Traders’ Diary: Evasive manoeuvres may be required as tricky week awaits the ASX trader

News

News

After a dreamlike start to November, Wall Street went and snapped its winning streak after US yields surged on the back of a very poorly attended US Treasury 30-year bond auction on Thursday night.

This was in itself largely the result of a resoundingly stubborn set of comments from the US Federal Reserve Chair J. Powell, who glowered at anyone in and out of the room that the Fed will not hesitate to tighten monetary policy further if necessary.

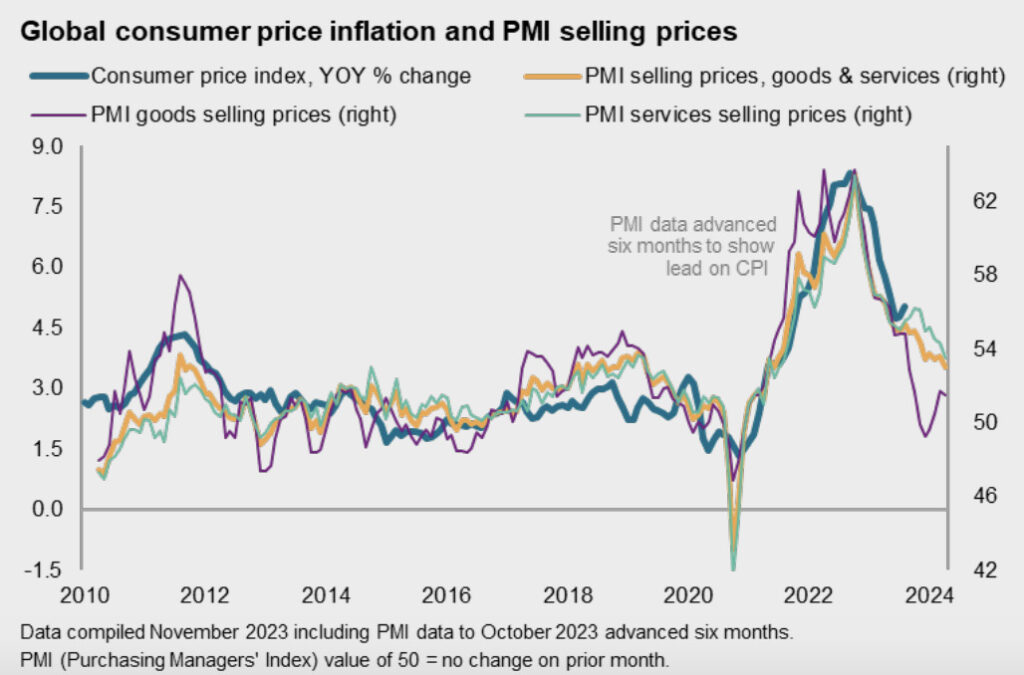

Powell came away looking entirely uncertain about achieving the bank’s 2% inflation target and looks pretty agnostic about further rate hikes

In comments at an International Monetary Fund (IMF) shindig, Powell said the Fed “is committed to achieving a stance of monetary policy that is sufficiently restrictive to bring inflation down to 2% over time…

“We are not confident that we have achieved such a stance.”

Tony Sycamore, IG market analyst, was among the few this week unsurprised that the Fed Chair got all hawkish and pushed back after the recent sharp easing in financial conditions (lower bond yields and higher equities).

“The Federal Reserve requires financial conditions to remain tight to stay on the sidelines, waiting for inflation to moderate,” he said.

Tony says local markets were supported in the early part of the week as Wall Street extended its rally, and following the Reserve Bank of Australia’s (RBA) dovish rate hike.

“We believe this hike likely signifies the end of the RBA’s tightening cycle,” Tony says.

Last Week in Bullet Points

It could be a positive start for the week, when trading kicks off in Sydney.

Local Futures are about +0.3% higher on Sunday night after US stocks rebounded strongly on Friday (Saturday morning Sydenham time) with the S&P500 closing up +1.55%, topping 4400 as bond market ructions eased.

For the week the broad-based US index closed up +1.3% trumping the ASX200 which edged marginally lower.

The Nasdaq Composite rallied hard, up +2.25% delivering its best day since July despite economic data which showed the consumer feels worse around the economy.

On the data front at home we have the October edition of the CommBank Household Spending Insights which drops in a few hours.

Both consumer and business sentiment data will drop on Tuesday via Westpac and NAB.

The gold standard for market moving data is the third quarter (Q3 23) Wage Price Index is released on Wednesday.

CBA expects a lift of 1.2%/qtr and 3.8%/yr, below both B A and consensus expectations of 1.3%/qtr.

“While we do expect an acceleration from the 0.8% recorded in Q2 23 and 1.1% recorded in Q3 22, our internal wage tracker suggests this softer than consensus number.

“We are expecting pass through from higher minimum and award wages and enterprise agreements, but there are signs private sector wages growth has plateaued.”

Labour market data is released on Thursday.

Elsewhere, its Consumer Price Inflation time for both the US and the UK.

US October retail sales will be exciting.

GDP data is due for both the UK and Japan for Q3 23, while the monthly data dump for China is due.

Around the region, China is still providing the bulk of GDP headwinds as geopolitical tensions, volatile commodity prices, property problems and an ongoing uncertainty around which growth path China will take all weigh on confidence. Barclays says signs of an export recovery might offer Beijing and its satellites some relief, but ‘central banks in the region are likely to pause for longer than previously expected, amid ongoing supply shocks.’

Josh Gilbert, market analyst at eToro, shares his three things to watch in Australia in the coming days.

AU Unemployment

Josh says that after last week‘s rate rise, incoming economic data holds the key to whether Tuesday was the last hike in the RBA’s current tightening cycle.

The first set of data we’ll get to shed some light will be the jobless figures this week.

“Employment looks set to remain robust, with unemployment figures lingering near record lows and net employment additions expected to be solid.

“The RBA will know that increasing unemployment is on the horizon, with the full extent of current economic conditions yet to be truly felt by the economy. Migration is high, and data from Seek this week showed job adverts are falling.

“Market forecasts for unemployment month-on-month have remained fairly accurate, and while November’s reading is unlikely to be the first time we see a sharp increase in the unemployment figures, it’s hard to see levels remaining low far into 2024. With that being the case, it’s unlikely the Reserve Bank will feel the need to tighten policy any further from here.”

AU Consumer Confidence

“This week‘s reading of consumer confidence is unlikely to indicate that consumers are feeling any more positive following another rate rise from the Reserve Bank and hotter-than-expected inflation.

“This latest move from the RBA will undoubtedly put pressure on households, especially as savings continue to evaporate just ahead of an expensive time of year,” Josh says.

“With many Australian households feeling the pinch, pressure is mounting on the Federal Labor Government to reconsider its plan to introduce stage three tax cuts. One of the party’s key election promises, the planned cuts to tax for high-income earners would likely cause a boost to retail sales and consumer confidence while doing little to ease the pressure felt by mortgage holders and renters – many of whom will inevitably feel the unwanted sting of this week’s rate rise, right before Christmas.”

Alibaba and Tencent Earnings

“It’s been a pretty miserable year for these two tech giants, with broader tech shares globally seeing huge gains while these Chinese-based companies continue to underwhelm.

“China’s struggling economy has weighed on these companies despite the relaxation of regulations from Chinese Authorities.”

Josh says the good news for investors is that both these stocks have depressed valuations, making them attractive for contrarian investors.

“Alibaba’s future may be looking brighter, however, with recent news from CEO Eddie Wu indicating the company aspires to become an open tech platform and provide infrastructure for AI innovation and transformation in thousands of industries.

“Tencent also has some positives on the horizon, with the company recently announcing it will be globally launching TanLIVE, its climate community platform, at the upcoming 2023 United Nations Climate Change Conference. The platform is designed to empower and connect organisations working towards carbon neutrality.”

Alongside lower valuations, earnings expectations are rising, Josh adds.

“A strong set of results this week, alongside solid forecasts, could be the tailwind these tech giants need to get a leg up in this market.”

Source: Commsec, Trading Economics, S&P Global Research, AMP

MONDAY

CommBank Household savings

TUESDAY

Australia Westpac Consumer Confidence (Nov)

Australia NAB Business Confidence (Oct)

WEDNESDAY

Australia Wage Price Index (Q3)

THURSDAY

Australia Employment (Oct)

FRIDAY

Source: Commsec, Trading Economics, S&P Global Research, AMP

MONDAY

Singapore, Malaysia Market Holiday

Japan PPI and Machine Tool Orders (Oct)

Turkey Current Account (Sep)

India Inflation (Oct)

Germany Current Account (Sep)

United Kingdom Regional PMI (Oct)

United States Consumer Inflation Expectations (Oct)

Global Business Outlook (Oct)

TUESDAY

India Market Holiday

New Zealand Food Inflation (Oct)

India WPI (Oct)

United Kingdom Labour Market Report (Sep)

South Africa Unemployment (Q3)

Eurozone Employment Change (Q3, prelim)

Eurozone GDP (Q3, 2nd est.)

Eurozone ZEW Economic Sentiment Index (Nov)

Germany ZEW Economic Sentiment Index (Nov)

United States CPI (Oct)

WEDNESDAY

Brazil Market Holiday

Japan GDP (Q3, prelim)

South Korea Trade (Oct)

China (Mainland) Industrial Production, Retail Sales, Fixed

Asset Investments (Oct)

China (Mainland) Unemployment Rate (Oct)

China (Mainland) 1-Year MLF Announcement

Indonesia Trade (Oct)

Japan Industrial Production (Sep, final)

Germany Wholesale Prices (Oct)

United Kingdom Inflation (Oct)

Eurozone Industrial Production (Sep)

Eurozone Balance of Trade (Sep)

United States PPI (Oct)

United States Retail Sales (Oct)

United States Business Inventories (Sep)

THURSDAY

Japan Trade (Oct)

Japan Machinery Orders (Sep)

China (Mainland) House Price Index (Oct)

Philippines BSP Interest Rate Decision

United States Industrial Production (Oct)

FRIDAY

Singapore Non-oil Domestic Exports (Oct)

Malaysia GDP (Q3)

United Kingdom Retail Sales (Oct)

Eurozone Inflation (Oct, final)

United States Building Permits (Oct, prelim)