Weekly Small Cap and IPO Wrap: ASX200 and XEC slide into Xmas, Energy Sector totally wins 2022

News

News

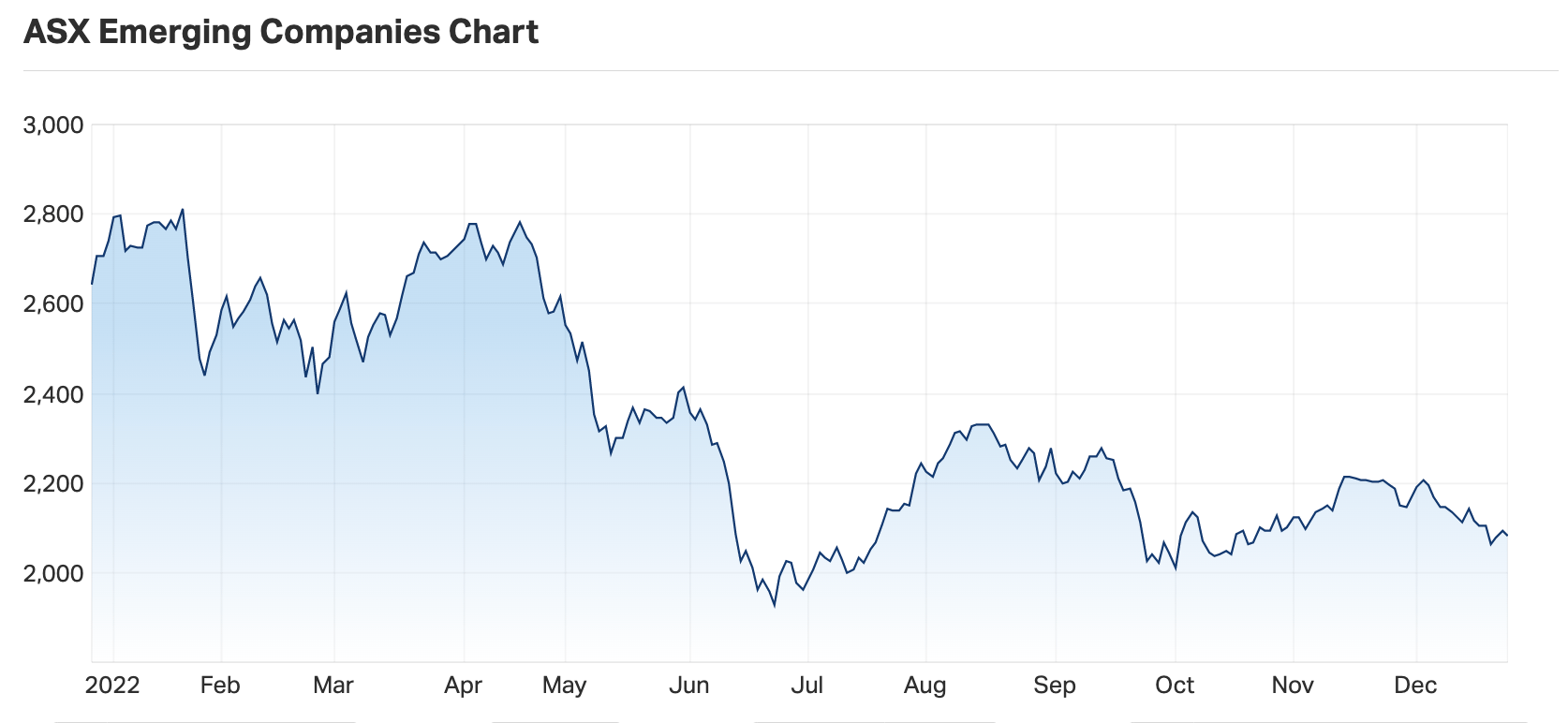

This is where we’re leaving the Aussie benchmark for micro-cap companies, the S&P/ASX Emerging Companies (XEC) in 2022.

A mighty volatile, yet impressively steady descent.

It’s not been an easy run, down 1.5% this week, adding to a bad month and a 2022 worth cremating.

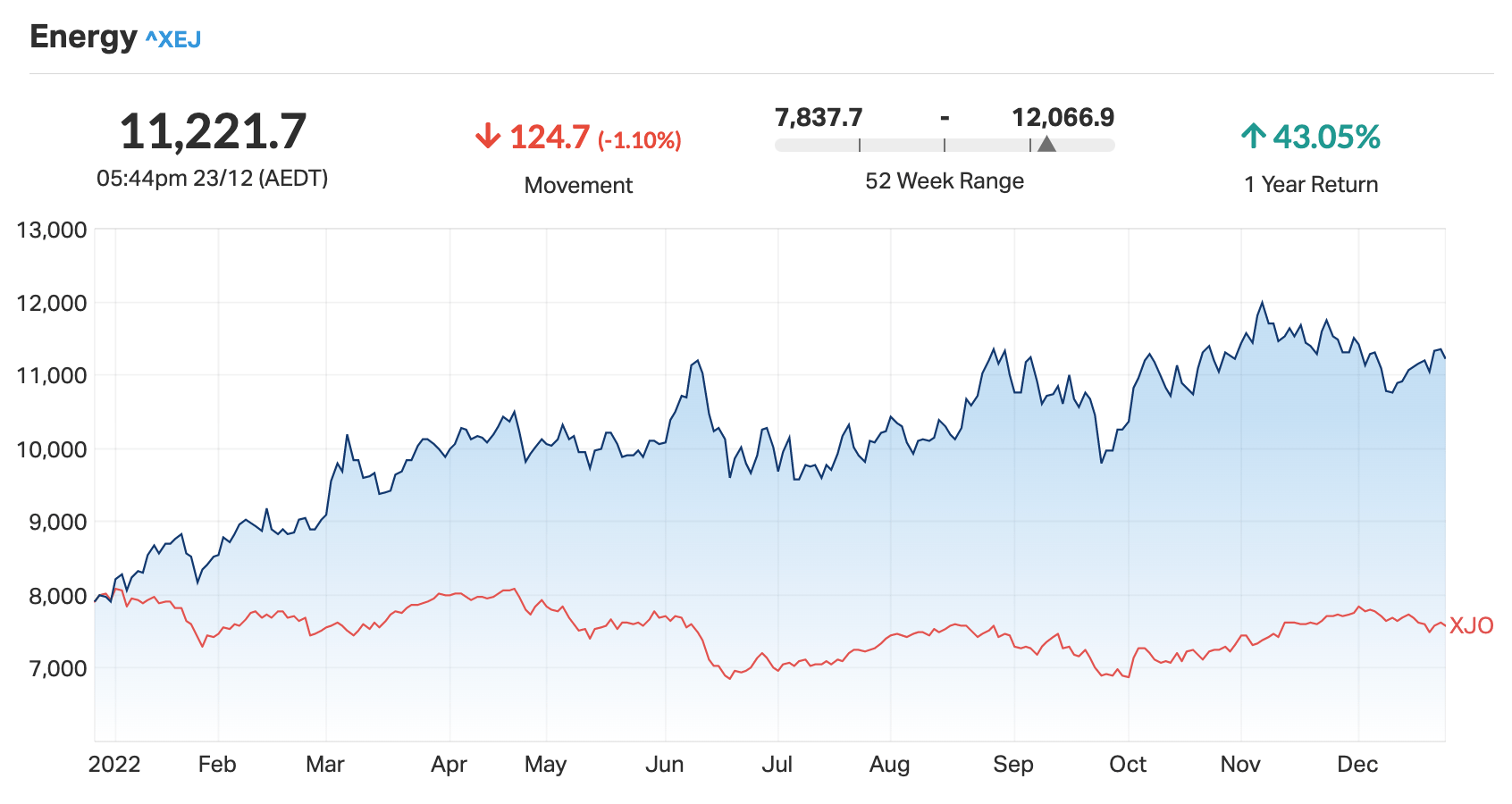

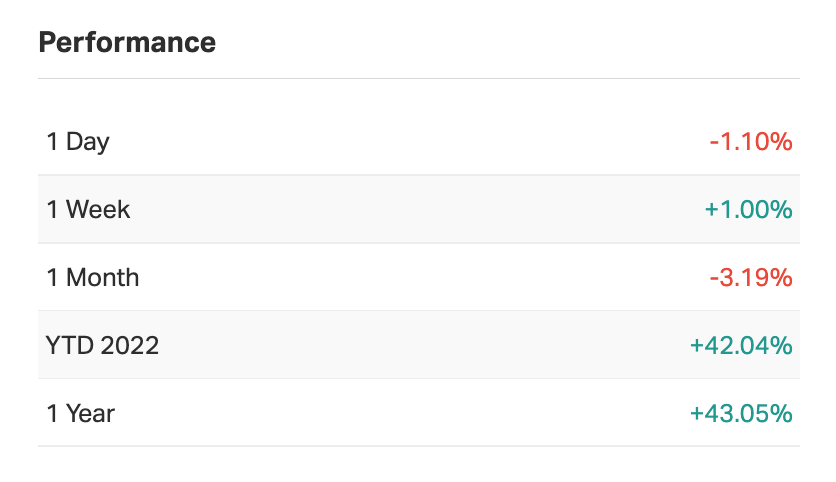

Once again, while sectors like Utilities, Materials, Health and Consumer stocks retreated on the benchmark ASX 200 (XJO), the only show of defiance came out of the Energy Sector, led by the old school producers.

The XEJ is up more than 1% since Monday morning, ending a year where it performed like a God’s first ever test run of the miraculous Atlantic salmon.

Once more unto the breach went equities during a week of light Christmas volumes across developed markets.

Global indices largely retreated over the last week as the big name central banks went more hawkish than expected fueling to recession fears along with weak economic data. The week before the Federal Reserve, the European Central Bank (ECB) and the Bank of England (BoE) clipped hope as was their aim, so when the Bank of Japan made sure that didn’t happen.

For the week Chinese shares were fairly insulated, down about 1%. Despite the shock announcement from a BoJ most of thought was actually just an empty building with a nice facade, Japanese shares barely registered a sweat, down 1.2%.

In the US shares fell harder, short 2.2%, after Tesla shed another bunch – 9.2% on Friday to $124.86 – that’s the EV hero’s worst score since September 2020.

The news is just all bad over in the House of Musk – the boss is distracted, the team is missing production targets, they’re slashing the price ($US7,500 discounts) on its formerly inaccessible fleet as sales drop, while a gargantuan 8 car pile up involving a self-driving Tesla all make for bad driving ahead.

EU markets shed 3.2%, I’m in France and I can tell you no-one seems to mind.

However, the negative global sentiment has been hitting home. The All Ords pulled back by 1% this week. Aussie bond yields fell as they did in the states and Europe, but again…

Elsewhere, commodity prices were mixed with energy doing good and iron ore and metals doing bad. The Aussie dollar didn’t do much other than decline a wee bit against a stagnant USD.

Back to the BoJ though, all 47 economists surveyed by Bloomberg expected yield-curve consistency. All 47 were proven wrong by the surprise hike. And since then, core Japanese consumer prices are rising at their fastest rate since about 1980, with energy pushing inflation up 3.7% for November year-on-year.

And that’s why I only listen to myself and Taylor Swift.

SOCO CORPORATION (ASX:SOC)

Listing: 23 December

IPO: $5m at $0.20

One lonely IPO is left before Christmas and it’s done pretty damn well.

SOCO Corporation is an Aussie-based IT consultancy, specialising in the delivery of cloud solutions, business applications and integration projects – with a particular focus on Microsoft solutions.

The company’s key target markets include federal government, local and state government, along with large corporates.

The offer was well oversubscribed, raising a total of $5M at $0.20 per share for an indicative market capitalisation of $25.3M. The IPO attracted strong support from institutional and retail investors. This included significant take-up from SOCO’s employees, further solidifying alignment towards SOCO’s continuing success.

There was no sell-down as part of the IPO, with SOCO’s founding team retaining a 79.2% shareholding and electing to voluntarily escrow 100% of their holding for 12-months from listing.

The IPO represents SOCO’s first ever external capital raising since its founding nine years ago. The only tradable shares will be those issued at the IPO.

This explorer listed on Monday with its fully underwritten IPO raising $7 million to conduct exploration activities for its three projects.

The company is focused predominantly on gold and polymetallic, and has three projects including the Highway and Challenger Westin projects in South Australia and Lake Barlee in Western Australia.

“Our exploration plans have started, and we are wasting no time in getting the planning ready for more intense exploration activities in the coming 2023,” MD Noel Ong said.

The Highway hosts major IOCG (iron oxide copper gold) deposits including Olympic Dam, Carrapateena and Prominent Hill.

The Olympic Dam deposit, discovered by Western Mining back in 1975, is considered one of the world’s largest iron-oxide-copper-gold (IOCG) deposits and the fourth largest copper deposit globally. It’s located roughly 350m below the surface.

Rigorous geophysics programs have provided compelling evidence for not only an extension to the OME Domain, but also that Merino Prospect itself is likely a shallow hydrothermal system, i.e. by way of the zircon isotope analyses.

Notably, the evaluation of the data shows that Merino is potentially tapping the source rocks that feed the Olympic Dam IOCG Belt.

Here are the best performing ASX small cap stocks for December 19 to 23

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| MEI | Meteoric Resources | 0.053 | 231% | $79,367,463 |

| KDY | Kaddy Limited | 0.072 | 157% | $9,489,222 |

| SKN | Skin Elements Ltd | 0.0165 | 83% | $7,924,293 |

| NGY | Nuenergy Gas Ltd | 0.032 | 78% | $35,542,932 |

| PXX | Polarx Limited | 0.019 | 58% | $25,705,991 |

| 3DA | Amaero International | 0.16 | 45% | $70,628,236 |

| PLG | Pearlgullironlimited | 0.031 | 42% | $1,701,972 |

| DCX | Discovex Res Ltd | 0.0035 | 40% | $11,558,988 |

| TEG | Triangle Energy Ltd | 0.021 | 40% | $29,579,874 |

| AVE | Avecho Biotech Ltd | 0.015 | 36% | $23,892,301 |

| ARE | Argonaut Resources | 0.002 | 33% | $12,723,743 |

| AUK | Aumake Limited | 0.004 | 33% | $3,497,788 |

| CT1 | Constellation Tech | 0.004 | 33% | $5,884,801 |

| KEY | KEY Petroleum | 0.002 | 33% | $3,935,856 |

| MGG | Mogul Games Grp Ltd | 0.002 | 33% | $6,526,882 |

| VIP | VIP Gloves | 0.004 | 33% | $3,933,907 |

| BBX | BBX Minerals Ltd | 0.091 | 32% | $41,371,325 |

| SIX | Sprintex Ltd | 0.04 | 29% | $10,937,236 |

| LME | Limeade Inc. | 0.25 | 28% | $64,042,018 |

| NSX | NSX Limited | 0.055 | 28% | $16,241,139 |

| FXG | Felix Gold Limited | 0.115 | 28% | $9,148,304 |

| WMG | Western Mines | 0.165 | 27% | $7,591,013 |

| MCE | Matrix C & E Ltd | 0.285 | 27% | $42,360,714 |

| NWE | Norwest Energy NL | 0.057 | 27% | ########## |

| BOC | Bougainville Copper | 0.35 | 25% | ########## |

| CAV | Carnavale Resources | 0.005 | 25% | $13,667,759 |

| MTL | Mantle Minerals Ltd | 0.0025 | 25% | $13,364,013 |

| TD1 | Tali Digital Limited | 0.0025 | 25% | $4,205,268 |

| AS2 | Askarimetalslimited | 0.415 | 24% | $18,748,866 |

| C1X | Cosmosexploration | 0.21 | 24% | $4,750,000 |

| IMB | Intelligent Monitor | 0.16 | 23% | $20,912,047 |

| PRN | Perenti Limited | 1.31 | 23% | ########## |

| RHT | Resonance Health | 0.06 | 22% | $27,651,119 |

| CBL | Control Bionics | 0.165 | 22% | $15,381,435 |

| TYM | Tymlez Group | 0.022 | 22% | $19,494,412 |

| CYM | Cyprium Metals Ltd | 0.097 | 21% | $67,178,244 |

| H2G | Greenhy2 Limited | 0.04 | 21% | $15,493,966 |

| SRX | Sierra Rutile | 0.23 | 21% | $93,332,018 |

| TNT | Tesserent Limited | 0.115 | 21% | ########## |

| MRM | MMAOffShor | 0.95 | 21% | ########## |

| HVY | Heavymineralslimited | 0.145 | 21% | $4,244,378 |

| APS | Allup Silica Ltd | 0.09 | 20% | $3,462,939 |

| BUX | Buxton Resources Ltd | 0.12 | 20% | $17,115,292 |

| CHK | Cohiba Min Ltd | 0.006 | 20% | $9,765,965 |

| GTG | Genetic Technologies | 0.003 | 20% | $27,701,895 |

| ICN | Icon Energy Limited | 0.006 | 20% | $3,840,068 |

| OMA | Omegaoilgaslimited | 0.18 | 20% | $21,827,071 |

| PUA | Peak Minerals Ltd | 0.006 | 20% | $6,248,225 |

| RAN | Range International | 0.006 | 20% | $5,635,742 |

| DUG | DUG Tech | 0.625 | 19% | $67,330,330 |

Goodness me it’s the right time to have some REE up your sleeve.

Living up to its name and then some, Meteoric Resources’ (ASX:MEI) gained about 230% this week, with news that the new Caldeira project does indeed contain ionic adsorption clay REEs.

“These results show a considerable portion of the target REEs are adsorbed onto clays allowing for recovery by a simple washing process, unlike the case for many REE projects, where the REEs are tightly bound within the mineral lattice or are even in colloidal suspension requiring a much more intensive treatment process,” MEI reported.

Merry Xmas.

Here are the worst performing ASX small cap stocks for December 19 to 23

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| SRJ | SRJ Technologies | 0.1 | -77% | $10,701,030 |

| BWX | BWX Limited | 0.16 | -75% | $36,997,688 |

| APL | Associate Global | 0.24 | -45% | $11,569,413 |

| EPY | Earlypay Ltd | 0.2 | -40% | $92,777,181 |

| SYM | Symbio Holdings Ltd | 1.53 | -40% | ########## |

| FHS | Freehill Mining Ltd. | 0.005 | -38% | $11,561,093 |

| PRM | Prominence Energy | 0.001 | -33% | $2,424,609 |

| RMY | RMA Global | 0.09 | -33% | $47,967,611 |

| BNO | Bionomics Limited | 0.036 | -31% | $54,343,211 |

| CCX | City Chic Collective | 0.455 | -31% | ########## |

| 29M | 29Metalslimited | 1.79 | -30% | ########## |

| INF | Infinity Lithium | 0.105 | -30% | $50,885,130 |

| SNX | Sierra Nevada Gold | 0.21 | -30% | $10,406,966 |

| BMO | Bastion Minerals | 0.031 | -30% | $3,567,164 |

| LVT | Livetiles Limited | 0.027 | -29% | $31,414,971 |

| IXU | Ixup Limited | 0.028 | -28% | $30,887,159 |

| KGD | Kula Gold Limited | 0.023 | -26% | $7,946,662 |

| PBH | Pointsbet Holdings | 1.345 | -26% | ########## |

| ADY | Admiralty Resources. | 0.006 | -25% | $7,821,475 |

| AYM | Australia United Min | 0.003 | -25% | $5,527,732 |

| DDT | DataDot Technology | 0.006 | -25% | $8,707,086 |

| GLV | Global Oil & Gas | 0.0015 | -25% | $4,017,407 |

| HPC | Thehydration | 0.09 | -25% | $13,164,530 |

| SHO | Sportshero Ltd | 0.015 | -25% | $9,686,504 |

| XST | Xstate Resources | 0.0015 | -25% | $6,430,363 |

| HMY | Harmoney Corp Ltd | 0.41 | -24% | $41,637,791 |

| EQE | Equus Mining Ltd | 0.072 | -23% | $13,977,931 |

| 99L | 99 Loyalty Ltd. | 0.01 | -23% | $11,596,828 |

| AD1 | AD1 Holdings Limited | 0.01 | -23% | $7,708,044 |

| NET | Netlinkz Limited | 0.017 | -23% | $64,490,829 |

| GCM | Green Critical Min | 0.017 | -23% | $17,486,615 |

| SER | Strategic Energy | 0.014 | -22% | $4,154,412 |

| TKL | Traka Resources | 0.007 | -22% | $4,821,422 |

| VML | Vital Metals Limited | 0.018 | -22% | ########## |

| ARN | Aldoro Resources | 0.18 | -22% | $20,888,779 |

| AWJ | Auric Mining | 0.063 | -21% | $6,569,124 |

| 1AE | Auroraenergymetals | 0.15 | -21% | $21,034,462 |

| HFY | Hubify Ltd | 0.03 | -21% | $18,357,043 |

| OSX | Osteopore Limited | 0.15 | -21% | $17,590,236 |

| INR | Ioneer Ltd | 0.375 | -21% | ########## |

| GRL | Godolphin Resources | 0.079 | -21% | $9,469,556 |

| TOU | Tlou Energy Ltd | 0.034 | -21% | $25,264,123 |

| HIQ | Hitiq Limited | 0.027 | -21% | $6,069,494 |

| MIO | Macarthur Minerals | 0.135 | -21% | $23,191,488 |

| TTM | Titan Minerals | 0.074 | -20% | ########## |

| AQX | Alice Queen Ltd | 0.002 | -20% | $4,400,500 |

| MXO | Motio Ltd | 0.04 | -20% | $8,627,344 |

| OEQ | Orion Equities | 0.12 | -20% | $1,877,907 |

| OPN | Oppenneg | 0.08 | -20% | $12,220,763 |

| PNX | PNX Metals Limited | 0.004 | -20% | $17,776,231 |