Top 10 at 11: ASX falls as NT Minerals jumps 50pc on copper project sale

NT Minerals is up after finalising sale of copper projects. Pic via Getty Images

Morning, and welcome to Stockhead’s Top 10 (at 11… ish), highlighting the movers and shakers on the ASX in early-doors trading.

With the market opening at 10am sharp eastern time, the data is taken at 10.15am in the east, once trading kicks off in earnest.

In brief, this is what the market has been up to this morning.

ASX lower despite overnight US gains

The S&P/ASX 200 has opened 0.44% lower on Tuesday, extending yesterday’s losses despite overnight gains on Wall Street. In the US, the S&P 500, Nasdaq and Dow Jones all closed higher as investors grew more confident the Federal Reserve may move to cut rates following another round of soft jobs data.

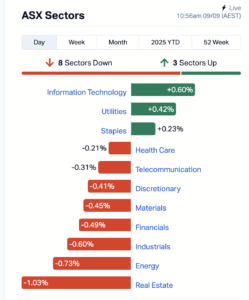

At home, eight of the 11 ASX sectors are in the red with technology leading the gainers and real estate the laggards.

The Aussie dollar is currently buying 66 US cents. Bitcoin is slightly up at US$111,664.

Oil is trading higher with crude at US$62.43 per barrel and Brent US$66.20 per barrel. Gold has also lifted to US$3641.14, boosting local gold stocks.

SMALL CAP WINNERS

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| NTM | NT Minerals Limited | 0.003 | 50% | 500000 | $2,421,806 |

| JLL | Jindalee Lithium Ltd | 0.58 | 45% | 921540 | $31,948,338 |

| LIT | Livium Ltd | 0.017 | 42% | 45234207 | $20,425,285 |

| SRN | Surefire Resources NL | 0.002 | 33% | 1275455 | $5,860,289 |

| SRJ | SRJ Technologies | 0.014 | 27% | 10113953 | $15,170,596 |

| T3D | 333D Limited | 0.05 | 25% | 240312 | $7,554,152 |

| CNJ | Conico Ltd | 0.005 | 25% | 20 | $1,088,583 |

| GUM | Gumtree Australia | 0.16 | 23% | 70000 | $41,726,436 |

| ADG | Adelong Gold Limited | 0.006 | 20% | 4337015 | $11,584,182 |

| CCO | The Calmer Co Int | 0.003 | 20% | 1016668 | $7,528,383 |

NT Minerals (ASX:NTM) is up 50% in morning trade after finalising the sale of its Redbank and Wollogorang copper projects in the Northern Territory to Golden Horse Minerals (ASX:GHM). The deal, originally flagged in July, has now been completed through GHM’s wholly-owned subsidiary, Golden Horse Minerals (Northern Territory) Pty Ltd.

Under the transaction, NT Minerals received $1 million in cash along with 4.63 million CHESS Depositary Interests (CDIs) in Golden Horse, currently worth more than $2.15 million. The CDIs will be escrowed for 12 months. Shareholders gave the green light for the divestment in August.

Jindalee Lithium (ASX:JLL) is up 45% this morning after signing a non-binding letter of intent (LOI) with Constellation Acquisition Corp – a US SPAC sponsored by Antarctica Capital, for a proposed merger involving its US subsidiary HiTech Minerals.

The deal values Jindalee’s US assets at US$500 million and includes plans to raise between US$20–30 million in new capital, with US$4 million already committed by Antarctica Capital affiliates. If completed, the merged entity, to be named NewCo, would list on a US national securities exchange. The company cautioned that the transaction remains at a non-binding stage, meaning there is no guarantee that the transaction would complete.

Livium (ASX:LIT) has entered into a term sheet with the University of Melbourne to secure exclusive global rights to its microwave-based technology for rare earth element (REE) extraction. The agreement builds on Livium’s existing exposure to the REE end-of-life supply chain and infrastructure, creating a direct opportunity to expand its recycling services.

The technology has demonstrated recovery rates of more than 95% for neodymium and over 80% for praseodymium, with potential to lift this above 90%. It also offers an estimated 85% reduction in energy use compared with conventional Hot Block methods. By using a selective leaching approach, the process delivers higher REE concentrates while cutting acid and reagent usage and reducing wastewater.

SMALL CAP LAGGARDS

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EAT | Entertainment Rewards | 0.002 | -33% | 1000000 | 3926358.05 |

| RTR | Rumble Resources | 0.028 | -26% | 14715131 | 36134206.5 |

| AYT | Austin Metals Ltd | 0.003 | -25% | 220000 | 6336765.4 |

| MTL | Mantle Minerals Ltd | 0.0015 | -25% | 1950000 | 12894891.7 |

| AN1 | Anagenics Limited | 0.004 | -20% | 26992 | 2481601.8 |

| FBR | FBR Ltd | 0.004 | -20% | 5350516 | 30371388.1 |

| GGE | Grand Gulf Energy | 0.002 | -20% | 452000 | 7051062.19 |

| SER | Strategic Energy | 0.004 | -20% | 175964 | 4183458.28 |

| 4DS | 4Ds Memory Limited | 0.01 | -17% | 77420261 | 24730784.6 |

| CZN | Corazon Ltd | 0.0025 | -17% | 3500000 | 3703716.77 |

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.