Weekly Small Cap and IPO Wrap: A tough one for myopic traders… or just the calm before the storm?

News

News

If politics can pack a lot in a day, give markets a week and they’ll take a mile.

It’s been hard work from Monday on. We’ve had three central bank rate rises. One record climb and a mighty fall in response.

The benchmark ASX200 is going to fall the most it has in a single week in well over a few years and the Emerging Companies XEC has shed some 6.6% for the week.

Ach. It’s not a great time to be all in tech. Our sector has shed about 4% today. One fears where the Nasdaq will head to from here.

Perhaps time to bring a few professionals in to the picture for a bit of a race around the grounds.

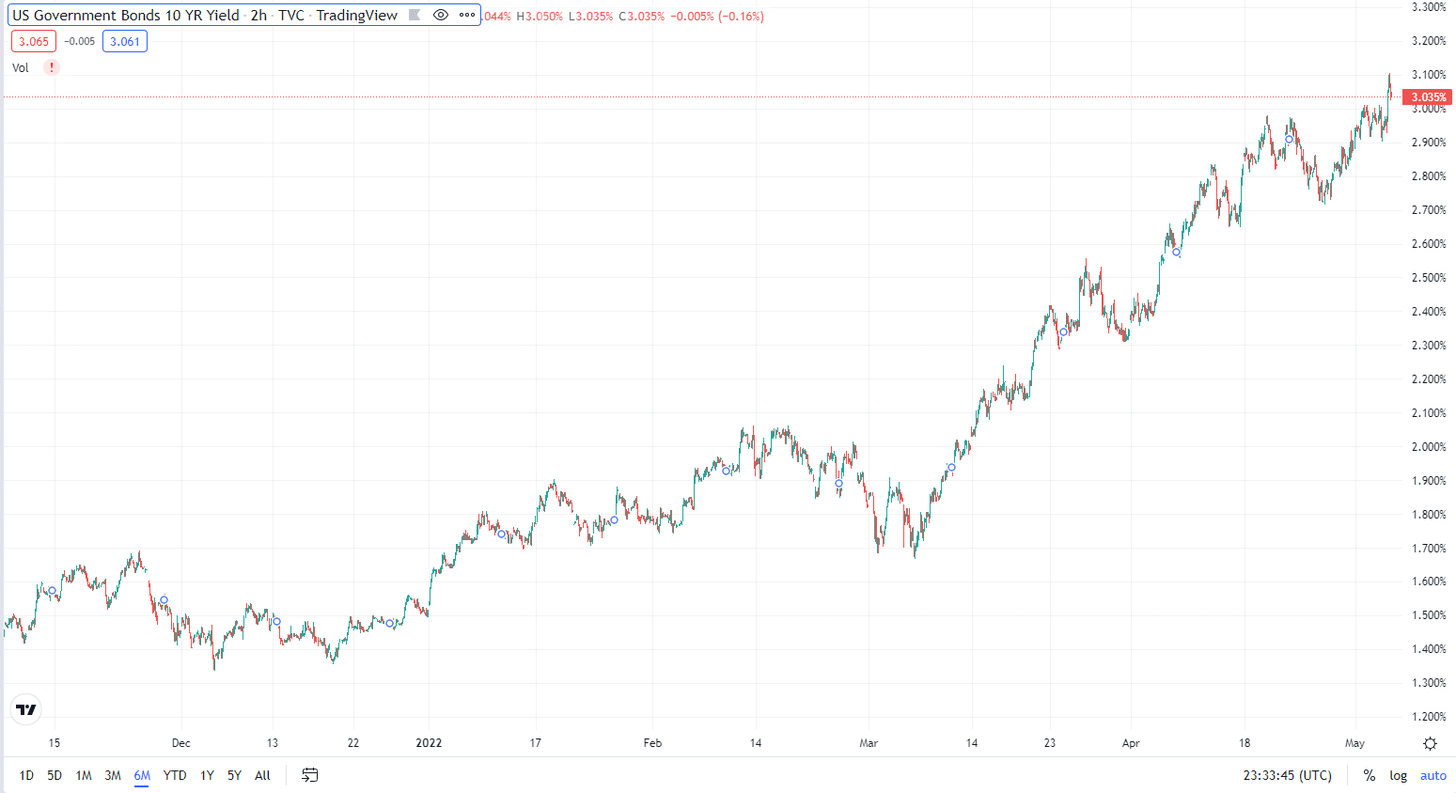

Mad chartist, philosopher and thinker, Lessep IM’s James White reckons bond yields are peaking.

He says the US-10yr is slowly losing upward momentum.

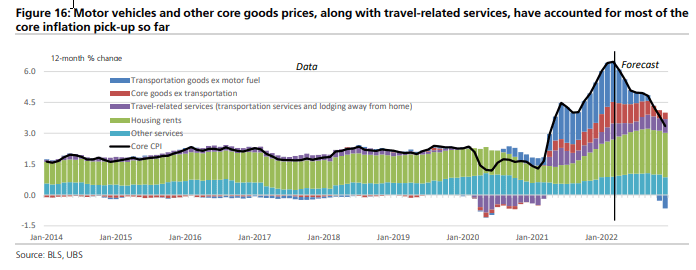

“Some of is the Fed, but it’s mainly activity,” White says. “UBS reckon April was the peak for inflation. They expect core and headline inflation to be below 2% by year end. The decline in transport reflects lower used-car prices.”

Indeed, White says, these tippy-toppy rises are likely to lead to lower prices, down the track, on the back of weaker demand.

“No Christian, the debate over transitory inflation or not has not been decided.”

Really?

“No. For instance, in Europe, one-year forward electricity prices are up 4x on the start of 2021. Lower demand is coming. Factories don’t make money on these prices.

Commentary in the US Services ISM Survey said as much with wholesalers highlighting cost pressures are hurting demand, retailers blaming supply chains and public administration impacted by staff shortages.”

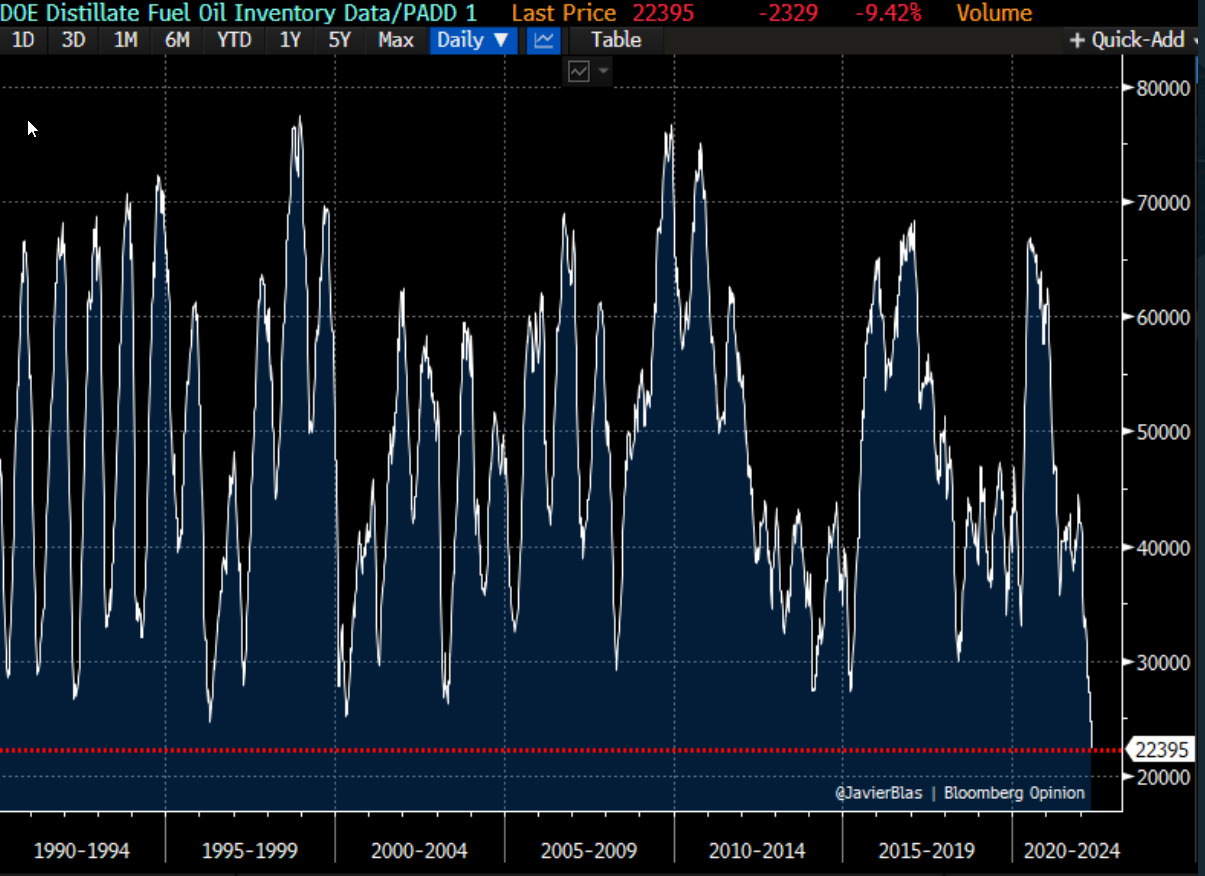

James says a common theme running through the fatalistic end of the market is “a complete breakdown in commodity markets. ”

“The Credit Suisse strategist Zoltan Pozsar sums it up best: “central banks can’t print oil”.

“The argument goes that there is no policy solution to an absence of physical commodities created by fundamental disruptions, such as the war in Ukraine,” he adds.

White’s current focus is New York diesel, where current inventories are at 30-year lows.

“It’s unclear what happens if they run to zero,” he says, without much irony.

Meanwhile over in lithium spodumene spot land, “prices seem to have eased slightly but remain high relative to history.

“This chart from Hartleys shows a gap between Allkem’s contract price and the spot price,” White observes.

Taking us back home is CBA’s Gareth Aird, who points out the central banks surely has radically upgraded their forecast profile for underlying inflation.

Aird reckons the RBA’s central scenario puts the trimmed mean at 4.6%/yr at end-2022 (where it’s forecast to peak). The bank now expects the unemployment rate to be 3.8% by mid-2022 and to further decline to 3.6% over 2023.

“We expect the RBA to deliver 25 basis point rate hikes in June, July, August and November 2022 that would see the cash rate target end the year at 1.35%.

“We then expect a further 25 basis point rate hike in February 2023 that would see the cash rate target at 1.60%, Aird says.

“From there we have the key policy rate on hold over 2023.”

“Looking ahead, the RBA acknowledged (in its SoMP) that there is significant uncertainty for the global economy.

“It is uncertain how consumer demand will respond to withdrawing stimulus in the context of very high inflation and tight labour markets. Due to the above factors and significant uncertainty, the RBA’s view is that the risk to global growth is skewed to the downside.

“We very much agree,” Aird says.

So. Not quite yet, is the answer.

Solstice Minerals (ASX:SLS) is down 16% for the week. Sadly, the wholly-owned subsidiary of OreCorp (ASX:ORR), gold and nickel focused Solstice jumped to 30% above its listing price to $0.26 per share before settling around $0.225 or 12.49% up on Monday.

The IPO of $12m at $0.20, focuses on four WA assets; Yarri, Kalgoorlie, Yundamindra and Ponton.

“We believe that the demerger and separate listing of Solstice Minerals presents an exceptional opportunity to realise the inherent long-term value of the WA Assets through the creation of a WA focussed corporate vehicle,” executive director Alastair Morrison said.

“With a cash balance of $17 million (before costs, including the Company’s cash balance at demerger) and an experienced Board and senior management team, we look forward to progressing exploration and development activities on the WA Assets and building long-term value for shareholders and other stakeholders.”

Sarama Resources (ASX:SRR) is down 5% for the week after it listed at 20 cents a pop following an IPO of $8m.

The West African gold explorer, already listed on the TSX, and jumped 10% in early trade on Monday.

The company has sights set on growing its flagship Sanutura project in Burkina Faso, which is already pretty big with mineral resource of 2.9Moz. Funds from the ASX IPO will be used for first major drill program in 5 years, with 50,000m of mostly extensional drilling planned in the next 12 months.

The company also has two other assets in the region – the Koumandara project and Karankasso JV with Endeavour Mining (TSE:EDV) Soil geochemical surveys and auger and scout drilling at Koumandara have all delivered high-grade results to date – including 4m at 13.55 g/t gold.

The CSIRO-backed mining-tech firm Chrysos Corp (ASX:C79) ‘coming out party really makes one want to go back in – it’s been a shite ASX debut and not your fault – but giving up a third of your market value probably doesn’t make it any easier to swallow.

The company backed by the hilt by 22% shareholder the science-y peeps at the CSIRO, does analysis for the gold sector. A fine niche, one would think.

They use X-rays that bombard rock samples and consequently activate gold atoms and the like.

Chrysos raised circa $185 million at $6.50 a pop, in what many reckoned would be one of the fatter float of ’22.

Here are the best performing ASX small cap stocks for May 2 – 6:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| E33 | East 33 Limited. | 0.075 | 200% | $18,020,421 |

| PBX | Pacific Bauxite Ltd | 0.19 | 90% | $8,648,326 |

| OEQ | Orion Equities | 0.375 | 79% | $4,773,015 |

| HCD | Hydrocarbon Dynamic | 0.032 | 68% | $16,437,484 |

| RAB | Adrabbit Limited | 0.041 | 64% | $9,475,874 |

| MMA | Maronanmetalslimited | 0.32 | 60% | $24,000,003 |

| SRK | Strike Resources | 0.2125 | 52% | $60,750,000 |

| JAV | Javelin Minerals Ltd | 0.0015 | 50% | $13,759,879 |

| MTC | Metalstech Ltd | 0.355 | 48% | $56,665,961 |

| IVZ | Invictus Energy Ltd | 0.275 | 45% | $190,812,545 |

| 99L | 99 Loyalty Ltd. | 0.048 | 41% | $55,664,772 |

| MMG | Monger Gold Ltd | 0.39 | 39% | $9,250,000 |

| BEL | Bentley Capital Ltd | 0.11 | 38% | $8,374,071 |

| SIH | Sihayo Gold Limited | 0.004 | 33% | $14,741,846 |

| ICT | Icollege Limited | 0.13 | 30% | $140,757,854 |

| BMR | Ballymore Resources | 0.24 | 30% | $17,634,739 |

| NET | Netlinkz Limited | 0.058 | 29% | $179,473,818 |

| RHI | Red Hill Iron | 4.38 | 28% | $277,652,448 |

| AZI | Altamin Limited | 0.096 | 28% | $37,996,525 |

| BIT | Biotron Limited | 0.093 | 27% | $63,173,944 |

| LEL | Lithenergy | 1.535 | 26% | $76,950,000 |

| ROG | Red Sky Energy. | 0.0075 | 25% | $42,417,818 |

| FRM | Farm Pride Foods | 0.16 | 23% | $8,001,125 |

| AR1 | Australresources | 0.24 | 23% | $63,755,533 |

| SUH | Southern Hem Min | 0.027 | 23% | $7,919,849 |

| PKO | Peako Limited | 0.022 | 22% | $7,402,898 |

| AVE | Avecho Biotech Ltd | 0.022 | 22% | $34,918,438 |

| TBA | Tombola Gold Ltd | 0.065 | 20% | $54,377,895 |

| RTG | RTG Mining Inc. | 0.096 | 20% | $76,443,898 |

Here are the best performing ASX small cap stocks for May 2 – 6:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| AMS | Atomos | 0.345 | -52% | $133,410,951 |

| ALT | Analytica Limited | 0.001 | -50% | $4,613,801 |

| YPB | YPB Group Ltd | 0.001 | -50% | $6,117,834 |

| OVN | Oventus Medical Ltd | 0.018 | -49% | $5,317,984 |

| RCW | Rightcrowd | 0.064 | -47% | $17,755,872 |

| BKG | Booktopia Group | 0.45 | -36% | $64,558,871 |

| ARV | Artemis Resources | 0.04 | -34% | $63,863,225 |

| ALY | Alchemy Resource Ltd | 0.025 | -34% | $23,826,851 |

| SDV | Scidev Ltd | 0.26 | -34% | $50,721,303 |

| ZLD | Zelira Therapeutics | 1.4 | -34% | $13,360,077 |

| NHE | Nobleheliumlimited | 0.2 | -33% | $17,625,412 |

| IOU | Ioupay Limited | 0.095 | -32% | $53,486,970 |

| MLS | Metals Australia | 0.1025 | -32% | $43,512,637 |

| IHR | intelliHR Limited | 0.11 | -31% | $42,392,614 |

| HVM | Happy Valley | 0.052 | -31% | $12,539,243 |

| RTH | Ras Tech | 0.52 | -30% | $24,774,929 |

| TPW | Temple & Webster Ltd | 4.33 | -29% | $595,342,040 |

| AQC | Auspaccoal Ltd | 0.17 | -29% | $8,582,418 |

| QHL | Quickstep Holdings | 0.475 | -29% | $36,530,282 |

| IMB | Intelligent Monitor | 0.22 | -29% | $14,630,968 |

| REM | Remsensetechnologies | 0.235 | -29% | $8,553,759 |

| HMI | Hiremii | 0.05 | -29% | $5,610,959 |

| MKL | Mighty Kingdom Ltd | 0.07 | -29% | $8,026,828 |

| TSL | Titanium Sands Ltd | 0.015 | -29% | $18,749,174 |

| AJX | Alexium Int Group | 0.043 | -28% | $29,036,547 |

| WMG | Western Mines | 0.245 | -28% | $8,974,963 |

| ABB | Aussie Broadband | 4.04 | -28% | $952,868,892 |

| NC1 | Nicoresourceslimited | 1.135 | -28% | $110,807,503 |

| MPG | Manypeaksgoldlimited | 0.405 | -28% | $14,124,880 |

| NIM | Nimyresourceslimited | 0.4 | -27% | $18,779,893 |

| WA1 | Wa1Resourcesltd | 0.16 | -27% | $5,667,001 |

| LPE | Locality Planning | 0.051 | -27% | $9,414,280 |

| EMS | Eastern Metals | 0.165 | -27% | $6,408,000 |

| HMD | Heramed Limited | 0.14 | -26% | $31,783,173 |

| PIL | Peppermint Inv Ltd | 0.014 | -26% | $29,956,284 |

| GED | Golden Deeps | 0.0155 | -26% | $19,637,709 |

| IVO | Invigor Group Ltd | 0.04 | -26% | $7,200,394 |

| WRM | White Rock Min Ltd | 0.145 | -26% | $22,076,620 |

| IAM | Income Asset | 0.145 | -26% | $49,719,748 |

| LRV | Larvottoresources | 0.305 | -26% | $12,980,363 |

| BCC | Beam Communications | 0.25 | -25% | $22,901,809 |

| BEX | Bikeexchange Ltd | 0.05 | -25% | $8,861,389 |

| AHK | Ark Mines Limited | 0.34 | -25% | $12,824,390 |

| BASDA | Bass Oil Ltd | 0.045 | -25% | $7,380,290 |

| EVE | EVE Health Group Ltd | 0.0015 | -25% | $6,464,713 |

| KEY | KEY Petroleum | 0.003 | -25% | $5,903,784 |

| LV1 | Live Verdure Ltd | 0.225 | -25% | $9,464,473 |

| NUHDB | Nuheara Limited | 0.18 | -25% | $17,641,526 |

| PO3 | Purifloh Ltd | 0.45 | -25% | $14,185,574 |

| VOL | Victory Offices Ltd | 0.105 | -25% | $16,574,042 |

| XST | Xstate Resources | 0.003 | -25% | $11,253,136 |

| SPX | Spenda Limited | 0.0135 | -25% | $41,085,188 |

| CCG | Comms Group Ltd | 0.083 | -25% | $33,241,490 |

| AFA | ASF Group Limited | 0.04 | -25% | $31,707,452 |

| TMZ | Thomson Res Ltd | 0.031 | -24% | $20,793,627 |

| WMC | Wiluna Mining Corp | 0.56 | -24% | $118,336,369 |

| VR8 | Vanadium Resources | 0.11 | -24% | $54,407,923 |

| RNU | Renascor Res Ltd | 0.22 | -24% | $505,665,882 |

| TEM | Tempest Minerals | 0.076 | -24% | $40,379,108 |

| 1AG | Alterra Limited | 0.016 | -24% | $4,444,420 |

| CZR | CZR Resources Ltd | 0.013 | -24% | $48,808,526 |

| PGY | Pilot Energy Ltd | 0.023 | -23% | $13,114,148 |

| AUH | Austchina Holdings | 0.01 | -23% | $22,063,375 |

| CRS | Caprice Resources | 0.1 | -23% | $8,222,347 |

| EGY | Energy Tech Ltd | 0.06 | -23% | $16,336,513 |

| GRE | Greentechmetals | 0.185 | -23% | $5,721,812 |

| AIV | Activex Limited | 0.044 | -23% | $9,512,913 |

| AYT | Austin Metals Ltd | 0.017 | -23% | $17,269,869 |

| EM1 | Emerge Gaming Ltd | 0.017 | -23% | $19,060,993 |

| CTT | Cettire | 0.51 | -23% | $217,305,785 |

| AVL | Aust Vanadium Ltd | 0.055 | -23% | $207,896,568 |

| REC | Rechargemetals | 0.31 | -23% | $11,078,050 |

| PVS | Pivotal Systems | 0.31 | -23% | $49,422,913 |

| LPM | Lithium Plus | 0.71 | -22% | $34,802,196 |

| AEV | Avenira Limited | 0.014 | -22% | $16,017,351 |

| AHN | Athena Resources | 0.007 | -22% | $6,503,740 |

| MIO | Macarthur Minerals | 0.35 | -22% | $56,438,721 |

| ACW | Actinogen Medical | 0.067 | -22% | $126,354,711 |

| BNR | Bulletin Res Ltd | 0.1675 | -22% | $50,765,790 |

| STP | Step One Limited | 0.6 | -22% | $114,910,980 |

| BWX | BWX Limited | 1.3875 | -22% | $238,860,015 |

| SCT | Scout Security Ltd | 0.039 | -22% | $5,982,391 |

| WC8 | Wildcat Resources | 0.032 | -22% | $20,003,455 |

| B4P | Beforepay Group | 0.36 | -22% | $12,861,666 |

| GBZ | GBM Rsources Ltd | 0.094 | -22% | $51,792,568 |

| AS2 | Askarimetalslimited | 0.545 | -22% | $24,669,470 |

| NRX | Noronex Limited | 0.051 | -22% | $8,693,449 |

| LRD | Lordresourceslimited | 0.31 | -22% | $9,697,156 |

| EDE | Eden Inv Ltd | 0.011 | -21% | $25,477,184 |

| TMK | TMK Energy Limited | 0.011 | -21% | $34,560,000 |

| WZR | Wisr Ltd | 0.11 | -21% | $149,182,520 |

| KGN | Kogan.Com Ltd | 3.57 | -21% | $404,186,339 |

| AM7 | Arcadia Minerals | 0.24 | -21% | $8,573,163 |

| RDN | Raiden Resources Ltd | 0.013 | -21% | $19,791,155 |

| ESS | Essential Metals Ltd | 0.52 | -21% | $141,221,592 |

| PGM | Platina Resources | 0.041 | -21% | $18,244,058 |

| CPM | Coopermetalslimited | 0.355 | -21% | $9,997,400 |

| ECT | Env Clean Tech Ltd. | 0.0245 | -21% | $46,338,795 |

| KNI | Kunikolimited | 0.91 | -21% | $39,191,100 |

| AX8 | Accelerate Resources | 0.038 | -21% | $10,274,897 |

| MXO | Motio Ltd | 0.057 | -21% | $15,246,814 |

| NGY | Nuenergy Gas Ltd | 0.023 | -21% | $37,023,887 |

| AN1 | Anagenics Limited | 0.035 | -20% | $8,398,810 |

| ODE | Odessa Minerals Ltd | 0.0175 | -20% | $9,668,720 |

| 3DA | Amaero International | 0.215 | -20% | $46,671,324 |

| AFW | Applyflow Limited | 0.002 | -20% | $5,915,216 |

| AJQ | Armour Energy Ltd | 0.008 | -20% | $18,355,062 |

| GLA | Gladiator Resources | 0.024 | -20% | $13,290,418 |

| KLI | Killiresources | 0.24 | -20% | $8,580,000 |

| LNY | Laneway Res Ltd | 0.004 | -20% | $31,510,082 |

| TD1 | Tali Digital Limited | 0.008 | -20% | $11,023,125 |

| BGT | Bio-Gene Technology | 0.2 | -20% | $39,832,497 |

| BRU | Buru Energy | 0.16 | -20% | $86,150,879 |

| GTG | Genetic Technologies | 0.004 | -20% | $36,935,861 |

| ICI | Icandy Interactive | 0.1 | -20% | $138,486,139 |

| CR9 | Corellares | 0.037 | -20% | $12,639,995 |

| POD | Podium Minerals | 0.37 | -20% | $117,976,402 |

| NIS | Nickelsearch | 0.165 | -20% | $11,132,316 |

| 1MC | Morella Corporation | 0.029 | -19% | $165,638,848 |

| JGH | Jade Gas Holdings | 0.05 | -19% | $28,685,612 |

| OVT | Ovato Limited | 0.125 | -19% | $18,242,078 |

| GLH | Global Health Ltd | 0.23 | -19% | $14,728,939 |

| NSB | Neuroscientific | 0.23 | -19% | $33,715,836 |

| CG1 | Carbonxt Group | 0.23 | -19% | $49,196,252 |

| PTR | Petratherm Ltd | 0.105 | -19% | $24,722,625 |

| CDT | Castle Minerals | 0.042 | -19% | $45,976,677 |

| HOR | Horseshoe Metals Ltd | 0.034 | -19% | $20,728,729 |

| LRK | Lark Distilling Co. | 2.88 | -19% | $235,708,960 |

| EXL | Elixinol Wellness | 0.043 | -19% | $13,599,420 |

| ARL | Ardea Resources Ltd | 1.315 | -19% | $232,540,748 |

| PAK | Pacific American Hld | 0.013 | -19% | $6,212,406 |

| PUA | Peak Minerals Ltd | 0.013 | -19% | $13,537,820 |

| SKF | Skyfii Ltd | 0.0715 | -19% | $31,048,404 |

| RDT | Red Dirt Metals Ltd | 0.435 | -19% | $136,392,074 |

| ICE | Icetana Limited | 0.035 | -19% | $5,977,653 |

| HCH | Hot Chili Ltd | 1.34 | -19% | $150,395,105 |

| IBX | Imagion Biosys Ltd | 0.044 | -19% | $52,697,271 |

| SPT | Splitit | 0.265 | -18% | $119,934,971 |

| AL3 | Aml3D | 0.062 | -18% | $9,478,878 |

| ENT | Enterprise Metals | 0.0155 | -18% | $10,958,997 |

| MR1 | Montem Resources | 0.031 | -18% | $7,984,393 |

| CIO | Connected Io Ltd | 0.04 | -18% | $13,988,456 |

| CL8 | Carly Holdings Ltd | 0.04 | -18% | $4,652,879 |

| NZK | NZK Salmon Ltd | 0.245 | -18% | $30,940,295 |

| ADR | Adherium Ltd | 0.009 | -18% | $19,874,260 |

| CUL | Cullen Resources | 0.018 | -18% | $7,323,459 |

| M3M | M3Mininglimited | 0.135 | -18% | $4,554,904 |

| PHO | Phosco Ltd | 0.135 | -18% | $32,776,811 |

| CRR | Critical Resources | 0.09 | -18% | $139,835,616 |

| AW1 | Americanwestmetals | 0.16 | -18% | $13,819,500 |

| KWR | Kingwest Resources | 0.16 | -18% | $41,305,414 |

| SHH | Shree Minerals Ltd | 0.0115 | -18% | $14,666,843 |

| WCN | White Cliff Min Ltd | 0.023 | -18% | $16,340,084 |

| CTO | Citigold Corp Ltd | 0.007 | -18% | $19,835,614 |

| MOH | Moho Resources | 0.042 | -18% | $6,246,177 |

| MPR | Mpower Group Limited | 0.028 | -18% | $6,441,478 |

| OAU | Ora Gold Limited | 0.014 | -18% | $13,754,238 |

| TMS | Tennant Minerals Ltd | 0.042 | -18% | $26,512,779 |

| TYM | Tymlez Group | 0.028 | -18% | $31,579,249 |

| MDR | Medadvisor Limited | 0.21 | -18% | $79,415,388 |

| QXR | Qx Resources Limited | 0.056 | -18% | $49,118,015 |

| EX1 | Exopharm Limited | 0.165 | -18% | $26,725,961 |

| SRN | Surefire Rescs NL | 0.033 | -18% | $45,601,205 |

| PRX | Prodigy Gold NL | 0.019 | -17% | $11,652,552 |

| MRR | Minrex Resources Ltd | 0.057 | -17% | $61,531,646 |

| ST1 | Spirit Technology | 0.076 | -17% | $50,518,992 |

| 3DP | Pointerra Limited | 0.2025 | -17% | $138,950,272 |

| HT8 | Harris Technology Gl | 0.043 | -17% | $12,528,410 |

| DOC | Doctor Care Anywhere | 0.215 | -17% | $49,988,424 |

| AKN | Auking Mining Ltd | 0.12 | -17% | $11,247,871 |

| SHO | Sportshero Ltd | 0.024 | -17% | $15,954,242 |

| VTI | Vision Tech Inc | 0.41 | -17% | $10,333,141 |

| AYA | Artryalimited | 0.725 | -17% | $45,411,912 |

| RRR | Revolverresources | 0.315 | -17% | $29,670,358 |

| ILA | Island Pharma | 0.17 | -17% | $7,784,339 |

| 3MF | 3D Metalforge | 0.025 | -17% | $3,610,946 |

| ABV | Adv Braking Tech Ltd | 0.03 | -17% | $11,374,463 |

| AVW | Avira Resources Ltd | 0.005 | -17% | $11,653,345 |

| CBL | Control Bionics | 0.3 | -17% | $15,099,272 |

| CR1 | Constellation Res | 0.2 | -17% | $11,228,721 |

| DLT | Delta Drone Intl Ltd | 0.015 | -17% | $4,798,181 |

| LNU | Linius Tech Limited | 0.01 | -17% | $19,425,394 |

| MEG | Megado | 0.125 | -17% | $5,596,344 |

| ROC | Rocketboots | 0.1 | -17% | $3,492,500 |

| SBR | Sabre Resources | 0.005 | -17% | $15,340,407 |

| TEG | Triangle Energy Ltd | 0.0125 | -17% | $12,903,707 |

| WEL | Winchester Energy | 0.015 | -17% | $15,153,297 |

| AIM | Ai-Media Technologie | 0.4 | -17% | $93,097,309 |

| K2F | K2Fly Ltd | 0.2 | -17% | $35,406,374 |

| MMI | Metro Mining Ltd | 0.025 | -17% | $80,696,782 |

| RGL | Riversgold | 0.06 | -17% | $34,858,212 |

| ITM | Itech Minerals Ltd | 0.53 | -17% | $49,559,998 |