Traders’ Diary: Everything you need to know before the ASX opens

News

Global equity markets mainly moved higher last week with the local benchmark doing well and US shares on the whole up around +0.2%, the latter helped by a late leg up from near Goldilocksian jobs data.

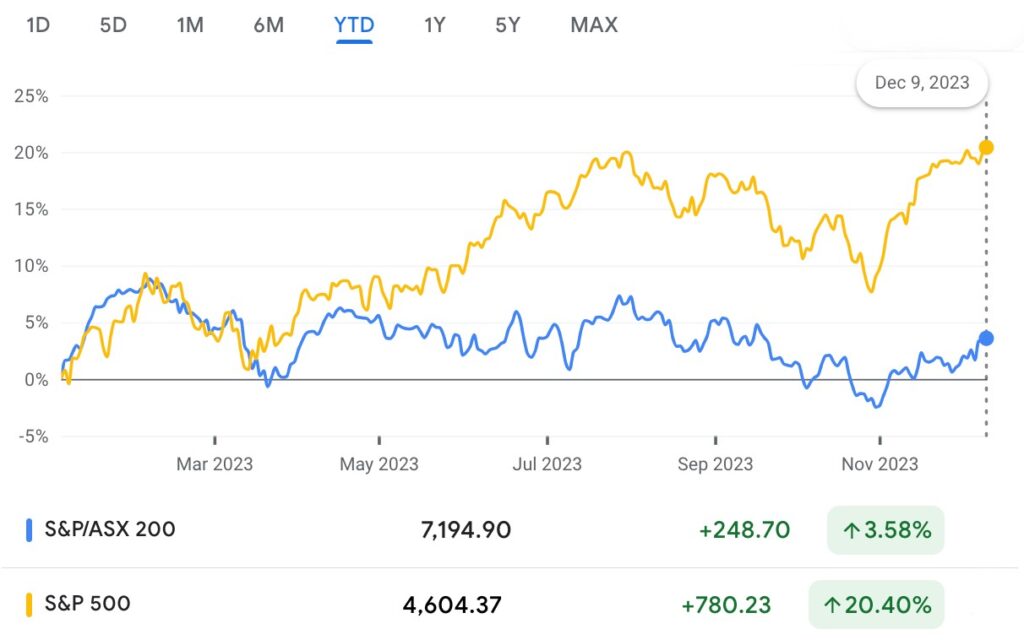

Here’s where the local benchmark stands, year-to-date against the US benchmark.

A bit of a gap starting to open up there, I note.

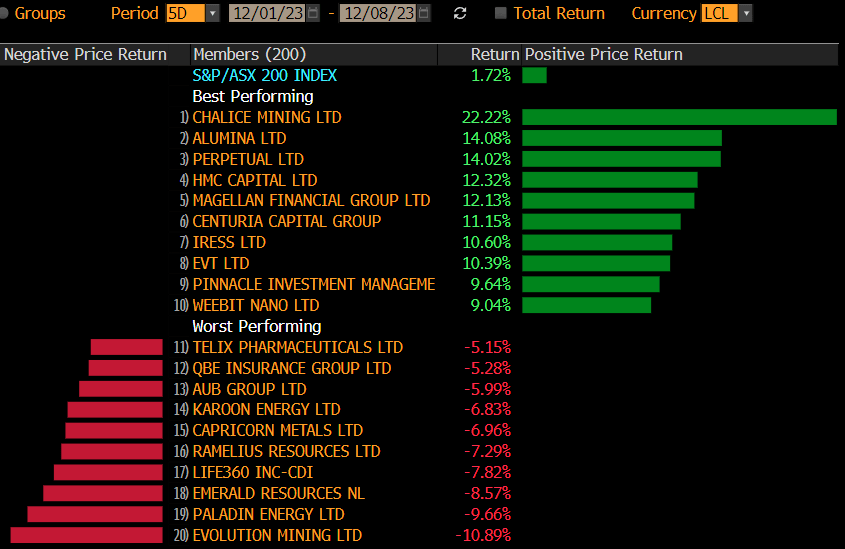

Last week, the ASX200 finished +1.7% higher after the RBA released a few more doves into the atmosphere with its second stay put decision as weaker-than-expected GDP dropped at the right time, resulting in expectations of RBA rate cuts for the second half of 2024.

At home, it was once again the Reserve Bank of Australia and interest rates that ‘dominated brain space’ as one Stockheadist told me, the speculation ending when the Board held off again, leaving the next moves up for discussion around the February meeting.

In the States, US stocks closed higher Friday following a strong monthly jobs report to clinch a sixth straight week of gains, with the S&P 500 and Nasdaq Composite hitting their highest closing levels since early 2022.

Analysts said the Labor Department’s report that November added 199,000 jobs on a seasonally adjusted basis likely keeps the Federal Reserve on pace to hold rates steady at next week’s meeting. More broadly, the drop in the unemployment rate to 3.7% combined with rising payrolls and earnings portrays an economy that is easing toward a soft landing and is not on the brink of a recession.

EU shares rose +2% on dovish ECB comments, but Japanese shares fell -3.4% on speculation of a BoJ rate hike soon (which also pushed the Yen up) and Chinese shares fell 1.7%.

The ASX benchmark began Friday on the back foot before rallying ~50pts into the close to finish at session highs, clearly a bullish tone to end the week with the solid intra-day move, helped by speculation that the RBA has finished tightening.

Bond yields rose slightly in the US and Japan but fell in Europe and Australia.

Oil prices fell -3.8%, briefly getting in under US$70 on the glimpse of a possible glut.

West Texas (WTI) crude was having a bounce off some of those lows but there’s weakness for all amid signs of increasing global supplies and softening demand.

US gasoline inventories picked the right moment to pull one of the biggest increases of the year last week – producing a stunning 5.4 million barrels out of nowhere, making the aggregate forecasts of 1 million barrels a supreme gag.

The US Bureau of Economic Data also has crude exports up at a record 6 million barrels a day during October, with European and Asian buyers partaking in something of a frenzy, while economic woes for the world’s biggest crude importer – China – also weighed on the mood of markets. Moody’s helped that by cutting its outlook on China’s government credit rating from stable to negative.

Finally, it really does seem that the OPEC+ cartel is losing cohesion which is pretty much good news for Volvo drivers (other drivers too, I suppose). Last week OPEC+ members came out to announce additional cuts of 2.2 million bpd.

Angola said afterwards that it wouldn’t play ball, despite signing up. And then in came big-hitters Saudi Arabia and Russia to announce they were extending more than 1.3 million of voluntary reductions.

Metal prices fell, but iron ore prices rose.

According to Dr Shane Oliver, head of investment and chief economist at AMP, despite the rebound in equity markets since the October lows there remain significant risks to keep an eye on including:

“However, while shares remain vulnerable to a very short term consolidation or pull back after strong gains since October they are likely to see more upside in the months ahead as inflation continues to ease, the monetary policy environment turns progressively less threatening, economic indicators remain consistent with a soft landing, geopolitical threats likely take a back seat for a while and positive share market seasonality remains in place with the Santa Rally normally kicking in later this month.

“So while we should expect lots of bumps along the way our base case remains that global and Australian shares can trend up,” Dr Oliver says.

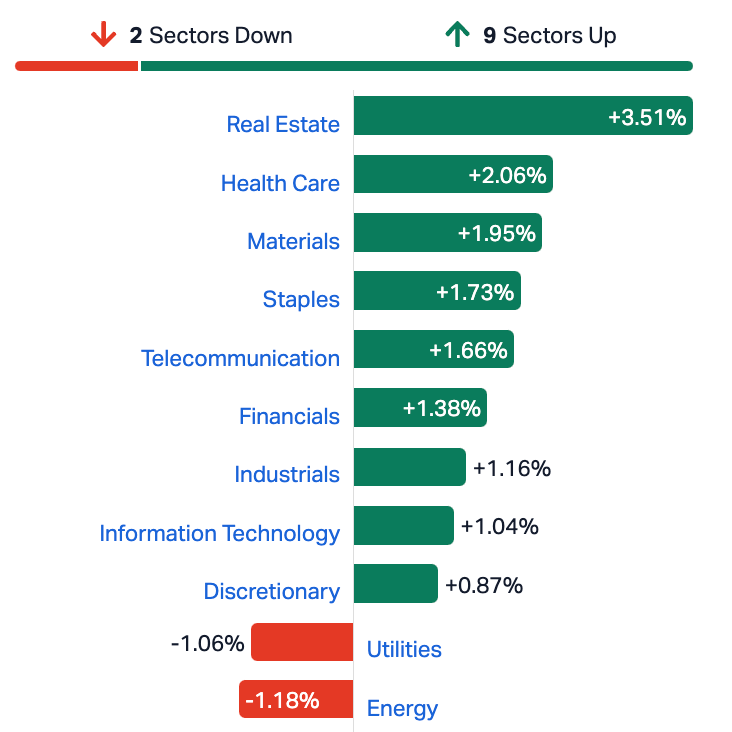

For the week, the ASX 200 put on +1.72% with the Real-Estate sector the standout up +3.51%.

In the US, the Federal Reserve is almost certain to keep its policy rate unchanged on Wednesday as the US economy finally appears to be losing some steam and inflation is coming under control.

Chair J. Powell has set the bar high for raising rates again, while investors have gone a step further and completely priced out any chance of additional tightening.

The focus therefore on Wednesday will be how soon the Fed will start lowering rates, specifically how many rate cuts do FOMC members foresee in the updated dot plot that’s due the same day.

In the last dot plot, policymakers were projecting that rates would end 2024 at 5.1%.

Following the recent soft readings on inflation, markets are betting that the Fed will cut rates five times in 2024, with a 25bps reduction fully priced in for May. If policymakers push back against such expectations and predict fewer cuts, the US dollar could gain on the back of the hawkish signals.

According to XM Australia CEO Peter McGuire, the most bullish scenario for the dollar is if the Fed doesn’t even adjust its median projection for 2024.

Still, a hawkish rate path will likely not be enough to set the markets straight and Powell will have a tough task on his hands convincing investors that rate cuts are not on the near-term horizon, especially if the inflation data keeps surprising to the downside.

The CPI report for November is due on Tuesday and the forecast is for the annual rate of headline CPI to have inched down to 3.1% from 3.2%.

All sources: Commsec, Westpac, Trading Economics, S&P Global Intelligence and IG Markets

MONDAY

Federal Mid–Year Budget update

TUESDAY

RBA Governor Bullock Speaking at AusPayNet Summit Westpac–MI Consumer Sentiment

NAB business survey Oct net migration

WEDNESDAY

Nope

THURSDAY

Aus Nov employment change / unemployment rate

Dec MI inflation expectations

RBA Assist’ Gov. (Financial Systems) Jones, speaking at Finance & Banking Conference

FRIDAY

Nope

MONDAY

UK Dec Right move house prices

TUESDAY

Eur Dec ZEW survey of expectations

UK Oct average weekly earnings

US Nov CPI

WEDNESDAY

Jpn Q4 Tankan large manufacturers index

Eur Oct industrial production

UK Oct trade balance US Nov PPI

US FOMC policy decision

THURSDAY

Jpn Oct machinery orders

Eur ECB policy decision UK BoE policy decision

US Nov retail sales (Captures Black Friday sale)

Nov import price index

Initial jobless claims

FRIDAY

China Nov retail sales ytd

Nov industrial production ytd

Nov fixed asset investment ytd

Eur Dec HCOB manufacturing PMI

Dec HCOB services PMI

UK Dec S&P Global manufacturing PMI

Dec GfK consumer sentiment

US Dec Fed Empire state index

Nov industrial production

Dec S&P Global manufacturing PMI

Dec S&P Global services PMI