UBS picks this ASX mining services stock to catch a ride on the next resources boom

Pic: DKosig / iStock / Getty Images Plus via Getty Images

In more than one expert’s view, global commodity markets have embarked on the next super cycle.

And that could have flow-on effects for other sub-sectors – including ASX mining services stocks, UBS says.

Mining services benefits when commodity prices (driven by supply/demand fundamentals) provide the economic incentive for resources companies to pull the trigger on large-scale capital investment programs.

Since the last mining boom wound down (early last decade), big capital expenditure programs took a back seat to cost-cutting and operating efficiencies.

However, iron ore is now holding at around $US150/tonne, with broader gains across the commodities spectrum.

Yesterday, Stockhead’s Mike Cooper highlighted some recent commentary from Goldman Sachs’ global head of commodities research, Jeffrey Currie:

“Policy-driven demand is going to create a capex cycle that is bigger than the BRICs (Brazil, Russia, India, China) in the 2000s. Not quite as big as the ’70s, but we are talking about that kind of a bull market in commodities.”

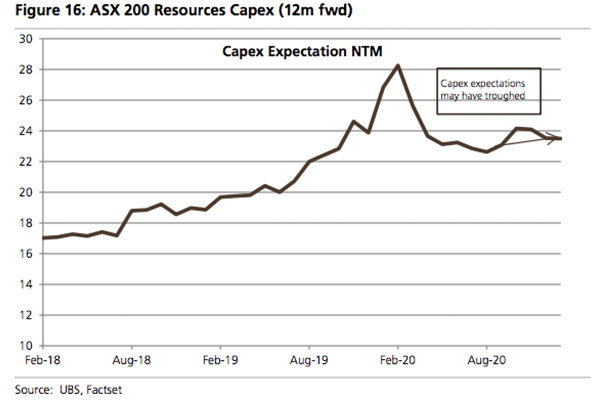

Looking at the domestic market, UBS noted that the capital expenditure expectations of Australia’s biggest companies dipped lower in the wake of the pandemic.

But that could be about to change:

“Capex expectations have likely bottomed after falling earlier in the year,” UBS said.

In addition, “increasing capex expectations is good for mining services.”

One of the key factors underpinning iron ore prices is that despite the increasing gap between supply and demand, iron ore companies are more or less tapped out in their capacity to bring new supply on deck.

However, the boom cycle is expected to remain supportive for mining services stocks as activity picks up.

“Resilient iron ore prices and the maintenance capex cycle may be positive for the sector,” UBS says.

The analysts’ top pick among ASX mining services plays is integrated service provider Downer EDI (ASX:DOW), which has a buy rating and also ticks the boxes for an overweight position in the bank’s model portfolio.

Shares in DOW have climbed off post-crisis lows beneath $3 to around $5.50, but the stock is still trading below pre-crisis levels above $7.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.