Traders’ Diary: Everything you need to get ready for the week ahead

ASX and global economic and corporate calendar for the week beginning 15 Aug. Picture Getty

The ASX 200 was up by 0.24% last week, while the S&P 500 rose by 3%.

Has US inflation finally peaked?

Last week’s headline was all about the US CPI.

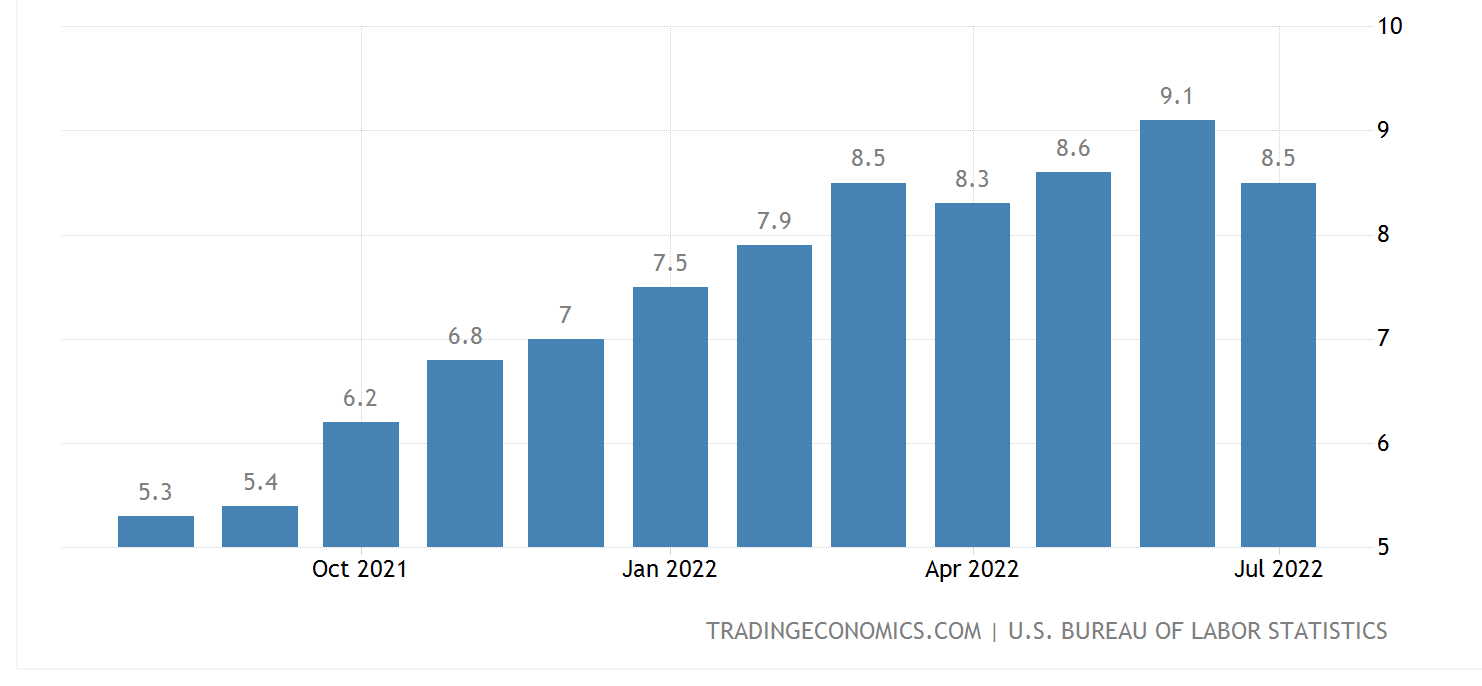

The annual headline inflation for July came in at 8.5%, lower than market predictions of 8.7%. In June, that headline rate was 9.1%.

There’s a sense of relief now that inflation might have peaked in the US, leaving some to predict the Fed might be on the verge of pivoting its policy following back-to-back 75bp increases in the last two months.

“The fact that inflation not only decelerated in the US, but at a faster pace than the consensus forecasts was a double win and risk assets are feeling the benefit,” said Oanda analyst, Craig Erlam.

Most analysts however still feel the Fed would have to see broader signs of inflationary pressure softening before it is willing to take its foot off the pedal.

Another important inflation report, the producer price index (or PPI), showed that US price growth is cooling off.

The US PPI in July turned negative for the first time since early in the pandemic, falling 0.5% from a month earlier but is still up 9.8% from a year ago.

“Inflationary pressures are clearly easing, but a lot of that decline is dependent (on) if oil prices continue to grind lower,” said Erlam.

The market is pricing in a 65% chance of a 50bp rate hike when the FOMC next convenes on September 20.

US inflation chart

Australian consumers are less confident

The latest Westpac consumer confidence index showed that Australian consumer sentiment fell again in August, down 3% to 81.2.

But business confidence and conditions have both surprisingly rose in July, up +7 and +20 points respectively.

CBA said the spread between consumer confidence and business confidence is the widest it’s ever been. This is partly because businesses have been able to successfully pass on their higher costs to customers.

[REPORT] Buoyant business boosts inflation risks https://t.co/QT6yfbmzPh #ausecon pic.twitter.com/wrSmHqn6oQ

— CommSec (@CommSec) August 9, 2022

A Westpac report said:

“The August decline in the index was mainly driven by consumers’ increasingly pessimistic expectations of family finances in the next 12 months, and a considerable decline in their buying intentions for major household items.”

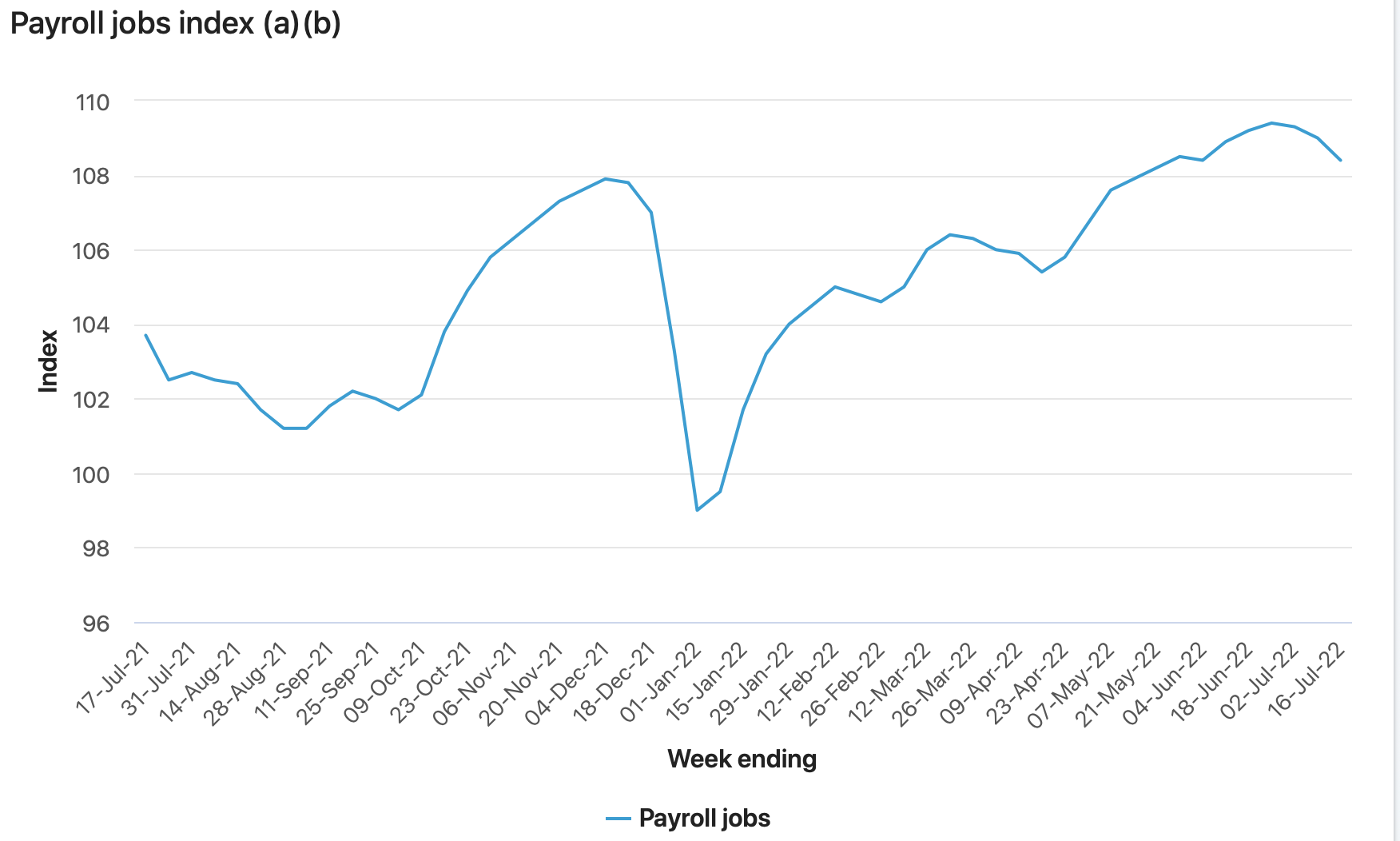

Meanwhile, Aussie payroll jobs decreased by 0.8% between the weeks ending 2 and 16 July, according to the ABS.

As per the custom, estimates of wages are not included in this release due to the end of financial year and reporting seasonality.

The Economic Calendar for this week

Source: Commsec and Investing.com

Highlights for the week ahead include: Australia’s labour force data and the Eurozone CPI.

Australia and New Zealand

TUESDAY

CBA household spending intentions for July

Monthly consumer price index indicator

Overseas arrivals and departures for June

Weekly consumer confidence

WEDNESDAY

Wage price index for June qtr

THURSDAY

Labour force for July

Average weekly earnings

Global

MONDAY

Japan GDP

China retail sales

China industrial production

China unemployment rate

TUESDAY

US industrial production for July

EU trade balance

WEDNESDAY

US retail sales for July

US FOMC minutes

THURSDAY

US home sales for July

Euro CPI

The ASX IPO calendar for this week

According to the ASX, no stocks are expected to list this week.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.