Traders’ Diary: Everything you need to know before the ASX opens

What grabbed the headlines last week?

First up, Aussie inflation is falling faster than the boffins at the RBA were expecting – down to 4.1%yoy in the December quarter which is well below the central bank’s forecast of 4.5%.

Inflation was 5.4% in the previous quarter and clocked 7.8% this time last year.

According to AMP senior economist Diana Mousina, services inflation in this country is finally heading lower now too, off in pursuit of already falling goods price inflation.

“What’s more the proportion of items seeing greater than 3% inflation has fallen sharply to 43% which is consistent with the pre-pandemic norm and monthly CPI inflation fell to 3.4%yoy in December.”

The US Fed’s made it clear it might not be cutting and its new priority is to talk traders down from their giddy heights.

EU inflation meanwhile, fell to 2.8% in January with core inflation down to 3.3%yoy. Diana says Brussels is starting to cluck like more like a dove.

Christine and the ECB are likely to start cutting in April, AMP believes.

And all that’s been great for Aussie stocks.

AMP chief economist Dr Shane Oliver warns this doesn’t mean there won’t be corrections.

Chinese property, war and sticky uncertainty “could provide a trigger for a pullback”.

“In fact, we saw a bit of the latter in the last week with the US share market initially falling after the Fed pushed back against expectations for a March rate cut,” Oliver says.

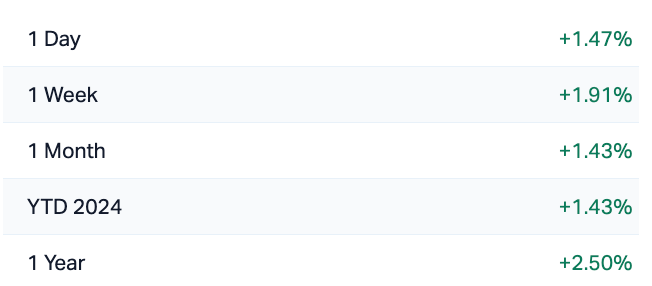

The ASX200 (XJO) index

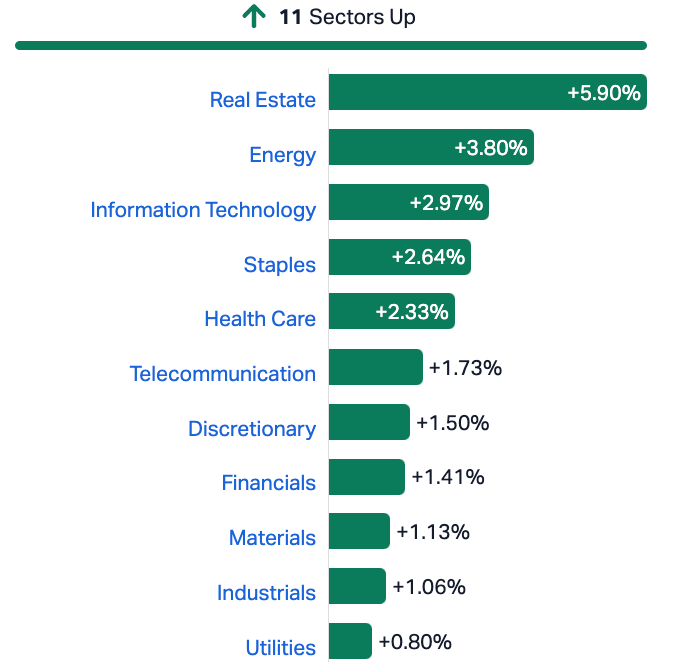

ASX Sectors Last Week

In the US…

Last week the S&P500 and Dow Jones IA each put on a circa 1.4% gain, while the tech heavy Nasdaq Composite collected 1.1%, a fourth week of wins for the three majors. Wall Street’s latest record high followed Friday’s blowout payroll report which ticked the Confidence in the Economy box, despite adding weight to the Fed’s Wait and See caution.

The blockbuster Friday jobs data also drummed up trader confidence in the outlook for corporate activity. Which naturally sparked yet another wildfire rally across tech stocks, with the accelerant provided this time by Meta’s surprise first-ever quarterly dividend, which saw the stock rise by a thunderous 21%.

Down the hall, Amazon exploded 8.3% after its own quarterly bonanza.

No surprise then that the US Tech100 closed the week at an all-time high of 17680. It’s up 8% in four weeks, 41% in 12 months.

Chinese markets…

Over the weekend Barclays warned that China could face ‘a prolonged deflationary environment,’ with weakened domestic demand exacerbating overcapacity issues. Not a stellar combo, and not when confidence continues to flag.

Commodities…

Reports of a ceasefire deal between Israel and Hamas are surely cut from the same mad cloth that started it all in October and a few thousand years before that; still, the notion of peace breaking out across the land smashed oil prices last week.

Crude futures crashed more than 6% over the week, a pall of positivity from looming interest rate cuts in the US, iced on Friday by non-farm payrolls.

The US WTI benchmark has struggled with good news all week.

Especially the loopy idea that this business in the Middle East might settle down. But continued Allied air strikes across Iraq and Syria – but with Iran’s name on it – won’t do much to mute the dull roar out of the Red Sea.

Oil boffins are structurally a barrel half-full bunch and apparently remain hopeful some kind of truce in Gaza means some kind of end to the Houthi attacks on Red Sea shipping.

A Qatari official has said there’s no ceasefire. And somehow Qatar is the voice of reason this time.

Then there’s the realisation China won’t be coming to the party like before.

Now the International Monetary Fund (IMF) is saying China’s economic recovery will be even more glacial with the fund pegging annual growth for this year at 4.6% to around 3.5% in 2028, further impacting crude demand.

Meanwhile, OPEC+ kept its current production policy, keeping output cuts of 2.2 million barrels per day in place for the first quarter. On the demand side, according to the EIA, worldwide demand will likely increase by 2 million barrels per day in 2024, much more demanding than the previous forecast of 1.24 million bpd.

The Week Ahead

At home, the Reserve Bank meets on Tuesday.

Market pricing suggests it’s a hold, but if there’s a gun, we best not jump it.

Fourth quarter retail volumes will drop while the ABS will also deliver the goods trade balance for December.

In New York, US corporate earnings return to centre stage.

The list incudes big boppers like Messrs McDonald’s, Caterpillar, Eli Lilly, Amgen, Walt Disney, Uber, S&P Global, Philip Morris, and Conoco Phillips.

The speakers of the US Federal Reserve will be highly attended, as will be US trade balance data.

Central bankers again light up the global docket.

Aside from our own interest rate decision, there’s calls to be made in India, the Philippines, Thailand, and Poland, while new cash rates are due out of Turkey, Brazil, and Mexico.

In China, the Caixin Services PMI drops as well as indicators for both consumer and producer prices.

Germany is bracing for a look at gloomy factory orders and industrial production data, both of which are likely to spark a little schadenfreude across the EU.

The Aussie Economic Calendar

Monday February 5 – Friday February 9

All sources: IG Markets, S&P Global Market Intelligence, CommSec

MONDAY

Australia Trade (Dec)

TUESDAY

Australia RBA Interest Rate Decision

WEDNESDAY

New Zealand Unemployment Rate (Q4)

THURSDAY

FRIDAY

Governor Bullock is due at the House of Representatives Standing Committee on Economics

*China, South Korea, Taiwan, Hong Kong SAR

(partial), Singapore (partial) Market Holiday

The Everyone Else Economic Calendar

Monday February 5 – Friday February 9

Monday 5 Feb

Worldwide Services, Composite PMIs, inc. global PMI* (Jan)

Australia Trade (Dec)

Indonesia GDP (Q4)

Thailand Inflation (Jan)

Singapore Retail Sales (Dec)

Germany Trade (Dec)

Turkey Inflation (Jan)

Eurozone PPI (Dec)

United States ISM Services PMI (Jan)

Tuesday 6 Feb

Japan Household Spending (Dec)

Philippines Inflation (Jan)

Germany Factory Orders (Dec)

Taiwan Inflation Rate (Jan)

Eurozone Retail Sales (Dec)

Global Sector PMI* (Jan)

Wednesday 7 Feb

Philippines Unemployment Rate (Dec)

Japan Leading Index (Dec)

Switzerland Unemployment Rate (Jan)

Germany Industrial Production (Dec)

Thailand BoT Interest Rate Decision

United Kingdom Halifax House Price Index (Jan)

France Trade (Dec)

Taiwan Trade (Jan)

Italy Retail Sales (Dec)

Brazil Retail Sales (Dec)

Mexico Consumer Confidence (Jan)

Canada Trade (Dec)

United States Trade (Dec)

Global Metal Users and Electronics PMI* (Jan)

Thursday 8 Feb

Taiwan, Indonesia Market Holiday

Japan Current Account (Dec)

China (Mainland) CPI, PPI (Jan)

India RBI Interest Rate Decision

Brazil Inflation (Jan)

Mexico Inflation (Jan)

United States Initial Jobless Claims

United States Wholesale Inventories (Dec)

United Kingdom KPMG / REC Report on Jobs (Jan)

Friday 9 Feb

China (Mainland), South Korea, Taiwan, Hong Kong SAR

(partial), Singapore (partial) Market Holiday

Germany Inflation (Jan, final)

Turkey Industrial Production (Dec)

Italy Industrial Production (Dec)

Mexico Industrial Production (Dec)

Canada Unemployment (Jan)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.