Traders’ Diary: Everything you need to get ready for the week ahead

Economic and IPO calendar for the week beginning 5 September 2022. Pic via Getty Images.

- RBA, ECB to make rates decision

- Aussie GDP is also scheduled

- US to release trade balance

It could be a week for the cold-blooded with a busy, potentially market-moving set of economic data in the post.

Critically, the Reserve Bank of Australia (RBA) and the European Central Bank (ECB) are announcing their interest rate decisions. The RBA board meeting is on Tuesday, and the experts have predicted another 25bp to 50bp rate hike this month.

President of the ECB, Christine Madeleine Odette Lagarde may do as she sees fit, the experts have predicated that too.

We’re also less than two weeks away from the pivotal inflation report, and three weeks from the FOMC meeting.

Data released last week showed that the US economy is still looking solid.

The number of Americans filing new unemployment benefit claims fell to a two-month low last week, while layoffs dropped in August.

The August US Purchasing Managers’ Index (PMI) meanwhile was flat at 52.8. This was critical, because a reading above 50 indicates expansion (and below 50 indicates contraction) and that’s good news, as manufacturing still accounts for 12% of total US economic output.

The JOLTs survey also pointed to a rosier picture, as new job openings rose to 11.239 million in July, compared to consensus of 10.45 million.

This was followed by the upbeat reading coming out of the Atlanta Fed GDPNow, which shows that third quarter GDP increasing from 1.57% to 2.59%.

“It seems like a certainty that the US economy will avoid a third consecutive negative GDP reading, which will completely end the debate that the economy is in a recession,” said OANDA analyst Edward Moya.

Whilst these are all positive, it does potentially allow the Fed to remain aggressive with tightening over the coming months.

Earlier in the week, New York Fed Reserve President John Williams spoke to the Wall Street Journal, of the bank’s “absolutely committed” purpose in achieving the two-percent inflation goal.

“The situation is very challenging. Inflation is very high. The economy has a lot of crosscurrents. I do think it will take a few years, but we’re going to get that done,” he said.

The Fed has increased rates four times this year, including two 75bp hikes in June and July. The next FOMC meeting will be on September 20th.

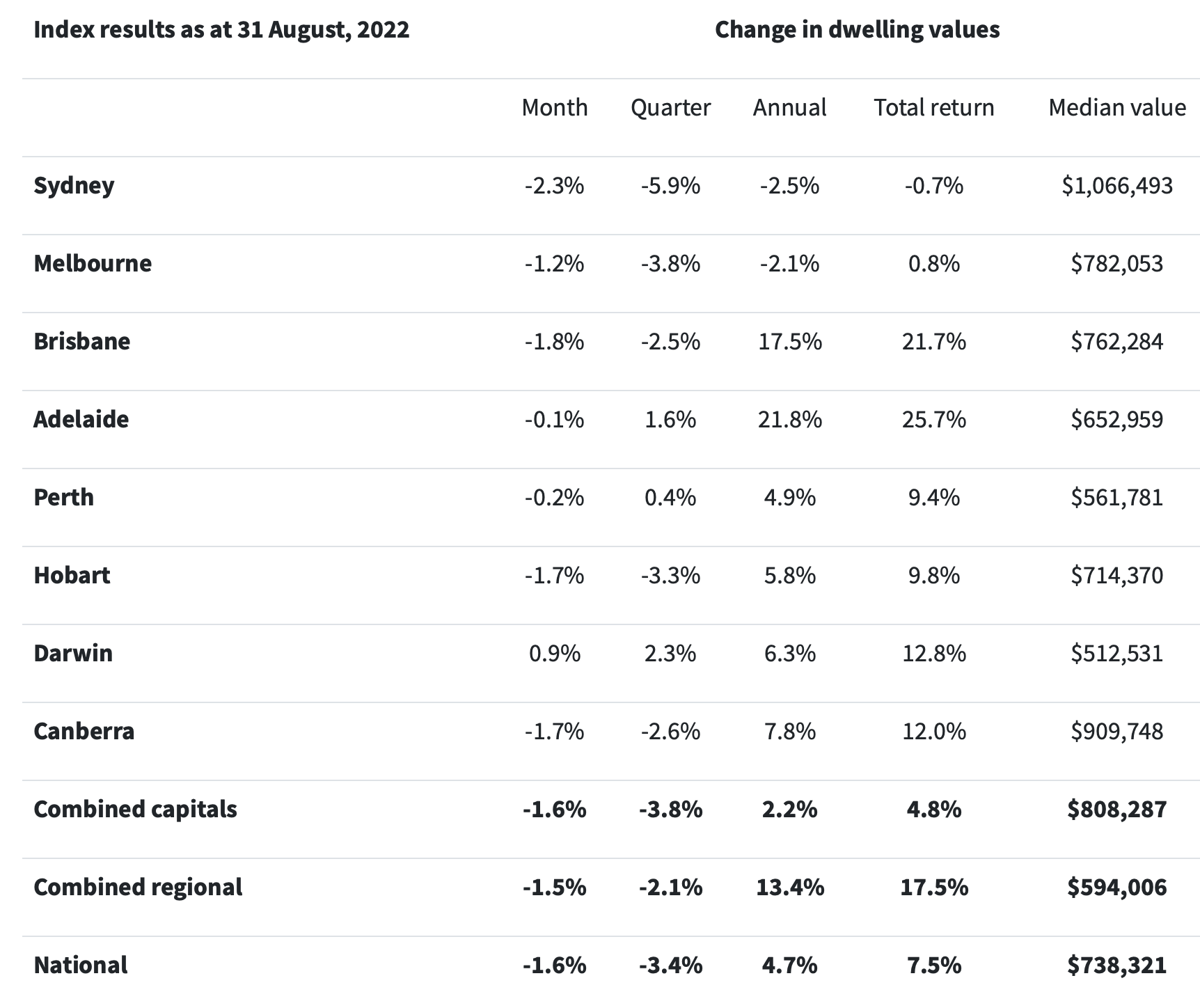

Back home, it was all about homes with the CoreLogic’s home value index slumping 1.6% in August, the biggest national monthly decline in 40 years.

The data showed Australia’s housing market decline has spread across all capital cities and to most regional areas.

Sydney continued to lead the downswing, with values falling -2.3% over the month, however weaker conditions in Brisbane accelerated sharply through August with values falling -1.8%.

CoreLogic’s research director, Tim Lawless, said: “It’s hard to see housing prices stabilising until interest rates find a ceiling and consumer sentiment starts to improve.”

There are however hopes the Australian economy is rebounding, with retail sales jumping by 1.3% (versus market consensus of 0.3%) in July to a record $34.7 billion.

The next RBA board meeting is on Tuesday, and experts have predicted another 25bp to 50bp rate hike this month.

The Economic Calendar for this week

Source: Investing.com

Australia and New Zealand

MONDAY

AIG Construction index for August

Services PMI for August

Business inventories for Q2

Company profits pre-tax for Q2

TUESDAY

Current account for Q2

RBA interest rates decision

WEDNESDAY

GDP for Q2

THURSDAY

Trade Balance for July

Global

MONDAY

Labor Day holiday in the US**

Euro Sentix consumer confidence

Euro retail sales for July

China services PMI

TUESDAY

US S&P Global Composite PMI for Aug

CB employment trends for Aug

Non manufacturing business activity for Aug

WEDNESDAY

US mortgage market index

US trade balance for July

Euro employment for Q2

Euro GDP for Q2

China trade balace

THURSDAY

US consumer credit for July

ECB interest rates decision

China FX reserves

FRIDAY

China CPI for Aug

China PPI for Aug

The ASX IPO calendar for this week

According to the ASX, these two stocks will make their debut listing this week (subject to change without notice):

Atlantic Lithium (ASX:AI1)

Listing: 8 September

IPO: $13.25m at $0.58

With an existing market cap of around $350m, Atlantic’s main game is the 30Mt Ewoyaa lithium project in Ghana, where it is funded through to production via a co-production agreement with fellow mine developer Piedmont Lithium.

Piedmont has the right to earn up to 50% at the project level for 50% SC6 spodumene concentrate offtake at market rates by solely funding US$17m towards studies and exploration and US$70m towards mine capex.

Atlantic completed a scoping study for Ewoyaa in December 2021 based upon a JORC 2012 resource of 21.3Mt at 1.31% Li2O and assuming US$900/t SC6 pricing and an 11.4-year mine life.

Plus, in March, Atlantic updated the mineral resource estimate at Ewoyaa by a massive 42%. The project hosts an MRE of 30.1 million metric tonnes at 1.26% lithium, including indicated resources of 20.5 million tonnes at 1.29%.

Listing: 8 September

IPO: $7.5m at $0.20

The company holds three owned projects – the HawkRock, Parker Lake and Pasfield Lake – covering 775sqkm in the Athabasca Basin, Canada, which contains the world’s largest and highest-grade uranium deposits.

“We are targeting greenfield discovery and brownfield developments close to existing production infrastructure to play a role in a clean carbon free economy,” executive chairman Andrew Vigar says.

The plan is to explore and develop the projects as well as seek out further complementary mineral exploration and resource opportunities.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.