ASX Small Caps & IPO Weekly Wrap: ASX dips 2.2pc and everyone Torqued like a pirate at Penzance

"Seriously, Warren... get down from there before you hit your head on the top of the picture". Pic via Getty Images.

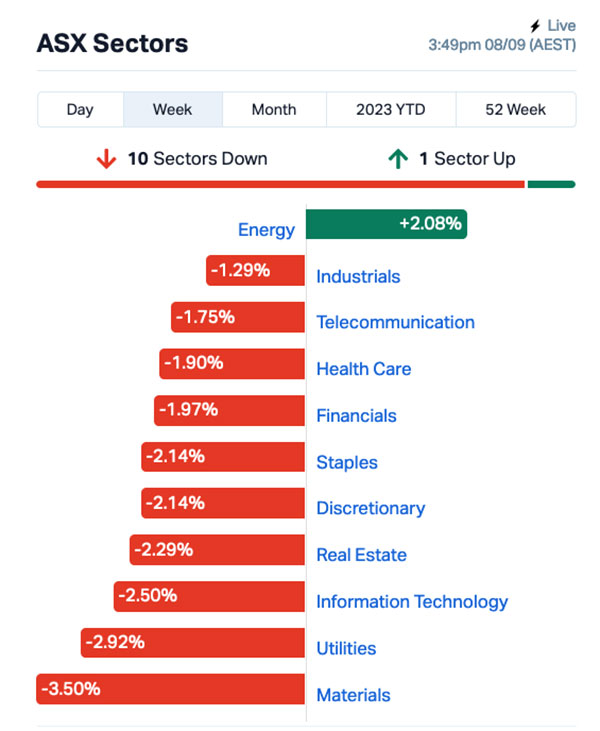

- ASX 200 benchmark rattles to a 2.2% halt since Monday morning.

- Energy sector adds 2.11%, while everything else sank like a stone.

- Torque Metals won the week, up more than 200% on new Penzance project in WA.

It’s not been the best of weeks for the ASX 200, after a string of less-than-excellent days left the benchmark down 2.2%.

Looking at the sectors, it’s not hard to see why – Energy was the lone decent performance from among a chorus of bum notes and bilious grunts, up 2.11% while everything else groaned like winded zombies and fell in a heap.

Even the goldies took a serious set of lumps this week, leaving the normally quite dependable XGD ASX All Ords Gold index a shade over 4.0% down for the week.

Early in the week, all anyone could talk about was lithium – mostly because the great “Will they? Won’t they?” dance between Albemarle and Liontown Resources (ASX:LTR) looked to have finally had a line drawn under it, thanks to Albemarle’s $3 a pop bid.

But… there seems to be some back-room discussions happening somewhere, because LTR’s price has continued to move in a manner suggesting that a rival, better bid could be lurking in the wings.

The rumour mill says Gina Reinhardt – who already owns 5% of LTR – might be considering a crack at gazumping Albemarle, but nothing’s been confirmed at the time of writing.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks for the week 04 – 08 September, 2023:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| TOR | Torque Met | 0.365 | 204% | $32,507,408 |

| LV1 | Live Verdure Ltd | 0.2 | 117% | $15,707,835 |

| CCE | Carnegie Cln Energy | 0.002 | 100% | $31,285,147 |

| CLE | Cyclone Metals | 0.002 | 100% | $20,529,010 |

| ZEU | Zeus Resources Ltd | 0.02 | 67% | $5,970,653 |

| BCT | Bluechiip Limited | 0.032 | 60% | $21,410,114 |

| DM1 | Desert Metals | 0.068 | 58% | $5,005,334 |

| LPM | Lithium Plus | 0.375 | 56% | $23,425,811 |

| ELS | Elsight Ltd | 0.47 | 52% | $57,121,441 |

| KNG | Kingsland Minerals | 0.28 | 51% | $12,074,346 |

| AXP | AXP Energy Ltd | 0.0015 | 50% | $8,737,021 |

| CRB | Carbine Resources | 0.009 | 50% | $3,862,164 |

| KEY | KEY Petroleum | 0.0015 | 50% | $2,951,892 |

| NAE | New Age Exploration | 0.0075 | 50% | $8,615,393 |

| ODE | Odessa Minerals Ltd | 0.012 | 50% | $9,471,118 |

| VPR | Volt Power Group | 0.0015 | 50% | $10,716,208 |

| XTC | Xantippe Res Ltd | 0.0015 | 50% | $35,056,011 |

| KLI | Killiresources | 0.055 | 49% | $3,097,903 |

| BUX | Buxton Resources Ltd | 0.22 | 47% | $33,399,321 |

| SXG | Southern Cross Gold | 0.73 | 46% | $67,091,439 |

| W2V | Way2Vatltd | 0.02 | 43% | $11,929,583 |

| VMM | Viridismining | 0.85 | 42% | $27,344,332 |

| SI6 | SI6 Metals Limited | 0.007 | 40% | $11,963,157 |

| TVN | Tivan Limited | 0.079 | 39% | $120,949,965 |

| IPB | IPB Petroleum Ltd | 0.011 | 38% | $5,651,224 |

| AGD | Austral Gold | 0.031 | 35% | $18,981,652 |

| C29 | C29Metalslimited | 0.09 | 34% | $3,723,022 |

| CXU | Cauldron Energy Ltd | 0.008 | 33% | $8,564,118 |

| ECT | Env Clean Tech Ltd. | 0.008 | 33% | $17,085,331 |

| ELE | Elmore Ltd | 0.004 | 33% | $5,597,535 |

| FAU | First Au Ltd | 0.004 | 33% | $5,807,973 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619 |

| TYM | Tymlez Group | 0.004 | 33% | $4,952,781 |

| SPD | Southernpalladium | 0.37 | 32% | $14,431,240 |

| SUH | Southern Hem Min | 0.025 | 32% | $11,063,933 |

| BXN | Bioxyne Ltd | 0.017 | 31% | $32,327,972 |

| EME | Energy Metals Ltd | 0.17 | 31% | $35,646,163 |

| RDN | Raiden Resources Ltd | 0.039 | 30% | $89,285,034 |

| PNT | Panthermetalsltd | 0.078 | 30% | $4,892,000 |

| SER | Strategic Energy | 0.0155 | 29% | $7,257,227 |

| ASR | Asra Minerals Ltd | 0.009 | 29% | $12,963,484 |

| GTR | Gti Energy Ltd | 0.009 | 29% | $15,582,033 |

| WCN | White Cliff Min Ltd | 0.009 | 29% | $8,799,130 |

| ASW | Advanced Share Ltd | 0.16 | 28% | $24,175,972 |

| A3D | Aurora Labs Limited | 0.023 | 28% | $5,653,586 |

| ARV | Artemis Resources | 0.037 | 28% | $61,421,816 |

| RC1 | Redcastle Resources | 0.014 | 27% | $4,000,978 |

| DOC | Doctor Care Anywhere | 0.057 | 27% | $19,798,681 |

| ERW | Errawarra Resources | 0.215 | 26% | $10,588,200 |

| BPH | BPH Energy Ltd | 0.024 | 26% | $22,325,652 |

The week’s clear Small Caps winner was Torque Metals (ASX:TOR), which cranked its way to a thunderous 204% gain, on the back of news that it’s all set to buy up a collection of gold, nickel and lithium-rich tenements.

The project will be renamed Penzance, located near Torque’s Paris gold camp in the Tier-1 Goldfields mining jurisdiction of WA.

This includes New Dawn, an untapped lithium and tantalum occurrence on granted mining leases, 600m along strike of the established Bald Hill lithium-tantalum operation.

The news has lots to get investors excited, but these are probs the two main reasons why Torque went sailing:

- The New Dawn lithium project occupies two pre-Native Title, granted Mining Licences, which enable potential discoveries to be pushed quickly into development.

- And early investigations at New Dawn have identified multiple outcropping spodumene-bearing pegmatites with rock samples grading up to 6% Li2O

Little-known (to me, at least…) Consumer Cyclical Live Verdure (ASX:LV1) marched into second place for the week with a 117% climb, on news that it has snagged commitments for a $1.68 million placement from new and existing sophisticated shareholders.

The funds raised will be used for “new product development, fund working capital requirements for large retail partnerships and to further accelerate the Company’s growth through investment in sales, marketing, and inventory initiatives,” LV1 said.

Minnows Carnegie Clean Energy (ASX:CCE) and Cyclone Metals (ASX:CLE) are sharing third step on the podium after moving 100% this week – CCE on the back of a contract to install its wave energy tech off the coast of Spain to make electricity from the ocean, and CLE because it just did, okay?

I genuinely don’t know why Cyclone’s needle moved – it ain’t said more than ‘boo’ to the market since 31 July this year.

ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks for the week 04 – 08 September, 2023:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| LLL | Leolithiumlimited | 0.56 | -51% | $567,660,111 |

| AVW | Avira Resources Ltd | 0.001 | -50% | $2,133,790 |

| SRR | Saramaresourcesltd | 0.03 | -50% | $1,968,862 |

| AMA | AMA Group Limited | 0.061 | -42% | $113,444,983 |

| M3M | M3Mininglimited | 0.078 | -42% | $6,046,729 |

| OM1 | Omnia Metals Group | 0.097 | -35% | $4,374,808 |

| AFA | ASF Group Limited | 0.051 | -34% | $64,184,200 |

| MTH | Mithril Resources | 0.001 | -33% | $3,368,804 |

| MXC | Mgc Pharmaceuticals | 0.002 | -33% | $13,283,905 |

| PVS | Pivotal Systems | 0.004 | -33% | $3,073,517 |

| WSI | Weststar Industrial | 0.14 | -33% | $15,507,133 |

| VN8 | Vonex Limited. | 0.019 | -32% | $7,960,230 |

| FRS | Forrestaniaresources | 0.044 | -31% | $4,218,737 |

| MFD | Mayfield Childcr Ltd | 0.71 | -31% | $45,718,894 |

| EGY | Energy Tech Ltd | 0.029 | -31% | $14,181,713 |

| T92 | Terrauraniumlimited | 0.097 | -31% | $5,160,516 |

| ESK | Etherstack PLC | 0.195 | -30% | $26,351,400 |

| MOB | Mobilicom Ltd | 0.007 | -30% | $9,950,075 |

| PRX | Prodigy Gold NL | 0.005 | -29% | $8,755,539 |

| NXM | Nexus Minerals Ltd | 0.052 | -27% | $17,574,479 |

| BAT | Battery Minerals Ltd | 0.041 | -27% | $5,382,202 |

| MMM | Marley Spoon Se | 0.066 | -26% | $29,501,980 |

| LYK | Lykosmetalslimited | 0.059 | -25% | $4,118,400 |

| AD1 | AD1 Holdings Limited | 0.006 | -25% | $6,580,551 |

| DDT | DataDot Technology | 0.003 | -25% | $3,632,858 |

| DXN | DXN Limited | 0.0015 | -25% | $2,585,010 |

| EDE | Eden Inv Ltd | 0.003 | -25% | $11,987,881 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| MAT | Matsa Resources | 0.028 | -24% | $14,270,221 |

| 29M | 29Metalslimited | 0.67 | -24% | $458,365,604 |

| MBK | Metal Bank Ltd | 0.034 | -23% | $10,367,765 |

| CL8 | Carly Holdings Ltd | 0.017 | -23% | $4,562,297 |

| UCM | Uscom Limited | 0.042 | -22% | $8,002,409 |

| TIE | Tietto Minerals | 0.3775 | -22% | $386,072,259 |

| NMR | Native Mineral Res | 0.039 | -22% | $8,061,425 |

| AW1 | Americanwestmetals | 0.235 | -22% | $75,974,110 |

| YRL | Yandal Resources | 0.047 | -22% | $8,679,169 |

| WMG | Western Mines | 0.31 | -22% | $18,165,849 |

| AAJ | Aruma Resources Ltd | 0.033 | -21% | $6,497,420 |

| TON | Triton Min Ltd | 0.022 | -21% | $34,349,823 |

| PGO | Pacgold | 0.205 | -21% | $13,735,116 |

| ECG | Ecargo Hldg | 0.03 | -21% | $20,303,250 |

| BUR | Burleyminerals | 0.115 | -21% | $11,142,643 |

| E33 | East 33 Limited. | 0.023 | -21% | $11,939,040 |

| WNR | Wingara Ag Ltd | 0.031 | -21% | $5,441,818 |

| JRV | Jervois Global Ltd | 0.04 | -20% | $113,505,869 |

| APC | Aust Potash Ltd | 0.004 | -20% | $4,154,758 |

| BPP | Babylon Pump & Power | 0.004 | -20% | $9,848,308 |

| COY | Coppermoly Limited | 0.012 | -20% | $7,421,777 |

| DCL | Domacom Limited | 0.016 | -20% | $7,403,530 |

HOW THE WEEK SHOOK OUT

Monday, 04 September: ASX 200 up 0.5%

The clinical stage biotech Emyria (ASX:EMD), has secured firm commitments from new and sophisticated investors to raise $2 million (before costs) through an oversubscribed placement.

Emyria says it will also kick off a non-renounceable pro rata entitlement offer to raise approximately $3.1 million (before costs) at the same terms.

The plan is to cash-up and fast-track development of EMD’s MDMA-assisted therapy for PTSD, the usual “revenue growth and data collection” stuff, as well as “payer engagement”.

Global Health (ASX:GLH) jumped in early trade off the back of positive FY23 news, including Customer Revenue growth of 20% to $7.81 million, and Annual Recurring Revenue up 11% to $5.73 million.

Elsewhere the digger Viking Mines (ASX:VKA) is up on news of a solid vanadium find at its Fold Nose deposit, where the company says it’s hit significant vanadium pentoxide (V2O5) intercepts, such as 42m at 0.74% V2O5 (>0.5%) from 79m, including 17m at 0.80% V2O5 (>0.8%) from 83m and 8m at 0.99% V2O5 (>0.8%) from 108m.

Artemis Resources (ASX:ARV) is ahead again, after recent laboratory XRD analysis – by JV partner Greentech Metals (ASX:GRE) – of a known lithium bearing sample collected within the Osborne JV tenement in the Pilbara has returned 3.6% Li20 from a sample that was 44% spodumene and 43% quartz.

Tuesday, 05 September: ASX 200 down 0.25%

Torque Metals (ASX:TOR) says the deal it’s inked to acquire a collection of gold, nickel and lithium-rich tenements — will be renamed Penzance.

The site is near its Paris gold camp in the Tier-1 Goldfields mining jurisdiction of WA.

This includes New Dawn, an untapped lithium and tantalum occurrence on granted mining leases, 600m along strike of the established Bald Hill lithium-tantalum operation.

The news has lots to get investors excited, but these two reasons help explain the price action:

- The New Dawn lithium project occupies two pre-Native Title, granted Mining Licences, which enable potential discoveries to be pushed quickly into development.

- And early investigations at New Dawn have identified multiple outcropping spodumene-bearing pegmatites with rock samples grading up to 6% Li2O

A Program of Work has now also been approved for due diligence drill holes at New Dawn to test spodumene values and diamond drilling is set to kick off this month.

Torque’s managing director, Cristian Moreno:

“The WA Goldfields reigns supreme on the global stage for minerals exploration and Torque is ecstatic to strengthen its presence in this renowned jurisdiction.Our footprint now spans over 500km², bolstered by 12 mining, 4 prospecting and 12 exploration licences.

“In the wake of remarkable and solid gold discoveries at the Paris gold systems, Torque is strategically expanding its presence in the region, whilst also venturing into the critical minerals domain with the acquisition of New Dawn pre-Native Title mining licences adjacent to the Bald Hill which hosts a 26.5 Mt @ 1% Li2O spodumene mine.”

Aussie gold hunter Kingsland Minerals (ASX:KNG) announced intersections of scale and grade significance, hitting total graphitic carbon at Leliyn with a “bonanza” intersection of 206m at 10% graphite, which it says “confirms Leliyn’s world-class potential”.

“Holes LEDD_04 and LEDD_05 were drilled at the north-western extremity of the current drilling area and show that these massive widths and grades are open along strike to the north,” Kingsland said.

Mineralisation has been outlined over a 5km strike length and remains open along strike and at depth, and the strike sits with a 20km-long graphitic schist host rock, which the company says highlights the scope for huge upside beyond the initial 5km identified strike.

Also on the winners list is gold explorer Southern Cross Gold (ASX:SXG) which announced the best hole drilled to date at its 100%-owned Sunday Creek project in Victoria including a wide and high grade intersection of gold-antimony mineralisation.

SXG says SDDSC077B drilled at the Rising Sun Prospect intersected 404.4m @ 5.6g/t AuEq (5.1g/t Au, 0.3 %Sb) from 374.0m (uncut), and traverses 13 individual high grade vein sets.

Furthermore, seven intervals have>100g/t Au (up to 2,670g/t Au), 20 intervals have >15g/t Au and 20 intervals have >5% Sb (up to 55.8% Sb).

2,670g/t is not a typo, by the way.

Wednesday, 06 September: ASX 200 down 0.8%

Energy minnow Carnegie Clean Energy (ASX:CCE), jumped on news that it’s inked a juicy contract with Ireland that will see its CETO wave energy tech installed there by mid-2025.

CCE says that its CETO Wave Energy Ireland (CWEI) subsidiary has been awarded a €3.75 million contract to build and operate a CETO wave energy converter at the Biscay Marine Energy Platform in the Basque Country, Spain and will deliver power to the grid.

The Consumer Cyclical company Live Verdure (ASX:LV1), has snagged commitments for a $1.68 million placement from new and existing sophisticated shareholders.

The funds raised will be used for “new product development, fund working capital requirements for large retail partnerships and to further accelerate the Company’s growth through investment in sales, marketing, and inventory initiatives,” LV1 says.

Boadicea Resources (ASX:BOA) climbed on no news while a number of other goldies including Austral Gold (ASX:AGD) and Gold 50 (ASX:G50) turned in significant jumps as well.

Thursday, 07 September: ASX 200 down 1.2%

Lithium Plus Minerals (ASX:LPM) is out in front of the pack at lunchtime, climbing ~43% on news that the first completed diamond hole (BYLDD019) at the Lei Prospect has intersected 127m of strongly mineralised pegmatite from 609m (with a true width of ~60m), with assays pending.

LPM says the find represents “one of the largest mineralised intersections ever recorded from the Bynoe pegmatite field”, putting the Lei pegmatite in company with Core Lithium’s (ASX: CXO) previously reported world-class 119m intercept at the BP33 deposit.

Killi Resources (ASX:KLI) was up over 25% before lunch after collecting high-grade copper hits up to 7.2% Cu and gold 12.4g/t Au at surface from rock chip samples from the Baloo prospect within the company’s 100% owned Mt Rawdon West project, Queensland.

Killi says 12 of the 26 rock chip samples collected have returned assays greater than 1% Cu, including 7.2% Cu and 27.2g/t Ag, 4.2% Cu, 1.16g/t Au, 75.8g/t Ag, 1 % Pb and 0.3 % Zn, and 4.5% Cu, 0.09g/t Au and 83.7g/t Ag.

Elsight (ASX:ELS) is soaring on news the US Federal Aviation Administration (FAA) has granted the Halo enabled Airobotics Optimus-1EX system a (really important) Type Certificate, that will allow flight operations over people and infrastructure without the need for case-by-case waivers.

Elsight and its project partner Airobotics have been working on getting the Optimus-1EX drone certified for four years, the company says, leaving Elsight CEO Yoav Amitai delighted at the result.

“We warmly congratulate Airobotics for this achievement,” Amitai said. “This is a major step forward for the drone industry in general. Completing the long-complicated process to achieve the first non-air carrier drone Type Certification by the FAA shows that the regulators are coming to the position that drones are a part of the future.”

Digital tracking firm Bluechiip (ASX:BCT) rose quickly after providing a strong strategic update, saying it would hit FY24 with a heap of momentum and plucky with optimism given the positivity around FY23.

In addition BCT says its Bluechiip tracking solution is now installed in a Big Pharma laboratory in Europe, and further Big Pharma groups in the US are expected to sign with Bluechiip by the end of calendar 2023.

Friday, 08 September: ASX 200 down 0.4%

Early leaders on Friday were Oliver’s Real Food (ASX:OLI), which has wandered somewhat zombie-like to a 35.3% rise on zero news.

Advanced Share Registry (ASX:ASW) is next on the list, up 32% this morning after revealing that it’s entered into a scheme of arrangement, under which Automic Enterprise will buy 100% of the company, at $0.165 per share.

ASW closed at $0.125 yesterday, and is sitting right on top of Automic’s target price at lunchtime today.

Southern Hemisphere Mining (ASX:SUH) is up 23.8% this morning, with Wednesday’s announcement that a shortfall from the Company’s recent entitlement offer has been filled providing enough of a tailwind to keep it moving today.

But by the end of the day, Zeus Resources (ASX:ZEU) had marched out in front with a 54% lift, despite having no fresh news to report.

Odessa Minerals (ASX:ODE) continued with its upward movement, adding another 30% today on yesterday’s news, which said the company’s got more than 46,000m strike-length of pegmatites mapped to date by geology crews on tenement at its Yinnietharra Lockier Range project, with the field programme about 50% complete.

That includes more than 16,500m strike-length of pegmatites mapped at Robinsons Bore alone, adjacent to Minerals 260’s “Aston” Lithium Project.

PO listings this week

There was talk of one (James Bay Minerals) that was due to happen this week, but it looks like it’s been delayed until next week:

Novo Resources (NVO) – Due to list on September 11, $7.5 million at $0.20

James Bay Minerals (JBM) – Revised to list on September 12, $6 million at $0.20

CGN Resources (CGR) – Due to list on September 15, $10 million at $0.20

Pioneer Lithium (PLN) – Due to list on September 18, $5 million at $0.20

Far Northern Resources (FNR) – Due to list on September 21, $6 million at $0.20

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.