Weekly Small Cap and IPO Wrap: ASX has brutal quarter, bitter month, cruel week, awful day – and it’s all England’s bloody fault

News

News

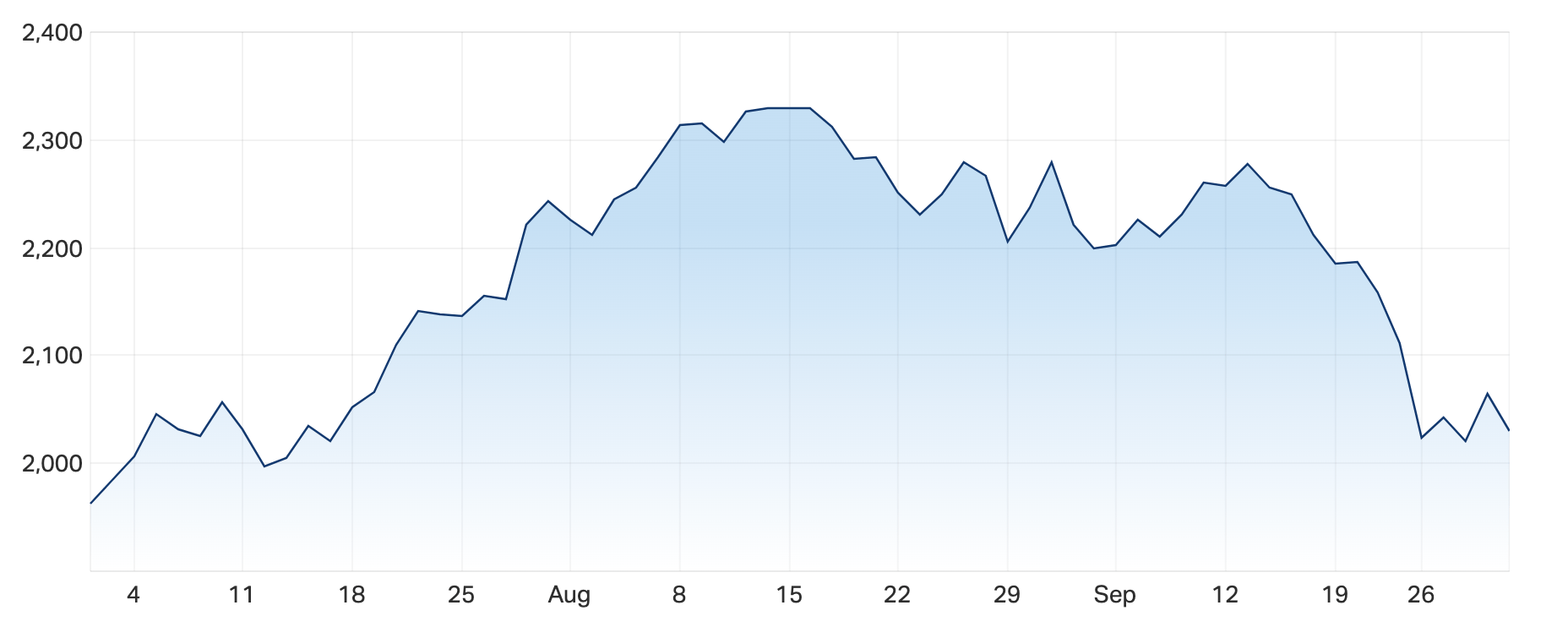

This is the ASX 200 over the September quarter just ended:

That’s a hell of a lot of work, for very little return:

- Friday down -1.2%

- This week down -3.3%

- September down -7.0%

- YTD 2022 down -13.0%

- 1 Year -11.6%

Not the funnest Friday read…

But also not the worst:

This is the Emerging Companies XEC index over the September quarter:

- Friday -1.5%

- This week -5.9%

- September -8%

- YTD 2022 -25.9%

- 1 Year -19.9%

“This royal throne of kings, this sceptred isle,

This earth of majesty, this seat of Mars,

This other Eden, demi-paradise,

This fortress built by Nature for herself

Against infection and the hand of war,

This happy breed of men, this little world,

This precious stone set in the silver sea,

Which serves it in the office of a wall

Or as a moat defensive to a house,

Against the envy of less happier lands,

This blessed plot, this earth, this realm, this England. ”– William Shakespeare, (likely drunk and trying to impress the new King… ringing any bells? ) Richard II

Who knew we’d be pinning this week’s woes on to the genii behind the new British “mini-budget.”

I for one did not.

I didn’t even think they’d be doing anything with such vigour post-HRM.

But they did.

They thought a few mega tax cuts for the plump and privileged would light a new fire under searing UK inflation, super charge UK government debt, roil markets, pound the pound … (pauses for breath) … trigger intervention from the central bank, get hate mail from the IMF and fulfil the sweetest dreams of secret overlord and master of Muppets, Vlad Putin.

That’s my call. It’s a Trump/Truss Russia thingy.

In any case, the GBP took a hammering while yields on UK government bonds surged like Floridian tides.

Enter the Bank of England (BoE) screaming and shouting it’ll buy infinity number of long-term government bonds to ‘restore orderly market conditions’.

Now, I know I’m not a central banker – or British – but why buy unlimited bonds for a fortnight, while instigating a whack of quantative tightening – ‘cos the BoE says it will continue as planned the trimming of the phat from its obscenely reddened balance sheet (by some £80bn).

Belinda Allen at CBA notes that this BoE intervention did settle yields – and give our markets a tidy bump on Thursday – but what’s that matter when the market pricing for rate hikes by the BoE at the next meeting remain very, very, very, very large – full Volcker territory ie: ~ 100bp.

Meanwhile, macro-wise at home the official office of numbers (ABS) delivered the entirely oxymoronic monthly CPI data – for the July and August. I’m no economist, my friends would also point out I don’t know math good, but isn’t that two months?

The data covered the months of July and August 2022. The data was only released partially which limits the capacity of economists to fully dissect the information. The indicator rose by 6.8%/yr to August 2022 (the annual rate stepped down from 7.0%/yr in July 2022) – see here.

Based on the monthly CPI data we expect the Q3 22 CPI to increase by 1.6%/qtr which would take the annual rate to 7.0% (this is marginally higher than our previously published preliminary forecast of 1.5%/qtr and 6.9%/yr). We receive the next release on the same day as the Q3 22 CPI on 26 October 2022.

The Final Budget Outcome for 2021/22 showed a very large improvement in the budget deficit to $A32bn from $A79.8bn due to delayed spending and higher revenue.

Retail trade for August also printed at 0.6%, just above consensus expectations.

Again, I’m not the governor of the Reserve bank of Australia – or a doctor – but why doesn’t Dr Lowe just ask us to pull ur heads in and not spend so much?

That’s obviously crazy talk because next week we’ve a bucket-load of housing data incoming , fitting in nicely with the RBA’s October Board Meeting on Tuesday.

Gareth Aird, CBA’s head of Australian economics’ has a pretty thorough preview which can be found here .

As Gareth notes there’s pretty much universal agreement amongst economists et al that the RBA will deliver a rate hike.

And quickly, here’s Belinda Allen’s assumptions for the rest of the week:

“Falls continue to accelerate in Brisbane but have slowed a touch in Sydney and Melbourne. Sydney prices have now fallen around 10% from the peak earlier this year,” Allen says.

“The impact of rising interest rates is working to cool demand for housing and subsequently credit, as well as reduce the amount households can borrow.”

On Thursday the trade balance is released – lok for a “modest lift in the trade surplus” to $A10bn.

IPO: $22m at $1.50

Listing today and steady at it’s initial price is a company designs and manufactures Original Equipment (OE) industrial radiators and engineered engine cooling for stationary and mobile heat exchangers are produced to specific customer requirements.

They also manufacture, import and distribute automotive parts for the aftermarket in Australia and New Zealand including passenger vehicles through to locomotives, ultra-heavy dump trucks as well as agricultural machinery and construction equipment.

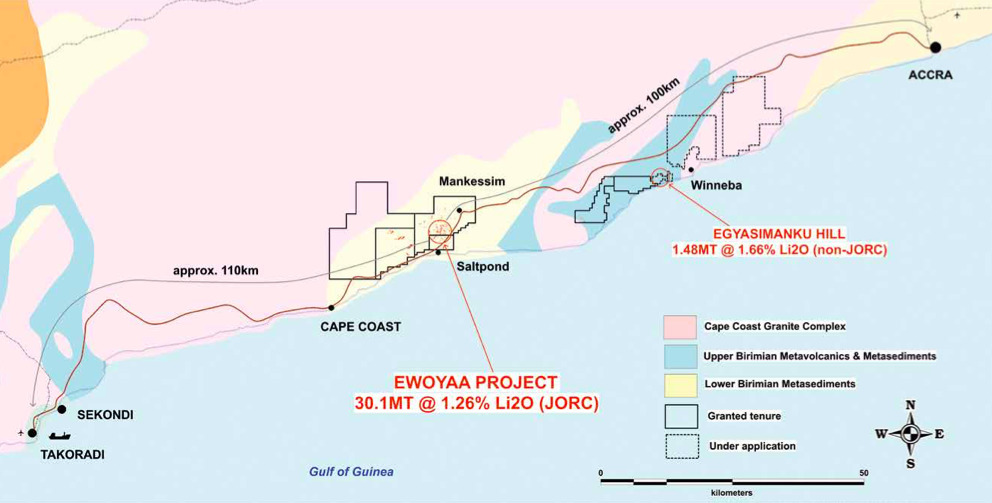

Atlantic listed on Monday after IPOing at $13.25m, with its main game the 30Mt Ewoyaa lithium project in Ghana, where it is funded through to production via a co-production agreement with fellow mine developer Piedmont Lithium (ASX:PLL).

Piedmont has the right to earn up to 50% at the project level for 50% SC6 spodumene concentrate offtake at market rates by solely funding US$17m towards studies and exploration and US$70m towards mine capex.

Atlantic completed a scoping study for Ewoyaa in December 2021 and in March, updated the mineral resource estimate by a massive 42% to 30.1 million metric tonnes at 1.26% lithium, including indicated resources of 20.5 million tonnes at 1.29%.

A project pre-feasibility study is due in the third quarter of CY2022 which will incorporate the expanded resource.

Atlantic also has two applications pending covering a combined 774km2 area for lithium in the Ivory Coast; Agboville and Rubino.

A11 is currently trading at $0.615, up 6% from its listing price of $0.58.

Critical Minerals Group (ASX:CMG)

The vanadium company listed Wednesday, IPOing at $5m at $0.20.

CMG struck an initial high of $0.279 and had gained some 25% from its listing price.

The company holds the Lindfield vanadium project in Queensland, which has an inferred mineral resource of 210 mt @ 0.39% V2O5 (vanadium pentoxide).

The plan is to complete bulk ore sample collection through its large diameter core drilling campaign, add to the existing JORC resource, and complete metallurgy and pilot plant test work and a scoping study.

CMG also holds the Figtree Creek and Lorena Surrounds, both greenfield copper-gold projects in the Cloncurry region.

Plus, they’ve got Japanese petroleum heavyweight Idemitsu on their register, with the conglomerate taking a 32% slice of the company.

“We believe that vanadium has a critical role to play in the future of energy and are delighted to have Idemitsu Australia as a cornerstone investor,” MD Scott Drelincourt said.

“Our partnership with Idemitsu provides the capital and direction to deliver the Lindfield Project and value to our shareholders. We are thrilled to have their strategic support.”

While adoption of vanadium redox flow batteries has been relatively slow, representing just 10 per cent of the stationary battery market to date, the battery metal is widely expected to become a key resource as the world moves increasingly towards electrification to support net zero emissions.

In fact, vanadium consumption in batteries is forecast to grow at an average compound rate of 41% per year from 2022 to 2031, and global production of vanadium, which is also used to strengthen steel, is expected to increase by as much as 50% by 2030.

Listing: 4 October

IPO: $4.5m at $0.20

This company provides Software-as-a-Service (SaaS) based Customer Relationship Management (CRM) and workflow solutions to employment, care and support industries. The software is a single platform that simplifies the unique data, compliance and documentary evidence requirements of major government-funded programs through a unified user interface, BGE says.

Listing: 4 October

IPO: $25m at $1.50

This company is focused on solving gas emission issues for landfill sites while generating dispatchable, distributed and renewable electricity and creating Australian Carbon Credit Units (ACCUs).

LGI has a current portfolio of 26 projects with long- term contracts, across the Australian eastern seaboard and says it has a strong pipeline of growth opportunities, investing capital to optimise the conversion of biogas to revenue,

The plan after listing is to increase biogas revenue through additional ACCU projects and landfill biogas-to-power stations, and expanding existing biogas-to-power stations; increase exposure to high quality landfill gas sites; and strengthen the premium electricity offering deploying hybrid battery systems that increase LGI’s ability to optimise the price it receives for electricity.

Listing: 11 October

IPO: $15m at $0.20

This O&G junior has two exploration permits in the Surat Basin in South East Queensland, ATP 2037 and ATP 2038. The two permits represent an area of over 250,000 acres and are located approximately 50km away from critical gas transmission infrastructure.

The exploration program will explore the Permian Deep Gas play which, if successful, represents a potential multi-TCF gas resource.

Listing: 13 October

IPO: $5m at $0.20

This explorer is focused on the exploration and development of manganese and rare earths projects in the NT and WA.

Projects include the Amadeus Project (prospective for manganese), the Coomarie Project (prospective for heavy rare earths), the Nolans East Project (prospective for light rare earths) and the Pargee Project (prospective for heavy rare earths).

Here are the best performing ASX small cap stocks for September 24 to September 30:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| DUN | Dundasminerals | 0.64 | 205% | $25,565,468.94 |

| MGA | Metalsgrovemining | 0.195 | 63% | $7,920,110.00 |

| CGS | Cogstate Ltd | 2.17 | 48% | $383,144,011.51 |

| BXN | Bioxyne Ltd | 0.026 | 44% | $17,924,071.14 |

| ATL | Apollo Tourism | 0.725 | 41% | $134,959,408.30 |

| QXR | Qx Resources Limited | 0.047 | 38% | $41,249,391.41 |

| CFO | Cfoam Limited | 0.004 | 33% | $2,568,442.22 |

| GGX | Gas2Grid Limited | 0.002 | 33% | $8,116,204.16 |

| ROO | Roots Sustainable | 0.004 | 33% | $3,373,347.10 |

| GW1 | Greenwing Resources | 0.38 | 33% | $50,098,939.60 |

| WC1 | Westcobarmetals | 0.275 | 31% | $7,380,018.00 |

| ALA | Arovella Therapeutic | 0.034 | 31% | $20,796,375.05 |

| LGM | Legacy Minerals | 0.15 | 30% | $6,868,620.30 |

| ALY | Alchemy Resource Ltd | 0.027 | 29% | $19,061,519.10 |

| PSC | Prospect Res Ltd | 0.11 | 28% | $48,537,243.51 |

| SKN | Skin Elements Ltd | 0.034 | 26% | $14,729,727.04 |

| CBY | Canterbury Resources | 0.044 | 26% | $5,174,338.26 |

| FTC | Fintech Chain Ltd | 0.025 | 25% | $16,269,239.70 |

| HVM | Happy Valley | 0.05 | 25% | $9,776,359.12 |

| MGG | Mogul Games Grp Ltd | 0.0025 | 25% | $6,526,882.41 |

| RDN | Raiden Resources Ltd | 0.01 | 25% | $14,845,518.70 |

| TTM | Titan Minerals | 0.079 | 23% | $103,022,942.58 |

| SOM | SomnoMed Limited | 1.47 | 23% | $115,863,041.00 |

| GES | Genesis Resources | 0.011 | 22% | $8,611,254.23 |

| UUL | Ultima Utd Ltd | 0.08 | 21% | $6,304,447.06 |

| SIH | Sihayo Gold Limited | 0.003 | 20% | $12,204,256.18 |

| CAU | Cronos Australia | 0.715 | 19% | $404,690,613.19 |

| NUH | Nuheara Limited | 0.22 | 19% | $30,182,971.72 |

| BTR | Brightstar Resources | 0.019 | 19% | $12,937,217.38 |

| DTI | DTI Group Ltd | 0.019 | 19% | $7,625,374.04 |

| ICG | Inca Minerals Ltd | 0.041 | 17% | $19,757,684.30 |

| IRX | Inhalerx Limited | 0.069 | 17% | $11,624,220.03 |

| AJQ | Armour Energy Ltd | 0.007 | 17% | $13,550,705.26 |

| SGI | Stealth Global | 0.14 | 17% | $11,465,500.00 |

| TEG | Triangle Energy Ltd | 0.014 | 17% | $17,479,016.17 |

| HMI | Hiremii | 0.05 | 16% | $5,293,357.95 |

| MTO | Motorcycle Hldg | 2.5 | 16% | $148,713,171.10 |

| 3PL | 3P Learning Ltd | 1.4 | 16% | $362,194,262.70 |

| GO2 | Thego2People | 0.015 | 15% | $6,099,573.81 |

| HXL | Hexima | 0.015 | 15% | $2,396,081.27 |

| IBG | Ironbark Zinc Ltd | 0.015 | 15% | $17,645,882.71 |

| RFA | Rare Foods Australia | 0.068 | 15% | $14,051,994.60 |

| IKE | Ikegps Group Ltd | 0.77 | 15% | $103,657,776.95 |

| MXO | Motio Ltd | 0.039 | 15% | $10,046,484.12 |

| BUY | Bounty Oil & Gas NL | 0.008 | 14% | $10,964,007.86 |

| GTG | Genetic Technologies | 0.004 | 14% | $27,701,895.43 |

| PCL | Pancontinental Energ | 0.004 | 14% | $22,662,668.43 |

| RBR | RBR Group Ltd | 0.004 | 14% | $5,150,481.38 |

| LIN | Lindian Resources | 0.325 | 14% | $271,471,044.16 |

| S3N | Sensore Ltd | 0.46 | 14% | $11,081,480.52 |

Here are the best performing ASX small cap stocks for September 19 to September 23:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| 1CG | One Click Group Ltd | 0.017 | -58% | $10,078,585.78 |

| REY | REY Resources Ltd | 0.12 | -55% | $25,431,304.68 |

| AR1 | Australresources | 0.2 | -42% | $59,191,366.80 |

| MCM | Mc Mining Ltd | 0.41 | -42% | $88,944,691.50 |

| HTG | Harvest Tech Grp Ltd | 0.06 | -38% | $43,654,564.18 |

| AYM | Australia United Min | 0.004 | -33% | $7,370,309.94 |

| EVE | EVE Health Group Ltd | 0.001 | -33% | $5,274,482.66 |

| RAN | Range International | 0.006 | -33% | $6,575,032.24 |

| ACS | Accent Resources NL | 0.025 | -32% | $13,048,763.92 |

| CBE | Cobre | 0.1275 | -31% | $27,500,773.73 |

| BMG | BMG Resources Ltd | 0.02 | -31% | $7,719,833.16 |

| CYM | Cyprium Metals Ltd | 0.068 | -31% | $50,383,682.70 |

| ALM | Alma Metals Ltd | 0.0105 | -30% | $10,376,067.08 |

| ADR | Adherium Ltd | 0.005 | -29% | $12,809,249.33 |

| NYR | Nyrada Inc. | 0.1 | -29% | $20,281,131.00 |

| LNY | Laneway Res Ltd | 0.005 | -29% | $39,228,098.46 |

| LEL | Lithenergy | 0.71 | -28% | $43,909,500.00 |

| RAG | Ragnar Metals Ltd | 0.028 | -28% | $15,167,395.56 |

| GRE | Greentechmetals | 0.14 | -26% | $4,535,599.86 |

| AJL | AJ Lucas Group | 0.115 | -26% | $137,572,963.03 |

| NC1 | Nicoresourceslimited | 0.52 | -26% | $48,798,376.11 |

| AO1 | Assetowl Limited | 0.0015 | -25% | $2,358,194.64 |

| ARE | Argonaut Resources | 0.0015 | -25% | $8,142,806.91 |

| AUH | Austchina Holdings | 0.006 | -25% | $14,257,829.12 |

| BOA | Boadicea Resources | 0.105 | -25% | $8,546,988.45 |

| BPP | Babylon Pump & Power | 0.0045 | -25% | $12,288,856.72 |

| CBH | Coolabah Metals Limi | 0.105 | -25% | $4,044,000.12 |

| DW8 | DW8 Limited | 0.006 | -25% | $16,225,272.10 |

| KEY | KEY Petroleum | 0.0015 | -25% | $3,935,856.25 |

| MBK | Metal Bank Ltd | 0.003 | -25% | $9,127,363.56 |

| TD1 | Tali Digital Limited | 0.003 | -25% | $3,697,891.57 |

| OZM | Ozaurum Resources | 0.079 | -25% | $5,925,860.00 |

| UVA | Uvrelimited | 0.14 | -24% | $4,724,998.50 |

| SRX | Sierra Rutile | 0.2125 | -24% | $93,332,018.34 |

| CRR | Critical Resources | 0.063 | -24% | $93,744,960.06 |

| SRR | Saramaresourcesltd | 0.099 | -24% | $4,291,168.09 |

| NIM | Nimyresourceslimited | 0.275 | -24% | $15,453,055.24 |

| S66 | Star Combo | 0.18 | -23% | $24,314,936.58 |

| PUR | Pursuit Minerals | 0.0115 | -23% | $11,978,150.33 |

| BTC | BTC Health Ltd | 0.043 | -23% | $12,401,239.58 |

| 3DA | Amaero International | 0.1 | -23% | $22,773,030.31 |

| HPC | Thehydration | 0.1 | -23% | $18,701,261.80 |

| INP | Incentiapay Ltd | 0.01 | -23% | $12,650,636.25 |

| NCZ | New Century Resource | 1.055 | -23% | $146,709,598.56 |

| PO3 | Purifloh Ltd | 0.27 | -23% | $8,511,344.46 |

| TGN | Tungsten Min NL | 0.081 | -23% | $73,136,527.30 |

| NRX | Noronex Limited | 0.034 | -23% | $5,966,092.55 |

| W2V | Way2Vatltd | 0.031 | -23% | $6,046,702.60 |

| RFT | Rectifier Technolog | 0.031 | -23% | $42,622,022.36 |

| LNR | Lanthanein Resources | 0.038 | -22% | $37,550,197.23 |