Traders’ Diary: 11th hour agreement in Washington could be harbinger of October bloom

Via Getty

The Economic Week That Was

As I return to the fold on a blistering Sunday arvo in Sydenham, my steel-toed boot into the midriff of American politics is out and the following tribute to breakmanship US style is in:

At about 9pm on Saturday night in Washington – three hours before a midnight trigger for the shutdown of the US federal government would kick in – the US Senate passed a half-arsed spending bill momentarily staving off the disaster of furloughing government workers as the money to continue the daily business of US federal services evaporates.

The bill is on its way to the White House for President Joe Biden’s signature.

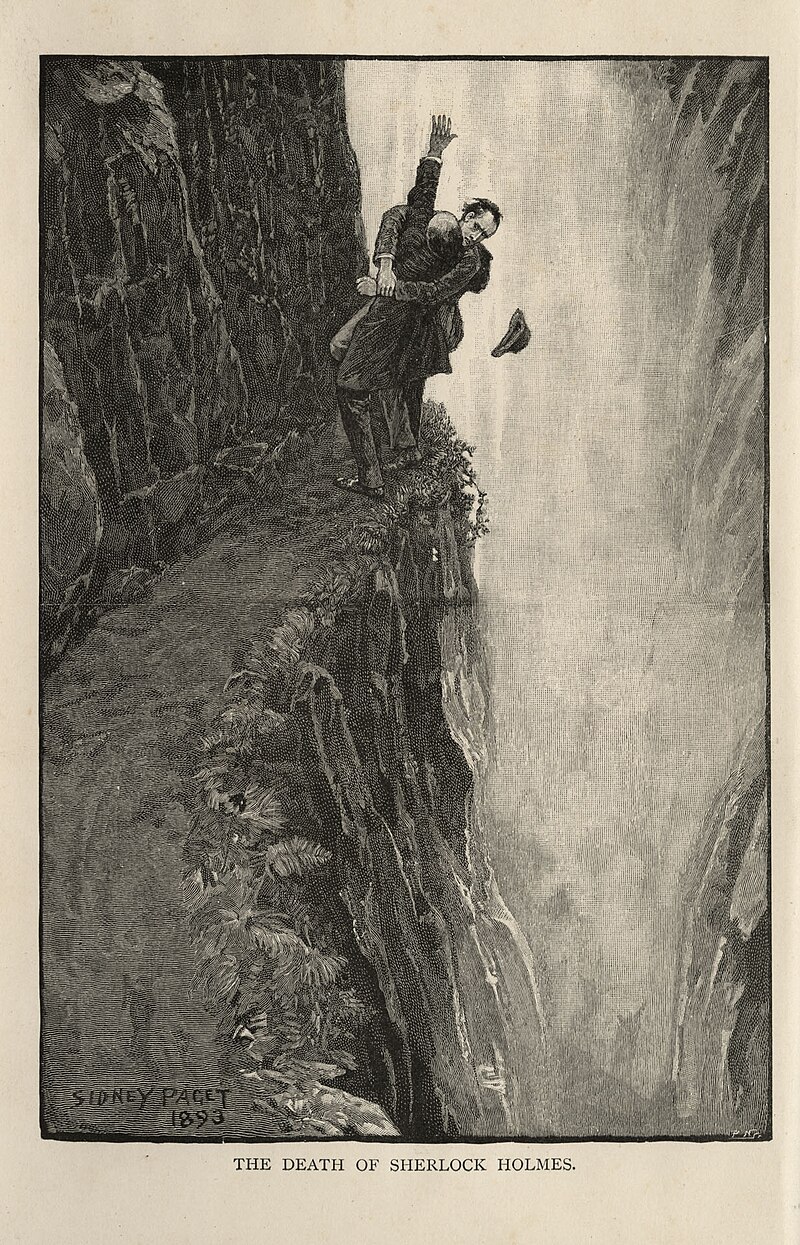

The bill, will permit the US government to stay open for near enough to seven weeks, giving the Republicans and Democrats, House and Senate more time to stay locked upon the precipice of pointlessness in the death embrace of so many mortal foes before them, captured nicely as ever by Sidney Paget’s original depiction in the Strand Magazine of Sherlock Holmes and Professor Moriarty at the Reichenbach Falls.

Febrile Republican House Speaker Kevin McCarthy managed to get in disaster relief funds, but couldn’t get the money for Ukraine which is a big part of the President’s initial request.

That won’t matter to Wall Street, where the S&P 500 on Friday wrapped up a miserable month and a fourth week of consecutive losses.

The US benchmark is 5% shorter after a September which lived up to its rep as traditionally the worst month of the trading calendar.

The Dow Jones lost -1.3% and the S&P 500 -0.7%, comparatively modest declines for the week.

The tech Heavy Nasdaq Composite found +0.1% after the magnificent mega-meaty megatronic and megaladonic tech names rose a bit on Friday.

US investors couldn’t quite come to terms with the Federal Reserve’s drum-beatin’ signal of ‘higher-for-longer’ on interest rates.

Then we had surging crude oil prices. My goodness oil prices know when to come when their master (OPEC+ led by Russian Troublemaker-in-Chief V. Putin) and his free-of-America-now friends in Riyadh call them.

The week was also curdling from the get-go on fears of the US government debt schemozzle, which got right under US long-term bond yields, with the benchmark 10-year Treasury yield reaching near 16-year highs, before stepping down, Friday.

Yet, with the Chinese on holiday for the week, the Federal funding farce on its 45-day hiatus (a lifetime in markets) and the following nigh-dovish dog whistle from Reserve Bank of New York boss John Williamson (in an address on Friday night US time), one can almost taste the sentimental shift in stateside headwinds:

“We are at, or near, the peak level of the target range for the federal funds rate… I expect we will need to maintain a restrictive stance of monetary policy for some time to fully restore balance to demand and supply and bring inflation back to desired levels.”

Not quite higher for shorter, but better than more recent signalling.

EU markets ended the week with a small victory, but optimism in recent sessions rounded off a weak month and the worst quarter for a year.

The pan-European Stoxx 600 provisionally closed up 0.5% on the prior session, with most sectors finishing in positive territory as tech and household goods led the pack.

The index ended Wednesday at a six-month low and has declined 2.1% this month, according to LSEG data, following a 2.8% fall in August. Despite making gains in July, that still takes the benchmark Stoxx to a 2.9% loss for the quarter, its worst performance for a year.

At home, the most important measure to drop was the now very handy monthly CPI indicator which had annual headline inflation up slightly – and right on the forecast – to 5.2%.

The ridonkulously high petrol prices a big contributor, says Harry Ottley at CBA (somewhat embellished).

“Our view remains that, with the economy slowing, inflation is on a downward trajectory. Exclusion‑based measures of core inflation continued to fall, highlighting the impact of volatile items.”

The ASX saw low volumes to round out trade into the long weekend for NSW, et al. The benchmark ASX200 ended the week 0.3% lower, impressive considering the repetition of early morning losses.

In small cap land, there’s a bit of excitement around Biotron (ASX:BIT). The local biotech is on the cusp of sharing the final stage of three Phase 2 clinical trials for HIV‐1 and COVID‐19.

“Biotron expects to have data from three such trials available in the very near term which puts the company in a very strong position,” Michelle Miller CEO and MD said in a letter to sharehholders earlier in the week, before a Friday ASX speeding ticket put a halt to the speculation.

Biotron is developing a batch of new anti-viral therapies which potentially have broad applications including the potential commercialising a novel small molecule approach that has the potential to treat a number of serious viral diseases.

The stock rose 125% last week before hitting that enforced trading halt.

The Week on the ASX

A quiet Friday from the market’s perspective given Melbourne’s public holiday on Friday (and Much of Australia off for Monday).

Materials continued to do well, offsetting the Energy Sector which gave back some gains after a strong week.

Also out last week – retail trade and job vacancies, the former up 0.2% month-on-month in August to be just 1.5% higher through the year, while job vacancies dropped sharply for the qtr, down 8.9%. That might suggest to CBA Harry and others that labour demand is softening as the RBA would wish.

The Economic Week That Will Be

Tuesday is set down as the cash rate call of the year, so this week is all about the RBA Board.

It’s Michele Bullock’s first OCR decision as governor and while it’s neither my job, nor my place to put a spin on this – here it is:

Nature demands the new Alpha imprint her scent on the pack. Therefore while everyone’s licking their pause, Michelle will demand a small hike. The damage has been done already. Putting one in the bank works best when it’s least expected. AND, the RBA doesn’t meet in January, as they take a group month of vackay somewhere in the South Pacific. So should signs of inflation rear up above the ramparts in November or December, then the solution is already baked in.

The adults in the room – in this case CBA – have a high conviction that rates will be left on hold for the fourth consecutive month. And almost everyone paid to know these things agrees with them.

“We expect the post‑meeting Statement will retain a tightening bias given the Board’s concerns around sticky services inflation and future wages growth. In our view, the dataflow since the September Board meeting will not pass the high bar we believe the Board has to tighten policy,” CBA says.

As per last month’s SOMP (policy meeting minutes) the board toyed with adding another 25 basis points before agreeing to hold at 4.1%.

But the bank has made it clear – this is a precarious transition and the local economy could slow more than anyone wants due to stalling domestic consumption and more silence from top trading partner China.

Housing related data is also in focus with house prices, new housing lending and approvals all due. International trade figures are also out

The RBNZ monetary policy decision is also due next week. An on-hold decision is anticipated.

It is a quiet week for offshore economic data with China on hols and US non‑farm payrolls on Friday the only market moving highlight.

Of course, there’s always US politics.

Your week on the ASX

Firstly, the Aussie dollar has managed to move out of the dunce square in the 2H23 handball of global currencies vs the USD.

That said, the Aussie dollar-buck has walked backwards some 3% over the quarter to Friday – largely due to demand doubts and unsighted stimmy out of a wobbly China and a combo of a more hawkish US FED and the American economic resilience it’s trying to quash.

The AUD rose past US$0.64 cents, some thing we can all appreciate after its decline to near one-year lows.

There was Friday’s miniscule pullback in the greenback and US Treasury yields, but it’s the growing volume of short-covering which has FX traders’ attention.

Gina Rinehart’s Hancock Prospecting has dropped another $110m or so into Liontown Resources, moving to a 12.36 per cent ownership stake.

This move was allowed to fall out of mind when sneakily, cunningly and yes even diabolically – Hancock made another large trade after the market closed on Wednesday, with the two day timeline to disclose changes to substantial shareholdings ticking past late on Friday afternoon, thanks to the hawkeye reportage from our cousins at The Australian.

Can the Aussie-led Hancock-block US lithium giant Albemarle’s $3 per share, ($6.6bn) bid for LTR? It’s harder to do the due diligence when someone with Gina’s rep and track record playing in the front yard.

Hancock BTW, needs to secure 25% of LTR shareholders to vote against Albermarle to skewer the deal.

The Australian Economic Calendar

Monday October 2 – Friday October 6

Source: Commsec, Trading Economics, S&P Global Research, AMP

MONDAY

Public Holiday (NSW, QLD & SA)

AU MI Inflation Gauge, Sep

AU CoreLogic Dwelling Prices, Sep

AU Judo Bank Composite PMI, Sep

TUESDAY

RBA Cash Rate Target, Oct

AU New Housing Loans, Aug

AU Building Approvals, Aug

WEDNESDAY

NZ RBNZ Official Cash Rate

NZ CoreLogic Dwelling Prices, Sep

THURSDAY

AU Imports, Aug

AU Exports, Aug

AU Trade Balance, Aug

FRIDAY

AU RBA Financial Stability Review, Oct

The Everyone Else Economic Calendar

Monday October 2 – Friday October 6

MONDAY

China (Mainland), India, Hong Kong SAR Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI (Sep)

South Korea Industrial Production and Retail Sales (Aug)

Japan Tankan Large Manufacturers Index (Q3)

Japan BOJ Summary of Opinions (Sep)

Indonesia Inflation (Sep)

Eurozone Unemployment (Aug)

United States ISM Manufacturing PMI (Sep)

TUESDAY

China (Mainland), South Korea Market Holiday

India S&P Global Manufacturing PMI (Sep)

Switzerland Inflation (Sep)

Turkey Inflation (Sep)

Brazil Industrial Production (Aug)

United States JOLTs Job Openings (Aug)

WEDNESDAY

China (Mainland) Market Holiday

Worldwide Services, Composite PMIs, inc. global PMI (Sep)

New Zealand RBNZ Interest Rate Decision

Eurozone Retail Sales (Aug)

Eurozone PPI (Aug)

United States ADP Employment Change (Sep)

United States ISM Services PMI (Sep)

United States Factory Orders (Aug)

THURSDAY

China (Mainland) Market Holiday

South Korea Inflation (Sep)

Hong Kong SAR S&P Global PMI (Sep)

Philippines Inflation (Sep)

Thailand Inflation (Sep)

India S&P Global Services and Composite PMI (Sep)

Singapore Retail Sales (Aug)

Germany Trade (Aug)

Taiwan Inflation (Sep)

Canada Trade (Aug)

United States Trade (Aug)

S&P Global Sector PMI (Sep)

FRIDAY

China (Mainland) Market Holiday

India RBI Interest Rate Decision

Germany Factory Orders (Aug)

UK Halifax House Price Index (Sep)

France Trade (Aug)

Taiwan Trade (Sep)

Canada Employment (Sep)

United States Non-farm Payrolls (Sep)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.