Traders’ Diary: Everything you need to get ready for the week ahead

News

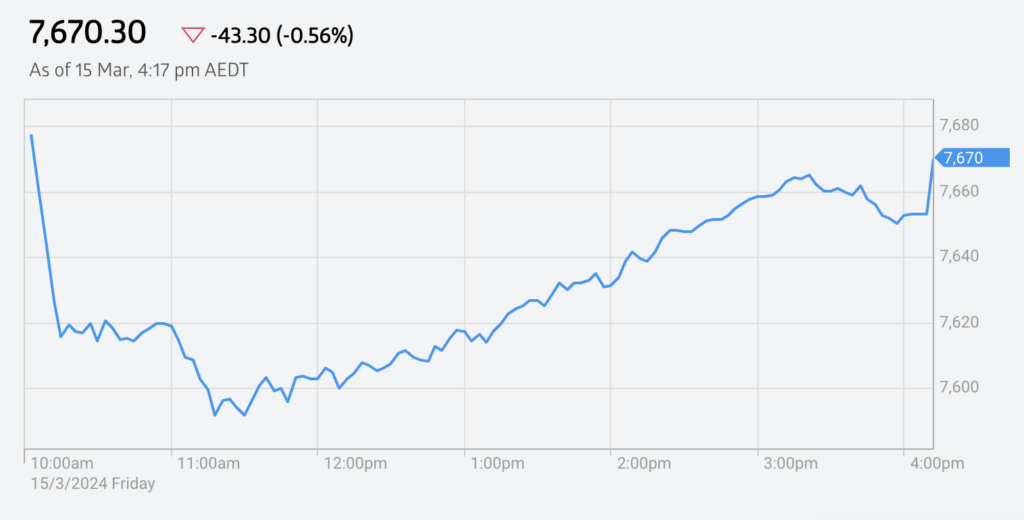

On Friday in Sydney, the Aussie benchmark got kicked hard out of the gate following a night of more Wall Street weakness – and after about 15 minutes of trade the top 200 index had given up a startling 124 points.

But – in typical ASX200 style – just when the dummy was launching from the lips, the sideline benches emptied and the dip-buying which had threatened for much of the week finally broke out – investors spent much of the arvo session hovering up the sharpest of the morning losses to end the XJO’s index re-weighting session down about 0.55%.

The ASX200 called it a week at 7,670.30 points, after 5 discombobulating sessions.

On March 15, the S&P/ASX200 ended 43 points or 0.56% lower:

According to the ASX, the benchmark index has lost 2.25% over the week and sits 2.33% below its 52-week high.

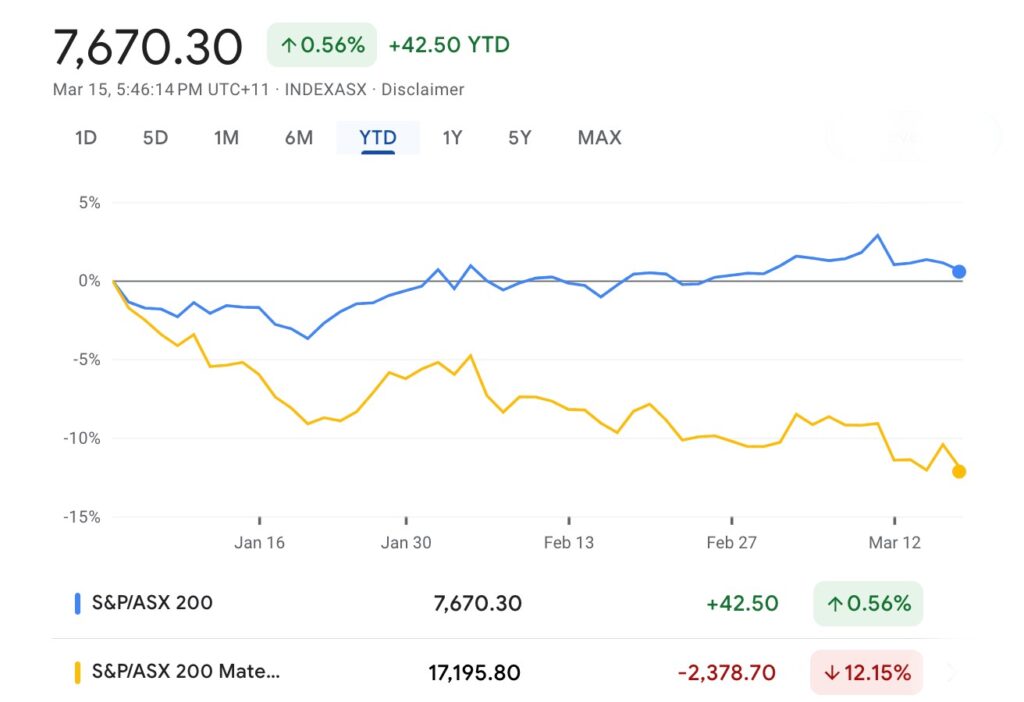

Far weirder is this (below) – a comparative chart one doesn’t see to regularly on the resources-laden ASX200:

Yes. The big miners are sucking in a big way so far in 2024 and played a major role in the benchmark’s worst week since September.

The major banks and the big iron ore miners were behind much of the bleeding as the big 4 copped a slew of downgrades and iron ore slumped ever closer to US$100.

So far in 2024 there’s been 3 decent-sized pullbacks, and its only the Ides of March, with a long way to go.

According to Shaw and Partners’ James Gerrish, also CIO at Market Matters year-to-date the ASX200 has ground higher in a “three steps forward, two steps back” attack pattern.

“While stock and sector rotation continue to dominate the market, investors have become increasingly comfortable selling into strength as valuations stretch on the upside.

“With the path of interest rates keeping investors fixated on economic data, we envisage an ongoing choppy/volatile market until we enjoy more clarity from the Fed, RBA, et al.

“We believe rates will start falling in 2024, but it may be a few months later than investors are hoping for,” James says.

Market Matters retain their optimism towards equities, “but volatility is likely to remain elevated” this FY.

Oil (WTI) finished strongly higher last week at US$81.00 up 4% and at five months highs.

Gold on the other hand took a breather following hotter-than-expected US CPI and PPI data, down 1% to around $2155 as US yields and the greenback gained.

A near 6% surge in copper prices will keep commodity traders engaged this week – it certainly sets up a fascinating day on the ASX on on Monday.

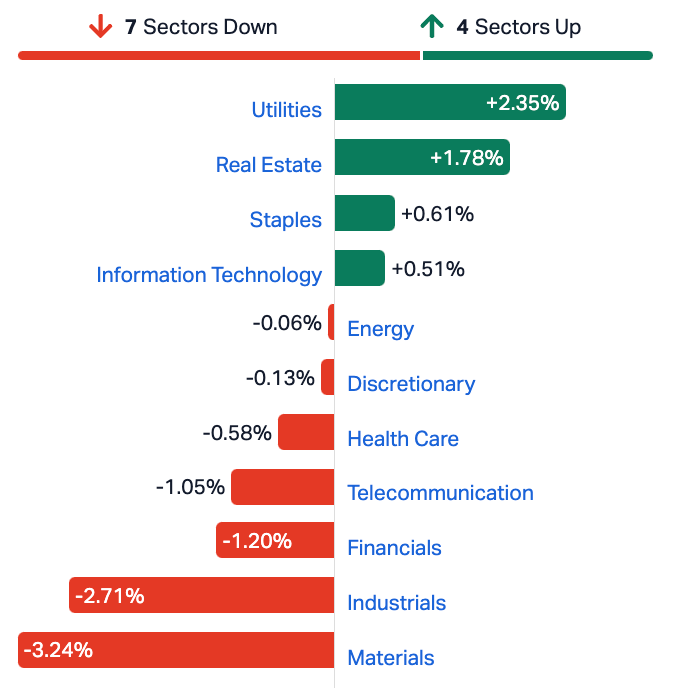

Materials and Industrials were the worst of the 11 ASX sectors last week, although Financials and Telcos were major contenders.

Utilities and Real Estate did just fine.

Wall Street ended a week of elevated volatility with more losses on Friday in New York.

Over in the US, retail sales were softer and February’s CPI came in a touch firmer than expected at 3.2%yr.

Wall Street’s 3 major indices ended last week in the red. The Dow, not by much, but the tech-heavy Nasdaq Composite lost 1.2% and the broader S&P500 was down 0.13%.

Ahead of this week’s FOMC meeting the risks are the Fed’s median dot will show just two rate cuts in 2024, down from the three cuts projected in December. The rates market is pricing in 71bp of cuts, the lowest since October 2023. A rate cut at the June FOMC meeting is now a coin flip.

“Before we can conclusively determine if last week marked a significant shift in sentiment across equity markets, there needs to be some allowance for Nvidia to again ride to the rescue,” says IG Markets analyst Tony Sycamore.

On Tuesday the RBA Board will meet to talk interest rates and consider what the recent inflation gauge, the Q4 National Accounts and Wage Price Index, say about the direction of monetary policy.

Westpac’s economic team holds the view that the RBA will be “comforted” by recent developments, given the Board’s aim to bring demand back into line with supply and ensure inflation continues to trend lower.

“We continue to expect the RBA to remain on hold until September, at which time they should have enough confidence in the inflation outlook to slowly begin easing policy.”

After Tuesday’s RBA interest rate meeting, we will roll on into jobs data on Thursday, and then it’s back to Martin Place for the RBA’s Financial Stability Review on Friday.

Monday March 18 – Friday March 22

MONDAY

Nope

TUESDAY

RBA Decision

WEDNESDAY

Nothing

THURSDAY

RBA speak Chief Operating Officer

Feb employment change

Feb unemployment rate

FRIDAY

RBA Financial Stability Review

Monday March 18 – Friday March 22

MONDAY

JP Jan core machinery orders

CH Feb retail sales ytd

CH Feb industrial production ytd

CH Feb fixed asset investment ytd

EU Jan trade balance

US Mar NAHB housing market index

TUESDAY

JP BoJ policy decision

EU Mar ZEW survey of expectations

US Feb housing starts

US Feb building permits

WEDNESDAY

EU Mar consumer confidence

UK Feb CPI %yr

US FOMC policy decision

THURSDAY

JP Mar Jibun Bank manufacturing PMI

JP Mar Jibun Bank services PMI

EU Mar HCOB manufacturing PMI

EU Mar HCOB services PMI

UK Mar S&P Global manufacturing PMI

UK Mar S&P Global services PMI

UK BoE policy decision

US Mar Phily Fed index

US Feb leading index

US Mar S&P Global manufacturing PMI

US Mar S&P Global services PMI

US Feb existing home sales

US Initial jobless claims

FRIDAY

JP Feb CPI %yr

Ger Mar IFO business climate survey

UK Mar GfK consumer sentiment

UK Feb retail sales

US Fedspeak (Bostic)

All sources: IG Markets, S&P Global Market Intelligence, CommSec