Dr Strain: And that, Ladies and Gentlemen, is a lot of US CPI pressure

Via Getty

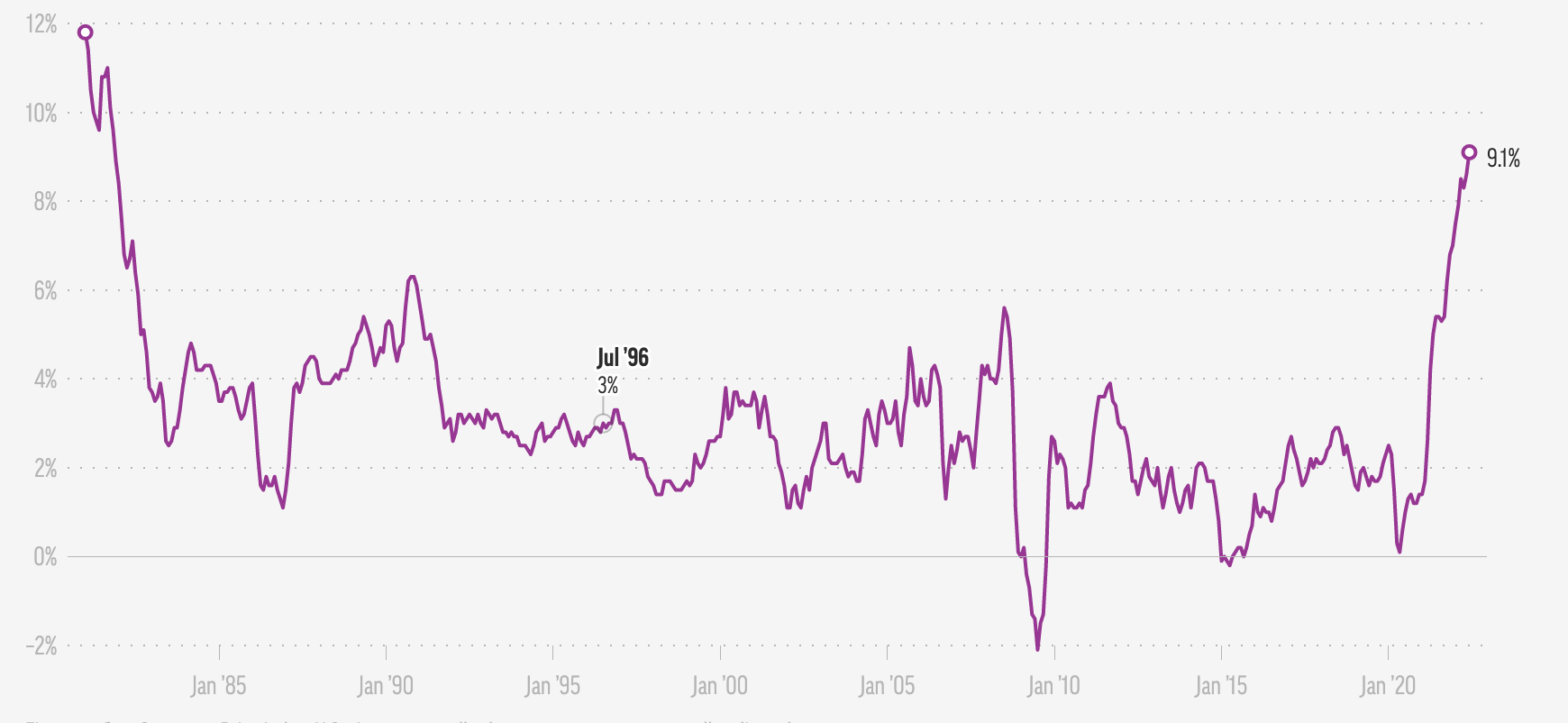

Already terrible US price pressures were worse than most of the smart people thought last month – the latest inflation numbers released overnight are bad – the June US consumer price index (US CPI) rose like a birthday balloon, 9.1% over the past year – according to the Bureau of Labor Statistics.

Relentless energy price rises contributed almost half of the increase, the BLS says.

The Associated Press says it’s the biggest yearly increase since 1981, with nearly half of the increase down to the incredible toppiness of global energy costs.

Energy prices accelerated higher at a rate of 7.5% from May to June. US gas prices are up nearly 60% compared to just a year ago. The new data shows vast increases in the prices energy, housing, and even food.

Economists again undershot their expectations for US headline CPI, which they’d forecast would rise by 1.1% month-on-month in June yo 8.8%/yr largely because of higher gas prices.

Come on. You had one job.

It’s worth sharing the words of a very emotional Dr Michael (still obviously under a lot of) Strain, who’s the director of economic policy studies at the American Enterprise Institute.

“There was not a drop of good news in this report,” Strain told the Washington Post overnight.

“I had an emotional reaction.”

He sure did.

“I was trying to think about the last time I had an emotional reaction to an economic data release,” Dr Strain said, “and I think you have to go to (sic) back to the financial crisis.”

“Dismay,” he said, unprompted.

“Frustration,” Dr Strain, still under enormous pressure, added.

US CPI and the price of energy

Yes Dr Strain seems to reflect an America overflowing with rising prices in June – prices which continued to climb at their fastest pace in 40 years across a broad and comprehensive sector of the world’s most important economy.

Spurred on of course, by ridonkulous energy prices, as we well know here.

Consumer Price Index, US city average,

Perhaps more troubling is the read was 1.3% higher than it was in May. And that May read – let’s not forget – begat some old school panic trading, triggering Wall Street’s worst session since January.

Released June 19, the May read which was the initial headline indicator which freaked US markets and at the time turned the spotlight back on The Fed’s failure to enact countermeasures earlier with a frustrated OANDA’s Edward Moya at the time telling Eddy it was The Fed’s ‘latest mistake.’

“They did not act strongly to cool inflation, and they will now be forced to deliver more rate hikes as inflation is clearly not transitory and not ready to peak.”

Definitely not transitory

And clearly not yet peaking.

The last time US inflation reached over 9% was November 1981.

At the heart of the June rise was an energy index, which looked plucked out of the ‘70s.

It was up 7.5% compared to May and contributed nearly half of the whole increase, remembering the energy index includes prices for all fuels, oil, the gasoline which goes into those ridonkulous cars and the ancient US state-led electricity grids.

It’s up 41.6% for the year, and that ladies and gents, is the largest 12-month rise since Ronald Reagan was doddering about the White House in April 1980.

And if you exclude the volatile food and energy categories, the US core inflation prices still rose 0.7% from May to June, the biggest spike in a year. Core prices jumped 5.9% on last year too.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.