Traders’ Diary: Everything you need to get ready for the week ahead

Ready for another quiet week. Via Getty

- Small caps and ASX 200 down 0.4% and 0.8% last week

- Global markets mostly lower on inflation fears

- So many PMIs this week, UK inflation read: hopefully dire after Poms’ rugby series win in Sydney

The economic week that was

Clean your gun.

The rising cost of things vs. the rising cost of the money to buy them – these were, and will likely remain the central narrative driving forward the investment market story last week and into this one.

Around the region, Japanese shares fell 1%. The Bank of Korea lifted rates at consecutive meets for the time in its history and Chinese shares ended the week down more than 4%, after the world’s second largest economy grew by just 0.4% in the second quarter. About twice as bad as expected.

The local All Ords index fell 1.1% last week, led by a calamitous run for mining and materials stocks where a crash in commodity prices worked in tandem with the utterly awful and equally perplexing stuff coming out of China – from resurgent COVID-numbers; absurd diplomacy; meaningless trade signals; the re-humiliation of tech giants like Alibaba and the biggie in the background, a sclerotic property sector – the largest single global consumer of the things we sell to make ghost cities.

Utilities also had a rough week. No-one really cares.

Almost as bad actually as banking and property stocks.

Those problems were more closely aligned with the worse-than-anticipated US inflation read which if you had to put a face to it might look a lot like of Marlon Brando in John Frankenheimer’s Island of Dr Moreau (1996).

In fact, the whole week was like being in that movie.

The US June CPI inflation was certainly unnerving.

It came on stronger and harder at 9.1% year-on year with core inflation (ie: sans food and energy) still pretty high at at 5.9%.

“Annual core inflation fell again but it’s still way too high,” said Shane Oliver at AMP Capital.

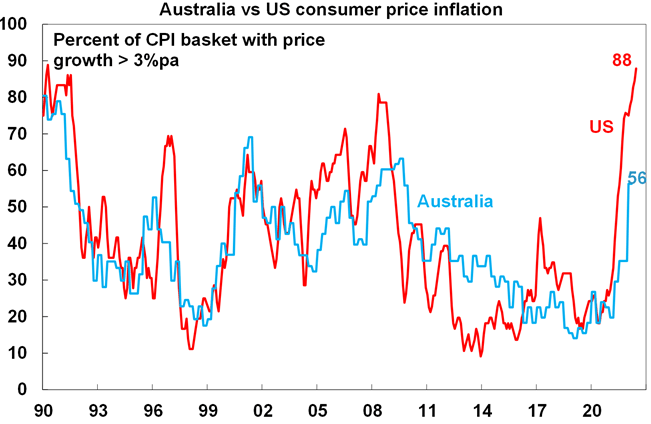

“And rapid price rises are now widespread with 88% of CPI items seeing price gains greater than 3% yoy (AMP Capital chart below) and median inflation now running around 6%.”

Meanwhile, they’re getting better at rugby, but European markets are still tres fragile.

The average 1.1% losses across the main EU indices really fail to present the true extent of the volatile, often loopy trade. Market anxieties were magnified as Berlin looks to get but a morsel of what a permanent shutdown of Russian gas flowing through the Nordstream 1 pipeline might taste like, following the incredibly presciently timed news of a “maintenance shutdown” broke out of Moscow.

And – not that it really matters but fun to note – the Italians are back in classic Italiano crisi politica, with the ill-named Five Star Movement alliance withdrawing support for the Draghi Government. Mario Draghi wants to quit, they want him to quit. But they also won’t let him.

Almost there.

Aussie home prices dropped again last week, AMP expects dwelling values to retreat by 15% to 20% into the second half of next year as awful affordability and suddenly rising mortgage rates take the ascendency. Sydney and Melbourne prices are already kind of flatlining. Most other cities and regions are seeing price gains slow right down ahead of what look like an outright stall.

The Bank of Canada hiked, so did the Kiwis. And given our very strong jobs data and the fuss over the need to prevent inflation moving on up, the major banks are largely pricing for another 0.5% RBA rate hike in August.

CBA’s Stephen Wu says the bank’s economic team – Aird, Clifton, Whetton, Allen, Wu et al, it’s a lot of quality grey matter in once place – have revised their profile for the cash rate target and see the RBA hiking by 50 basis points at both its August and September board meeting.

“The August 50bps centralises an upside risk we had previously noted while the expected 50bps in September reflects our view that the RBA will remain concerned about the potential shift in inflation psychology,” Wu said.

The economic week that will be

We’ve a s..t-tonne of PMIs due this week.

On the bank side of things the current plaything of Christine Lagarde, the ECB, is likely to increase its policy rate by 0.25% on Thursday.

The BoJ is expected to leave monetary policy on hold on Thursday, but there is some risk that it may weaken its bond target.

Japanese inflation for June is expected to fall to 2.4% yoy (from 2.5%) and core inflation is expected to rise to 0.9% yoy (from 0.8%).

At home, the minutes from the last RBA meet drop on Tuesday – I quite like to read these.

Governor Lowe talks on Wednesday probably just to mention we’re already cactus because they messed up inflation big time, it can’t be stopped, we should all sell our homes and buy up some Yen.

(Or that he’ll do “what is necessary” to return inflation to target.)

Australia and New Zealand

MONDAY

New Zealand CPI read

TUESDAY

RBA Minutes of July Policy Meeting/RBA’s Bullock speech

WEDNESDAY

RBA’s Gov. Philip Lowe speech

Westpac Leading Index MoM

THURSDAY

NZ Trade balance for June

NAB Business Confidence

FRIDAY

S&P Global Australia PMI Composite

S&P Global Australia PMI Services

S&P Global Australia PMI Manufacturing

Global

MONDAY

UK Employment Change

Euro Area Bank Lending Survey

Eurozone CPI MoM for June

Eurozone CPI Core YoY for June too

US Housing Starts MoM that’s June

US Building Permits MoM June

TUESDAY

China One-Year Loan Prime Rate/Five-Year Loan Prime Rate

UK House Price Index

UK just a heap of inflation reads, they’d be pretty nervous

EU – ECB Current Accounts

Canada CPI read, IDK if Canadians are reading

WEDNESDAY

UK Monthly GDP May

EU Industrial Production May

US CPI June

US Federal Reserve Beige Book

Canada BoC Meeting, Monetary Policy Report

BoC Governor Macklem speaks post-decision (again if the Canadians care)

THURSDAY

US Existing Home Sales

US Initial Jobless Claims

Eurozone Consumer Confidence FOR JULY

Japan Trade Balance June / Exports / Imports

EU ECB Main Refinancing Rate / Deposit Facility Rate

EU ECB President Christine Lagarde press conf!

Japan BOJ Policy Balance Rate / 10-Yr Yield Target / CPI and GDP Forecast

Friday

Japan Jibun Bank Japan PMI Services July / PMI Composite July

EU S&P Global Eurozone Manufacturing PMI July / Services PMI July / Composite PMI July

UK Consumer Confidence July

UK Retail Sales

UK S&P Global/CIPS UK Manufacturing PMI July / Services PMI / Composite PMI

US S&P Global US Manufacturing PMI

Source: CBA, investingdotcom

The ASX IPO calendar for this week

According to the ASX these stocks will make their debut listing this month (subject to change without notice)

Aeramentum Resources (ASX:AEN)

Listing: 20 July

IPO: $8m at $0.20

The copper explorer has tenements in the prospective North West minerals province of QLD – adjacent to the world-class Mt Isa mines.

The company is embarking on an aggressive drill program with target testing underway.

Australia Sunny Glass Group (ASX:AG1)

Listing: 26 July

IPO: $7.5m at $0.35

This Australian-based holding company, through its subsidiaries, operates a glass production and supply business for structural building facades.

The group has a fully automated processing plant which it says is highly efficient, accurate and scalable and an R&D focus on the development of cyclone resistant glass using new laminating and bonding techniques.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.