Trader’s Diary: Everything you need to get ready for the week ahead

It's a Titanic kind of week via Getty

- Markets had another angsty week, ASX more than holding its own globally

- Chinese lockdown stimmy and central banks take centre stage

- Six new names expected to make their ASX debut this week

Major economic headlines last week

Markets faced more music last week, an old tune with a rate hike rhythm and Chinese lockdowns blues.

The good news for our resource-laden equity markets was Friday’s vague but unprompted declarations of more market stimulation out of Beijing.

Details are thin, but the reassurances are not just wee in the wind: China’s economic authorities only say what they mean – so investors can bank on support for the vulnerable sectors (property, construction, retail and most importantly tech) and a few tricks to boost domestic consumption – most of which bode well for an Australian market rich in the commodities which act as the building blocks of so much China creates.

In the states, the tech-heavy Nasdaq took on further water, just as its Messiah Elon Musk took over more of what makes it tick (or tweet). The Nasdaq has now shed 23% from its record high, while broader US shares lost 3.3% for the week and 14% from early January highs.

We’re still a bloody equity-outperformer here. We might be flat for 2022, but aside from Brazil and Canada (both commodity countries) we’re kicking global butt.

Dr Shane Oliver, chief economist and head of investment strategy at AMP Capital’s pep-talk to the ASX is pretty simple – keep your chin-up, ‘cos your high exposure to resources and low exposure to tech makes you a relative winner in ’22.

“Our base case for investment markets remains that US, global and Australian recession will be avoided over the next 18 months at least and this will enable share markets to have reasonable returns on a 12-month horizon. However, the past week provided a reminder that short term risks around inflation, rate hikes, the war in Ukraine and Chinese growth remain high, which of course saw more volatility in share markets with US shares falling back to their March low and Nasdaq and Chinese shares making new lows.”

Elsewhere last week the Russian President played his gas card on Poland and Blugaria, deftly and easily sowing the seeds of European disharmony, while America’s flow of arms and support in to Ukraine is making NATO resistance look a lot like US war by proxy. President Joe Biden actually signalled his intent to bleed the strength out of Russia.

So investment markets will be a long way from putting this particular ‘cignes-noir’ to bed.

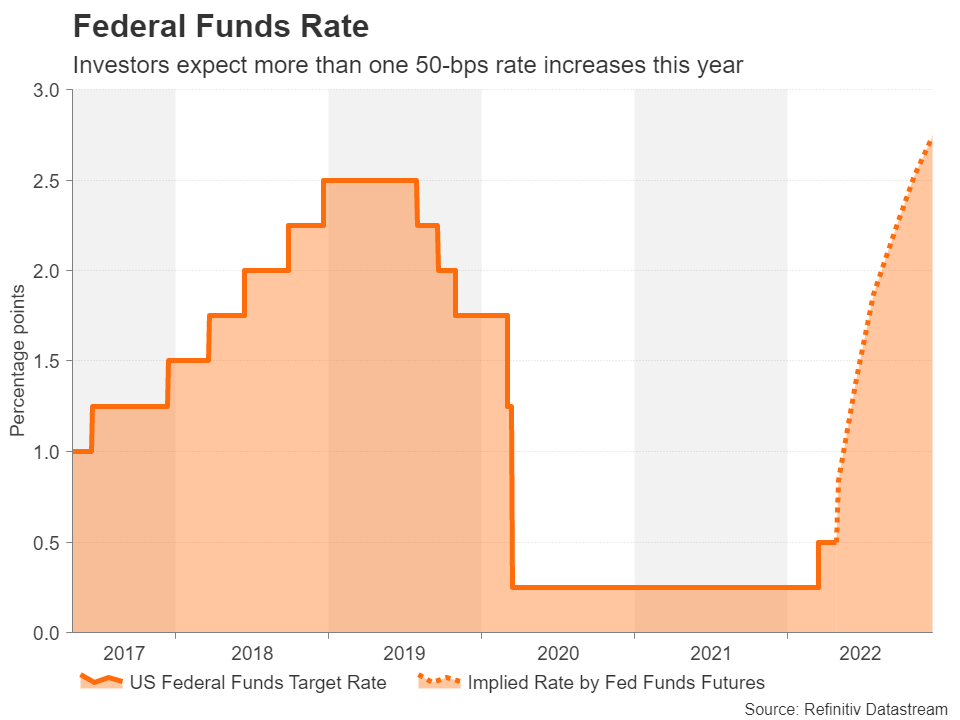

So looking ahead, the Fed and the Bank of England rather likely to raise interest rates, though the Poms are expected to win that particular weeing contest. The Reserve Bank of Australia (RBA) feeling the heat to get on with things this week, rather than wait till it’s all over (election and other) in June. It will also be a busy week for jobs data.

But the main spotlight will be on the Federal Reserve, which is almost a gimme for a 50bp hike on Wednesday.

The move looks set to be the first of many in this cycle and Chair Powell, Jerome, has not been home to any dove talk of late.

OPEC holds its monthly meet but with energy prices moving like a George A Romero zombie, whether they surprise and pump more oil is an issue for discussion worth having on a deck chair, heading to the new world on a great big unsinkable boat symbolising all the hubris of a world in love with its newfound ability to bend the planet to its will.

Stuff is also costing more. Our scene now turns to the RBA May meet for a bit of rate hike action.

Economic calendar for this week

Sources: Westpac, Commsec.

Australia

MONDAY

Final Manufacturing PMI

CoreLogic House prices

Melbourne Index Inflation Gauge

Job Ads & Food Prices

TUESDAY

Reserve Bank board meets to get all hikey on the cash rate

WEDNESDAY

Australian Final Services PMI

ABS Retail Sales & Home Loans

THURSDAY

ABS Trade & Building Applications

FRIDAY

Reserve Bank’s SoMP

International calendar

US (AEDT)

MONDAY

Final Manufacturing PMI & Manu. ISM

TUESDAY

JOLTS & Factory Orders

WEDNESDAY

ADP Employment data

Trade, Final Services PMI

Services ISM & FOMC

THURSDAY

1Q Productivity & Claims

FRIDAY

NFP/Employment

Europe (AEDT)

MONDAY

Final Eurozone manufacturing PMI

EU Econ./Ind./Services Confidence read

TUESDAY

UK Final Manufacturing PMI

Germany Retail Sales

WEDNESDAY

BoE Policy Meeting & MPR

UK Final Services PMIGermany Trade & Final Services PMIs

EU Retail Sales

THURSDAY

Germany Factory Orders

FRIDAY

Germany Industrial Prod.

And according to the ASX, these companies are listing:

Allup Silica (ASX:APS)

Listing: 2 May

IPO: $5m at $0.20

This explorer is focused on its silica sand tenements – and has high hopes for the commodity which is essential for the manufacture of photovoltaic panels (solar) and other vital industrial applications.

The company holds the Unicup, Antwalker, Pipeclay Tree, Esperance and Argyle projects in WA.

Listing: 2 May

IPO: $8m at $0.20

This West African gold explorer is already listed on the TSX, and has sights set on growing its flagship Sanutura project in Burkina Faso.

But Sanutura is already pretty big, with mineral resource of 2.9Moz, including 9.4Mt at 1.9g/t for 600,000oz in the indicated category and 52.7Mt at 1.4g/t for 2.3Moz inferred.

The company has 50,000m of mostly extensional drilling planned in the next 12 months.

Listing: 2 May

IPO: $12m at $0.20

A wholly-owned subsidiary of OreCorp (ASX:ORR), Solstice holds OreCorp’s interests in four WA assets; the Yarri, Kalgoorlie, Yundamindra and Ponton projects.

Going forwards, OreCorp’s existing core business will focus on the Nyanzaga Project in Tanzania, with Solstice Minerals focusing on the WA assets – which are prospective for orogenic-style gold mineralisation – with the Kalgoorlie Project also prospective for komatiite hosted nickel sulphide mineralisation.

Listing: 3 May

IPO: $12.5m at $0.50

This explorer is building a pipeline of precious and base metal discoveries in Nevada, USA.

Its portfolio includes the Blackhawk polymetallic silver-gold epithermal discovery and the Blackhawk porphyry copper-gold discovery.

SNG also has the Warrior, New Pass and Colorback gold projects.

Around 12,000m of drilling is planned over the next 12 months.

Listing: 5 May

IPO: $10m at $0.20

This gold explorer is focused on revitalising the Victorian goldfields, which host Fosterville and Costerfield, two of the highest-grade underground deposits in the world.

The company is a spin-out from Toronto Stock Exchange listed Mawson Gold – which is now a Nordic focused gold exploration company which holds the Rajapalot gold-cobalt project in northern Finland.

SXG operates the Sunday Creek, Redcastle and Whroo projects in Victoria, along with the Mt Isa polymetalic project in Queensland.

Listing: 6 May

IPO: $183.5m at $6.50

This assay player combines science and software to create technology solutions for the global mining industry.

Its flagship product PhotonAssay was originally developed at Australia’s national science agency, CSIRO, and delivers faster, safer, more accurate and environmentally-friendly analysis of gold, silver and complementary elements.

The company says the technology has rapidly displaced slower, more hazardous and costly processes to become the mining industry’s most innovative and valuable assaying solution.

They’re so interesting, Josh Chiat has the full skinny on them here.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.