CHK | Cohiba Min Ltd | 0.007 | -22% | $11,393,626 |

| BLU | Blue Energy Limited | 0.055 | -21% | $105,495,345 |

| EEG | Empire Energy Ltd | 0.22 | -21% | $177,740,816 |

| KAI | Kairos Minerals Ltd | 0.037 | -21% | $74,635,553 |

| GGG | Greenland Minerals | 0.0505 | -21% | $77,277,409 |

| SXG | Southern Cross Gold | 0.27 | -21% | $17,433,570 |

| AW1 | American West Metals | 0.155 | -21% | $17,764,440 |

| PO3 | Purifloh Ltd | 0.35 | -20% | $11,033,224 |

| MKG | Mako Gold | 0.051 | -20% | $19,876,563 |

| MCM | Mc Mining Ltd | 0.53 | -20% | $139,346,683 |

| MOH | Moho Resources | 0.0295 | -20% | $5,066,958 |

| CTT | Cettire | 0.79 | -20% | $333,583,443 |

| COB | Cobalt Blue Ltd | 0.735 | -20% | $249,607,029 |

| AS2 | Askarimetalslimited | 0.32 | -20% | $15,323,552 |

| CLE | Cyclone Metals | 0.002 | -20% | $12,233,474 |

| EXL | Elixinol Wellness | 0.028 | -20% | $8,855,436 |

| ICN | Icon Energy Limited | 0.016 | -20% | $12,288,219 |

| M2R | Miramar | 0.1 | -20% | $6,418,666 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.