Traders’ Diary: Will the ASX become a correctional facility over the next few weeks?

News

Following some really ordinary global leads and some really ordinary Chinese economics, it really was a terrifically ordinary week on the ASX 200.

The back end of the week was a torrid time for Aussie equities. The benchmark lost 2.2%.

The ASX Emerging Co’s (XEC) index lost -0.35% on Friday and -1.9% for the week. The ASX Small Ords (XSO) shed -0.2 and -2.2%.

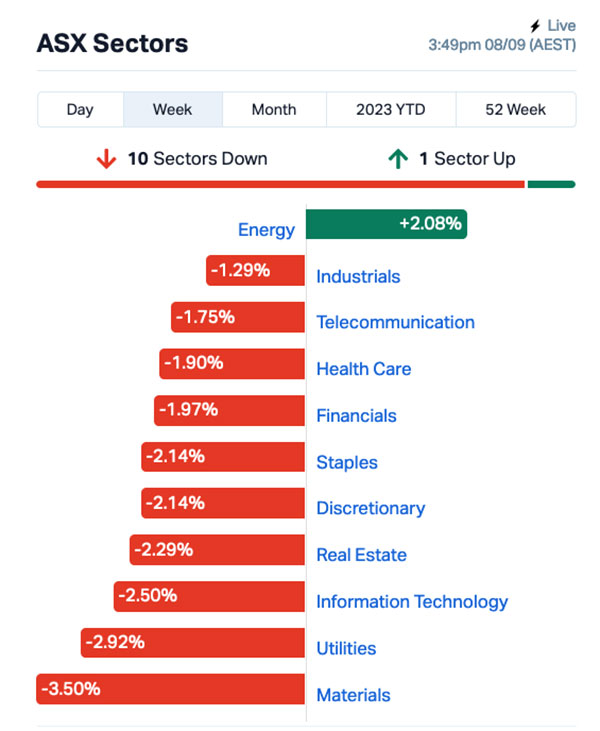

The losses were led by Materials, IT, Utilities and Telco shares.

Energy (+2.1%) was the only sector on song, the rest – as my wingman Gregor Stronach said – offered only bum notes and bilious grunts.

Even the goldies lost some real lustre, the All Gold ASX (XGD) index dropping over -4.0% for the week.

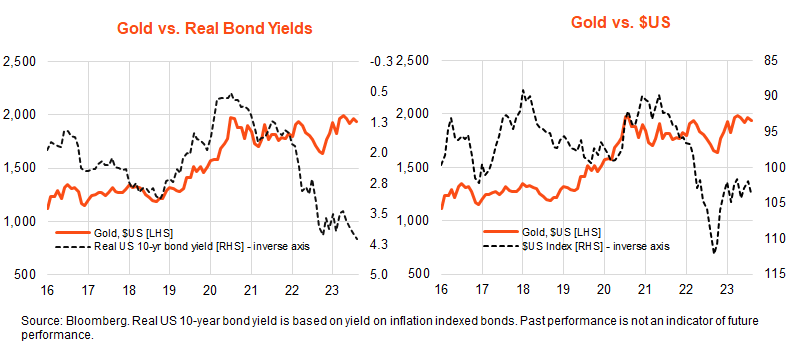

USD gold prices fell 1.3% in August, not helped by higher global bond yields and a firmer US dollar. Both natural enemies of stronger gold prices, according to Betashares David Bassanese.

“Gold performance has inversely tracked that of bond yields and the US dollar in the past year.

“Gold prices weakened over 2022 as bond yields and the US dollar rose, then recovered when both eased from late last year. Accordingly, the rise in bond yields and stablisation of the US dollar has checked the rise of gold yields in recent months.”

Early in the week, the Mulder and Scully routine between US lithium giant Albemarle and our Liontown Resources (ASX:LTR) looked to have finally jumped the shark after Albemarle’s latest $3 a share attempt..

Late in the week LTR’s price has jagged higher in a manner suggestive of a potential last minute rival bid.

But whom might that possibly be, Gina?

Yes, there’s been talk among the traps – loose, drunken talk perhaps – of 5% shareholder Gina Reinhardt lobbing a bomb at the LTR/Albemarle love-in.

Later in the week it was Lithium Plus Minerals (ASX:LPM) which leapt on news that the first completed diamond hole (BYLDD019) at the Lei Prospect has intersected 127m of strongly mineralised pegmatite from 609m (with a true width of ~60m), with assays pending.

LPM says the find represents “one of the largest mineralised intersections ever recorded from the Bynoe pegmatite field”, putting the Lei pegmatite in company with – as it happens – Lithium Plus Minerals’ (ASX:LPM) previously reported world-class 119m intercept at the BP33 deposit.

Shane says the list of existential threats shadowing equity markets in the near-term remains long:

“While shares had a nice bounce at the end of August, they failed to break above late July highs and have started to come under pressure again consistent with our view that the risk of a further near-term correction remains significant.”

In the US, the focus will be on August CPI inflation data (Wednesday) which analysts expect will rebound to 0.6% mom/3.6% yoy (from 3.2% yoy in July) reflecting the rise in oil and gas prices.

US producer price inflation (PPI) drops on Thursday as does retail sales, while industrial production and the New York manufacturing conditions index arrive Friday.

The European Central Bank (ECB) meet Thursday with Christine Lagarde certain to maintain her furious, hawkish bias.

“The risk of a rate hike is high,” Dr Oliver says. “Given concerns about sticky inflation.”

Chinese monthly activity data for August is due on Friday, as are measurements on money supply and credit data.

At home, August jobs data on Thursday.

The Westpac/MI consumer sentiment survey for September and the NAB business survey for July will be released on Tuesday. But I’m not into those.

All sources from Commsec, Trading Economics, S&P Global Research, AMP

MONDAY

TUESDAY

Westpac/MI Consumer Sentiment, September

NAB Business Survey, August

THURSDAY

Labour force survey, August

Employment Participation rate Unemployment rate

FRIDAY

Monday

Malaysia Industrial Production (Jul)

Malaysia Retail Sales (Jul)

Turkey Industrial Production (Jul)

United States Consumer Inflation Expectations (Aug)

China (Mainland) M2, New Yuan Loans, Loan Growth (Aug)

Tuesday

United Kingdom Labour Market Report (Jul)

Eurozone ZEW Economic Sentiment (Sep)

India Industrial Production (Jul)

India Inflation (Aug)

Brazil Inflation (Aug)

OPEC Monthly Report

S&P Global Investment Manager Index (Sep)

Wednesday

South Korea Import and Export Prices (Aug)

South Korea Unemployment Rate (Aug)

Japan PPI (Aug)

United Kingdom monthly GDP, incl. Manufacturing, Services and Construction Output (Jul)

Hong Kong SAR Industrial Production (Q2)

Eurozone Industrial Production (Jul)

United States CPI (Aug)

Thursday

Japan Machinery Orders (Jul)

Australia Employment (Aug)

Singapore Unemployment Rate (Q2, final)

Japan Industrial Production (Jul, final)

South Africa Inflation (Aug)

India WPI (Aug)

Eurozone ECB Interest Rate Decision

United States Retail Sales (Aug)

United States Jobless Claims

United States Business Inventories (Jul)

GEP Global Supply Chain Volatility Index (Aug)

Friday

South Korea Trade (Aug)

Singapore Non-oil Domestic Exports (Aug)

China (Mainland) House Prices (Aug)

China (Mainland) Industrial Production (Aug)

China (Mainland) Retail Sales (Aug)

China (Mainland) Unemployment Rate (Aug)

China (Mainland) Fixed Asset Investment (Aug)

Indonesia Trade (Aug)

Germany Wholesale Prices (Aug)

Eurozone Trade (Jul)

India Trade (Aug)

United States Import and Export Prices (Aug)

United States Industrial Production (Aug)

United States Capacity Utilisation (Aug)

United States UoM Sentiment (Sep, prelim)

United Kingdom Labour Market Report (Jul)

Eurozone ZEW Economic Sentiment (Sep)

India Industrial Production (Jul)

India Inflation (Aug)

Brazil Inflation (Aug)

OPEC Monthly Report

S&P Global Investment Manager Index (Sep)