Trader’s Diary: Everything you need to get ready for the week ahead

Pic: d3sign / Moment via Getty Images

Major economic headlines last week

Timid global share markets retreated last week mainly on the aggressive tone of hawkish central bankers and the spreading, blue-green alge-esque blooming of bond yields.

Aussie equities did relatively well, compared to markets on Wall Street and in the EU which both fell well on average over 1%.

The Nikkei was pole-axed 2.5% and Chinese markets fell 1.1%.

The ASX200 only gave away 0.2%, favoured by surprise strength in utilities, some of the energy names and a cracking return to form for a few punchy commodities IPOs.

Tech stocks and materials weighed, the ASX Emerging Companies (XEC) index lost 0.5% last week.

Oil and iron ore ended a volatile week lower and while the Aussie dollar-buck nudged $US0.76 it fell back in the face of a rising USD.

Also last week: the broad consensus is that the property market has passed its zenith, now both the Fed and the RBA have escalated their own versions of being hawkish.

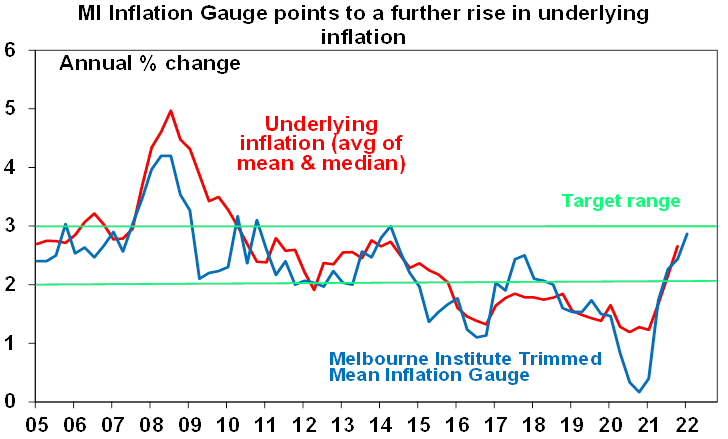

“The problem central banks face is that while the surge in inflation is mainly due to supply side constraints, which they can’t do much about, the longer inflation stays high the more it will be built into inflation expectations and becoming self-perpetuating. Hence the scramble to tighten is all about keeping inflation expectations down,” says AMP Capital’s Shane Oliver.

What did fly under the economic radar last week was Friday’s RBA Financial Stability Review – once such a source of great excitement for economists and angst for major lenders, leveraged up the wazoo as they are in mortgages.

The central bank reports the financial system looks in pretty good shape and appears ready for a run of higher interest rates.

Aussie banks are well capitalised, loan arrears are low and many households have built up buffers on their mortgages.

Political risk is back on the main stage. A perpetually uncertain Europe is dealing with deep uncertainty around the next phase of the war in Ukraine and how to deal with its punitive approach to Russia.

At the time of writing my beautiful wife is at the Lycée Condorcet aka – The International French School of Sydney – with her eccentric expatriate ilk, queuing in a state of fury with which only the French can muster. There’s an election in France. It’s so très sérieux that Le Monde is launching an english language version of the French broadsheet to cover it. And with some 500 French journalists working out of the Paris newsroom its certain to have in-depth coverage that is late, rude and a bit winey.

On that note, our own Prime Minister PM has flown to Canberra, done something symbolic with the Governor General and we’re on for May 21.

Economic calendar for this week

Sources: Westpac, ANZ, Commsec, Refinitiv

Australia

TUESDAY

NAB business conditions survey for March

ABS March overseas arrivals

WEDNESDAY

April WBC–MI Consumer Sentiment

THURSDAY

April MI inflation expectations

ABS March unemployment rate

FRIDAY

Australia/NZ Mkts close – very Good Friday

International calendar

US (AEST)

MONDAY

US Fedspeak: Evans, Bostic, Bowman, Waller at Fed Listens event

TUESDAY

US inflation data

US small business optimism

WEDNESDAY

Producer price inflation

Fedspeak: Brainard

THURSDAY

March retail sales

March import price index

Initial jobless claims

February business inventories

Apr Uni. of Michigan sentiment read

Fedspeak: Mester

FRIDAY

April Fed Empire state index

March industrial production

China

MONDAY

Chinese CPI/PPI inflation

WEDNESDAY

Mar trade balance

Europe (AEST)

MONDAY

UK Feb trade balance

TUESDAY

April ZEW survey of expectations

WEDNESDAY

EU February industrial production

UK March CPI

THURSDAY

ECB policy decision

ASX IPO calendar for this week

Listing: 13 April

IPO: $5m at $0.20

The exploration company is focused on nickel-copper-PGE discoveries in Australia.

NYM holds the Narryer project in WA, and the Sturt and Ceduna projects in SA, in what the company says are strategic geological domains that have been under-explored.

Listing: 14 April

IPO: $8.12m at $0.25

The explorer holds tenements in Queensland and Western Australia and lithium rights to certain tenements in the Yalgoo Lithium province.

The portfolio contains lithium, rubidium, nickel, cobalt, copper and gold, which the company says places them in an ideal position as the battery metals industry develops into the future.

Listing: 14 April

IPO: $5m at $0.20

The explorer and developer is targeting gold and base metals discoveries.

In SA, the company has the Yumbarra Project (nickel and mineral sands), along with the Fowler, Coorabie Shear Zone, and Tallacootra projects (nickel/copper and gold)

The Sandford Project in Victoria is prospective for gold and base metals (copper, lead, silver, and zinc), as well as ionic REE clays and heavy mineral sands.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.