Top 10 at 11: ASX hits record high as BPH soars on valuable metals in polluted seaweed

Pic via Getty Images

Morning, and welcome to Stockhead’s Top 10 (at 11… ish), highlighting the movers and shakers on the ASX in early-doors trading.

With the market opening at 10am sharp eastern time, the data is taken at 10.15am in the east, once trading kicks off in earnest.

In brief, this is what the market has been up to this morning.

ASX hits record high

The ASX 200 was up 0.5% in early morning trade to hit a record high of 8852.3 points, slightly exceeding the previous record high of 8848.8 points hit last week. It’s since pulled back a tad at time of publishing this article, but still solid at around +0.25%

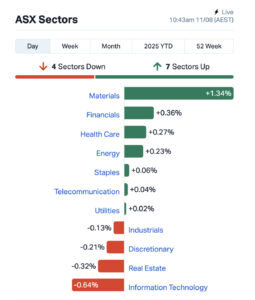

Gains are being led by the materials and financials sectors, while healthcare, energy, staples, teclos and utilities are also in the green. Dragging on the market a tad this morning are the tech, real estate, discretionary and industrials sectors.

The image below tells the story.

Small cap winners

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ETM | Energy Transition | 0.12 | 118% | 21,794,651 | $85,327,477 |

| BP8 | BPH Global Ltd | 0.002 | 100% | 3,163 | $1,050,985 |

| FL1 | First Lithium Ltd | 0.14 | 33% | 85,653 | $8,363,628 |

| BCC | Beam Communications | 0.155 | 29% | 120,000 | $10,370,631 |

| FNR | Far Northern Resources | 0.175 | 25% | 71,142 | $5,637,216 |

| ZEO | Zeotech Limited | 0.071 | 20% | 7,530,809 | $110,933,456 |

| DAL | Dalaroo Metals | 0.03 | 20% | 100,000 | $6,491,298 |

| ADY | Admiralty Resources | 0.006 | 20% | 3,340 | $13,147,397 |

| SER | Strategic Energy | 0.006 | 20% | 166,666 | $4,183,458 |

| SPQ | Superior Resources | 0.006 | 20% | 4,794,499 | $11,854,914 |

BPH Global (ASX:BP8) rose 100% in opening trade after announcing that Temasek Innovation Holdings (TPIH) in collaboration with its Singapore-based R&D consultant Gaia Mariculture will carry out additional assays on Sesuvium portulacastrum seaweed samples harvested from polluted waters in Johor, Malaysia.

This supplementary testing will focus on the mineral content of gold, silver, and rare earths in the harvested biomass, and will be conducted at no cost to BPH Global. The work builds on recent findings that identified Sesuvium portulacastrum as a hyper-accumulator of valuable metals.

Emerging mineral processing technology company Zeotech (ASX:ZEO) is up 20% after signing a binding kaolin direct shipping ore (DSO) offtake term sheet with Jiangsu Mineral Sources International Trading Co. Jiangsu is a major China-based international trading house and one of the world’s leading independent bulk raw material traders.

The offtake term sheet outlines the key binding commercial terms for the supply of Zeotech’s kaolin and cosmetic kaolin DSO products. It also provides the framework for advancing to a full binding offtake agreement, expected to be executed in October.

Small cap losers

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SNT | Syntara Limited | 0.031 | -46% | 9,448,522 | $92,775,383 |

| MTL | Mantle Minerals Ltd | 0.001 | -33% | 655 | $9,671,169 |

| BUX | Buxton Resources Ltd | 0.029 | -31% | 7,870,351 | $14,431,448 |

| AQX | Alice Queen Ltd | 0.003 | -25% | 2,500 | $5,538,785 |

| GTR | Gti Energy Ltd | 0.003 | -25% | 1,895,616 | $14,890,619 |

| JAY | Jayride Group | 0.003 | -25% | 983,469 | $5,711,556 |

| OLH | Oldfields Holdings | 0.02 | -23% | 181,353 | $5,539,537 |

| EQS | Equity Story Group | 0.02 | -20% | 126,964 | $4,170,510 |

| AYM | Australia United Mining | 0.002 | -20% | 500 | $4,606,444 |

| AOK | Australian Oil | 0.0025 | -17% | 500,328 | $3,113,349 |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.