ASX Lunch Wrap: ASX wobbles again; Block up 10pc, Paladin dives 24pc after slashing guidance

Nice trip? ASX 200 falls again. Picture via Getty Images

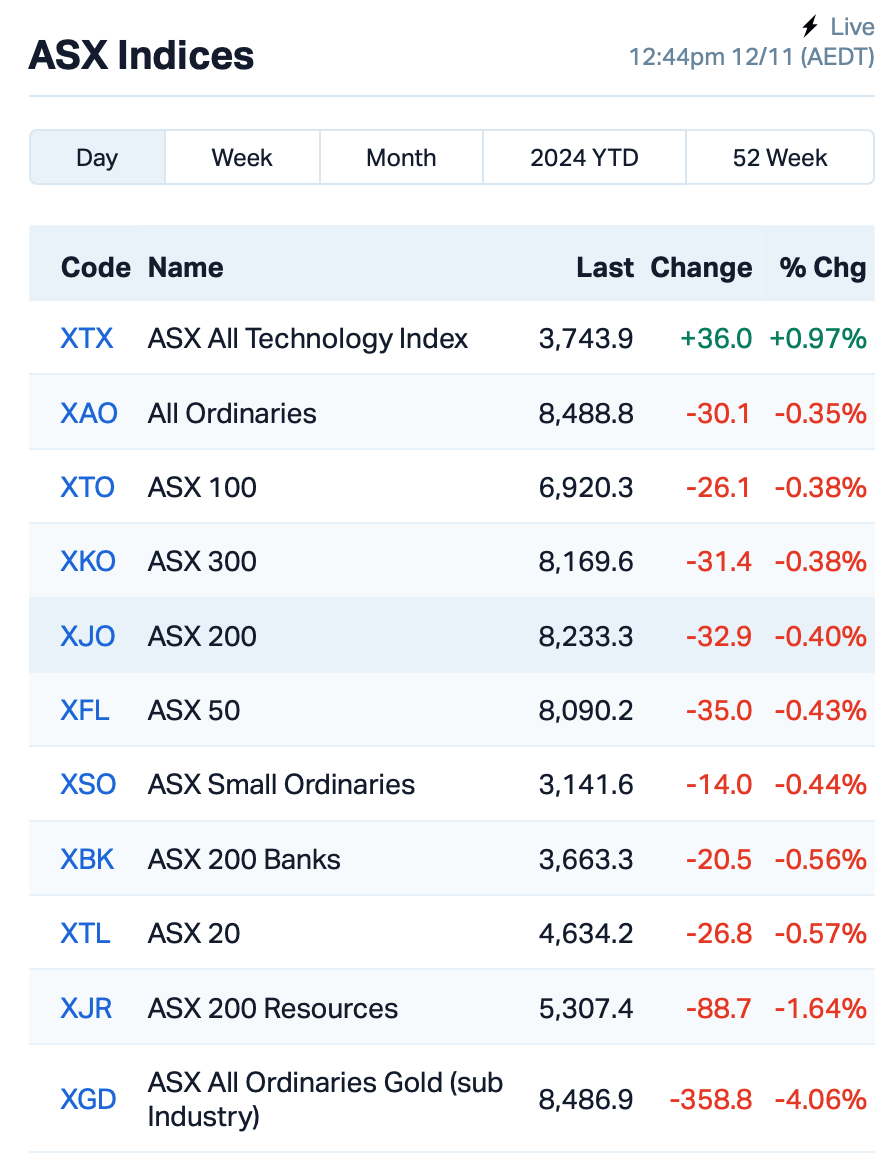

- ASX slips again as mining, energy stocks fall

- Paladin Energy slashes guidance, shares tumble over 24pc

- US rally continues overnight with Bitcoin and Tesla soaring

The ASX wobbled again on Tuesday, with the S&P/ASX 200 down 0.34% at 1pm, adding to yesterday’s 0.4% drop.

The local market is feeling the sting from mining stocks, which are down 2% across the board.

BHP (ASX:BHP) is leading the charge south, off by around 2% after iron ore prices slipped to just under $US100 per tonne.

Energy stocks also tumbled, with coal miners dragging the sector. This comes as both oil and gold fell in overnight trading.

Liontown Resources (ASX:LTR) was bucking the trend, rising 3% on no news.

Afterpay owner Block Inc (ASX:SQ2) popped 10% after Piper Sandler initiated coverage with an ‘overweight’ rating for the NYSE-listed parent company overnight, following the company’s Q3 results. Despite revenue falling short of expectations, Piper cited Block’s impressive margin performance, particularly in adjusted EBITDA.

One of the biggest shockers this morning, however, was uranium miner Paladin Energy (ASX:PDN), which has slashed its production guidance for FY2025 by almost 23%, citing production issues at its Langer Heinrich mine in Namibia. The news sent its shares tumbling by 24%.

Sill in large caps, Aristocrat Leisure (ASX:ALL) is selling its social gaming business, Plarium Global, to Modern Times Group for $US620 million. The sale comes after a strategic review of its business, and the company says it will now focus more on its core land-based gaming operations. Shares were down over 1%.

Over in the retail sector, Coles Group (ASX:COL) was under the microscope after its chairman, James Graham, told shareholders he was very disappointed about the politicisation of cost-of-living issues, noting the supermarket’s efforts to address inflationary pressures and maintain customer trust.

Graham said ongoing regulatory scrutiny and an ACCC case alleging misleading discount practices could undermine consumer confidence. Coles’ shares were down 0.5%.

NOT THE ASX

The Trump-inspired rally in the US markets and Bitcoin’s massive surge suggest global investors are still hungry for risk assets.

Overnight, the S&P 500 set another new record high before flattening out.

Tesla surged 9%, and Bitcoin jumped a massive 10%, soaring past US$88,000 in early Asian trading.

Coinbase surged by 20% and has been up by 75% over the past five days. Robinhood rose 7%, with speculation that its legal chief could lead the SEC under Trump.

The US dollar also edged closer to a one-year high, keeping the momentum going; but oil, gold, and iron ore all traded lower.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for November 12 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GMN | Gold Mountain Ltd | 0.002 | 100% | 903,500 | $3,907,473 |

| HCD | Hydrocarbon Dynamic | 0.003 | 50% | 176,543 | $1,617,165 |

| PRX | Prodigy Gold NL | 0.003 | 50% | 50,000 | $6,350,111 |

| RFT | Rectifier Technolog | 0.011 | 38% | 5,923,000 | $11,055,872 |

| TAS | Tasman Resources Ltd | 0.004 | 33% | 1,241,700 | $2,415,749 |

| TYX | Tyranna Res Ltd | 0.004 | 33% | 125,000 | $9,863,776 |

| IG6 | Internationalgraphit | 0.069 | 28% | 539,126 | $10,452,150 |

| ERA | Energy Resources | 0.003 | 25% | 226,298 | $44,296,598 |

| EMT | Emetals Limited | 0.006 | 20% | 800,000 | $4,250,000 |

| EPM | Eclipse Metals | 0.006 | 20% | 255,906 | $11,264,278 |

| EMD | Emyria Limited | 0.039 | 18% | 2,359,312 | $13,707,850 |

| FNR | Far Northern Res | 0.130 | 18% | 62,282 | $3,989,241 |

| DOU | Douugh Limited | 0.013 | 18% | 3,909,844 | $11,902,758 |

| MGL | Magontec Limited | 0.205 | 17% | 16,676 | $13,937,659 |

| CCM | Cadoux Limited | 0.049 | 17% | 68,739 | $15,578,539 |

| ID8 | Identitii Limited | 0.021 | 17% | 2,813,874 | $11,710,936 |

| ILA | Island Pharma | 0.140 | 17% | 205,965 | $18,708,085 |

| BMO | Bastion Minerals | 0.007 | 17% | 26,231 | $3,086,205 |

| JAV | Javelin Minerals Ltd | 0.004 | 17% | 207,110 | $15,568,189 |

| LML | Lincoln Minerals | 0.007 | 17% | 2,054,846 | $12,337,557 |

| WBT | Weebit Nano Ltd | 3.170 | 16% | 1,345,111 | $518,432,610 |

| MPK | Many Peaks Minerals | 0.230 | 15% | 427,211 | $16,297,537 |

| FFG | Fatfish Group | 0.012 | 15% | 1,868,636 | $14,065,730 |

International Graphite (ASX:IG6) has secured a $4.5m grant from the Western Australian government to build Australia’s first commercial graphite micronising plant.

The grant will fund Stage 1 of the project, with $2M for the construction of a 3,000 tpa facility in Collie, estimated to cost $4M. Stage 2, aimed at expanding the facility to 10,000 tpa, will receive the remaining $2.5M. This facility will process graphite from the company’s Springdale mine, positioning it as a significant global producer outside of China.

The project will be completed in stages, with a front-end engineering study to finalise the schedule and economics.

Magontec (ASX:MGL) has reached a Memorandum of Settlement (MoS) with Qinghai Salt Lake Magnesium (QSLM) to buy back and cancel 22.68 million shares held by QSLM, representing 28.48% of Magontec’s shares. The MoS was contingent on approval from QSLM’s creditors and the Xining court, both of which have now been granted.

Magontec will seek shareholder approval for the buyback at an upcoming Extraordinary General Meeting (EGM). An EGM timetable will be announced soon.

Bastion Minerals (ASX:BMO) has reported significant results from its recent reconnaissance sampling and pXRF analyses across new properties along the REE Line in Sweden.

Up to 18.5% Total Rare Earth Elements (TREE+Y) and 24% copper were found in magnetite skarn mineralisation at several locations, including Striberg, Karlberg, and Nyberget. The high magnetic response in the area corresponds to historical magnetite mines, helping identify high-potential zones for further exploration.

Additional sampling is planned to prioritise areas for drilling, with laboratory assay results expected later this month.

Javelin Minerals (ASX:JAV) has decided to sell its Bonaparte copper-silver-lead-zinc project in Western Australia’s Kimberley region as part of a strategy to divest non-core assets.

The Bonaparte Project, which covers 564 sq km, has identified mineralisation similar to Mississippi Valley Style deposits, with three key prospects showing promising assay results. However, following Javelin’s recent acquisition of the Eureka and Coogee gold projects near Kalgoorlie, the company is focusing on its gold exploration initiatives.

The Bonaparte project will be sold as Javelin concentrates on its two brownfields gold projects.

EMvision Medical Devices (ASX:EMV) has announced excellent results from its world-first neurodiagnostic technology for early stroke identification.

The EMView multi-site study involved 307 participants, including 277 suspected stroke patients, and demonstrated high diagnostic performance: 92% sensitivity and 85% specificity for haemorrhage detection, and 85% sensitivity and 78% specificity for ischemia detection.

The AI-based algorithms showed improved performance with more clinical data, allowing EMVision to proceed with a validation trial to support FDA clearance and product commercialisation. The trial, expected to cost $4m and last 6-12 months, will further refine the technology.

Also read Tim Borehams’s Health Check: It’s a small world after all for global microcap index additions LTR Pharma and EZZ Life Science

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for November 12 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TRM | Truscott Mining Corp | 0.040 | -49% | 57,000 | $14,273,888 |

| AVE | Avecho Biotech Ltd | 0.002 | -33% | 837,976 | $9,507,891 |

| CDE | Codeifai Limited | 0.001 | -33% | 1,005,654 | $3,961,942 |

| EDE | Eden Inv Ltd | 0.001 | -33% | 5,000 | $6,162,314 |

| RIE | Riedel Resources Ltd | 0.001 | -33% | 334,000 | $3,335,753 |

| SI6 | SI6 Metals Limited | 0.001 | -33% | 59,451 | $4,150,938 |

| ERL | Empire Resources | 0.003 | -25% | 1,922,311 | $5,935,653 |

| PDN | Paladin Energy Ltd | 7.335 | -24% | 10,050,498 | $2,895,414,053 |

| PRO | Prophecy Internation | 0.525 | -24% | 149,547 | $50,801,894 |

| WEC | White Energy | 0.038 | -22% | 300 | $9,750,230 |

| JAY | Jayride Group | 0.007 | -22% | 215,824 | $2,146,140 |

| GRE | Greentechmetals | 0.095 | -21% | 35,575 | $9,969,597 |

| GBZ | GBM Rsources Ltd | 0.008 | -20% | 3,069,433 | $11,566,889 |

| MOM | Moab Minerals Ltd | 0.004 | -20% | 7,361 | $4,464,294 |

| SRN | Surefire Rescs NL | 0.004 | -20% | 900,000 | $9,931,539 |

| TTI | Traffic Technologies | 0.004 | -20% | 10,909 | $5,594,090 |

| ADR | Adherium Ltd | 0.009 | -18% | 262,371 | $8,344,380 |

| DTZ | Dotz Nano Ltd | 0.075 | -18% | 35,605 | $49,387,710 |

| GW1 | Greenwing Resources | 0.045 | -17% | 19,462 | $12,995,180 |

| MCE | Matrix C & E Ltd | 0.250 | -17% | 166,552 | $67,143,354 |

| AKN | Auking Mining Ltd | 0.005 | -17% | 1,000,500 | $2,348,102 |

| BP8 | Bph Global Ltd | 0.003 | -17% | 132,712 | $1,189,924 |

| CDT | Castle Minerals | 0.003 | -17% | 4,033,333 | $5,001,693 |

| NAE | New Age Exploration | 0.005 | -17% | 682,040 | $12,863,393 |

| MNC | Merino and Co | 0.895 | -15% | 857,731 | $55,730,399 |

IN CASE YOU MISSED IT

Codeifai (ASX:CDE) is hosting an investor webinar on Wednesday, 14 November at 2:00pm AEDT (11:00am AWST).

CDE executive chairman and group CEO John Houston will be joined by chief operating officer Martin Ross to update shareholders on ConnectQR and its importance to the business. The briefing will be followed by a Q&A. Questions can be submitted to [email protected] now, or in written form during the webinar.

Those interested may register by clicking the following link: Registration Link.

Javelin Minerals (ASX:JAV) has decided to put its Bonparte copper-silver-lead-zinc asset in WA’s Kimberley region up for sale as part of the company’s strategy to dispose of non-core projects.

The decision follows Javelin’s recently announced purchase of the highly prospective Eureka Gold project near Kalgoorlie. Along with its Coogee Gold Project, JAV now owns and is fully focused on its two brownfields gold exploration projects in WA’s Eastern Goldfields.

“The Bonaparte project has been exposed to very little recent exploration and has significant upside based on the historical copper, silver, lead and zinc exploration results,” JAV executive chairman Brett Mitchell said.

“Given our very active exploration schedule totally focused on Eureka and Coogee, we have decided to offer Bonaparte for sale”.

At Stockhead we tell it like it is. While Codeifai and Javelin Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should really consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.