Weekly Small Cap and IPO Wrap: Loopy week ends on high for mad caps, as IPO market stays hot

Pic: DKosig / iStock / Getty Images Plus via Getty Images

The ASX200 is having a decent session to end a bit of a loopy week.

This despite some ordinary leads coming out of the US overnight. The three key US indices ended flat or slightly higher thanks in part to some bearish hyperbole about inflation needing to be met with aggressive interest rate action from the Fed’s Muscle of St. Louis, Jim Bullard.

US traders are probably still turning in their beds, after Bullard claimed to expect US rates to be a good 3.25% higher by 2H.

In any case, the AX200 is up about 0.5% with most sectors making soft gains on low volumes except for the tech sector which giveth, then taketh away, then giveth again but a bit less, then sits on hands to wait for what happens on the Nasdaq tonight.

Unless of course, we’re talking smallies, in which case you’ll note the ASX Emerging Companies (XEC) index – up 1.2% on Friday afternoon, yet down 0.4% for the week, is no mere visitor to this dark Vale of Volatility, but is rather more of a semi-permanent loiterer with intent.

A mixed night run on Wall Street and a crappy one in Europe don’t bother the small cap index none.

What else? Ah yes, iron ore started the week well over $US160 but no longer is.

The Aussie dollar-buck was eyeing 76 US cents on Monday, now it’s not. And oil – sweet baby Jesus – it’s under a hundred US($) now, but the stuff they call crude has been more unpredictable than a French presidential election.

Oh the volatility!

A crazy old time for markets was paraphrased nicely into the last five days of trade. We’ve had some of the purest refined volatility to ever go up the ASX nostrils and into the local trading bloodstream with wild price swings, stonking inflationary pressures, silly energy prices and naturally a Musk event on Twitter of some market moving significance.

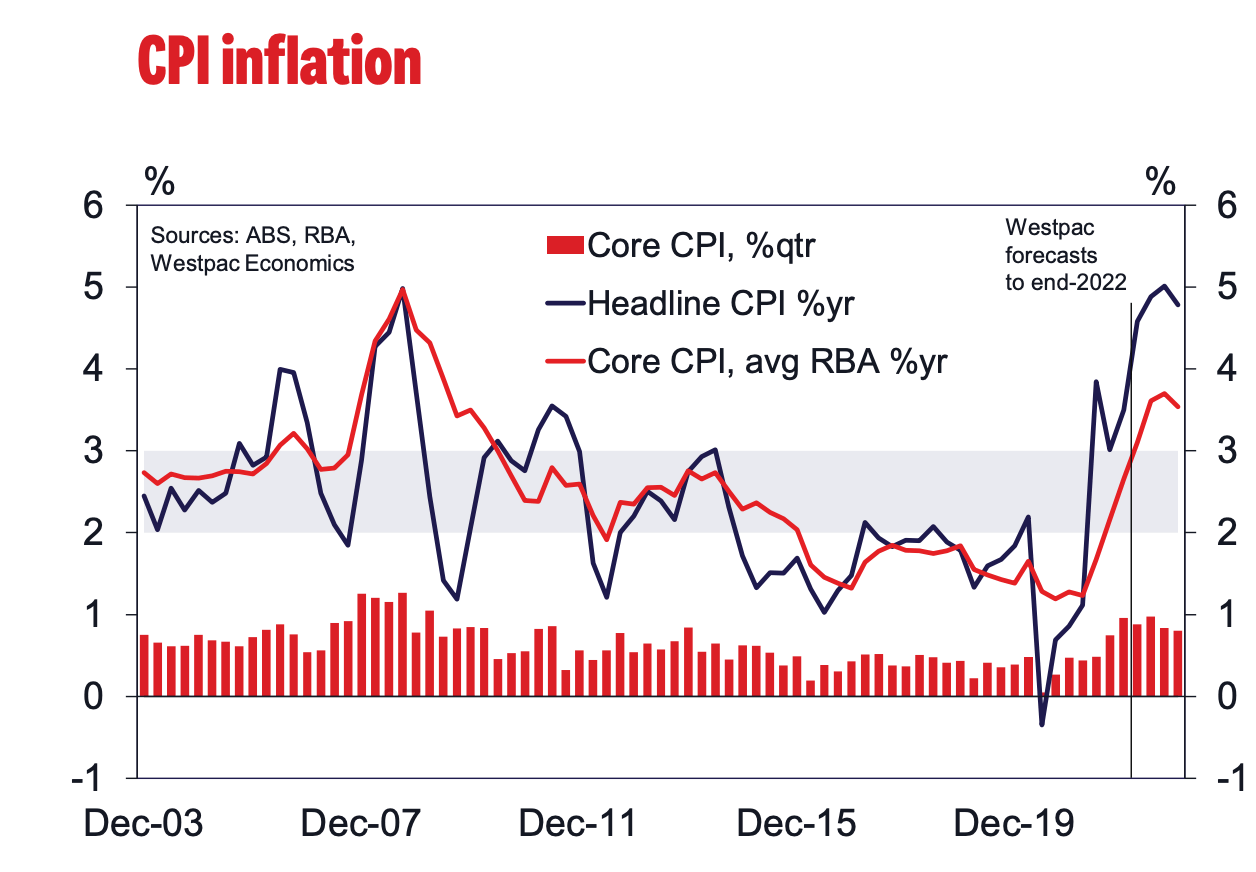

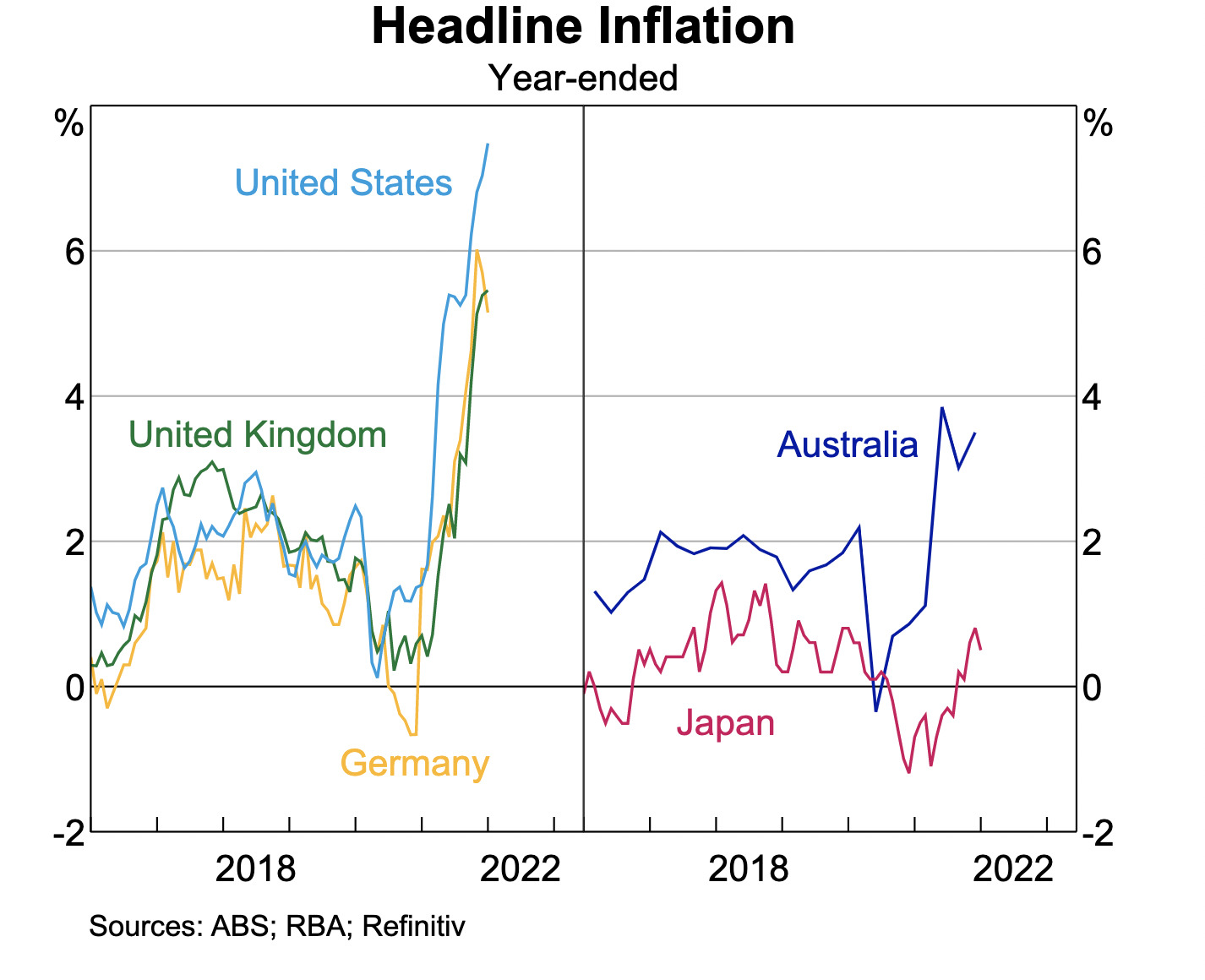

A solidifying fear of inflation is starting to look like a common factor in a lot of investment decision making:

Central bankers and the economists that track them rebooted their takes on interest rates just as new data suggests the property pot has finally gone off the boil.

This week the Reserve Bank of Australia (RBA), ditched the dominant adjective of the current interest rate era – ‘patient.’ And the best part of that is you don’t even need to replace it with anything, because now the jig is up and pretty much everyone reckons the RBA tightening cycle will kick off in June.

Westpac’s rate-whisperer and chief economist Bill Evans sees it the same, bringing forward the bank’s first rise from August, and saying the cash rate will rise to 1.25% this year and then peak at 2.0% in mid-2023 (previously 1.75% at the end of 2023).

“This view is informed by positive labour market developments, with evidence of strong demand and the prospect that the unemployment rate will likely move lower than previously anticipated,” Evans adds.

So maybe get your housing in order.

How did this week’s IPOs perform?

Noble or not, the fascination for helium is getting very real, up over 100% is Tanzanian-focused – Noble Helium (ASX:NHE) which raised $10m at $0.20 and has hit the boards on Friday absolutely pelting.

NHE is exploring and developing helium assets in the United Republic of Tanzania, where it says the first of four licensed Tanzanian basins gives it the potential to become a Tier One project at proof in 2023.

NHE also says its current projections show that Tanzania will be one of the largest helium resources in the world and the company believe’s its timing is very, very good.

Thanks to a looming take up of nuclear fusion as an alt-source of raw energy, NHE sees a 400% increase in helium demand.

Fighting words those, but there are many uses in the US$6 billion global helium market today. The lightweight gas is used in semiconductor production (19% and forecast to hit 28% of all demand), fibre optics, rocket fuel pressurisation, making funny voices, cryogenics, and cooling superconducting magnets used in medical imaging.

Noble is seeking helium in four basins across Tanzania, where if proven, would represent 17 years of supply based on current global demand.

International Graphite’s (ASX:IG6), fabulous debut on Thursday – closing about 80% stronger – appears no fluke with the stock climbing a further 7% on Friday.

The integrated mine and downstream graphite business in WA says its goal is to produce battery anode material for the burgeoning electric vehicle )RV) industry. Investors like the plan so far. A lithium-ion battery needs 10 times more graphite than lithium, with each EV requiring ~55kg of flake graphite to make the battery anode.

Experts say the supply deficits are already here, and prices are beginning to show it. The Benchmark Graphite Price Index is currently up by 22% year-on-year. A solid bet, for day one.

Finder Energy (ASX:FDR) is on the boards at last, 18 years after it first formed as Finder Exploration.

The stock was steady in Friday trade, up over 2% at the time of writing after it raised $15 million in an IPO at 20c a pop, with one of the largest portfolios in Australia’s North West Shelf including interests in permits in the Dampier and Beagle sub-basins as well as the Vulcan Sub-basin of the Bonaparte Basin.

The company is poised to spud its Kanga-1 oil exploration well in early May that targets best case prospective resources of about 170 million barrels of oil with 25.5MMbbl net to Finder (15%) in the high-quality Legendre reservoir.

“A discovery will be a game-changer. Because of our tight capital structure with only around 150 million shares on issue, shareholders have enormous leverage to success,” managing director Damon Neaves told Stockhead’s Bevis Yeo.

There are some big industry names on board with Indiana Resources (ASX:IDA) executive chair Bronwyn Barnes, taking on an independent exec chair role and Fred Wehr, the brains behind the big Dorado oil discovery in 2018, an independent non-exec director.

ASX SMALL CAP WINNERS:

Here are the best performing ASX small cap stocks for March 4 – 8:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| LRS | Latin Resources Ltd | 0.19 | 102.1% | $324,587,229 |

| GED | Golden Deeps | 0.022 | 100.0% | $16,292,880 |

| PUR | Pursuit Minerals | 0.032 | 68.4% | $31,203,123 |

| LCY | Legacy Iron Ore | 0.032 | 68.4% | $249,866,222 |

| JNO | Juno | 0.15 | 57.9% | $18,313,830 |

| HIO | Hawsons Iron Ltd | 0.41 | 57.7% | $257,419,062 |

| XTC | Xantippe Res Ltd | 0.014 | 55.6% | $110,961,395 |

| AHK | Ark Mines Limited | 0.4 | 53.8% | $11,658,536 |

| GME | GME Resources Ltd | 0.14 | 53.8% | $83,158,707 |

| ENT | Enterprise Metals | 0.023 | 53.3% | $13,537,584 |

| RMI | Resource Mining Corp | 0.052 | 52.9% | $19,289,981 |

| WML | Woomera Mining Ltd | 0.026 | 52.9% | $16,483,994 |

| NET | Netlinkz Limited | 0.038 | 52.0% | $130,526,413 |

| PNN | PepinNini Minerals | 0.695 | 51.1% | $42,852,820 |

| PBX | Pacific Bauxite Ltd | 0.15 | 50.0% | $1,189,876 |

| PWN | Parkway Corp Ltd | 0.012 | 50.0% | $26,464,262 |

| YPB | YPB Group Ltd | 0.0015 | 50.0% | $12,235,667 |

| OEX | Oilex Ltd | 0.006 | 50.0% | $35,838,954 |

| OKR | Okapi Resources | 0.475 | 48.4% | $42,152,102 |

| MM1 | Midasmineralsltd | 0.235 | 42.4% | $11,976,388 |

| HAW | Hawthorn Resources | 0.115 | 42.0% | $45,024,608 |

| G6M | Group 6 Metals Ltd | 0.22 | 41.9% | $138,766,037 |

| AAJ | Aruma Resources Ltd | 0.155 | 40.9% | $25,113,840 |

| GGE | Grand Gulf Energy | 0.053 | 39.5% | $68,004,865 |

| RGL | Riversgold | 0.088 | 38.7% | $42,410,390 |

| ADD | Adavale Resource Ltd | 0.054 | 38.5% | $19,153,295 |

| TMK | TMK Energy Limited | 0.018 | 38.5% | $51,840,000 |

| EMP | Emperor Energy Ltd | 0.065 | 38.3% | $14,842,986 |

| AOA | Ausmon Resorces | 0.011 | 37.5% | $7,715,604 |

| OPN | Oppenneg | 0.275 | 37.5% | $29,316,202 |

| CAN | Cann Group Ltd | 0.35 | 37.3% | $102,991,440 |

| BMM | Balkanminingandmin | 0.37 | 37.0% | $12,281,250 |

| AS2 | Askarimetalslimited | 0.765 | 36.6% | $24,778,421 |

| VOL | Victory Offices Ltd | 0.15 | 36.4% | $23,677,202 |

| WCN | White Cliff Min Ltd | 0.034 | 36.0% | $21,470,671 |

First up a big shout out to those IPOs mentioned above International Graphite’s (ASX:IG6), for a fabulous debut on Thursday, and Noble Helium (ASX:NHE) which literally outdid the former on Friday.

A sterling week it has been for Okapi Resources (ASX:OKR)

where its bold uranium ambitions were just about going nuclear after the announcement on Thursday of its acquisition of a 51% stake in the high-grade Hansen deposit in Colorado.

There’s a heap going on in favour of the strategic acquisition, not least the mega-boost to the size of its JORC resource at the Tallahassee uranium project by 81% to 49.8 million pounds of U3O8 while increasing its grade by 10% to 540ppm U3O8.

This gives Okapi a significant slice of the US uranium pie at a time when the world’s largest consumer of the energy metal is trying to reduce its reliance on imports from Russia, Kazakhstan and Uzbekistan, which supply 46% of its demand.

Adding further interest, Hansen – located immediately south of and adjacent to the company’s wholly-owned Taylor and Boyer deposits – actually had feasibility studies completed and all permits secured to start production prior to the collapse of the uranium market in 1982.

While these permits have long since expired, they do indicate that the company has control over a well-defined uranium deposit that has already proven to be attractive enough to be considered for development.

That the acquisition has a modest upfront cost of just $500,000 which will be covered by existing cash reserves is just the cherry on top of the cake.

Up about 25% for the week after a similarly cracking run in March was Cuba-based Melbana Energy (ASX:MAY), which has just kept posting a gaggle of strong updates from its Alameda-1 well which briefly saw the stock hit 19c — a gain of ~10x from where it started the year (2c).

On Thursday MAY added its latest, ‘extremely good result’ which ‘easily exceeds our pre-drill expectation,’ in the words of Andrew Purcell, the exec chair.

“The Alameda-1 exploration well has confirmed the presence of oil across significant intervals in three structures (with potential for upside, given the two larger structures – Alameda and Marti – were intersected a long way down dip from their crests),” Purcell said.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for March 4 – 8:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| ERD | Eroad Limited | 3.27 | -21.0% | $410,460,288 |

| RD1 | Registry Direct | 0.015 | -21.1% | $7,524,799 |

| FTZ | Fertoz Ltd | 0.225 | -21.1% | $53,734,403 |

| HPG | Hipages Group | 1.63 | -22.0% | $225,401,347 |

| KFE | Kogi Iron Ltd | 0.007 | -22.2% | $9,800,068 |

| CGA | Contango Asset | 0.605 | -22.4% | $32,712,004 |

| RDT | Red Dirt Metals Ltd | 0.565 | -22.6% | $195,970,739 |

| CM8 | Crowd Media Limited | 0.033 | -23.3% | $21,434,849 |

| CXM | Centrex Limited | 0.15 | -23.6% | $80,306,603 |

| LV1 | Live Verdure Ltd | 0.24 | -23.8% | $11,564,252 |

| NTL | New Talisman Gold | 0.0015 | -25.0% | $4,690,838 |

| SFM | Santa Fe Minerals | 0.135 | -25.0% | $9,830,537 |

| SIH | Sihayo Gold Limited | 0.0045 | -25.0% | $18,427,307 |

| B4P | Beforepay Group | 0.635 | -25.3% | $22,162,448 |

| AJQ | Armour Energy Ltd | 0.011 | -26.7% | $21,776,353 |

| 3MF | 3D Metalforge | 0.033 | -28.3% | $5,344,201 |

| DCG | Decmil Group Limited | 0.135 | -35.7% | $29,475,318 |

| MEL | Metgasco Ltd | 0.03 | -36.2% | $27,348,213 |

| UUL | Ultima Utd Ltd | 0.16 | -37.3% | $12,828,817 |

| AIZ | Air New Zealand | 0.745 | -37.7% | $842,133,170 |

| TEM | Tempest Minerals | 0.115 | -37.8% | $47,748,108 |

| ADN | Andromeda Metals Ltd | 0.115 | -37.8% | $294,902,334 |

| MHI | Merchant House | 0.051 | -48.0% | $4,807,591 |

The losses are coming in hard during this Friday session for fan-unfavourite fund manager Platinum Asset Management (ASX:PTM) whose shares crashed on exiting the gate this morning to a record low. Overnight, in a fairly sneaky way, Platinum told the ASX saying FUM (funds under management) were clipped almost two billion dollar-bucks in the space of a moth which was bad but not life-ending from $21.1 billion in February to $19.4 billion in March.

Platinum reported outflows of around $220 million, mainly from underperforming trust funds. The stock lost 16% in the morning session alone.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.